State minimum liability insurance is a legal requirement in most states, designed to protect you financially if you cause an accident. It covers damages to others, including their vehicles, medical bills, and lost wages.

This essential coverage is the bare minimum, and it’s important to understand its limitations and consider additional coverage to ensure comprehensive protection.

What is State Minimum Liability Insurance?

State minimum liability insurance is a type of car insurance that is required by law in most states. It is designed to protect drivers from financial ruin in the event of an accident.

State minimum liability insurance is a legal requirement that protects drivers from financial ruin in the event of an accident. This type of insurance covers the costs associated with bodily injury and property damage to others, up to a certain limit.

Types of Accidents Covered by State Minimum Liability Insurance

State minimum liability insurance covers a range of accidents, including:

- Accidents involving bodily injury: This coverage protects drivers from financial liability for medical expenses, lost wages, and other costs associated with injuries caused to others in an accident.

- Accidents involving property damage: This coverage protects drivers from financial liability for repairs or replacement costs of damaged property, such as another vehicle or a building.

Requirements and Coverage Limits

State minimum liability insurance requirements are essential for all drivers. They establish the minimum financial protection required in case of an accident, ensuring that victims have access to compensation for their losses. Understanding these requirements is crucial for responsible driving and financial security.

Each state has its own minimum liability insurance coverage limits, which vary significantly. These limits specify the maximum amount of money that an insurance company will pay for certain types of damages caused by an insured driver in an accident.

Coverage Limits in Different States

The following table Artikels the minimum liability insurance coverage limits for different states in the United States. These limits are subject to change, so it is always best to consult with your insurance provider or the Department of Motor Vehicles (DMV) in your state for the most up-to-date information.

| State | Bodily Injury Per Person | Bodily Injury Per Accident | Property Damage |

|---|---|---|---|

| Alabama | $25,000 | $50,000 | $25,000 |

| Alaska | $50,000 | $100,000 | $25,000 |

| Arizona | $25,000 | $50,000 | $15,000 |

| Arkansas | $25,000 | $50,000 | $25,000 |

| California | $15,000 | $30,000 | $5,000 |

| Colorado | $25,000 | $50,000 | $15,000 |

| Connecticut | $20,000 | $40,000 | $10,000 |

| Delaware | $25,000 | $50,000 | $25,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| Georgia | $25,000 | $50,000 | $25,000 |

| Hawaii | $20,000 | $40,000 | $10,000 |

| Idaho | $25,000 | $50,000 | $15,000 |

| Illinois | $20,000 | $40,000 | $15,000 |

| Indiana | $25,000 | $50,000 | $10,000 |

| Iowa | $25,000 | $50,000 | $20,000 |

| Kansas | $25,000 | $50,000 | $10,000 |

| Kentucky | $25,000 | $50,000 | $10,000 |

| Louisiana | $15,000 | $30,000 | $10,000 |

| Maine | $50,000 | $100,000 | $25,000 |

| Maryland | $30,000 | $60,000 | $15,000 |

| Massachusetts | $20,000 | $40,000 | $5,000 |

| Michigan | $25,000 | $50,000 | $10,000 |

| Minnesota | $30,000 | $60,000 | $10,000 |

| Mississippi | $25,000 | $50,000 | $25,000 |

| Missouri | $25,000 | $50,000 | $10,000 |

| Montana | $25,000 | $50,000 | $25,000 |

| Nebraska | $25,000 | $50,000 | $25,000 |

| Nevada | $25,000 | $50,000 | $25,000 |

| New Hampshire | $25,000 | $50,000 | $25,000 |

| New Jersey | $15,000 | $30,000 | $5,000 |

| New Mexico | $25,000 | $50,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

