Auto insurance companies in Washington state play a crucial role in protecting drivers and their vehicles. The state’s unique insurance landscape is shaped by mandatory coverage requirements, a robust regulatory environment, and a diverse population with varying needs. Navigating this complex market can be challenging, but understanding the key factors that influence insurance rates, the different types of policies available, and how to find the best company for your situation is essential. This guide will provide you with the insights you need to make informed decisions about your auto insurance.

From understanding the impact of demographic factors like age and driving history to exploring the influence of vehicle type and safety features on insurance costs, this guide will delve into the intricacies of Washington state’s auto insurance market. We will also discuss strategies for finding the most affordable and suitable policy, managing claims effectively, and taking advantage of available discounts to save money.

Understanding Washington State’s Auto Insurance Landscape

Navigating the world of auto insurance in Washington State can feel complex, but understanding the key elements can help you make informed decisions. The state’s unique regulations and requirements play a significant role in shaping the auto insurance market and ultimately influence your premiums.

Mandatory Coverage Requirements

Washington State mandates several types of auto insurance coverage to ensure financial protection for drivers and their victims in the event of an accident. These requirements aim to protect the public and ensure financial responsibility on the road.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injuries or property damage to others. Washington requires a minimum of $25,000 per person/$50,000 per accident for bodily injury liability and $10,000 for property damage liability. This coverage helps cover medical expenses, lost wages, and property repairs for the other party.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance. Washington requires a minimum of $25,000 per person/$50,000 per accident for both UM and UIM coverage. This coverage is crucial, as it can help cover your medical bills, lost wages, and property damage even if the other driver is at fault and cannot pay for the damages.

- Damages to Your Own Vehicle (PD): This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. While not mandatory, most drivers choose to purchase this coverage to protect themselves from financial losses in the event of an accident. It’s typically offered with a deductible, which is the amount you pay out-of-pocket before the insurance coverage kicks in.

These mandatory coverage requirements directly impact insurance premiums. The higher the minimum coverage limits, the higher the premium cost. However, it’s crucial to understand that choosing minimum coverage limits may not be sufficient in all situations. Consider your individual needs and risk tolerance when deciding on coverage limits.

Role of the Washington State Office of Insurance Commissioner

The Washington State Office of Insurance Commissioner (OIC) plays a vital role in regulating the auto insurance industry within the state. The OIC ensures that insurance companies operate fairly and transparently, protecting consumers from unfair practices and ensuring that they have access to affordable and reliable coverage.

The OIC’s responsibilities include:

- Licensing and Oversight: The OIC licenses and oversees insurance companies operating in Washington State. This includes ensuring that companies meet financial stability requirements and comply with state regulations.

- Consumer Protection: The OIC investigates consumer complaints and helps resolve disputes between consumers and insurance companies. They also provide educational resources to help consumers understand their rights and make informed insurance decisions.

- Rate Regulation: The OIC reviews and approves insurance rates to ensure they are fair and reasonable. They work to balance the need for affordable insurance with the need for insurance companies to remain financially viable.

- Market Conduct: The OIC monitors the conduct of insurance companies to ensure they comply with state laws and regulations. They investigate and take action against companies that engage in unfair or deceptive practices.

The OIC’s role is crucial in creating a fair and competitive auto insurance market in Washington State. By overseeing the industry, the OIC helps protect consumers and ensures that they have access to the coverage they need at a fair price.

Key Factors Influencing Auto Insurance Rates in Washington

Auto insurance rates in Washington, like elsewhere, are determined by a complex interplay of factors. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Demographic Factors

Demographic factors play a significant role in determining your insurance rates. Your age, driving history, and location are key considerations.

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums. As you gain experience and reach your mid-20s, your rates typically decrease.

- Driving History: Your driving history is a major factor in your insurance rates. A clean record with no accidents or traffic violations will result in lower premiums. However, accidents, speeding tickets, and DUI convictions can significantly increase your rates.

- Location: The location where you live affects your insurance rates. Areas with higher crime rates, traffic congestion, or a higher incidence of accidents tend to have higher insurance premiums.

Vehicle Factors

The type of vehicle you drive also influences your insurance costs.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance vehicles are often associated with higher insurance premiums due to their higher repair costs and potential for higher speeds.

- Vehicle Model: Specific models within a vehicle type can also impact insurance rates. For example, models with a history of safety issues or frequent accidents may have higher premiums.

