State Farm auto insurance pricing is a complex subject influenced by a variety of factors. Understanding how State Farm determines premiums can help consumers make informed decisions about their insurance coverage. This analysis delves into the key factors that influence State Farm’s pricing, examining their pricing model and the impact of their strategies on customers. We will explore how State Farm’s pricing compares to other major insurers and discuss the potential future of their pricing strategy in a rapidly changing landscape.

From driver demographics and vehicle characteristics to driving history and location, numerous elements play a role in shaping State Farm’s auto insurance premiums. The company’s pricing model incorporates risk assessment and actuarial analysis to calculate premiums, reflecting the likelihood of claims and the potential cost of coverage. State Farm also offers a range of discounts and promotions aimed at attracting and retaining customers, further impacting their pricing strategy.

State Farm Auto Insurance Pricing Factors

State Farm, like other insurance companies, considers various factors when determining your auto insurance premiums. Understanding these factors can help you understand why your rates are what they are and how you can potentially lower them.

Factors Considered by State Farm

State Farm considers several factors when determining your auto insurance premium. These factors can vary depending on your location, vehicle, and driving history.

- Your driving history: This is one of the most important factors. State Farm considers your driving record, including any accidents, traffic violations, and DUI convictions. Drivers with clean records typically receive lower rates. For example, a driver with a recent DUI conviction may see their rates significantly increase compared to a driver with no violations.

- Your age and gender: Younger drivers and males are generally considered higher risk due to their higher likelihood of accidents. Therefore, they often pay higher premiums. As drivers gain experience and age, their premiums tend to decrease. This is because older drivers are statistically less likely to be involved in accidents.

- Your location: State Farm considers the location where you live. Areas with higher crime rates or traffic congestion often have higher premiums. For example, living in a major city with a high density of vehicles might result in higher premiums than living in a rural area with lower traffic volume.

- Your vehicle: The make, model, year, and safety features of your vehicle play a role in determining your premium. Vehicles with higher safety ratings and anti-theft features often receive lower rates. For instance, a newer car with advanced safety features like automatic emergency braking might receive a discount compared to an older car without these features.

- Your coverage: The amount of coverage you choose impacts your premium. Higher coverage limits generally mean higher premiums. For example, opting for higher liability limits will likely result in a higher premium than choosing lower limits. However, it’s important to have sufficient coverage to protect yourself financially in case of an accident.

- Your credit score: While controversial, State Farm, like many other insurers, considers your credit score as a proxy for risk. A good credit score often indicates a lower risk profile, which can result in lower premiums. This practice is based on the idea that people with good credit are more likely to be responsible and make informed financial decisions, including driving safely.

Comparison to Other Insurers

Most major insurance companies consider similar factors when determining auto insurance premiums. However, the specific weight assigned to each factor and the resulting premiums can vary. For example, some insurers may place a higher emphasis on driving history, while others may focus more on credit score. It’s important to compare quotes from multiple insurers to find the best rates for your individual needs and circumstances.

State Farm’s Pricing Model

State Farm, like other insurance companies, uses a complex pricing model to determine auto insurance premiums. This model considers various factors related to the insured individual, their vehicle, and the risk of accidents. The goal is to create a fair and accurate pricing structure that reflects the individual’s risk profile.

Risk Assessment and Actuarial Analysis

State Farm utilizes a sophisticated risk assessment and actuarial analysis process to determine premiums. This involves collecting and analyzing data on various factors that influence the likelihood of accidents, including:

- Driving History: State Farm reviews the insured’s driving record, including past accidents, traffic violations, and driving experience. A clean driving record generally translates to lower premiums.

- Vehicle Information: The make, model, year, and safety features of the insured’s vehicle are considered. Vehicles with advanced safety features or lower theft rates tend to have lower premiums.

- Location: Geographic factors like population density, traffic congestion, and crime rates play a role. Areas with higher accident rates generally have higher premiums.

- Demographics: Factors like age, gender, and marital status can influence pricing. For example, younger drivers or those with a history of risky behavior may face higher premiums.

State Farm uses actuarial analysis to statistically assess the risk of accidents based on these factors. This involves using historical data and statistical models to predict future claims and adjust premiums accordingly.

Differences from Competitors

State Farm’s pricing model is similar to that of other insurance companies in its fundamental principles. However, there are some key differences that set State Farm apart:

- Usage-Based Insurance (UBI): State Farm offers a program called Drive Safe & Save that uses telematics devices to track driving behavior. This data can lead to discounts for safe driving habits, such as avoiding hard braking or speeding.

