Texas State Minimum Auto Insurance is a crucial requirement for all drivers in the Lone Star State. Understanding the minimum coverage requirements, the different types of insurance available, and the factors influencing premiums can help you make informed decisions about your auto insurance needs.

This guide will delve into the legal requirements for minimum auto insurance coverage in Texas, outlining the types of coverage, financial responsibility limits, and potential scenarios where minimum coverage might be insufficient. We’ll also explore various coverage options beyond the minimum requirements, compare their benefits and drawbacks, and identify situations where additional coverage could be beneficial.

Texas State Minimum Auto Insurance Requirements

In Texas, it is mandatory for all vehicle owners to have at least the minimum required auto insurance coverage. This ensures that drivers can financially compensate for damages caused in an accident, protecting themselves and others on the road.

Types of Coverage Included in Minimum Requirements

The minimum auto insurance requirements in Texas include three primary types of coverage: liability, medical payments, and uninsured/underinsured motorist coverage.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person. It covers the cost of repairs, medical expenses, and other related expenses incurred by the other party.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who caused the accident. It covers medical bills, lost wages, and other related expenses incurred due to injuries sustained in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident caused by a driver who is uninsured or underinsured. It covers your medical expenses and property damage, as well as any legal fees incurred in the process.

Financial Responsibility Limits for Each Coverage Type

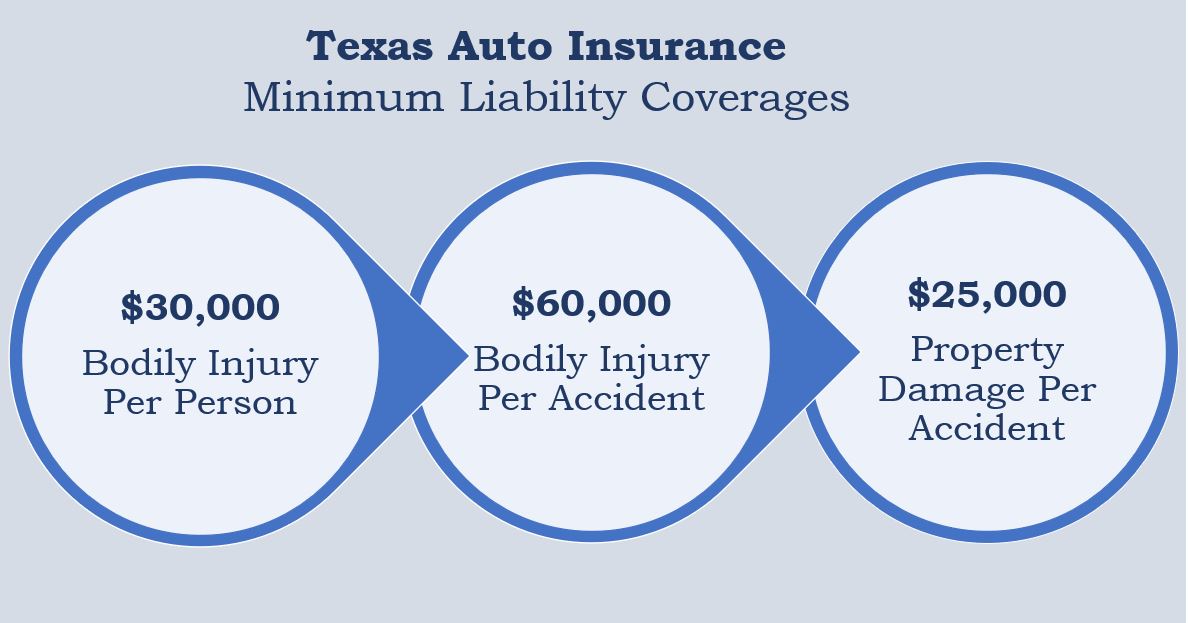

The Texas Department of Transportation (TxDOT) mandates specific financial responsibility limits for each type of coverage:

| Coverage Type | Financial Responsibility Limit |

|---|---|

| Liability Coverage (Bodily Injury per Person) | $30,000 |

| Liability Coverage (Bodily Injury per Accident) | $60,000 |

| Liability Coverage (Property Damage per Accident) | $25,000 |

| Medical Payments Coverage | $2,500 |

| Uninsured/Underinsured Motorist Coverage (Bodily Injury per Person) | $30,000 |

| Uninsured/Underinsured Motorist Coverage (Bodily Injury per Accident) | $60,000 |

| Uninsured/Underinsured Motorist Coverage (Property Damage per Accident) | $25,000 |