- Safety Features: Vehicles equipped with safety features such as anti-lock brakes, airbags, and stability control often receive lower insurance rates due to their reduced risk of accidents and severity of injuries.

Driving Habits

Your driving habits also play a role in your insurance rates.

- Mileage: The more you drive, the higher your risk of being involved in an accident. Insurance companies typically offer discounts for low-mileage drivers.

- Driving Patterns: Your driving patterns, such as commuting during peak hours or driving long distances, can also affect your rates.

Navigating Auto Insurance Options in Washington: Auto Insurance Companies In Washington State

Choosing the right auto insurance policy in Washington can feel overwhelming, with a variety of options available. Understanding the different types of coverage and their features is crucial to finding a policy that suits your needs and budget.

Understanding Different Types of Auto Insurance

Auto insurance policies in Washington are categorized into different types of coverage, each offering protection against specific risks. These types of coverage can be combined into various policy packages to meet individual needs.

- Liability Coverage: This is the most basic type of auto insurance and is required by law in Washington. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident.

- Property Damage Liability: Covers damages to another person’s vehicle or property caused by an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who’s at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, fire, hail, and natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who’s at fault in an accident.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers medical expenses, lost wages, and other expenses for you and your passengers, regardless of who’s at fault.

Comparing Coverage Options

The decision of which coverage options to include in your policy depends on your individual circumstances, including your driving history, the age and value of your vehicle, and your risk tolerance.

- Liability Coverage: This is mandatory in Washington and is essential for financial protection in case of an accident. The minimum liability coverage limits required by law are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage. However, it’s recommended to consider higher limits, especially if you have valuable assets to protect.

- Collision and Comprehensive Coverage: These coverages are optional but are generally recommended for newer vehicles or vehicles with a high market value. They provide financial protection against unexpected damage and can help you avoid significant out-of-pocket expenses.

- UM/UIM Coverage: This coverage is crucial as it protects you from financial hardship if you’re involved in an accident with an uninsured or underinsured driver. It’s important to ensure your UM/UIM coverage limits are equal to or higher than your liability limits.

- Med Pay or PIP: These coverages can be helpful for covering medical expenses for you and your passengers, regardless of who’s at fault. However, they are optional and their benefits may overlap with other health insurance plans.

Deductibles and Coverage Limits, Auto insurance companies in washington state

Deductibles and coverage limits are key factors that significantly influence the cost of your auto insurance policy.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums.

- Coverage Limits: These are the maximum amounts your insurance company will pay for covered losses. Higher coverage limits provide greater financial protection but also result in higher premiums.

Example: If you have a $500 deductible for collision coverage and your vehicle is damaged in an accident, you’ll be responsible for paying the first $500 of the repair costs, and your insurance company will cover the remaining expenses up to your coverage limit.

Finding the Best Auto Insurance Company in Washington

Finding the right auto insurance company in Washington can be a daunting task, given the vast number of options available. It’s crucial to carefully consider your needs and compare different companies to find the most suitable and affordable policy.

