The State Farm car insurance cost estimator is a powerful tool that helps you understand your insurance needs and get a personalized quote. This user-friendly tool considers a variety of factors, such as your driving history, vehicle type, and coverage preferences, to provide you with an accurate estimate of your insurance costs.

Understanding how the estimator works and the factors it considers can help you make informed decisions about your car insurance coverage. By providing accurate information, you can get a more precise quote and potentially save money on your premiums.

Understanding State Farm Car Insurance Cost Estimator

The State Farm car insurance cost estimator is a user-friendly online tool that allows potential customers to get a quick and personalized estimate of their car insurance premiums. It helps you understand the factors that influence your insurance costs and provides a general idea of how much you might pay.

Factors Considered in Cost Estimation

The State Farm car insurance cost estimator considers various factors to provide an accurate estimate of your car insurance premiums. These factors include:

- Your Driving History: This includes your driving record, any accidents or violations you have had, and your driving experience. A clean driving record generally leads to lower premiums.

- Your Vehicle Information: The estimator takes into account the year, make, and model of your car, as well as its safety features. Newer cars with advanced safety features typically have lower insurance costs.

- Your Location: The location where you live can influence your car insurance premiums due to factors like traffic density, crime rates, and the frequency of accidents.

- Your Coverage Options: The estimator allows you to choose the type and amount of coverage you need, such as liability, collision, comprehensive, and uninsured motorist coverage. Selecting higher coverage levels generally leads to higher premiums.

- Your Personal Information: The estimator may ask for your age, gender, marital status, and credit history. These factors can influence your insurance premiums based on statistical trends.

Data Points Required for a Quote

To get a personalized car insurance quote, the State Farm car insurance cost estimator will ask you to provide some information. This information typically includes:

- Your Contact Information: This includes your name, address, phone number, and email address.

- Your Driving History: You will be asked about your driving record, including any accidents, violations, or traffic tickets.

- Your Vehicle Information: You will need to provide details about your car, such as the year, make, model, and VIN (Vehicle Identification Number).

- Your Coverage Preferences: You will be asked about the type and amount of coverage you desire, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Your Personal Information: You may be asked for your age, gender, marital status, and credit history.

Benefits of Using the Estimator

The State Farm car insurance cost estimator is a valuable tool that provides users with a quick and easy way to estimate their potential insurance costs. This can be particularly helpful for individuals who are shopping for car insurance, as it allows them to compare rates from different providers and choose the best option for their needs.

Estimator Features Compared to Other Tools

The State Farm car insurance cost estimator stands out from other similar tools available in the market by offering a comprehensive and user-friendly experience. Unlike many basic online calculators that only ask for limited information, the State Farm estimator allows users to input a wider range of details, including:

- Vehicle information, such as make, model, year, and mileage

- Driver information, such as age, driving history, and credit score

- Coverage preferences, such as liability limits, comprehensive and collision coverage, and uninsured/underinsured motorist coverage

- Location information, such as zip code and state of residence

This level of detail provides users with a more accurate estimate of their potential insurance costs, as it takes into account a wider range of factors that can affect pricing.

How the Estimator Helps Users Make Informed Decisions

The State Farm car insurance cost estimator empowers users to make informed decisions about their insurance coverage by providing them with the following:

- A personalized estimate: The estimator considers individual factors, such as driving history and vehicle information, to generate a tailored estimate. This helps users understand how their specific circumstances impact their potential insurance costs.

- A comparison tool: Users can easily compare different coverage options and their associated costs, allowing them to choose the best balance of coverage and affordability.

- Transparency: The estimator provides a breakdown of the factors that contribute to the estimated cost, giving users a clear understanding of how their choices impact the price.

- A starting point for further discussion: The estimator can serve as a starting point for conversations with a State Farm agent, allowing users to discuss their specific needs and explore additional options.

By leveraging these benefits, users can gain valuable insights into their car insurance options and make informed decisions that align with their individual circumstances and financial goals.

