State Farm housing insurance is a comprehensive solution designed to safeguard your home and belongings against various risks. It offers a range of coverage options, tailored to meet the specific needs of homeowners and renters alike. From protecting your dwelling against perils like fire and theft to covering personal property and liability, State Farm provides a robust insurance plan to secure your peace of mind.

This guide delves into the intricacies of State Farm housing insurance, exploring its key features, coverage options, pricing factors, and customer service. We will also compare it to other leading insurance providers and discuss available discounts and bundling opportunities. By understanding the nuances of State Farm housing insurance, you can make an informed decision about protecting your valuable asset.

State Farm Housing Insurance Overview

State Farm is a leading provider of housing insurance, offering a comprehensive range of coverage options to protect your home and belongings. State Farm housing insurance is designed to provide financial protection against various risks, including damage from fire, theft, and natural disasters.

State Farm housing insurance offers several benefits, including:

Types of Coverage

State Farm offers a variety of coverage options to meet the unique needs of homeowners and renters. Here are the main types of coverage:

- Homeowners Insurance: Provides coverage for damage to your home and belongings, as well as liability protection if someone is injured on your property.

- Renters Insurance: Covers your personal belongings and provides liability protection in case someone is injured in your rental unit.

- Condominium Insurance: Offers coverage for your unit’s interior and personal belongings, as well as liability protection.

Components of a State Farm Housing Insurance Policy

State Farm housing insurance policies typically include the following components:

- Dwelling Coverage: Protects your home’s structure against damage from covered perils, such as fire, windstorm, and hail.

- Other Structures Coverage: Provides coverage for detached structures on your property, such as garages, sheds, and fences.

- Personal Property Coverage: Protects your belongings inside your home, including furniture, electronics, clothing, and jewelry.

- Liability Coverage: Offers financial protection if someone is injured on your property or if you are found liable for damage to someone else’s property.

- Additional Living Expenses Coverage: Helps cover the costs of temporary housing and other living expenses if your home becomes uninhabitable due to a covered event.

Coverage Options and Customization

State Farm allows you to customize your policy by choosing different coverage limits and deductibles. You can also add endorsements to your policy to provide additional protection for specific risks, such as earthquake coverage or flood insurance.

Coverage Options and Customization

Your State Farm housing insurance policy is more than just a standard plan. It’s designed to be tailored to your specific needs and protect your home in the way that works best for you. With a variety of coverage options and customization features, you can create a policy that fits your unique circumstances.

Dwelling Coverage

Dwelling coverage protects the physical structure of your home, including the attached structures like a garage or porch. This coverage helps pay for repairs or rebuilding if your home is damaged or destroyed by a covered peril, such as fire, windstorm, or hail. The amount of dwelling coverage you need depends on the replacement cost of your home.

Personal Property Coverage

This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and other personal items. It helps pay for replacement or repair if your belongings are damaged or stolen. You can choose the level of personal property coverage that best suits your needs, and you can also add endorsements for valuable items like jewelry or artwork.

Liability Coverage

Liability coverage protects you if someone is injured on your property or if you are found liable for damage to someone else’s property. This coverage can help pay for medical expenses, legal fees, and other costs associated with a liability claim.

Additional Living Expenses Coverage

This coverage helps pay for additional living expenses if you are forced to live elsewhere while your home is being repaired or rebuilt after a covered loss. This can include expenses such as rent, hotel stays, and meals.

Customization Options

State Farm offers a variety of customization options to tailor your policy to your specific needs. These options include:

- Endorsements for Valuable Items: You can add endorsements to your policy to provide additional coverage for valuable items like jewelry, artwork, or collectibles. These endorsements can provide higher limits of coverage and specialized protection for these items.

- Specific Risk Coverage: You can add coverage for specific risks that are not covered by standard homeowners insurance, such as earthquake or flood insurance. These endorsements can help protect your home from these potentially devastating events.

