Car insurance State Farm cost is a crucial factor for anyone seeking affordable and reliable coverage. State Farm, a leading insurance provider, offers a wide range of car insurance options designed to meet diverse needs and budgets. This guide delves into the intricacies of State Farm car insurance costs, exploring the key factors that influence premiums, providing a step-by-step guide to obtaining quotes, and outlining coverage options, discounts, and customer experiences.

Understanding the factors that affect State Farm car insurance costs is essential for making informed decisions. This includes evaluating individual driving history, vehicle type, location, and other relevant variables. By understanding how these factors impact premiums, you can optimize your coverage and potentially save money. This guide also provides insights into the different coverage options offered by State Farm, allowing you to select the most suitable plan for your specific requirements.

State Farm Car Insurance Overview

State Farm is one of the largest and most well-known insurance companies in the United States, offering a wide range of insurance products, including car insurance. The company has a long history and a strong reputation for providing reliable and affordable coverage.

State Farm car insurance is designed to protect you financially in the event of an accident or other covered event. It provides coverage for various aspects of your car, including damage to your vehicle, injuries to yourself or others, and liability for property damage.

State Farm’s Reputation and History

State Farm has been in business for over 100 years, founded in 1922. Throughout its history, the company has earned a reputation for financial stability, customer service, and a strong commitment to its policyholders. State Farm consistently ranks highly in customer satisfaction surveys and is known for its friendly and helpful agents.

Key Features and Benefits of State Farm Car Insurance

State Farm car insurance offers a variety of features and benefits that can help you customize your coverage and protect your financial interests. These features include:

- Comprehensive and Collision Coverage: These coverages protect you from damage to your car due to accidents, theft, vandalism, or other covered events.

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes injury or damage to others.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you are involved in an accident with a driver who does not have adequate insurance.

- Personal Injury Protection (PIP): This coverage helps cover medical expenses for you and your passengers in the event of an accident.

- Rental Car Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged in an accident and needs repairs.

- Roadside Assistance: This coverage provides assistance for things like flat tires, jump starts, and towing.

- Discounts: State Farm offers a wide range of discounts to help lower your insurance premiums, such as discounts for good driving records, safety features in your car, and bundling multiple insurance policies.

State Farm also offers various digital tools and resources to make managing your insurance easier. These include online account access, mobile apps, and 24/7 customer support.

Factors Affecting State Farm Car Insurance Costs

State Farm, like other insurance providers, calculates your car insurance premiums based on a variety of factors. These factors are designed to assess your individual risk and determine the likelihood of you filing a claim. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your car insurance rates. State Farm considers your past driving record, including accidents, traffic violations, and driving experience.

- Accidents: A recent accident, even if you weren’t at fault, can significantly increase your premiums. State Farm may see you as a higher risk driver, leading to a higher premium.

- Traffic Violations: Speeding tickets, reckless driving, and other violations also contribute to higher premiums. These violations indicate a higher risk of future accidents.

- Driving Experience: New drivers typically pay higher premiums than experienced drivers. This is because they have less experience on the road and may be more likely to be involved in accidents.

Vehicle Type

The type of vehicle you drive is another key factor in determining your insurance costs. State Farm considers factors such as:

- Vehicle Make and Model: Some car models are known to be more expensive to repair or replace, leading to higher insurance premiums.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often associated with lower premiums. These features reduce the likelihood of accidents and severity of injuries, leading to lower insurance costs.

- Vehicle Value: The value of your vehicle also plays a role. More expensive vehicles generally have higher premiums due to the higher cost of repairs or replacement.

Location

Your location can impact your State Farm car insurance premiums due to factors such as:

- Population Density: Areas with higher population density often have more traffic, leading to a higher risk of accidents. This can result in higher insurance premiums.

- Crime Rates: Areas with high crime rates may have higher premiums as there is a greater risk of theft or vandalism.

- Weather Conditions: Regions with extreme weather conditions, such as hurricanes or heavy snowfall, can lead to higher premiums. These conditions can increase the likelihood of accidents and damage to vehicles.