Factors Affecting Insurance Costs

The cost of car insurance is influenced by a variety of factors, and understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Factors Affecting Insurance Costs

Here’s a breakdown of key factors that impact your car insurance premiums:

| Factor | Description | Impact on Cost | Example |

|---|---|---|---|

| Driving History | Your driving record, including accidents, traffic violations, and DUI convictions. | Higher premiums for drivers with a poor driving history. | A driver with two speeding tickets and an at-fault accident will likely pay higher premiums than a driver with a clean record. |

| Age and Gender | Insurance companies typically consider age and gender when calculating premiums, as these factors are statistically correlated with risk. | Younger and male drivers generally pay higher premiums due to higher risk. | A 20-year-old male driver might pay more than a 40-year-old female driver. |

| Vehicle Type and Value | The make, model, year, and safety features of your car can significantly impact your insurance costs. | Higher-performance or luxury vehicles with expensive repair costs or a history of theft tend to have higher premiums. | A sports car like a Porsche 911 will generally have higher premiums than a family sedan like a Honda Accord. |

| Location | Where you live can influence your insurance costs due to factors like traffic density, crime rates, and weather conditions. | Areas with higher crime rates or more frequent accidents tend to have higher premiums. | A driver living in a densely populated city might pay more than a driver living in a rural area. |

| Coverage Options | The type and amount of coverage you choose, such as liability, collision, and comprehensive, will directly affect your premium. | Higher coverage limits and additional options like roadside assistance or rental car coverage will increase your premium. | Choosing higher liability limits or adding collision and comprehensive coverage will increase your premium, but also provide more financial protection in case of an accident. |

| Credit Score | In some states, insurance companies may use your credit score to assess your risk, as a lower credit score is often associated with a higher risk of claims. | Drivers with lower credit scores may pay higher premiums. | A driver with a credit score of 600 might pay more than a driver with a credit score of 750. |

| Driving Habits | Factors like your annual mileage, commuting distance, and driving frequency can influence your premiums. | Drivers who commute long distances or drive frequently may pay higher premiums. | A driver who commutes 50 miles each way to work might pay more than a driver who works from home. |

Obtaining a Quote and Customization

The State Farm car insurance cost estimator provides a quick and easy way to get an idea of how much your car insurance might cost. You can get a personalized quote by providing some basic information about yourself and your vehicle. The estimator also allows you to customize your coverage options to ensure you have the right protection for your needs.

Obtaining a Quote, State farm car insurance cost estimator

You can get a quote using the State Farm car insurance cost estimator by following these simple steps:

- Visit the State Farm website and navigate to the car insurance cost estimator page.

- Enter your zip code and select your state.

- Provide information about your vehicle, such as the year, make, and model.

- Enter your driver information, such as your age, driving history, and the number of years you have been licensed.

- Select your desired coverage options.

- Click on the “Get Quote” button.

The estimator will then provide you with a personalized quote based on the information you provided.

Customizing Coverage Options

The State Farm car insurance cost estimator allows you to customize your coverage options to meet your specific needs. This means you can choose the level of coverage that is right for you and your budget.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. You can choose the amount of liability coverage that you need based on your individual circumstances.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than an accident, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

You can adjust your coverage options and see how the changes affect your quote. This allows you to find the right balance between coverage and affordability.

