State of Illinois auto insurance is a crucial aspect of driving in the Land of Lincoln, ensuring financial protection in the event of an accident. Illinois law mandates specific coverage levels, and understanding these requirements is essential for every driver. This guide delves into the complexities of Illinois auto insurance, exploring rates, discounts, and the process of choosing the right policy.

Navigating the intricacies of Illinois auto insurance can feel daunting, but this guide aims to provide clarity and empower drivers with the knowledge they need to make informed decisions. From understanding the mandatory coverage requirements to exploring available discounts, this resource offers comprehensive information to help you secure the best possible protection on the road.

Illinois Auto Insurance Requirements

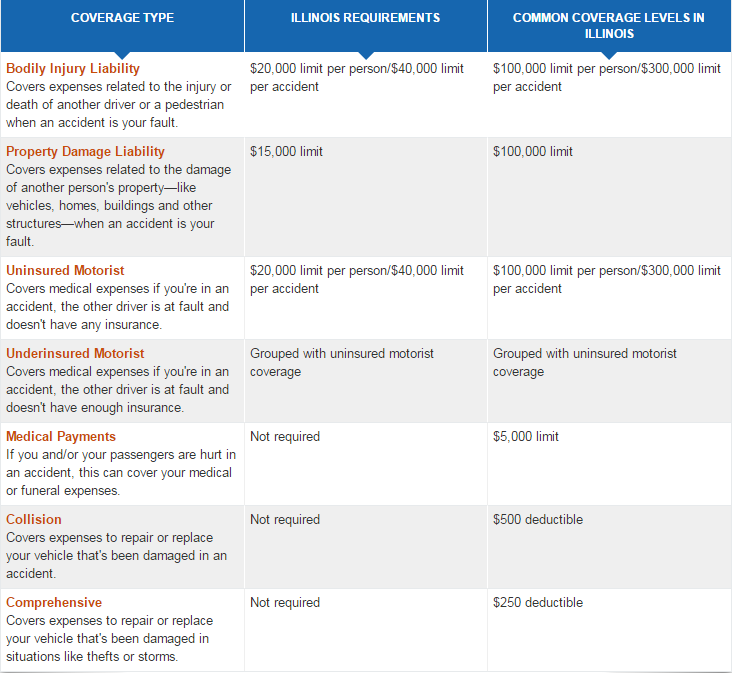

Driving in Illinois requires you to have the proper auto insurance coverage to protect yourself and others on the road. Illinois law mandates specific types and amounts of insurance coverage for all drivers. Understanding these requirements is crucial for ensuring you’re legally compliant and financially protected in case of an accident.

Liability Coverage

Liability coverage is essential in case you cause an accident that injures another person or damages their property. It covers the costs of:

* Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for people injured in an accident you caused.

* Property Damage Liability: This covers damage to another person’s vehicle or property if you are at fault in an accident.

Illinois law requires all drivers to carry a minimum amount of liability coverage:

* Bodily Injury Liability: $25,000 per person/$50,000 per accident

* Property Damage Liability: $20,000 per accident

These minimum limits may not be sufficient to cover all potential costs in a serious accident. Consider increasing your liability coverage to provide greater financial protection.

Uninsured/Underinsured Motorist Coverage

This coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or has insufficient insurance.

Illinois law requires all drivers to carry uninsured/underinsured motorist coverage with limits that match your liability coverage. This means if your liability coverage is $25,000/$50,000, your uninsured/underinsured motorist coverage should also be $25,000/$50,000.

You can choose to purchase higher limits for uninsured/underinsured motorist coverage. It’s essential to have adequate coverage to protect yourself in case of an accident with a driver who lacks sufficient insurance.