Other Factors

Beyond driving history, vehicle type, and location, other factors can also influence your State Farm car insurance premiums:

- Credit Score: In some states, insurance companies may consider your credit score as a factor in determining your premiums. A good credit score is often associated with responsible behavior, which can lead to lower premiums.

- Coverage Options: The type and amount of coverage you choose can significantly impact your premiums. For example, opting for higher coverage limits or additional coverage options, such as comprehensive or collision coverage, will generally lead to higher premiums.

- Discounts: State Farm offers various discounts that can help reduce your premiums. These discounts can be based on factors such as good driving history, safety features, multiple policies, and bundling insurance.

State Farm Car Insurance Quotes and Comparison

Getting a car insurance quote from State Farm is a straightforward process that can be completed online, over the phone, or in person. The quotes you receive can vary depending on several factors, and comparing State Farm’s quotes with those from other major insurance providers can help you find the best value for your needs.

Obtaining a Car Insurance Quote from State Farm

To obtain a car insurance quote from State Farm, you can follow these steps:

- Visit the State Farm website. You can find the website at statefarm.com.

- Click on the “Get a Quote” button. This button is typically located in the top right corner of the website.

- Enter your personal information. This includes your name, address, date of birth, and contact information.

- Provide details about your vehicle. This includes the make, model, year, and VIN number.

- Answer questions about your driving history. This includes your driving record, the number of years you have been driving, and any accidents or violations you have had.

- Select your desired coverage options. This includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Review your quote and make any necessary changes. Once you have reviewed your quote, you can make any changes to your coverage options or adjust your deductible.

- Submit your quote request. Once you are satisfied with your quote, you can submit your request and State Farm will provide you with a personalized quote.

Examples of Typical Car Insurance Quote Scenarios

Here are some examples of typical car insurance quote scenarios with varying factors:

- Scenario 1: A 25-year-old driver with a clean driving record and a new car might receive a lower quote than a 65-year-old driver with a history of accidents and an older car.

- Scenario 2: A driver who lives in a high-risk area, such as a city with a lot of traffic, might receive a higher quote than a driver who lives in a rural area.

- Scenario 3: A driver who chooses to increase their deductible might receive a lower premium than a driver who chooses to keep a lower deductible.