- Replacement Cost Coverage: This coverage option helps pay for the full replacement cost of your home and belongings, without deducting for depreciation. This can be a valuable option if you want to ensure that you can rebuild your home or replace your belongings with new items.

- Deductible Options: You can choose a deductible that best fits your budget. A higher deductible will generally result in a lower premium, while a lower deductible will result in a higher premium.

Coverage Options Comparison

| Coverage Option | Benefits | Key Differences | Advantages |

|—|—|—|—|

| Dwelling Coverage | Protects the physical structure of your home | Covers repairs or rebuilding due to covered perils | Ensures you can rebuild your home in the event of a covered loss |

| Personal Property Coverage | Protects your belongings inside your home | Covers replacement or repair of belongings | Provides peace of mind knowing your possessions are protected |

| Liability Coverage | Protects you from liability claims | Covers medical expenses, legal fees, and other costs | Safeguards you from financial ruin in the event of a liability claim |

| Additional Living Expenses Coverage | Helps pay for additional living expenses | Covers expenses like rent, hotel stays, and meals | Provides financial support while your home is being repaired or rebuilt |

Pricing and Factors Affecting Cost

State Farm housing insurance pricing is based on a variety of factors, ensuring that premiums are fair and reflect the individual risks associated with each policy. This means that your premium will be influenced by several factors, and understanding these factors can help you make informed decisions about your insurance coverage.

Factors Affecting Housing Insurance Costs

The cost of your State Farm housing insurance premium can vary significantly depending on a range of factors. These factors are assessed to determine the risk associated with insuring your property. Here’s a breakdown of some of the most influential factors:

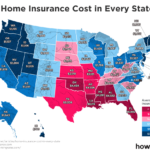

- Location: Your home’s location plays a crucial role in determining your premium. Areas prone to natural disasters, such as earthquakes, hurricanes, or wildfires, generally have higher insurance costs. Additionally, urban areas with higher crime rates or denser populations may also have higher premiums.

- Property Value: The value of your home is a primary factor in determining your premium. Homes with higher values generally require more coverage and therefore have higher premiums.

- Coverage Level: The amount of coverage you choose for your home will directly impact your premium. Higher coverage levels, which provide more protection against losses, will result in higher premiums.

- Individual Risk Profile: Your individual risk profile is also considered. This includes factors such as your credit score, claims history, and safety features installed in your home. A good credit score and a history of responsible behavior can lead to lower premiums.

Impact of Factors on Pricing

The following table illustrates how different factors can influence the price of State Farm housing insurance.

| Factor | Impact on Premium |

|---|---|

| Location in a high-risk area (e.g., hurricane zone) | Higher premium |

| Home value of $500,000 | Higher premium than a home valued at $250,000 |

| Comprehensive coverage with high deductibles | Lower premium than a policy with lower deductibles |

| Good credit score and no claims history | Lower premium than someone with a poor credit score and a history of claims |

Claims Process and Customer Service

Navigating a claim after a covered event can be stressful. State Farm aims to make the process as smooth as possible. Understanding the steps involved and available resources can help you feel prepared.

Filing a Claim, State farm housing insurance

When a covered event occurs, it’s important to contact State Farm as soon as possible. You can report your claim through various channels:

- Online: Through State Farm’s website, you can submit a claim 24/7, providing details of the event and your policy information. This allows for quick initial reporting and often includes the ability to upload photos of damages.

- Phone: You can reach State Farm’s customer service line directly by phone, providing details of the incident and your policy information. This is a convenient option for immediate reporting and speaking with a representative.

- Mobile App: State Farm’s mobile app allows you to report a claim, track its progress, and communicate with your adjuster directly. This offers a streamlined experience for managing your claim on the go.

Customer Service Channels

State Farm offers a variety of customer service channels to ensure you can reach them when you need assistance:

- Phone: State Farm has a dedicated customer service line available 24/7, allowing you to reach a representative at any time for immediate assistance. This option is particularly helpful for urgent inquiries or situations requiring immediate attention.