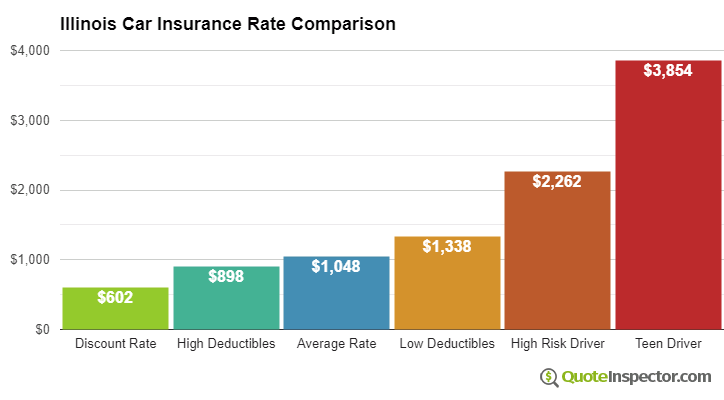

Illinois Auto Insurance Rates

Illinois auto insurance rates can vary widely based on several factors, making it essential to understand what influences your premium and how you can potentially lower it. This section explores the key factors determining your Illinois auto insurance rates, comparing and contrasting rates from different providers to help you make informed decisions.

Factors Influencing Auto Insurance Rates

Several factors influence your auto insurance rates in Illinois, and understanding them can help you make informed decisions about your coverage and potentially lower your premiums.

- Driving History: Your driving history is a major factor determining your insurance rates. A clean driving record with no accidents or violations will result in lower premiums compared to someone with multiple accidents or traffic tickets. This is because insurance companies consider drivers with a history of accidents or violations to be higher risks, making them more likely to file claims.

- Vehicle Type: The type of vehicle you drive also significantly impacts your insurance rates. Sports cars, luxury vehicles, and vehicles with powerful engines are generally considered higher risk and, therefore, have higher insurance premiums. Conversely, smaller, less expensive cars with lower horsepower tend to have lower insurance rates.

- Location: Your location can also influence your auto insurance rates. Areas with higher crime rates, more traffic congestion, or a greater number of accidents tend to have higher insurance premiums. This is because insurance companies face a higher risk of claims in these areas.

- Age and Gender: While insurance companies can no longer discriminate based solely on age or gender, these factors can still indirectly influence your rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. Additionally, certain gender groups may have higher accident rates in specific vehicle types.

- Credit Score: In some states, including Illinois, insurance companies may use your credit score to determine your insurance rates. This practice is controversial, as critics argue that it unfairly penalizes individuals with lower credit scores, who may not be higher risk drivers. However, insurance companies argue that credit score can be a reliable indicator of risk, as individuals with poor credit history may be more likely to file claims.

- Coverage Levels: The type and amount of coverage you choose will also affect your insurance rates. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will generally result in higher premiums. However, choosing adequate coverage is essential to protect yourself financially in case of an accident.

Comparing Auto Insurance Rates

It’s crucial to compare rates from different insurance providers in Illinois to find the best deal for your needs. Several online tools and comparison websites can help you quickly compare rates from multiple insurers.

- Online Comparison Websites: Websites like Bankrate, NerdWallet, and The Zebra allow you to enter your information once and compare rates from multiple insurance providers. These websites can save you time and effort in finding the best deal.

- Direct Quotes from Insurers: You can also obtain quotes directly from individual insurance providers. This allows you to get personalized quotes based on your specific circumstances and coverage needs.

- Local Insurance Brokers: Local insurance brokers can provide you with personalized advice and help you compare rates from various insurers. They can also assist you in understanding your coverage options and choosing the right policy for your needs.

Average Auto Insurance Rates in Illinois

The table below shows average auto insurance rates for different types of coverage in Illinois, based on data from the Illinois Department of Insurance:

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $500 – $1,000 |

| Liability and Collision | $1,000 – $2,000 |

| Liability, Collision, and Comprehensive | $1,500 – $3,000 |

Note: These are just average rates and can vary significantly depending on the factors mentioned above.