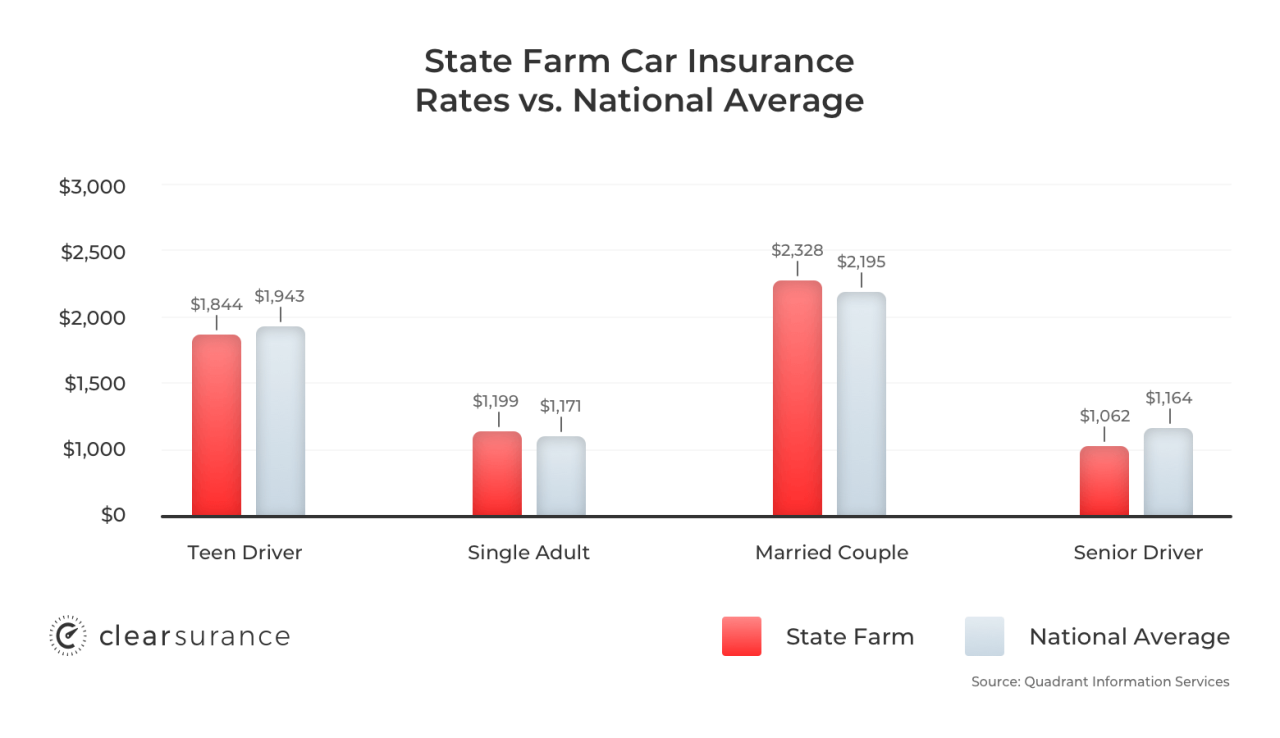

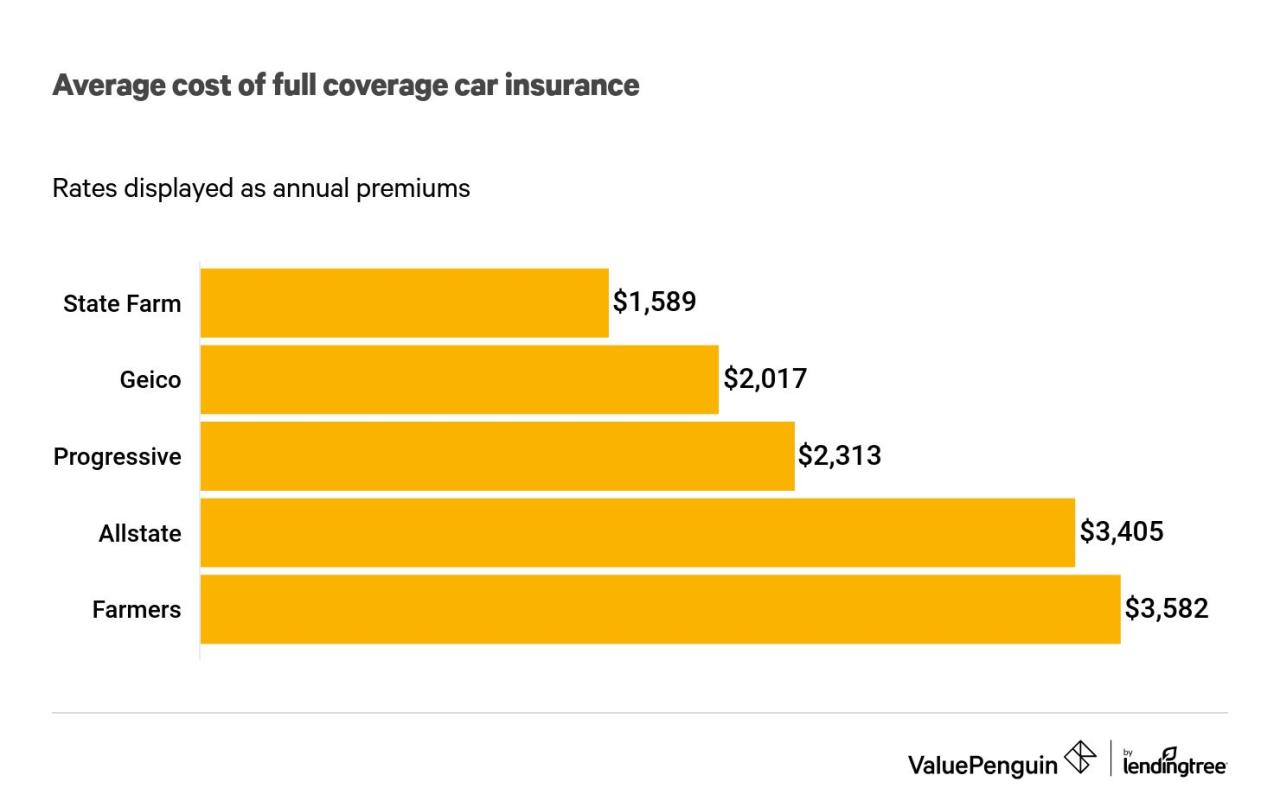

Comparing State Farm Car Insurance Quotes with Other Providers

It is essential to compare car insurance quotes from multiple providers to ensure you are getting the best value. You can use online comparison websites, such as Policygenius or The Zebra, to quickly and easily compare quotes from different insurers. When comparing quotes, it is important to consider the following factors:

- Coverage options: Make sure you are comparing quotes for the same coverage options.

- Deductibles: A higher deductible will generally result in a lower premium.

- Discounts: Many insurance providers offer discounts for good drivers, safe vehicles, and other factors.

- Customer service: Consider the insurer’s reputation for customer service and claims handling.

It is important to note that the best car insurance provider for one person may not be the best for another. It is essential to compare quotes from multiple providers and choose the policy that best meets your individual needs and budget.

State Farm Car Insurance Coverage Options

State Farm offers a comprehensive range of car insurance coverage options to meet the diverse needs of its policyholders. Understanding these coverage options and their benefits is crucial for making informed decisions about your car insurance policy. This section will provide a detailed overview of the different coverage types offered by State Farm, highlighting their benefits and limitations.

Liability Coverage

Liability coverage is a fundamental component of car insurance. It protects you financially if you cause an accident that results in injuries or property damage to others. State Farm offers two main types of liability coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver(s) and passengers involved in an accident caused by you. It also covers legal defense costs if you are sued.

- Property Damage Liability: This coverage pays for repairs or replacement costs for the other driver’s vehicle and any other property damaged in an accident caused by you.