- Loyalty Discounts: State Farm rewards long-term customers with loyalty discounts, which can significantly reduce premiums over time.

- Bundling Discounts: State Farm offers substantial discounts for bundling multiple insurance policies, such as auto and home insurance, with the same company.

These features differentiate State Farm’s pricing model and provide potential benefits to customers.

State Farm Discounts and Promotions

State Farm offers a wide range of discounts and promotions to help customers save money on their auto insurance. These discounts can be applied to various factors, including safe driving, vehicle features, and bundling insurance policies.

State Farm Discounts

State Farm’s discounts are designed to reward customers for their responsible behavior and commitment to safety. These discounts can significantly reduce the overall cost of auto insurance.

- Safe Driving Discount: This discount is offered to drivers with a clean driving record, typically with no accidents or traffic violations for a specified period. This discount is a common practice among insurance companies and is usually a significant factor in determining premiums.

- Good Student Discount: Students who maintain a certain GPA or rank in their class may qualify for this discount. This encourages students to focus on their education while promoting safe driving habits.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices and potentially qualify you for a discount.

- Multi-Car Discount: Insuring multiple vehicles with State Farm can result in a discount on your premiums. This encourages customers to bundle their insurance policies and build loyalty with the company.

- Multi-Policy Discount: This discount is available when you bundle other insurance policies, such as homeowners or renters insurance, with your auto insurance. This is a common practice among insurance companies to encourage customers to consolidate their insurance needs under one provider.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, in your vehicle can make it less appealing to thieves, potentially reducing the risk of theft. This can lead to a discount on your insurance premium.

- Vehicle Safety Features Discount: Vehicles equipped with safety features, such as airbags, anti-lock brakes, or electronic stability control, are generally considered safer and may qualify for a discount.

- Loyalty Discount: Long-term State Farm customers may be eligible for a loyalty discount, rewarding them for their continued business.

- Pay-in-Full Discount: Paying your insurance premium in full upfront can sometimes result in a discount, as it eliminates the need for State Farm to manage installment payments.

- Paperless Discount: Opting for electronic communication, such as online billing and policy management, can often qualify you for a discount. This helps State Farm reduce its operational costs.

Comparison of State Farm Discounts with Other Insurers

State Farm’s discounts are generally competitive with those offered by other major insurance providers. Most insurance companies offer discounts for safe driving, good student status, multi-car, and multi-policy bundling. However, the specific details and eligibility criteria for these discounts may vary between companies.

Impact of State Farm’s Promotional Strategies on Customer Acquisition and Retention

State Farm’s promotional strategies, including discounts and other incentives, play a crucial role in attracting new customers and retaining existing ones. These strategies are designed to highlight the value proposition of State Farm insurance and differentiate it from competitors.

State Farm’s promotional campaigns are often targeted at specific customer segments, such as young drivers, families, or homeowners. They utilize various channels, including television advertising, online marketing, and social media. These campaigns often focus on highlighting the benefits of State Farm’s insurance products and services, including discounts, customer service, and financial stability.

For example, State Farm’s “Like a Good Neighbor” campaign has been highly successful in building brand recognition and fostering a positive image among consumers. This campaign emphasizes State Farm’s commitment to customer satisfaction and community involvement.

By offering competitive discounts and engaging in effective promotional strategies, State Farm aims to increase customer satisfaction, loyalty, and ultimately, profitability.

State Farm’s Pricing Transparency

State Farm, like other insurance companies, faces a delicate balancing act when it comes to pricing transparency. While customers desire clarity about how their premiums are calculated, insurers also need to protect their proprietary pricing models. This section examines how State Farm approaches this challenge.

State Farm’s Pricing Transparency Practices

State Farm provides a reasonable level of transparency regarding its pricing policies. They offer a range of resources to help customers understand the factors influencing their premiums. Here are some examples:

- State Farm’s website: This platform features an extensive “Get a Quote” section where customers can explore various factors that affect pricing, including vehicle type, driving history, and coverage options. The website also provides general information about State Farm’s pricing philosophy, emphasizing factors like safety, driving experience, and claims history.

- Agent interactions: State Farm agents are trained to explain pricing details to customers. They can provide personalized quotes and discuss how individual factors impact premiums. This personal interaction allows for clarification and addresses specific customer concerns.