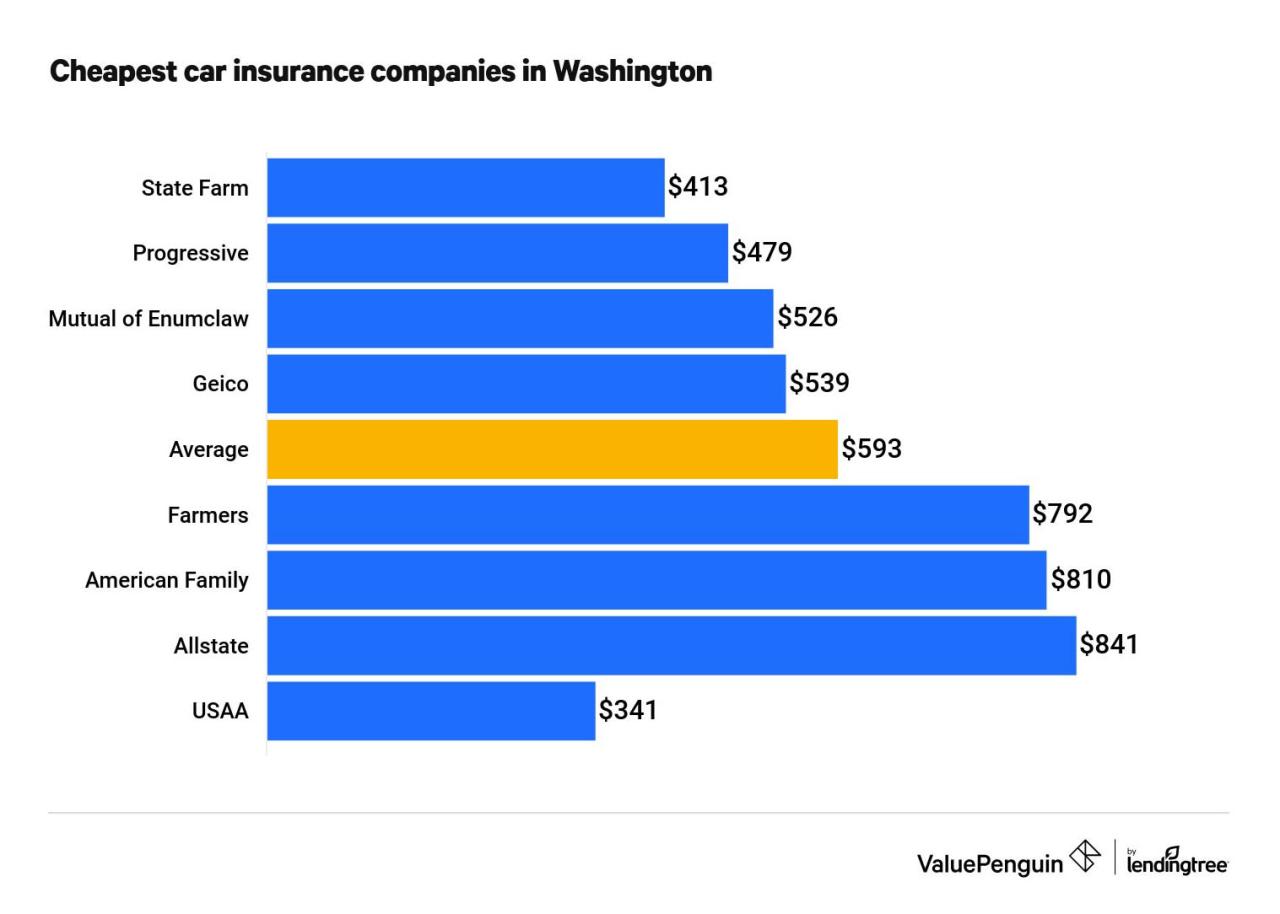

Reputable Auto Insurance Companies in Washington

Choosing a reputable auto insurance company is essential for ensuring you receive reliable coverage and excellent customer service. Here’s a list of well-established companies operating in Washington state:

- State Farm

- Geico

- Progressive

- Allstate

- Farmers Insurance

- USAA (for military members and their families)

- Liberty Mutual

- Nationwide

- American Family Insurance

Comparing Key Features and Pricing

When evaluating different insurance companies, it’s essential to compare their key features and pricing. Here’s a table outlining some important factors:

| Company | Average Annual Premium | Coverage Options | Discounts | Customer Service Ratings |

|---|---|---|---|---|

| State Farm | $1,200 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Multi-Policy | 4.5/5 |

| Geico | $1,150 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Multi-Policy | 4.2/5 |

| Progressive | $1,100 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Multi-Policy | 4.0/5 |

| Allstate | $1,250 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Multi-Policy | 4.3/5 |

| Farmers Insurance | $1,300 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Multi-Policy | 4.1/5 |

Note: These are average premiums and may vary based on individual factors like driving history, vehicle type, location, and coverage level.

Strategies for Finding Affordable Auto Insurance

Several strategies can help you secure the most affordable auto insurance policy:

- Shop around and compare quotes: Don’t settle for the first quote you receive. Contact multiple insurance companies and compare their offerings to find the best deal.

- Bundle your insurance policies: Combining your auto insurance with other policies like homeowners or renters insurance can often result in significant discounts.

- Maintain a good driving record: A clean driving history is a major factor in determining your insurance premium. Avoid traffic violations and accidents to keep your rates low.

- Increase your deductible: A higher deductible means you’ll pay more out of pocket in case of an accident, but it can lower your premium significantly.

- Consider discounts: Many insurance companies offer discounts for safe drivers, good students, and those who install anti-theft devices in their vehicles. Explore these options to potentially reduce your premium.

Understanding and Managing Auto Insurance Claims in Washington

Accidents happen, and when they do, it’s important to know how to navigate the process of filing an auto insurance claim. Washington State has specific regulations and procedures that govern this process, ensuring fairness and transparency for both policyholders and insurance companies. Understanding these procedures can help you effectively manage your claim and receive the compensation you deserve.