The amount of liability coverage you need depends on your individual circumstances and the laws in your state. State Farm typically offers liability coverage limits in increments of $25,000 or $50,000 per person and $50,000 or $100,000 per accident. For example, a 25/50/100 policy provides up to $25,000 per person for bodily injury, up to $50,000 per accident for bodily injury, and up to $100,000 per accident for property damage.

Collision Coverage

Collision coverage protects you financially if your vehicle is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement, minus your deductible. For instance, if your vehicle is involved in an accident and the damage exceeds your deductible, State Farm will pay for the repairs or replacement. However, collision coverage does not cover damage caused by events like floods, earthquakes, or vandalism.

Comprehensive Coverage

Comprehensive coverage protects you financially if your vehicle is damaged due to events other than an accident, such as theft, vandalism, fire, or natural disasters. It covers the cost of repairs or replacement, minus your deductible. For instance, if your car is stolen or damaged by a hailstorm, comprehensive coverage will help cover the repair or replacement costs. However, it does not cover damage caused by normal wear and tear or accidents.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. This coverage pays for your medical expenses, lost wages, and other damages, up to the policy limits. For instance, if you are involved in an accident with an uninsured driver, UM coverage will help cover your losses. UM/UIM coverage is highly recommended, as it provides an additional layer of protection against the financial burden of an accident caused by an uninsured or underinsured driver.

Personal Injury Protection (PIP)

PIP coverage, also known as No-Fault coverage, is required in some states. It covers your medical expenses, lost wages, and other damages, regardless of who is at fault in an accident. For example, if you are involved in an accident and are injured, PIP coverage will help cover your medical expenses and lost wages, regardless of who caused the accident.

Medical Payments Coverage (Med Pay)

Med Pay coverage is optional and provides additional coverage for medical expenses, regardless of who is at fault in an accident. For instance, if you are injured in an accident, Med Pay coverage will help cover your medical expenses, even if you are not at fault.