Illinois Auto Insurance Discounts

Saving money on your car insurance is something everyone wants. Fortunately, Illinois insurance companies offer a wide variety of discounts to help you do just that. These discounts can significantly reduce your premiums, making your car insurance more affordable.

Discounts for Safe Drivers

Safe drivers are rewarded with lower insurance premiums. Here are some common discounts for good driving records:

- Safe Driver Discount: This is one of the most common discounts, and it’s awarded to drivers with a clean driving record. If you haven’t been involved in any accidents or received any traffic violations, you’re likely eligible for this discount.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your premiums. This course helps you learn about safe driving practices and can even reduce your insurance rates.

- Good Student Discount: This discount is available to students who maintain good grades. It recognizes that good students tend to be responsible and safer drivers.

Discounts for Safety Features

Having safety features in your car can make it safer to drive and can also lower your insurance premiums. Here are some common discounts for safety features:

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can deter theft and reduce your risk of a claim. Insurance companies offer discounts for these features.

- Airbag Discount: Cars with airbags have proven to reduce the severity of injuries in accidents, so insurance companies often offer discounts for vehicles equipped with them.

- Anti-lock Brake System (ABS) Discount: ABS helps drivers maintain control of their vehicles during emergency braking situations, leading to fewer accidents. Insurance companies offer discounts for vehicles with ABS.

Discounts for Multiple Policies

Bundling multiple insurance policies with the same company can save you money.

- Multi-Policy Discount: Insuring your car, home, and other assets with the same insurance company can result in significant savings through a multi-policy discount. Insurance companies often offer discounts for bundling policies, as it makes them more profitable to insure you.

Other Discounts

In addition to the common discounts mentioned above, many other discounts are available, depending on your insurance company and your specific circumstances.

- Military Discount: Some insurance companies offer discounts to active military personnel and veterans.

- Senior Citizen Discount: Drivers over a certain age may qualify for a discount, as statistics show they tend to be safer drivers.

- Loyalty Discount: Insurance companies may reward long-term customers with a loyalty discount.

- Pay-in-Full Discount: Paying your premium in full upfront may qualify you for a discount.

| Discount | Eligibility Criteria |

|---|---|

| Safe Driver Discount | Clean driving record with no accidents or violations |

| Defensive Driving Course Discount | Completion of a state-approved defensive driving course |

| Good Student Discount | Maintaining good grades in school |

| Anti-theft Device Discount | Installation of anti-theft devices, such as alarms or tracking systems |

| Airbag Discount | Vehicle equipped with airbags |

| Anti-lock Brake System (ABS) Discount | Vehicle equipped with anti-lock brakes |

| Multi-Policy Discount | Bundling multiple insurance policies with the same company |

| Military Discount | Active military personnel or veterans |

| Senior Citizen Discount | Drivers over a certain age |

| Loyalty Discount | Long-term customer of the insurance company |

| Pay-in-Full Discount | Paying your premium in full upfront |

Choosing the Right Auto Insurance in Illinois

Navigating the world of auto insurance can feel overwhelming, especially in a state like Illinois with its unique requirements and diverse coverage options. To ensure you’re adequately protected while driving, it’s essential to carefully choose the right policy. This involves considering your individual needs, understanding the different types of coverage, and comparing quotes from various insurance providers.

Factors to Consider When Choosing Auto Insurance

It’s important to assess your specific needs and circumstances when selecting an auto insurance policy. Here are some key factors to consider:

- Driving History: Your driving record, including accidents, violations, and years of driving experience, significantly impacts your insurance rates. A clean driving record typically translates to lower premiums.

- Vehicle Type: The make, model, and year of your vehicle influence insurance costs. Newer, high-performance vehicles tend to have higher premiums due to their greater repair costs and theft risk.

- Location: Where you live affects your insurance rates. Areas with higher crime rates or more traffic congestion generally have higher premiums.