Scenarios Where Minimum Coverage Might Be Insufficient

While the minimum insurance requirements fulfill legal obligations, they might not be sufficient in certain scenarios. For instance:

- Multiple Injuries: If an accident involves multiple individuals with significant injuries, the minimum liability coverage might not be enough to cover all medical expenses and related costs.

- High-Value Property Damage: In case of an accident involving damage to a high-value vehicle or property, the minimum property damage liability coverage may not fully compensate for the incurred costs.

- Uninsured/Underinsured Motorist Claims: If an accident is caused by an uninsured or underinsured driver, the minimum uninsured/underinsured motorist coverage might not cover all your medical expenses, lost wages, and property damage.

Understanding Texas Auto Insurance Coverage Options

While Texas law mandates minimum auto insurance coverage, it’s crucial to understand that these requirements may not be enough to protect you and your finances in the event of an accident. Choosing additional coverage options can provide you with greater financial security and peace of mind.

Texas Auto Insurance Coverage Options

Beyond the state’s minimum requirements, several other coverage options can be added to your policy, each designed to address specific risks and situations. Understanding these options can help you tailor your coverage to your needs and budget.

| Coverage Option | Description | Potential Benefits |

|---|---|---|

| Collision Coverage | Covers damage to your vehicle caused by a collision with another vehicle or object, regardless of fault. | Pays for repairs or replacement of your vehicle after an accident, regardless of who is at fault. Provides financial protection in case of a total loss. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. | Protects your vehicle against various risks beyond collisions. Provides financial protection in case of damage from events that are not your fault. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Protects you and your passengers in case of an accident caused by a driver who is uninsured or underinsured. | Provides financial compensation for injuries and damages when the other driver is uninsured or their coverage is insufficient to cover your losses. |

| Medical Payments Coverage (Med Pay) | Covers medical expenses for you and your passengers, regardless of fault, after an accident. | Provides financial assistance for medical bills, including hospital stays, doctor visits, and rehabilitation. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other expenses for you and your passengers after an accident, regardless of fault. | Offers comprehensive financial protection for medical expenses, lost income, and other expenses related to injuries. |

| Rental Reimbursement Coverage | Covers the cost of renting a vehicle while your car is being repaired after an accident. | Provides financial assistance to cover the cost of a rental car, ensuring you have transportation while your vehicle is unavailable. |

| Towing and Labor Coverage | Covers the cost of towing your vehicle to a repair shop after an accident or breakdown. | Provides financial assistance for towing and labor costs, ensuring your vehicle is transported safely and efficiently. |

Factors Influencing Texas Auto Insurance Premiums

Your auto insurance premium in Texas is determined by a variety of factors, each playing a role in shaping the final cost. Understanding these factors can help you make informed decisions to potentially lower your premiums and ensure you have adequate coverage.

Driving History

Your driving history is a significant factor influencing your auto insurance premium. A clean driving record with no accidents or traffic violations generally results in lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates. Insurance companies consider your driving history as a measure of your risk, and a history of accidents or violations indicates a higher likelihood of future claims.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance premium. Insurance companies assess the cost of repairs and replacement for different vehicle types. Generally, newer, more expensive vehicles, or those with high repair costs, will have higher insurance premiums compared to older, less expensive vehicles.

Location

The location where you live or where your vehicle is primarily parked can impact your auto insurance premiums. Insurance companies analyze factors such as crime rates, traffic congestion, and the frequency of accidents in specific areas. Areas with higher crime rates or a greater number of accidents may have higher insurance premiums due to the increased risk of claims.

Choosing the Right Auto Insurance Provider in Texas

Finding the right auto insurance provider in Texas can significantly impact your financial well-being, especially if you’re ever involved in an accident. You need an insurer that offers comprehensive coverage, competitive rates, and excellent customer service.