Rental Car Coverage

Rental car coverage provides temporary transportation while your vehicle is being repaired after an accident. It covers the cost of renting a car, up to a certain amount and for a specific duration. For instance, if your car is damaged in an accident and needs repairs, rental car coverage will help cover the cost of renting a car while your vehicle is being repaired.

Towing and Labor Coverage

Towing and labor coverage provides reimbursement for the cost of towing and labor services if your vehicle breaks down or is disabled. For instance, if your car breaks down on the side of the road, towing and labor coverage will help cover the cost of towing your vehicle to a repair shop.

Other Coverage Options

State Farm also offers several other coverage options, such as:

- Gap Insurance: This coverage pays the difference between the actual cash value of your vehicle and the amount you owe on your auto loan or lease if your vehicle is totaled in an accident.

- Roadside Assistance: This coverage provides assistance with flat tires, jump starts, and other roadside emergencies.

- Custom Equipment Coverage: This coverage provides additional protection for aftermarket modifications or custom equipment installed on your vehicle.

Coverage Comparison

| Coverage Type | Inclusions | Typical Cost |

|---|---|---|

| Liability | Bodily injury and property damage to others | Varies based on coverage limits and driving record |

| Collision | Damage to your vehicle in an accident | Varies based on vehicle type and driving record |

| Comprehensive | Damage to your vehicle due to non-accident events | Varies based on vehicle type and driving record |

| UM/UIM | Damage caused by uninsured or underinsured drivers | Varies based on coverage limits and driving record |

| PIP | Medical expenses and lost wages, regardless of fault | Varies based on state requirements and coverage limits |

| Med Pay | Medical expenses, regardless of fault | Varies based on coverage limits and driving record |

| Rental Car | Temporary transportation while your vehicle is being repaired | Varies based on coverage limits and driving record |

| Towing and Labor | Reimbursement for towing and labor services | Varies based on coverage limits and driving record |

State Farm Car Insurance Discounts and Programs

State Farm offers a variety of discounts and programs that can help you save money on your car insurance. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and loyalty to State Farm. By taking advantage of these programs, you can significantly reduce your car insurance premiums and potentially save hundreds of dollars each year.

Discounts, Car insurance state farm cost

State Farm offers a wide range of discounts that can reduce your car insurance premiums. These discounts are categorized based on your driving habits, vehicle features, and other factors. Here are some of the most common discounts offered by State Farm:

- Safe Driving Discounts: These discounts reward drivers with a clean driving record. For example, State Farm offers discounts for drivers who have not had any accidents or traffic violations for a specific period.

- Good Student Discount: This discount is available to students who maintain a certain GPA. This discount is typically offered to high school and college students who have a good academic record.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and qualify you for a discount on your car insurance premiums.

- Multiple Policy Discount: State Farm offers a discount for customers who bundle their car insurance with other insurance policies, such as homeowners, renters, or life insurance.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can help deter theft and qualify you for a discount on your car insurance premiums.

- Vehicle Safety Features Discount: Cars with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and can qualify for a discount.

- Loyalty Discount: State Farm rewards long-term customers with loyalty discounts. The longer you remain a State Farm customer, the more you can save on your car insurance premiums.

- Paperless Discount: Opting for electronic communication instead of paper statements can qualify you for a discount on your car insurance premiums.

- Paid-in-Full Discount: Paying your car insurance premiums in full upfront can qualify you for a discount.

Programs

State Farm offers several programs that can help you save money on your car insurance. These programs are designed to encourage safe driving practices and promote responsible vehicle ownership. Here are some of the most notable programs:

- Drive Safe & Save: This program uses telematics devices to track your driving habits and provide feedback on your driving style. Based on your driving behavior, you may qualify for a discount on your car insurance premiums.

- State Farm Steer Clear: This program is designed to help young drivers develop safe driving habits. It offers discounts for completing a driver’s education course and for maintaining a clean driving record.

- State Farm Accident Forgiveness: This program allows you to avoid a rate increase for your first at-fault accident. This can be a valuable benefit for drivers who have a clean driving record and are concerned about a single accident affecting their insurance premiums.

