State minimum car insurance Texas is a legal requirement for all drivers, designed to protect you and others on the road in case of an accident. This article will guide you through the essential aspects of Texas’s minimum car insurance requirements, including coverage types, cost factors, and the consequences of driving without insurance.

Texas law mandates that all drivers carry a minimum amount of liability insurance to cover potential damages to others in case of an accident. This minimum coverage includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. The specific limits for each coverage type are set by the state and are crucial to understanding your legal obligations and financial protection.

Texas Minimum Car Insurance Requirements

In Texas, having car insurance is not just a good idea; it’s a legal requirement. Driving without insurance can result in serious consequences, including hefty fines and even the suspension of your driver’s license. The state mandates that all drivers carry a minimum level of insurance coverage to protect themselves and others in case of an accident.

Minimum Coverage Requirements

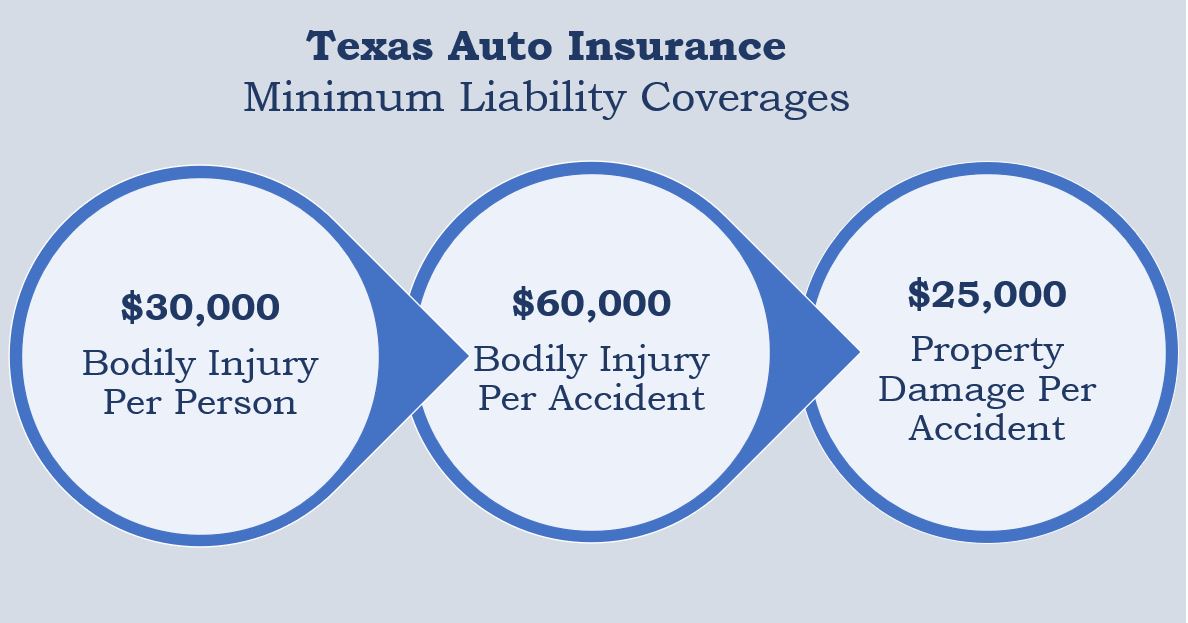

Texas law mandates that all drivers carry specific types of car insurance coverage with minimum limits. These coverage types are designed to provide financial protection in the event of an accident.

| Coverage Type | Minimum Limit | Description |

|---|---|---|

| Liability Coverage | $30,000 per person / $60,000 per accident | This coverage protects you financially if you are at fault in an accident that causes injuries to others. It covers medical expenses, lost wages, and other damages. |

| Property Damage Liability Coverage | $25,000 per accident | This coverage protects you if you are at fault in an accident that damages another person’s property. It covers repairs or replacement costs for the damaged vehicle or property. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | $30,000 per person / $60,000 per accident | This coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver. It helps cover medical expenses, lost wages, and other damages. |

Understanding Coverage Types

The Texas minimum car insurance requirements are designed to provide basic financial protection in case of an accident. However, these requirements are just the bare minimum. To ensure you have adequate coverage, it’s important to understand the different types of car insurance and their purpose.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident that causes injury or damage to others. It covers the costs associated with the other driver’s medical expenses, property damage, and lost wages.