- Brochures and materials: State Farm offers brochures and other materials that Artikel its pricing policies. These resources often include examples and scenarios to illustrate how different factors can affect premiums.

Comparison of State Farm’s Pricing Transparency to Other Major Insurers

The following table provides a comparison of State Farm’s pricing transparency with that of other major insurers:

| Insurer | Website Transparency | Agent Transparency | Other Resources |

|---|---|---|---|

| State Farm | Good: Provides detailed information about factors affecting pricing, including a “Get a Quote” section. | Good: Agents are trained to explain pricing details and provide personalized quotes. | Good: Offers brochures and other materials that Artikel pricing policies. |

| Geico | Good: Offers a user-friendly “Get a Quote” section with detailed information about factors affecting pricing. | Good: Agents are knowledgeable about pricing and can provide personalized quotes. | Good: Provides online resources and FAQs about pricing. |

| Progressive | Good: Offers a comprehensive “Get a Quote” section with detailed information about factors affecting pricing. | Good: Agents are trained to explain pricing details and provide personalized quotes. | Good: Provides online resources and FAQs about pricing. |

| Allstate | Good: Provides a “Get a Quote” section with information about factors affecting pricing. | Good: Agents are trained to explain pricing details and provide personalized quotes. | Good: Offers brochures and other materials that Artikel pricing policies. |

Impact of State Farm’s Pricing on Customers

State Farm’s pricing strategy significantly impacts customer satisfaction and loyalty. While the company aims to offer competitive rates, its pricing approach can sometimes lead to mixed reactions from customers.

Customer Satisfaction and Loyalty

State Farm’s pricing strategy has a direct impact on customer satisfaction and loyalty. Customers are generally more satisfied when they feel they are getting a fair price for their insurance coverage. This can lead to increased loyalty, as customers are more likely to stick with a company they feel is providing them with value. However, if customers feel that State Farm’s prices are too high, they may be more likely to shop around for a better deal. This can lead to customer churn, as they switch to a competitor that offers lower rates.

Advantages and Disadvantages of State Farm’s Pricing Strategies

State Farm’s pricing strategies offer both advantages and disadvantages for customers.