Filing an Auto Insurance Claim in Washington

Filing an auto insurance claim in Washington typically involves the following steps:

- Report the Accident: Immediately contact your insurance company to report the accident. This is crucial for initiating the claims process and ensuring proper documentation. Provide accurate details about the accident, including the date, time, location, and involved parties.

- File a Claim: Once you’ve reported the accident, your insurance company will guide you through the claim filing process. This usually involves completing a claim form, providing relevant information, and possibly submitting supporting documentation like police reports or medical records.

- Investigation and Assessment: After you file the claim, your insurance company will investigate the accident and assess the damage. This may involve inspecting the vehicle, reviewing police reports, and potentially contacting witnesses.

- Negotiation and Settlement: Once the investigation is complete, your insurance company will make a settlement offer. This offer may cover the cost of repairs, medical expenses, lost wages, and other related expenses. You have the right to negotiate this offer, and if you’re not satisfied, you can appeal the decision.

- Payment and Closure: If you accept the settlement offer, your insurance company will issue payment for your claim. The claim will then be closed, and the process is complete.

Tips for Saving on Auto Insurance in Washington

Auto insurance in Washington state can be expensive, but there are several ways to save money on your premiums. By understanding the factors that influence your rates and implementing smart strategies, you can significantly reduce your insurance costs.

Understanding Factors That Influence Auto Insurance Rates

Your auto insurance premiums are calculated based on several factors, including your driving history, vehicle type, and location. Here are some of the key factors that influence your rates:

- Driving History: Your driving record is a major factor in determining your insurance rates. Accidents, traffic violations, and even your age and years of driving experience can affect your premiums.

- Vehicle Type: The type of vehicle you drive also influences your insurance rates. Luxury cars, high-performance vehicles, and expensive SUVs tend to have higher insurance premiums due to their higher repair costs and greater risk of theft.

- Location: Where you live can significantly impact your insurance rates. Areas with high crime rates or a higher frequency of accidents generally have higher premiums.

- Credit Score: In some states, including Washington, insurance companies use your credit score as a factor in determining your rates. This is because individuals with good credit scores are often considered to be more responsible and less likely to file claims.

Improving Driving Habits and Reducing Risk Factors

By improving your driving habits and reducing risk factors, you can lower your insurance premiums. Here are some tips to help you achieve this:

- Maintain a Safe Driving Record: Avoid traffic violations, such as speeding or running red lights, as these can significantly increase your insurance premiums.

- Avoid Distracted Driving: Distracted driving is a major cause of accidents, and it can lead to higher insurance rates. Put your phone away while driving and avoid engaging in other distracting activities.

- Practice Defensive Driving: Defensive driving techniques can help you avoid accidents and lower your insurance premiums. Enroll in a defensive driving course to learn these techniques.

Taking Defensive Driving Courses and Seeking Discounts

Defensive driving courses can help you improve your driving skills and reduce your risk of accidents, which can lead to lower insurance premiums. Additionally, many insurance companies offer discounts for taking these courses. Here are some other discounts you may be eligible for:

- Good Student Discount: If you maintain good grades in school, you may be eligible for a good student discount.

- Safe Driver Discount: Many insurance companies offer discounts for drivers with a clean driving record.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount.

- Loyalty Discount: Some insurance companies offer discounts to customers who have been with them for a certain period of time.

Final Wrap-Up

Choosing the right auto insurance company in Washington state is a significant decision that can impact your financial well-being and peace of mind. By understanding the state’s unique insurance landscape, exploring different coverage options, and leveraging available resources, you can navigate this process confidently. Remember to prioritize your needs, compare quotes from multiple companies, and seek guidance from a trusted insurance professional to ensure you have the right coverage at the best possible price.

Clarifying Questions

What is the minimum auto insurance coverage required in Washington state?

Washington state requires all drivers to carry liability insurance, which covers damages to others in case of an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I get a discount on my auto insurance in Washington?

Several discounts are available in Washington state, including good driver discounts, multi-policy discounts, safe driver courses, and anti-theft device discounts. You can also explore discounts for being a member of certain organizations or having a good credit score.

What should I do if I have an accident in Washington?

After an accident, it’s crucial to prioritize safety and call emergency services if needed. Then, exchange information with the other driver(s) involved, document the accident scene, and report it to your insurance company as soon as possible.