- Bodily Injury Liability: This coverage pays for the medical expenses, lost wages, and pain and suffering of the other driver and passengers in the other vehicle.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other property damaged in the accident.

Medical Payments Coverage

Medical payments coverage (Med Pay) covers your medical expenses, regardless of who is at fault in the accident. This coverage applies to you, your passengers, and sometimes even pedestrians involved in an accident with your vehicle.

- Medical Payments Coverage: This coverage is optional, but it can be very helpful in covering medical bills, even if you are not at fault in an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you in case you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses.

- Uninsured Motorist Coverage (UM): This coverage pays for your medical expenses and property damage if you are hit by an uninsured driver.

- Underinsured Motorist Coverage (UIM): This coverage pays for your medical expenses and property damage if you are hit by an underinsured driver.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is highly recommended if you have a car loan or lease.

- Collision Coverage: This coverage covers the cost of repairs or replacement of your vehicle, minus your deductible.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle if it is damaged by something other than an accident, such as theft, vandalism, fire, or hail. This coverage is optional, but it is highly recommended if you have a new or expensive vehicle.

- Comprehensive Coverage: This coverage covers the cost of repairs or replacement of your vehicle, minus your deductible.

Table Comparing Coverage Types

| Coverage Type | Purpose | Benefits | Limitations |

|---|---|---|---|

| Liability Coverage | Protects you financially if you are at fault in an accident. | Covers the other driver’s medical expenses, property damage, and lost wages. | Does not cover your own medical expenses or property damage. |

| Medical Payments Coverage | Covers your medical expenses, regardless of who is at fault. | Pays for your medical bills, even if you are not at fault. | Limited coverage amount. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are hit by a driver without insurance or with insufficient insurance. | Covers your medical expenses and property damage. | Only applies if the other driver is uninsured or underinsured. |

| Collision Coverage | Pays for repairs or replacement of your vehicle if it is damaged in an accident. | Covers the cost of repairs or replacement, minus your deductible. | Only applies to accidents, not other types of damage. |

| Comprehensive Coverage | Pays for repairs or replacement of your vehicle if it is damaged by something other than an accident. | Covers the cost of repairs or replacement, minus your deductible. | Only applies to non-accident damage, such as theft or vandalism. |

Factors Affecting Insurance Costs

While Texas law mandates minimum car insurance coverage, the actual cost of your policy can vary significantly. Numerous factors play a role in determining your insurance premiums, influencing how much you pay for the required coverage. Understanding these factors can help you make informed decisions to potentially reduce your insurance costs.

Driving History

Your driving history is a significant factor in determining your insurance premiums. Insurance companies assess your driving record to gauge your risk of accidents.

- Accidents: Having a history of accidents, especially at-fault accidents, generally increases your insurance premiums. Insurance companies view you as a higher risk driver, making them more likely to charge higher premiums.

- Traffic Violations: Traffic violations like speeding tickets, reckless driving, and DUI convictions can also lead to higher insurance premiums. These violations indicate a greater risk of future accidents, prompting insurance companies to charge more.

- Clean Driving Record: Conversely, maintaining a clean driving record with no accidents or violations can lead to lower premiums. Insurance companies recognize you as a responsible driver, making you a less risky investment for them.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance costs. Certain vehicle characteristics can influence your premiums, making some vehicles more expensive to insure than others.

- Vehicle Value: The value of your vehicle is a significant factor. More expensive vehicles are generally more costly to repair or replace, leading to higher insurance premiums. Insurance companies charge more to cover the potential financial burden associated with these vehicles.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often associated with lower insurance premiums. These features help mitigate accident severity, reducing the potential cost of claims for insurance companies.

- Vehicle Performance: High-performance vehicles, known for their speed and power, are often considered riskier to insure. Insurance companies may perceive them as having a higher potential for accidents, resulting in higher premiums.

Location

The location where you live can also impact your insurance premiums. Factors related to your location, such as the density of population, crime rates, and traffic congestion, influence insurance costs.

- Urban Areas: Living in densely populated urban areas with higher traffic volume and crime rates can often lead to higher insurance premiums. These areas generally have a higher risk of accidents and vehicle theft, making insurance companies charge more to cover potential claims.