Advantages

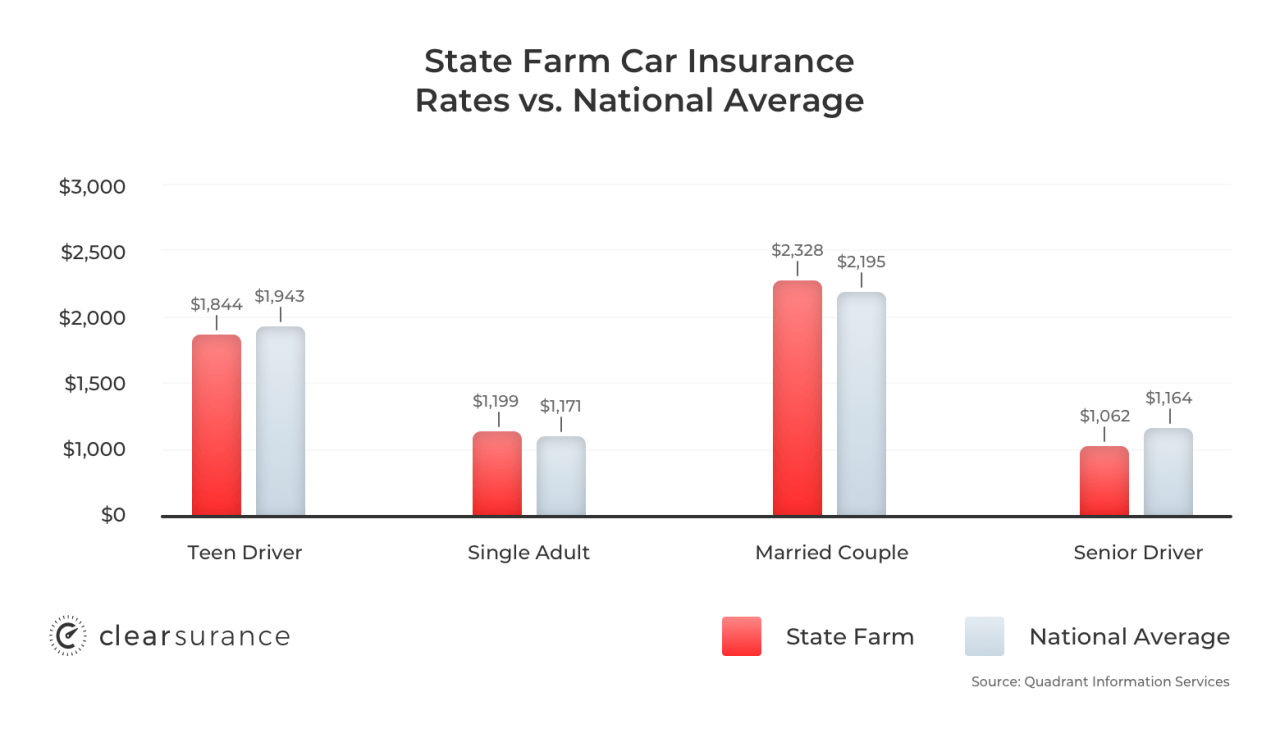

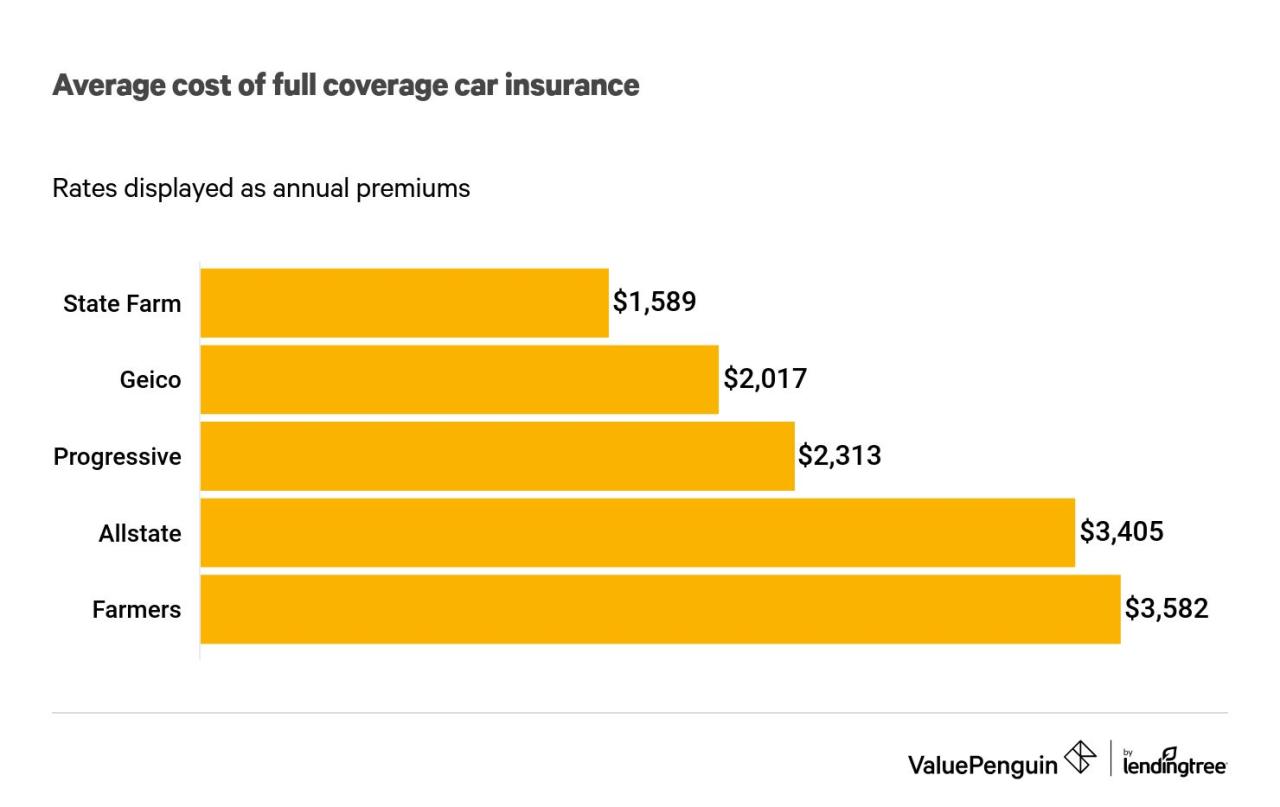

- Competitive Rates: State Farm generally offers competitive rates, especially for customers with good driving records and a clean claims history. This can be a significant advantage for customers looking for affordable insurance.

- Discounts and Promotions: State Farm offers a wide range of discounts and promotions, which can help customers save money on their premiums. These discounts can include things like good student discounts, safe driver discounts, and multi-policy discounts.