| North Carolina | $25,000 | $50,000 | $25,000 |

| North Dakota | $25,000 | $50,000 | $25,000 |

| Ohio | $25,000 | $50,000 | $25,000 |

| Oklahoma | $25,000 | $50,000 | $10,000 |

| Oregon | $25,000 | $50,000 | $20,000 |

| Pennsylvania | $15,000 | $30,000 | $5,000 |

| Rhode Island | $25,000 | $50,000 | $25,000 |

| South Carolina | $25,000 | $50,000 | $25,000 |

| South Dakota | $25,000 | $50,000 | $25,000 |

| Tennessee | $25,000 | $50,000 | $15,000 |

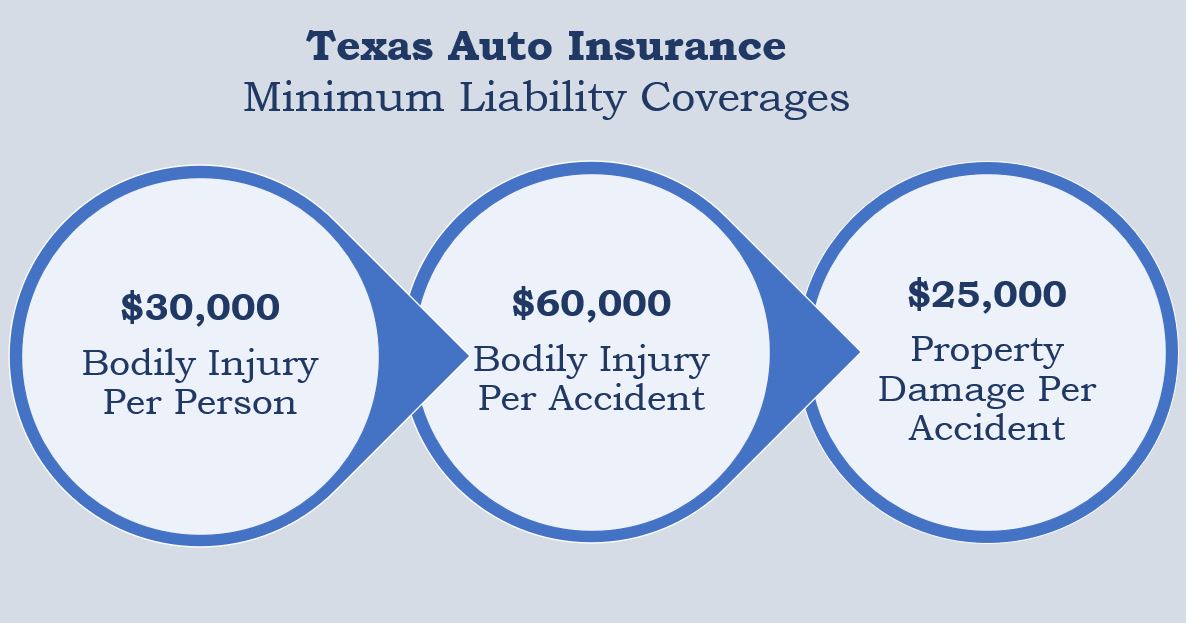

| Texas | $30,000 | $60,000 | $25,000 |

| Utah | $25,000 | $65,000 | $15,000 |

| Vermont | $50,000 | $100,000 | $25,000 |

| Virginia | $25,000 | $50,000 | $20,000 |

| Washington | $25,000 | $50,000 | $10,000 |

| West Virginia | $25,000 | $50,000 | $25,000 |

| Wisconsin | $25,000 | $50,000 | $10,000 |

| Wyoming | $25,000 | $50,000 | $25,000 |

Consequences of Driving Without Minimum Liability Insurance

Driving without the minimum required liability insurance is not only illegal but also carries significant financial and legal repercussions. If you’re involved in an accident without proper insurance, you could face severe penalties and be held personally liable for all damages and injuries.

Legal Ramifications

The legal consequences of driving without insurance can be serious. Depending on your state, you could face fines, license suspension, and even jail time. In some cases, your vehicle might be impounded.

Penalties for Driving Without Insurance

- Fines: Fines for driving without insurance can vary widely depending on the state and the number of offenses. You could be looking at fines ranging from a few hundred dollars to thousands of dollars.

- License Suspension: Driving without insurance is a serious offense, and many states will suspend your driver’s license for a certain period of time. The suspension period can range from a few months to several years, depending on the severity of the offense.

- Jail Time: In some states, driving without insurance can even lead to jail time, especially if you are involved in an accident that results in injuries or property damage.

- Vehicle Impoundment: Your vehicle could be impounded if you are caught driving without insurance, especially if you are involved in an accident. You will be responsible for the cost of towing and storage fees.

Financial Consequences of Being Uninsured

If you are involved in an accident without insurance, you could be held personally liable for all damages and injuries. This means that you would be responsible for paying out of pocket for:

- Medical Expenses: If you injure someone in an accident, you will be responsible for their medical bills, including hospital stays, surgeries, and rehabilitation.

- Property Damage: If you damage another person’s vehicle or property, you will be responsible for the cost of repairs or replacement.

- Legal Fees: If you are sued by the other party, you will be responsible for your own legal fees, as well as any damages awarded by the court.

- Lost Wages: If you are unable to work due to injuries sustained in the accident, you will be responsible for your own lost wages.

Understanding Liability Insurance Coverage: State Minimum Liability Insurance

Liability insurance coverage protects you financially if you are responsible for causing harm to another person or their property. It is a crucial component of auto insurance, and understanding the different types of coverage is essential to ensure you have adequate protection.

Types of Liability Insurance Coverage

Liability insurance coverage is designed to cover various situations, including:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages if you injure someone in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of property you damage in an accident, such as another vehicle, a building, or a fence.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by a driver who has no insurance or insufficient insurance to cover your losses.