Comparing Quotes from Multiple Providers

It’s crucial to compare quotes from multiple insurance providers before making a decision. This ensures you get the best possible price for the coverage you need. Online comparison websites, like those offered by insurance companies or independent brokers, make this process convenient. These platforms allow you to enter your information once and receive quotes from various providers, simplifying the comparison process.

Factors to Consider When Choosing an Insurance Provider in Texas

- Coverage Options: Evaluate the coverage options offered by each provider, ensuring they meet your specific needs. Consider factors like liability limits, collision and comprehensive coverage, and optional add-ons like roadside assistance or rental car reimbursement.

- Premiums and Discounts: Compare the premiums offered by different providers and explore available discounts. Discounts can be based on factors like good driving history, safe driving courses, multiple policy bundling, or installing safety features in your vehicle.

- Customer Service and Claims Handling: Research the provider’s reputation for customer service and claims handling. Look for positive reviews and testimonials, and consider factors like the ease of filing claims, the speed of claim processing, and the overall customer experience.

- Financial Stability: Assess the financial stability of the insurance provider. Look for companies with strong ratings from reputable agencies like A.M. Best or Standard & Poor’s. This indicates the provider’s ability to pay claims in the event of a major catastrophe or financial hardship.

Evaluating Insurance Providers

- Customer Service: Evaluate the provider’s responsiveness, accessibility, and helpfulness. Consider factors like the availability of 24/7 customer support, online resources, and the ease of contacting agents.

- Claims Handling: Research the provider’s claims process, including the speed of claim processing, the transparency of communication, and the overall customer experience during the claims process.

- Financial Stability: Check the provider’s financial ratings from reputable agencies like A.M. Best or Standard & Poor’s. Look for companies with strong ratings, indicating their financial stability and ability to meet their obligations.

Pros and Cons of Different Insurance Providers in Texas

| Provider | Pros | Cons |

|---|---|---|

| State Farm | Wide network of agents, comprehensive coverage options, competitive rates, strong financial stability. | May have higher premiums compared to some competitors, customer service experiences can vary depending on the agent. |

| Geico | Competitive rates, convenient online and mobile tools, excellent customer service. | Limited coverage options compared to some competitors, may not have a wide network of agents. |

| Progressive | Innovative features like Name Your Price tool, various coverage options, strong financial stability. | Customer service experiences can vary, may have higher premiums for certain drivers. |

| USAA | Exclusive coverage options for military members and their families, excellent customer service, strong financial stability. | Only available to military members and their families. |

| Allstate | Comprehensive coverage options, strong financial stability, wide network of agents. | May have higher premiums compared to some competitors, customer service experiences can vary. |

Understanding Your Auto Insurance Policy

Your auto insurance policy is a legally binding contract that Artikels the terms and conditions of your coverage. Understanding the key elements of your policy is crucial for ensuring you have adequate protection and can navigate the claims process effectively.

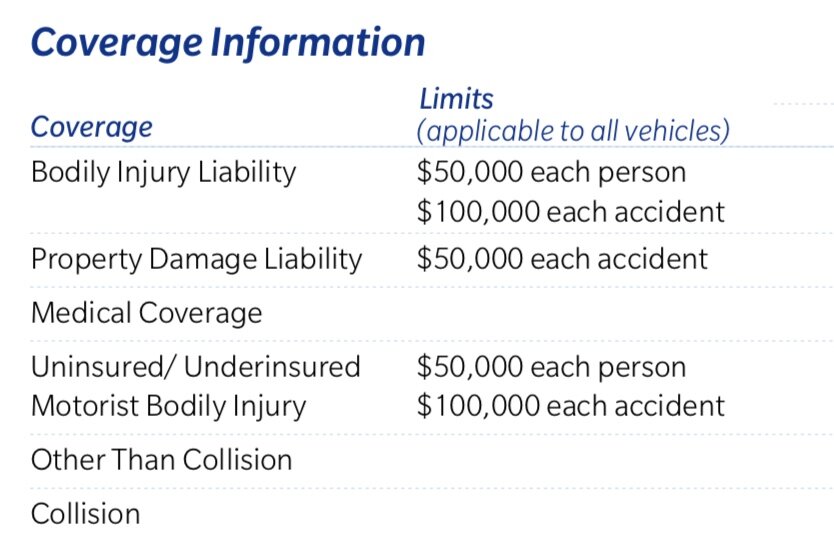

Key Elements of a Texas Auto Insurance Policy, Texas state minimum auto insurance

- Declarations Page: This page summarizes your policy’s essential information, including your name, address, vehicle details, coverage limits, and premium amount. It also lists the effective dates of your policy.