- Rural Areas: Conversely, residing in rural areas with lower population density and less traffic congestion can often result in lower insurance premiums. These areas typically have lower accident rates and vehicle theft, leading to reduced insurance costs.

Finding Affordable Coverage

Finding the most affordable minimum car insurance in Texas requires a proactive approach and a bit of research. You don’t have to settle for the first quote you get, and there are several strategies you can employ to lower your premiums.

Comparing Quotes from Multiple Providers

It’s crucial to compare quotes from multiple insurance providers to find the best rates. This is because different companies use different factors to calculate premiums, so what might be a good deal with one company might not be with another.

- Online comparison websites: These websites allow you to enter your information once and get quotes from multiple insurers. Some popular options include:

- Insurify

- Policygenius

- The Zebra

- Contact insurers directly: You can also contact insurance companies directly to get a quote. This allows you to ask specific questions and discuss your needs in more detail.

Benefits of Discounts and Policy Adjustments

Many insurance companies offer discounts and policy adjustments that can significantly lower your premiums.

- Good driver discounts: If you have a clean driving record, you may be eligible for a good driver discount.

- Safe driver discounts: Some insurers offer discounts for drivers who have completed a defensive driving course.

- Multi-car discounts: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount.

- Bundling discounts: You can often save money by bundling your car insurance with other types of insurance, such as homeowners or renters insurance.

- Loyalty discounts: Some insurers offer discounts to long-term customers.

- Payment plan discounts: You may be able to save money by paying your premiums annually or semi-annually instead of monthly.

- Safety features discounts: Some insurers offer discounts for vehicles with safety features like anti-theft devices or airbags.

It’s worth taking the time to explore these options and see how they can impact your premiums.

Consequences of Driving Without Insurance: State Minimum Car Insurance Texas

Driving without the minimum required car insurance in Texas can lead to serious legal and financial repercussions. If you’re caught driving without insurance, you could face penalties, fines, and even license suspension. Moreover, you’ll be responsible for covering any damages or injuries you cause in an accident.

Legal Penalties

The legal consequences of driving without insurance in Texas are severe. The state considers driving without insurance a serious offense, and the penalties can be substantial.

- Fines: You could face a fine of up to $350 for the first offense and $500 for subsequent offenses.

- License Suspension: Your driver’s license could be suspended for up to six months for a first offense, and up to two years for subsequent offenses.

- Jail Time: While rare, you could face jail time if you’re caught driving without insurance multiple times.

Financial Liabilities

Driving without insurance in Texas means you’ll be fully responsible for any damages or injuries you cause in an accident. This can result in significant financial burdens.

- Property Damage: You’ll be responsible for repairing or replacing any damaged property, including the other vehicle and any other property involved in the accident.

- Medical Expenses: If you injure someone in an accident, you’ll be responsible for their medical bills, including hospital stays, surgeries, and rehabilitation.

- Lost Wages: You may be required to pay for the injured party’s lost wages if they are unable to work due to the accident.

- Lawsuits: The injured party could sue you for damages, potentially leading to significant financial losses.

Other Potential Consequences

Beyond legal penalties and financial liabilities, driving without insurance can also have other consequences.

- Increased Insurance Costs: If you eventually obtain insurance, you may face higher premiums due to your history of driving without coverage.

- Difficulty Obtaining Insurance: Some insurance companies may be hesitant to insure you if you have a history of driving without insurance.

- Damage to Your Credit Score: If you are sued for damages and lose, the judgment could be reported to credit bureaus, negatively impacting your credit score.

Understanding Your Policy

Your car insurance policy is a legally binding contract that Artikels the terms of your coverage and the responsibilities of both you and your insurance provider. It’s crucial to thoroughly understand your policy to ensure you have the right coverage and to avoid any surprises or misunderstandings in the event of an accident or claim.

Reviewing Your Policy

It’s essential to review your policy documents carefully to understand your coverage details. You should pay attention to the following key aspects:

- Coverage Limits: This refers to the maximum amount your insurance company will pay for each type of coverage. Ensure the limits are sufficient to cover your potential liabilities.