- Coverage Needs: Evaluate your specific needs and the risks you face. If you have a newer car or a high-value vehicle, comprehensive and collision coverage might be crucial. If you’re financially responsible and have a good driving record, you might consider opting for lower liability limits.

- Budget: Determine how much you can afford to spend on insurance premiums. Consider factors like your income, expenses, and financial goals.

Comparing Insurance Quotes and Coverage Options

Once you’ve considered your individual needs, it’s time to start comparing quotes from different insurance companies. Here’s a checklist to help you navigate the process:

- Gather Information: Collect details about your vehicle, driving history, and desired coverage levels. This will help you provide accurate information to insurance companies when requesting quotes.

- Contact Multiple Insurers: Get quotes from at least three to five different insurance providers. Don’t hesitate to use online comparison tools or contact insurance agents directly.

- Review Coverage Options: Carefully compare the coverage offered by each insurer, paying attention to the limits, deductibles, and exclusions. Look for policies that best match your needs and budget.

- Compare Prices: Analyze the premiums quoted by each insurer, taking into account the coverage levels and any discounts offered. Remember that the cheapest option might not always be the best choice if it compromises coverage.

- Check for Discounts: Inquire about available discounts, such as good driver, safe vehicle, multi-car, or bundling discounts. These can significantly reduce your premiums.

- Read Policy Documents: Before making a decision, carefully review the policy documents provided by each insurer. Pay close attention to the fine print, including exclusions, limitations, and cancellation terms.

Types of Auto Insurance Policies

Illinois law requires all drivers to carry liability insurance, but you can choose to purchase additional coverage depending on your needs and risk tolerance. Here’s a breakdown of common types of auto insurance policies:

- Liability Insurance: This coverage protects you financially if you cause an accident that results in injury or property damage to another person. It covers the other driver’s medical expenses, lost wages, and property repairs. Illinois requires a minimum liability coverage of $25,000 per person, $50,000 per accident, and $20,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of fault. It’s often included in a comprehensive policy. Collision coverage is typically optional but can be beneficial if you have a newer or financed vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It’s often included in a collision policy. Comprehensive coverage is typically optional but can be valuable if you have a high-value vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage. This coverage is optional in Illinois but highly recommended, especially given the prevalence of uninsured drivers.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, pays for your medical expenses and lost wages regardless of who is at fault in an accident. It’s required in Illinois, with a minimum coverage of $25,000.

Filing a Claim in Illinois

Filing an auto insurance claim in Illinois is a straightforward process, but it’s essential to understand the steps involved to ensure a smooth and efficient resolution. This section will guide you through the process, from reporting the accident to resolving claims and handling disputes.

Reporting an Accident

After an accident, it’s crucial to prioritize safety and then promptly report the incident to your insurance company. This step initiates the claims process and ensures that your coverage is activated.

- Contact your insurance company: Immediately notify your insurance company about the accident, providing details like the date, time, location, and parties involved. This step triggers the claims process and allows your insurer to start investigating the incident.

- Gather necessary documentation: Collect essential documents related to the accident, such as a copy of the police report, photos of the damage, and contact information of witnesses. This documentation will be crucial for supporting your claim and providing evidence to your insurer.

- File a claim: Once you’ve reported the accident, your insurance company will guide you through the process of filing a claim. This typically involves completing a claim form and providing the necessary documentation.

Resolving Claims

Once you’ve filed your claim, your insurance company will investigate the incident to determine the extent of the damage and liability. This process involves reviewing the documentation, interviewing witnesses, and potentially conducting an inspection of the vehicle.

- Negotiating a settlement: Based on the investigation findings, your insurance company will propose a settlement amount. You have the right to negotiate this amount if you believe it’s insufficient to cover your losses. It’s advisable to consult with an attorney if you’re unsure about the settlement offer.

- Receiving payment: If you agree to the settlement offer, your insurance company will issue payment for the covered damages. This payment may be made directly to you or to the repair shop if your vehicle needs repairs.