- Transparent Pricing: State Farm provides customers with clear and transparent pricing information. This helps customers understand how their premiums are calculated and allows them to compare State Farm’s rates with other insurers.

Disadvantages

- Higher Prices for Certain Customers: State Farm’s pricing model can result in higher premiums for certain customers, such as those with a poor driving record or a history of claims. This can be a disadvantage for customers who are already struggling to afford insurance.

- Limited Flexibility: State Farm’s pricing model may not offer as much flexibility as some of its competitors. This can be a disadvantage for customers who are looking for customized insurance plans that meet their specific needs.

Customer Reviews and Feedback on State Farm’s Pricing, State farm auto insurance pricing

Customer reviews and feedback on State Farm’s pricing vary depending on individual experiences and specific circumstances.

Positive Reviews

- Many customers praise State Farm’s competitive rates and discounts. They appreciate the company’s efforts to offer affordable insurance options.

- Customers also often highlight the company’s transparent pricing and the ease of understanding how their premiums are calculated.

Negative Reviews

- Some customers complain about higher premiums compared to other insurers, particularly for customers with a poor driving record or a history of claims.

- Others express frustration with the lack of flexibility in State Farm’s pricing model, particularly for customers with unique insurance needs.

State Farm’s Pricing Strategy in the Future: State Farm Auto Insurance Pricing

State Farm, like other insurance companies, must adapt to the changing landscape of the automotive industry. Emerging technologies and shifting consumer preferences are creating new opportunities and challenges for pricing strategies.

Impact of Emerging Trends on State Farm’s Pricing Model

The emergence of autonomous vehicles (AVs) and the growing use of data analytics will significantly influence State Farm’s pricing model.

- Autonomous Vehicles: AVs are expected to drastically reduce accidents, potentially leading to lower insurance premiums. However, the transition to AVs will also introduce new risks and complexities. State Farm will need to adjust its pricing models to account for the unique characteristics of AVs, such as their reliance on software and the potential for cyberattacks.

- Data Analytics: State Farm already uses data analytics to assess risk and personalize pricing. In the future, the company will likely leverage even more data sources, such as telematics data, to create more accurate and individualized pricing models. This will allow State Farm to offer more competitive rates to low-risk drivers while charging higher premiums to high-risk drivers.

Hypothetical Scenario Illustrating State Farm’s Future Pricing Strategy

Imagine a future where AVs are commonplace and telematics data is widely used. State Farm might offer a tiered pricing system based on the level of autonomy and safety features of a vehicle. Drivers with fully autonomous vehicles with advanced safety features could receive significant discounts. On the other hand, drivers who choose to retain manual control might face higher premiums due to the increased risk of accidents.

State Farm could also offer personalized discounts based on individual driving habits, such as speed, braking patterns, and time of day. This would allow the company to incentivize safe driving behavior and reward responsible drivers with lower premiums.

In this hypothetical scenario, State Farm’s pricing strategy would be more dynamic and personalized, reflecting the changing nature of driving and the increasing availability of data.

Outcome Summary

State Farm’s auto insurance pricing strategy is constantly evolving in response to changing market conditions and technological advancements. As the automotive industry embraces innovation, with the emergence of autonomous vehicles and data analytics, State Farm’s pricing model will likely adapt to reflect these trends. By understanding the factors that influence State Farm’s pricing, consumers can navigate the insurance landscape and make informed decisions that best suit their needs.

FAQ Corner

What factors does State Farm consider when determining auto insurance premiums?

State Farm considers a variety of factors, including your driving history, age, location, vehicle type, credit score, and coverage options.

How does State Farm’s pricing model work?

State Farm uses a complex pricing model that incorporates risk assessment and actuarial analysis. This model takes into account the likelihood of claims and the potential cost of coverage to determine your premium.

What discounts are available from State Farm?

State Farm offers a wide range of discounts, such as good driver discounts, safe driver discounts, multi-policy discounts, and discounts for anti-theft devices.

How transparent is State Farm about its pricing policies?

State Farm provides a moderate level of transparency regarding its pricing policies. They offer online tools and resources that allow customers to get personalized quotes and understand the factors that influence their premiums.

What are the potential future trends in State Farm’s pricing strategy?

As the automotive industry evolves, State Farm’s pricing strategy will likely be impacted by trends such as autonomous vehicles, data analytics, and the use of telematics devices.