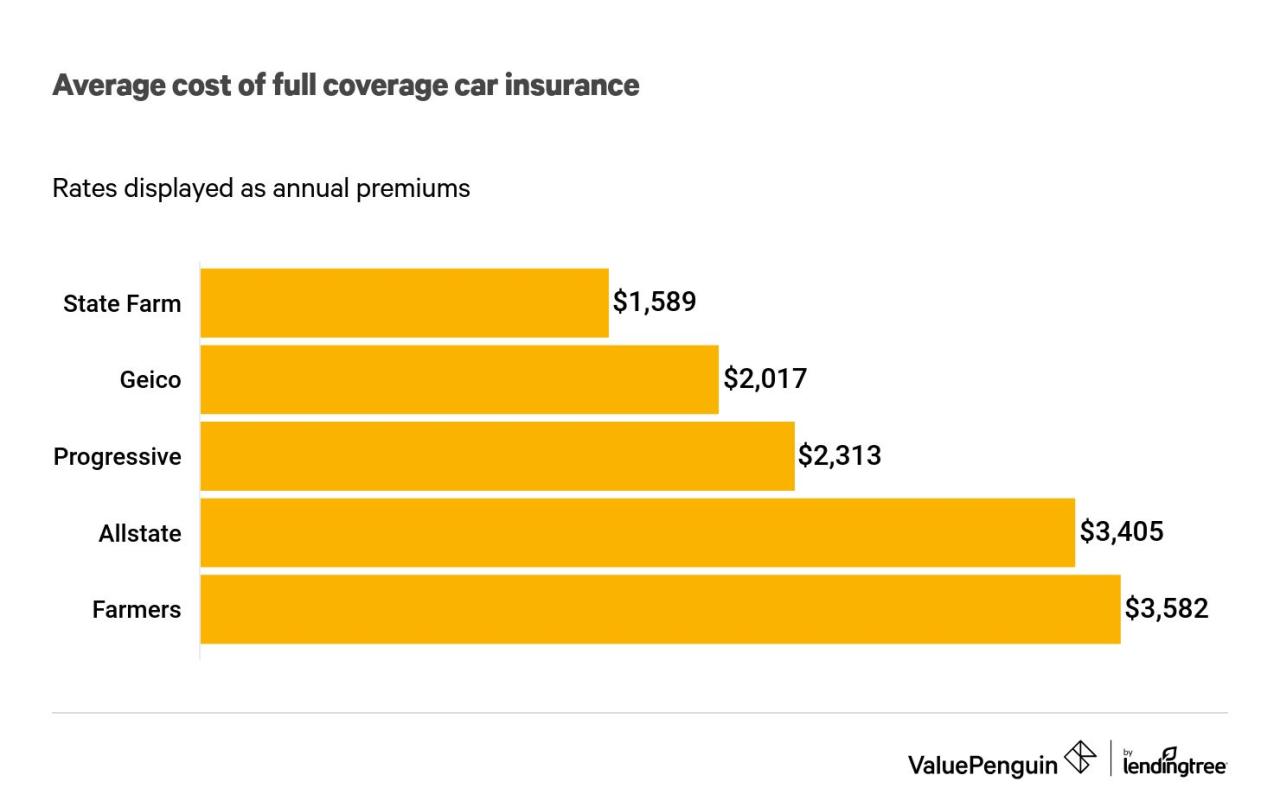

Comparison with Other Insurers

The State Farm car insurance cost estimator is a valuable tool for comparing rates and finding the best coverage for your needs. However, it’s important to consider other insurance providers and their cost estimation tools to get a comprehensive view of your options.

This section compares the State Farm car insurance cost estimator with similar tools offered by other major insurance providers. We’ll analyze the strengths and weaknesses of each estimator and highlight key differentiators.

Comparison of Estimator Features

Here’s a comparison of some key features of car insurance cost estimators from major providers, including State Farm, GEICO, Progressive, and Allstate.

| Feature | State Farm | GEICO | Progressive | Allstate |

|---|---|---|---|---|

| Ease of Use | Intuitive and straightforward | User-friendly interface | Simple and easy to navigate | Straightforward and well-organized |

| Customization Options | Comprehensive options for coverage, vehicle, and driver details | Wide range of customization options | Allows for detailed customization of coverage and vehicle information | Extensive customization options for coverage, discounts, and vehicle details |

| Accuracy of Estimates | Generally accurate, but may vary based on individual circumstances | Provides fairly accurate estimates, but may not reflect all discounts | Estimates can be reliable, but may not account for all factors | Estimates are generally accurate, but can be influenced by specific factors |

| Availability of Discounts | Shows a variety of discounts, including safe driving, good student, and multi-policy | Offers a wide range of discounts, including safe driver, good student, and multi-policy | Highlights various discounts, including safe driver, good student, and multi-policy | Displays a range of discounts, including safe driver, good student, and multi-policy |

| Customer Support | Offers 24/7 customer support through phone, email, and online chat | Provides 24/7 customer support through phone, email, and online chat | Offers customer support through phone, email, and online chat | Provides 24/7 customer support through phone, email, and online chat |

Strengths and Weaknesses of Different Estimators

Each insurance cost estimator has its strengths and weaknesses. For example, State Farm’s estimator is known for its comprehensive customization options, while GEICO’s estimator is praised for its user-friendly interface.

- State Farm: Strengths include its comprehensive customization options, accurate estimates, and availability of various discounts. However, it may not always reflect all potential discounts or provide detailed explanations of coverage options.