Handling Disputes

Despite efforts to resolve claims amicably, disputes can arise. If you disagree with your insurance company’s assessment or settlement offer, you have options for resolving the dispute.

- Internal review: You can request an internal review of your claim if you believe it was handled unfairly. This process involves presenting your concerns to a higher authority within your insurance company.

- Mediation: Mediation involves a neutral third party facilitating discussions between you and your insurance company to reach a mutually acceptable resolution. This option can help avoid costly litigation.

- Arbitration: Arbitration is a formal process where a neutral third party reviews the case and makes a binding decision. This option is often chosen when mediation fails to resolve the dispute.

- Litigation: As a last resort, you can file a lawsuit against your insurance company if all other dispute resolution methods fail. This option should be considered only after exploring all other avenues and consulting with an attorney.

Illinois Auto Insurance Laws and Regulations

Illinois has a comprehensive set of laws and regulations governing auto insurance, aiming to protect both drivers and consumers. The state mandates specific coverage requirements, regulates insurance rates, and provides consumer protection measures.

Role of the Illinois Department of Insurance

The Illinois Department of Insurance (DOI) is the primary regulatory body responsible for overseeing the auto insurance industry in the state. The DOI’s role is to ensure fair and competitive practices, protect consumers from unfair or deceptive practices, and ensure that insurance companies comply with state laws.

Key Illinois Auto Insurance Laws and Regulations

Illinois auto insurance laws are designed to ensure adequate coverage for drivers and to protect consumers. Some key laws and regulations include:

- Minimum Liability Coverage Requirements: Illinois requires all drivers to carry a minimum amount of liability insurance, which covers damages to others in the event of an accident. The minimum coverage requirements are as follows:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $20,000 per accident

- Uninsured/Underinsured Motorist Coverage: This coverage protects drivers in case they are involved in an accident with a driver who is uninsured or underinsured. Illinois requires all insurance companies to offer this coverage.

- No-Fault Insurance: Illinois is a no-fault state, meaning that drivers are generally required to file claims with their own insurance company, regardless of who caused the accident. This system is designed to streamline the claims process and reduce litigation.

- Rate Regulation: The DOI regulates insurance rates to ensure that they are fair and competitive. Insurance companies are required to file their rates with the DOI, which reviews them for compliance with state regulations.

Consumer Protection Laws and Rights, State of illinois auto insurance

Illinois provides numerous consumer protection laws and rights related to auto insurance. Some key provisions include:

- Right to Choose Your Own Insurance Company: Illinois residents have the right to choose their own insurance company, subject to the state’s minimum coverage requirements.

- Right to Renew Your Policy: Insurance companies cannot arbitrarily refuse to renew a policy unless there are valid reasons, such as non-payment of premiums or a change in risk.

- Right to File a Complaint: Consumers have the right to file a complaint with the DOI if they believe they have been treated unfairly by an insurance company.

- Right to Negotiate Your Rate: Consumers can negotiate with insurance companies to try to get a lower rate.

- Right to Appeal a Rate Increase: If an insurance company increases your rate, you have the right to appeal the decision.

Final Review: State Of Illinois Auto Insurance

Understanding Illinois auto insurance is vital for all drivers, ensuring peace of mind and financial security in the event of an accident. By understanding the state’s requirements, exploring available discounts, and carefully choosing a policy that meets your needs, you can navigate the roads of Illinois with confidence.

FAQ Overview

How do I find the cheapest auto insurance in Illinois?

Compare quotes from multiple insurance companies, consider discounts, and adjust your coverage levels to find the most affordable option that meets your needs.

What happens if I get into an accident without insurance in Illinois?

Driving without insurance in Illinois is illegal and can result in fines, license suspension, and even jail time. Additionally, you will be responsible for all accident-related costs.

How often should I review my auto insurance policy?

It’s recommended to review your policy annually, or whenever there’s a significant life change, such as a new car, a change in driving history, or a move to a different location.