- Deductibles: This is the amount you pay out of pocket before your insurance kicks in. Higher deductibles typically result in lower premiums, but you’ll have to pay more in the event of a claim.

- Exclusions: This refers to situations or events not covered by your policy. Understanding these exclusions is vital to avoid disappointment or financial burden.

- Policy Period: This specifies the duration of your policy and when it will expire. Remember to renew your policy before it expires to ensure continuous coverage.

Interpreting Your Policy

Insurance policies can be complex and filled with legal jargon. Here are some tips for interpreting your policy documents:

- Read the entire policy: Don’t just skim through it; read it carefully to understand all the terms and conditions.

- Use a dictionary: If you encounter unfamiliar terms, use a dictionary or online resources to clarify their meaning.

- Ask for clarification: If you have any questions or doubts, don’t hesitate to contact your insurance provider for clarification.

- Seek professional help: If you find the policy too complicated, consider consulting an insurance broker or agent who can explain it to you in plain language.

Seeking Clarification from Your Insurance Provider

Your insurance provider is your best resource for understanding your policy. Don’t hesitate to contact them if you have any questions or need clarification on any aspect of your policy.

- Call their customer service line: This is the most direct way to get immediate answers to your questions.

- Visit their website: Many insurance companies have comprehensive FAQs and online resources that may address your concerns.

- Schedule an appointment: If your questions require more in-depth explanation, consider scheduling an appointment with an insurance agent or representative.

Making Claims and Filing Disputes

In the unfortunate event of an accident, understanding how to file a claim under your minimum car insurance policy is crucial. This section Artikels the process of filing a claim and resolving disputes with your insurance provider.

Filing a Claim

After an accident, it’s important to act promptly to ensure your claim is processed efficiently.

- Contact your insurance company: Immediately report the accident to your insurance company. Provide details such as the date, time, location, and nature of the accident.

- File a police report: If the accident involves injuries or property damage, it’s essential to file a police report. This documentation serves as official evidence of the incident.

- Gather information: Collect contact information from all parties involved, including witnesses. Obtain their names, addresses, phone numbers, and insurance details.

- Take photos and videos: Document the accident scene by taking photographs or videos of the damage to your vehicle and any injuries sustained.

- Seek medical attention: If you or anyone else is injured, seek medical attention immediately.

- Complete claim forms: Your insurance company will provide you with claim forms to complete. Ensure you provide accurate and detailed information.

Resolving Disputes with Your Insurance Provider, State minimum car insurance texas

Disputes with insurance providers can arise. Here’s how to navigate the process:

- Review your policy: Familiarize yourself with the terms and conditions of your policy. Understand your coverage limits and any exclusions.

- Communicate effectively: Maintain clear and concise communication with your insurance company. Document all interactions, including dates, times, and key points discussed.

- Negotiate a settlement: If you disagree with the initial settlement offer, attempt to negotiate a fair resolution.

- Seek mediation or arbitration: If negotiations fail, consider seeking mediation or arbitration. These processes involve a neutral third party who can help resolve the dispute.

- Consult with an attorney: If you believe your insurance company is acting in bad faith or refusing to pay a legitimate claim, consulting with an attorney is advisable.

Conclusive Thoughts

Driving without minimum car insurance in Texas can lead to significant legal and financial consequences. It’s essential to understand your policy, compare quotes from multiple providers, and make sure you have adequate coverage to protect yourself and others. Remember, responsible driving practices and maintaining adequate insurance coverage are crucial for a safe and secure driving experience in Texas.

Key Questions Answered

What happens if I get into an accident and don’t have minimum car insurance?

You could face significant legal penalties, including fines, license suspension, and even jail time. You would also be responsible for all damages caused to other vehicles and individuals involved in the accident, potentially leading to substantial financial losses.

How do I find affordable car insurance in Texas?

Start by comparing quotes from multiple insurance providers online or through a broker. Look for discounts, such as safe driving records, good student discounts, and multi-policy discounts. Consider increasing your deductible to lower your premium, but make sure you can afford to pay the deductible in case of an accident.

What are the benefits of having more than minimum car insurance?

Higher coverage limits provide greater financial protection in case of a serious accident. Additional coverage options, such as collision and comprehensive coverage, can help cover repairs or replacement costs for your own vehicle in case of an accident or other events like theft or vandalism.