- Coverage Sections: This section details the types of coverage you have purchased, such as liability, collision, comprehensive, and personal injury protection (PIP). It also Artikels the limits and exclusions for each coverage type.

- Exclusions and Limitations: This section specifies the situations or events that are not covered by your policy. It may include things like driving under the influence, intentional acts, or damage caused by wear and tear.

- Conditions: This section Artikels the obligations of both you and the insurance company. It may include things like your duty to cooperate with the insurer, your right to appeal a claim denial, and the process for making changes to your policy.

Filing a Claim

- Contact Your Insurance Company: Report the accident or incident to your insurance company as soon as possible. You can typically do this by phone, online, or through a mobile app.

- Provide Information: Be prepared to provide details about the incident, including the date, time, location, and any other relevant information. You may also need to provide information about the other parties involved, including their contact information and insurance details.

- Follow Instructions: Your insurance company will guide you through the next steps of the claims process. This may include filing a police report, obtaining medical attention, or providing additional documentation.

Driving Without Insurance in Texas

Driving without insurance in Texas is illegal and carries serious consequences. You could face:

- Fines and Penalties: Drivers caught without insurance face fines of up to $350 for a first offense and up to $1,000 for subsequent offenses.

- License Suspension: Your driver’s license may be suspended if you are caught driving without insurance multiple times.

- Vehicle Impoundment: Your vehicle may be impounded if you are caught driving without insurance.

- Financial Responsibility: If you are involved in an accident without insurance, you will be personally liable for all damages and injuries, which could lead to significant financial hardship.

Navigating the Claims Process

- Report the Accident: Contact your insurance company immediately after the accident. Provide all the necessary details, including the date, time, location, and any other relevant information.

- Gather Information: Collect contact information from all parties involved, including witnesses. If possible, take pictures of the accident scene and any damage to your vehicle.

- File a Police Report: If the accident involves injuries or significant property damage, file a police report. This will provide official documentation of the incident.

- Seek Medical Attention: If you are injured, seek medical attention immediately. Document all injuries and treatment received.

- Cooperate with Your Insurance Company: Provide your insurance company with all requested information and documentation promptly. Respond to any questions or requests for information in a timely manner.

- Negotiate a Settlement: If you are not satisfied with the initial offer from your insurance company, you can negotiate a higher settlement. You may want to consult with an attorney for assistance with this process.

Summary

Navigating the world of auto insurance in Texas can be complex, but understanding the basics of Texas State Minimum Auto Insurance is a great starting point. By comparing quotes from multiple insurance providers, considering factors like driving history and vehicle type, and choosing coverage options that align with your needs, you can find the best auto insurance policy for your situation. Remember, driving without insurance in Texas can lead to serious consequences, so ensuring you have adequate coverage is crucial for protecting yourself and others on the road.

FAQ Guide: Texas State Minimum Auto Insurance

What happens if I get into an accident with only the minimum required auto insurance?

If you only have the minimum required auto insurance and you get into an accident, your coverage might not be enough to cover all the damages and injuries. You could be held personally liable for any costs exceeding your coverage limits.

How often should I review my auto insurance policy?

It’s a good idea to review your auto insurance policy at least annually, or even more frequently if there are significant changes in your driving situation, such as getting a new car or moving to a new location.

What are some common discounts offered by auto insurance providers in Texas?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for having safety features like anti-theft devices in your vehicle.

Can I cancel my auto insurance policy if I sell my car?

Yes, you can usually cancel your auto insurance policy if you sell your car. However, you should contact your insurance provider to confirm the process and ensure that your policy is properly terminated.