- Email: You can contact State Farm through their website, providing your policy information and details of your inquiry. This option is suitable for non-urgent inquiries and allows for a detailed written record of communication.

- Online Resources: State Farm’s website provides a wealth of information, including frequently asked questions, policy details, claim filing instructions, and helpful resources for navigating the claims process. This allows for self-service and finding answers to common inquiries.

Claim Handling Reputation

State Farm is widely recognized for its efficient and customer-focused claim handling process. According to J.D. Power, State Farm consistently ranks high in customer satisfaction for homeowners insurance, indicating a positive experience for policyholders during the claims process.

State Farm’s commitment to customer satisfaction is evident in their claim handling process, with a focus on prompt communication, transparent procedures, and fair settlements.

Comparison with Other Insurance Providers

Choosing the right housing insurance provider is crucial, as it safeguards your biggest investment. State Farm is a well-known name in the industry, but it’s essential to compare it with other leading providers to determine the best fit for your needs. This section will compare State Farm with its competitors, focusing on key factors such as coverage options, pricing, and customer service.

Coverage Options

Understanding the coverage offered by different providers is essential for making an informed decision. Here’s a comparison of State Farm’s coverage options with those of its competitors:

| Feature | State Farm | Competitor A | Competitor B |

|---|---|---|---|

| Personal Property Coverage | Offers coverage for personal belongings, including jewelry, electronics, and artwork. | Provides similar coverage with optional add-ons for specific items. | Includes personal property coverage with a standard limit, but offers higher limits for an additional premium. |

| Liability Coverage | Covers legal expenses and damages if someone is injured on your property. | Offers liability coverage with various limits to choose from. | Provides liability coverage with a standard limit and options to increase it. |

| Additional Living Expenses | Covers temporary housing costs if your home is uninhabitable due to a covered event. | Offers similar coverage with varying limits and timeframes. | Includes coverage for additional living expenses with a specific limit and duration. |

Pricing and Factors Affecting Cost

Insurance premiums vary depending on several factors, and comparing prices across different providers is essential. Here’s a breakdown of how State Farm’s pricing compares to its competitors:

- Location: Premiums are influenced by location due to factors like risk of natural disasters, crime rates, and construction costs. State Farm’s pricing might differ from its competitors in certain areas.

- Home Value: The value of your home significantly impacts the premium. Providers like State Farm and its competitors calculate premiums based on the home’s replacement cost.

- Deductible: A higher deductible generally leads to lower premiums. This applies to both State Farm and its competitors. Choosing a deductible that aligns with your risk tolerance and financial situation is crucial.

- Coverage Options: Additional coverage options, such as flood insurance or earthquake coverage, can increase premiums. State Farm and its competitors offer various add-ons, so comparing their costs is essential.

- Discounts: Several discounts are available to lower premiums, such as those for home security systems, fire alarms, and multiple policies. State Farm and its competitors offer similar discounts, though specific eligibility criteria may vary.

Customer Service

Customer service is a vital aspect of the insurance experience. State Farm is known for its extensive network of agents and its commitment to customer satisfaction. However, comparing customer service across providers is essential:

- Agent Accessibility: State Farm has a vast network of agents, offering easy access to personalized assistance. Other providers might have a different agent network, which could affect accessibility.

- Claims Process: State Farm has a reputation for efficient and straightforward claims processing. Comparing the claims process across providers is essential, as it can significantly impact your experience during a difficult time.

- Online Tools and Resources: State Farm offers online tools and resources for managing policies and filing claims. Other providers may have similar online platforms, but their features and functionality might differ.

- Customer Reviews and Ratings: Reviews and ratings from existing customers provide valuable insights into the overall customer service experience. Comparing State Farm’s ratings with those of its competitors can offer a comprehensive perspective.

Discounts and Bundling Options: State Farm Housing Insurance

State Farm offers various discounts to help you save on your home insurance premiums. These discounts are designed to reward you for taking steps to protect your home and minimize the risk of claims. You can also save money by bundling your home insurance with other State Farm products.