Examples of Savings

The discounts and programs offered by State Farm can significantly impact your car insurance premiums. Here are some examples of how these programs can save you money:

- Safe Driving Discount: A driver with a clean driving record for five years may qualify for a 10% discount on their car insurance premiums.

- Good Student Discount: A high school student with a 3.5 GPA or higher may qualify for a 15% discount on their car insurance premiums.

- Multiple Policy Discount: A customer who bundles their car insurance with homeowners insurance may qualify for a 10% discount on their car insurance premiums.

- Drive Safe & Save: A driver who consistently demonstrates safe driving habits through the Drive Safe & Save program may qualify for a 10% discount on their car insurance premiums.

State Farm Car Insurance Customer Experience: Car Insurance State Farm Cost

Having a positive customer experience is essential for any insurance company, and State Farm is no exception. They aim to provide a seamless and satisfying experience for their policyholders.

Customer Reviews and Testimonials

Customer reviews and testimonials offer valuable insights into the real-world experiences with State Farm car insurance. Many customers praise State Farm’s friendly and responsive customer service representatives. Others appreciate the company’s clear and concise communication, making it easy to understand their policies and coverage options.

“I’ve been with State Farm for over 10 years and have always been happy with their service. They’ve been there for me when I needed them, and their claims process is straightforward and efficient.” – John S., a satisfied State Farm customer.

State Farm’s Customer Service Channels

State Farm offers various customer service channels to cater to different preferences and needs. These include:

- Online Platform: State Farm’s website provides a comprehensive online platform for managing policies, paying bills, filing claims, and accessing account information. The platform is user-friendly and accessible 24/7.

- Mobile App: The State Farm mobile app offers convenient access to policy information, claims reporting, roadside assistance, and other services. It is available for both iOS and Android devices.

- Phone Support: State Farm has a dedicated customer service phone line available for assistance with various inquiries and issues. Their representatives are available 24/7 to provide support.

- Local Agents: State Farm has a vast network of local agents across the United States. These agents can provide personalized service, answer questions, and assist with policy changes or claims.

Overall Customer Satisfaction Levels

State Farm consistently ranks highly in customer satisfaction surveys. For example, J.D. Power’s 2023 U.S. Auto Insurance Satisfaction Study ranked State Farm among the top insurance companies in terms of overall customer satisfaction. This high level of customer satisfaction can be attributed to several factors, including:

- Strong Brand Reputation: State Farm has a long-standing reputation for reliability and customer-centricity, which contributes to high levels of trust and satisfaction.

- Competitive Pricing: State Farm offers competitive insurance rates, making it an attractive option for budget-conscious consumers.

- Wide Range of Coverage Options: State Farm provides a wide array of coverage options to cater to diverse needs and preferences. This allows customers to tailor their insurance policies to meet their specific requirements.

- Excellent Claims Service: State Farm has a reputation for handling claims efficiently and fairly. Their claims process is designed to be straightforward and hassle-free, ensuring a smooth experience for customers.

Closing Summary

Navigating the world of car insurance can be daunting, but this comprehensive guide equips you with the knowledge and tools to make informed decisions about State Farm car insurance costs. By understanding the factors that influence premiums, comparing quotes, and exploring available discounts, you can find the best possible coverage at a price that suits your budget. With its extensive coverage options, competitive pricing, and commitment to customer satisfaction, State Farm remains a trusted choice for car insurance needs.

FAQ Corner

What factors affect State Farm car insurance costs?

Factors such as your driving history, vehicle type, location, and coverage options can significantly impact your State Farm car insurance premiums.

How can I get a car insurance quote from State Farm?

You can obtain a quote online, over the phone, or by visiting a local State Farm agent.

Does State Farm offer discounts on car insurance?

Yes, State Farm offers various discounts for safe driving, good student records, bundling insurance policies, and more.

What are the different types of coverage offered by State Farm?

State Farm offers a range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

How is State Farm’s customer service?

State Farm has a reputation for providing excellent customer service through various channels, including online platforms and contact information.