- GEICO: Strengths include its ease of use, user-friendly interface, and accurate estimates. However, it may not provide as many customization options as other estimators or offer detailed explanations of coverage options.

- Progressive: Strengths include its simple navigation, accurate estimates, and clear presentation of coverage options. However, it may not have as many customization options as other estimators.

- Allstate: Strengths include its extensive customization options, accurate estimates, and comprehensive coverage information. However, it may not be as user-friendly as other estimators.

Benefits and Drawbacks of Using Different Estimators

Using different insurance cost estimators can be beneficial for comparing rates and understanding your options. However, it’s important to consider the potential drawbacks.

- Benefits:

- Provides a broader perspective on rates and coverage options.

- Helps you identify the best deals and potential savings.

- Allows you to compare features and customization options across different insurers.

- Drawbacks:

- Can be time-consuming to use multiple estimators.

- May not always reflect all discounts or factors affecting your insurance cost.

- Can lead to confusion if estimates vary significantly across different insurers.

Considerations for Users

The State Farm car insurance cost estimator is a powerful tool that can help you save money on your insurance premiums. By understanding how to use the estimator effectively, you can maximize your savings and negotiate better rates.

Tips for Maximizing Savings

Here are some tips to help you get the most out of the State Farm car insurance cost estimator:

- Be Accurate with Your Information: The accuracy of the information you provide to the estimator directly impacts the quote you receive. Ensure you enter your correct driving history, vehicle details, and personal information to get a precise estimate.

- Explore Different Coverage Options: The estimator allows you to adjust your coverage levels and explore various options. Experiment with different deductible amounts and coverage types to see how they affect your premium. This can help you find the right balance between cost and coverage.

- Consider Bundling Policies: Bundling your car insurance with other policies, such as home or renters insurance, can often lead to significant discounts. Use the estimator to compare the cost of bundled policies and see how much you can save.

- Inquire About Discounts: State Farm offers various discounts, such as good driver, safe driver, and multi-car discounts. Make sure to ask about these discounts when you’re using the estimator or speaking with a representative.

Leveraging the Estimator for Negotiation

The State Farm car insurance cost estimator can be a valuable tool for negotiating better insurance rates.

- Use the Estimate as a Starting Point: The estimator provides a starting point for negotiations. When you contact a State Farm agent, you can use the estimate to demonstrate your research and show that you’re informed about potential rates.

- Highlight Your Positive Factors: If you have a clean driving record, have taken defensive driving courses, or have other factors that may qualify you for discounts, highlight these aspects during your negotiations. The estimator can help you identify and quantify the potential savings from these factors.

- Compare Quotes from Other Insurers: Using the State Farm estimator, you can compare quotes from other insurers. This can help you leverage competitive rates and negotiate a better deal with State Farm.

Comparing Quotes and Choosing the Best Plan

When comparing quotes from different insurers, including State Farm, consider these factors:

- Coverage Levels: Ensure that the coverage levels offered by each insurer meet your needs. Don’t solely focus on the cheapest quote; consider the comprehensiveness of the coverage.

- Deductibles: Higher deductibles generally lead to lower premiums. Carefully assess your risk tolerance and financial situation when choosing a deductible.

- Customer Service and Claims Process: Research each insurer’s customer service reputation and claims handling process. This information can be crucial in case you need to file a claim.

- Financial Stability: Check the financial stability of the insurance company to ensure they can fulfill their obligations in case of a significant claim.

Epilogue

With its comprehensive approach and user-friendly interface, the State Farm car insurance cost estimator empowers you to take control of your insurance needs. By understanding the factors that influence your costs and comparing quotes, you can find the best coverage for your specific circumstances and potentially save money in the process.

FAQ Section

How accurate are the quotes provided by the State Farm estimator?

The State Farm car insurance cost estimator provides a personalized quote based on the information you provide. While it aims to be accurate, it’s important to remember that the final cost may vary slightly depending on additional factors that are not captured in the initial estimate.

Can I get a quote without providing personal information?

No, to receive a personalized quote, the State Farm car insurance cost estimator requires some basic personal information, such as your name, address, and driving history. This information is used to calculate your insurance costs accurately.

Is the State Farm car insurance cost estimator available on mobile devices?

Yes, the State Farm car insurance cost estimator is available on both desktop and mobile devices. You can access it through the State Farm website or their mobile app.