Liability Insurance Coverage Explained

The table below illustrates the different types of liability insurance coverage and their respective functions:

| Type of Coverage | Function |

|---|---|

| Bodily Injury Liability | Pays for medical expenses, lost wages, and other damages if you injure someone in an accident. |

| Property Damage Liability | Pays for repairs or replacement of property you damage in an accident, such as another vehicle, a building, or a fence. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are injured in an accident caused by a driver who has no insurance or insufficient insurance to cover your losses. |

Real-World Scenarios

Here are some real-world scenarios where different types of liability insurance coverage would apply:

- Bodily Injury Liability: You are driving and accidentally hit another car, injuring the driver. Your bodily injury liability coverage would pay for the driver’s medical expenses and lost wages.

- Property Damage Liability: You back your car into a parked car, causing damage to the rear bumper. Your property damage liability coverage would pay for the repairs to the other car.

- Uninsured/Underinsured Motorist Coverage: You are stopped at a red light when another car runs a red light and hits your car, causing injuries. The other driver has no insurance. Your uninsured/underinsured motorist coverage would pay for your medical expenses and lost wages.

Factors Influencing State Minimum Liability Insurance

The minimum liability insurance requirements set by each state are influenced by a complex interplay of factors, including economic considerations, public safety concerns, and political influences. These requirements are not static but evolve over time, reflecting changes in societal values, accident rates, and the cost of healthcare.

Role of State Legislatures and Insurance Regulators

State legislatures play a pivotal role in setting minimum liability insurance requirements. They enact laws that establish the specific coverage amounts and types that drivers must maintain. These laws are typically based on recommendations from state insurance regulators, who are responsible for overseeing the insurance industry and ensuring that insurance policies meet certain standards. Insurance regulators conduct research, analyze accident data, and consider economic factors to advise legislatures on appropriate minimum liability limits.

Impact of Rising Healthcare Costs and Accident Frequency

Rising healthcare costs and increasing accident frequency have a significant impact on state minimum liability insurance requirements. As medical expenses escalate, the potential financial burden on individuals involved in accidents also increases. This has led some states to consider raising minimum liability limits to ensure that injured parties receive adequate compensation for their medical bills and other damages. Similarly, an increase in accident frequency, often attributed to factors such as distracted driving and aging infrastructure, can put pressure on insurance companies, potentially leading to higher premiums and a push for higher minimum liability limits to mitigate risk.

Choosing the Right Liability Insurance Coverage

State minimum liability insurance is the bare minimum coverage required by law. While it’s essential to comply with legal requirements, it might not be enough to protect you financially in case of an accident. Choosing the right liability insurance coverage involves considering your individual needs, potential risks, and financial capacity.

Evaluating Different Insurance Quotes and Comparing Coverage Options, State minimum liability insurance

When choosing the right liability insurance coverage, it’s essential to evaluate different insurance quotes and compare coverage options. Several factors influence insurance premiums, including your driving history, age, location, and the type of vehicle you drive. It’s advisable to request quotes from multiple insurers to compare prices and coverage.

- Compare coverage limits: Pay close attention to the liability limits offered by different insurers. Higher limits provide greater financial protection in case of a serious accident.

- Analyze deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums. Choose a deductible you can comfortably afford while balancing the cost of insurance.

- Review additional coverage options: Many insurers offer additional coverage options beyond the state minimum, such as uninsured/underinsured motorist coverage, collision coverage, and comprehensive coverage. Evaluate your needs and determine if these additional coverages are worthwhile for you.

- Consider discounts: Insurers offer various discounts, such as good driver discounts, safe driving discounts, and multi-car discounts. Inquire about available discounts and leverage them to lower your premiums.

- Read policy documents carefully: Before finalizing your decision, carefully review the policy documents provided by the insurer. Ensure you understand the terms and conditions, coverage limits, and exclusions.

Last Point

Understanding state minimum liability insurance is crucial for all drivers. By knowing the coverage limits, consequences of driving without insurance, and the various types of coverage available, you can make informed decisions to protect yourself and others on the road. Remember, it’s always better to be safe than sorry, and adequate insurance can provide peace of mind and financial security in case of an unexpected event.

Answers to Common Questions

What happens if I get into an accident and only have state minimum liability insurance?

If your coverage limits are insufficient to cover all the damages you caused, you could be personally liable for the remaining costs.

Is state minimum liability insurance enough for everyone?

While state minimums are required, they may not be enough for everyone. Consider your individual needs and assets to determine if additional coverage is necessary.

How can I find out what the state minimum liability insurance requirements are in my state?

You can contact your state’s Department of Motor Vehicles or an insurance agent to get this information.

Can I be penalized for having too much liability insurance?

No, you can’t be penalized for having more coverage than the state minimum. It’s always better to have too much insurance than not enough.