Discounts

Discounts can significantly reduce your home insurance premiums. Here are some common discounts offered by State Farm:

- Home Security System Discount: Installing a monitored home security system can deter burglaries and lower your risk of claims. State Farm recognizes this effort by offering a discount to policyholders with security systems.

- Fire Alarm Discount: Having a working smoke detector and fire alarm system can significantly reduce the risk of fire damage. State Farm offers discounts to policyholders with these safety features.

- Multiple Policy Discount: Bundling your home insurance with other State Farm policies, such as auto insurance, can lead to substantial savings. State Farm often offers significant discounts for bundling multiple policies, rewarding you for consolidating your insurance needs with them.

- Loyalty Discount: State Farm may offer discounts to policyholders who have been with them for a certain period, demonstrating loyalty and consistent risk management.

- Other Discounts: State Farm may offer additional discounts based on specific factors like your home’s construction materials, roof age, or safety features.

Bundling Benefits

Bundling your home insurance with other State Farm products, such as auto insurance, offers numerous benefits beyond just discounts.

- Convenience: Managing all your insurance policies with a single provider simplifies your insurance needs, streamlining payments, communication, and claims processes.

- Streamlined Claims Process: In the event of a claim, dealing with a single insurer can simplify the process, as you only need to interact with one company for both your home and auto insurance.

- Potential for Additional Discounts: Bundling often unlocks additional discounts that might not be available if you have separate policies with different insurers.

- Improved Customer Service: Having all your policies with State Farm can lead to improved customer service, as you build a stronger relationship with a single provider.

Savings Examples

Bundling and discounts can lead to significant savings. Here are some potential savings examples:

- Bundling Discount: Bundling your home and auto insurance with State Farm could save you 15% or more on your combined premiums, depending on your specific policies and coverage.

- Home Security System Discount: Installing a monitored home security system could save you 5% to 10% on your home insurance premiums.

- Fire Alarm Discount: Having a working fire alarm system could save you 2% to 5% on your home insurance premiums.

Remember: The specific discounts and savings available to you will depend on your individual circumstances, location, and the specific policies you choose. Contact a State Farm agent to get a personalized quote and explore the discounts and bundling options available to you.

Resources and Additional Information

You can find comprehensive information about State Farm’s housing insurance policies and services on their official website. This resource provides detailed policy information, online tools for calculating premiums and customizing coverage, and access to their extensive network of agents.

Contact Information

State Farm offers multiple channels for customers to connect with their agents and customer support. These channels include their website, phone, and mobile app, providing convenient access to information and assistance.

| Resource | Contact Information |

|---|---|

| State Farm Website | https://www.statefarm.com/ |

| State Farm Customer Service | 1-800-STATE-FARM (1-800-782-8332) |

| State Farm Agent Locator | https://www.statefarm.com/find-an-agent/ |

Ultimate Conclusion

In conclusion, State Farm housing insurance presents a compelling option for homeowners and renters seeking comprehensive protection. Its flexible coverage options, competitive pricing, and dedicated customer service make it a reliable choice. By carefully considering your individual needs and comparing State Farm’s offerings to other providers, you can find the best insurance plan to safeguard your home and financial well-being.

FAQ Overview

What types of coverage are included in a State Farm housing insurance policy?

State Farm housing insurance typically includes dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. However, specific coverage options can vary depending on the policy.

How do I file a claim with State Farm for housing insurance?

You can file a claim with State Farm by contacting their customer service line, visiting their website, or contacting your insurance agent. State Farm provides detailed instructions on their website for filing a claim.

What discounts are available for State Farm housing insurance?

State Farm offers various discounts for housing insurance, including those for home security systems, fire alarms, multiple policy bundling, and safe driving records.

Can I bundle my State Farm housing insurance with other products?

Yes, you can bundle your State Farm housing insurance with other products like auto insurance, life insurance, or health insurance to potentially save on premiums.