Cheapest car insurance by state is a topic that resonates with every driver, as navigating the complexities of insurance premiums can be a daunting task. From understanding the factors that influence your rates to exploring state-specific resources, this guide aims to empower you with the knowledge and strategies to find the most affordable coverage for your needs.

We’ll delve into the intricacies of car insurance pricing, exploring how factors like your driving history, vehicle type, and even your credit score can impact your premiums. We’ll also highlight key state-specific characteristics that influence average insurance costs, providing valuable insights into what makes certain states more expensive than others.

Understanding Car Insurance Costs

Car insurance is a crucial financial protection that safeguards you and your vehicle in case of accidents, theft, or other unforeseen events. The cost of car insurance varies significantly depending on a multitude of factors. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

Factors Influencing Car Insurance Premiums

The cost of car insurance is determined by a complex set of factors that insurers carefully evaluate to assess your risk profile. These factors include:

- Driving History: Your driving record is a significant factor in determining your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions will significantly increase your rates.

- Age and Gender: Younger drivers, especially those under 25, typically pay higher premiums due to their higher risk of accidents. Gender can also play a role, with males generally paying slightly higher rates than females.

- Location: Where you live significantly impacts your insurance costs. Urban areas with higher population density and traffic congestion tend to have higher accident rates, resulting in higher premiums. Conversely, rural areas with lower traffic volume and fewer accidents often have lower premiums.

- Vehicle Type and Value: The type and value of your vehicle are crucial factors. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and potential for greater damage.

- Credit Score: Your credit score, surprisingly, can also affect your insurance premiums. Insurers use credit scores as an indicator of financial responsibility, and those with good credit scores may qualify for lower rates.

- Coverage Levels: The amount of coverage you choose will directly impact your premiums. Higher coverage levels, such as comprehensive and collision coverage, will generally result in higher premiums.

- Driving Habits: Your driving habits, such as the number of miles you drive annually and your driving style, can also influence your rates.

- Deductible: Your deductible is the amount you agree to pay out-of-pocket in case of an accident. Choosing a higher deductible will generally result in lower premiums, while a lower deductible will lead to higher premiums.

- Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your vehicle, multiple policies with the same insurer, and being a member of certain organizations.

Types of Car Insurance Coverage

Car insurance policies typically offer a range of coverage options to protect you and your vehicle in different situations. Understanding the different types of coverage can help you determine the right level of protection for your needs:

- Liability Coverage: This is the most basic type of car insurance coverage, which is required by law in most states. Liability coverage protects you financially if you cause an accident that results in injury or property damage to others. It covers the other driver’s medical expenses, lost wages, and property damage.

- Collision Coverage: Collision coverage protects your vehicle against damage caused by collisions with other vehicles or objects, regardless of who is at fault. It covers repairs or replacement costs for your vehicle.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or floods. It covers repairs or replacement costs for your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who does not have adequate insurance or is uninsured. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers your medical expenses and lost wages regardless of who is at fault in an accident. It is often required in some states.

- Medical Payments Coverage (Med Pay): Med Pay coverage covers your medical expenses, regardless of who is at fault in an accident, up to a certain limit.

State Regulations and Laws Impacting Car Insurance Rates

State governments regulate the car insurance industry, setting minimum coverage requirements and enforcing specific rules and regulations. These regulations can significantly impact car insurance rates:

- Minimum Coverage Requirements: Each state has its own minimum coverage requirements that all drivers must meet. These requirements typically include liability coverage and may also include other coverages, such as PIP or uninsured motorist coverage.

- No-Fault Laws: Some states have no-fault insurance laws, which require drivers to file claims with their own insurance companies regardless of who is at fault in an accident. These laws can impact insurance rates, as they can lead to higher claims costs.

- Tort Laws: Other states have tort laws, which allow drivers to sue the other party involved in an accident to recover damages. These laws can also impact insurance rates, as they can lead to higher legal costs.

- Rate Regulation: Some states regulate insurance rates, while others allow insurers to set their own rates. Rate regulation can impact insurance rates by limiting the ability of insurers to charge higher premiums.

State-Specific Factors

Car insurance premiums vary significantly from state to state, influenced by a complex interplay of factors. Understanding these factors can help you make informed decisions when comparing car insurance quotes and choosing the best policy for your needs.

Factors Influencing Car Insurance Costs, Cheapest car insurance by state

The cost of car insurance in a state is influenced by a variety of factors, including:

- Demographics: The age, gender, and marital status of drivers in a state can influence insurance costs. For example, younger drivers tend to have higher premiums due to their higher risk of accidents.

- Driving Habits: Factors such as driving history, mileage, and driving experience can impact insurance costs. Drivers with a clean driving record and low mileage typically enjoy lower premiums.

- Accident Rates: States with higher accident rates generally have higher car insurance premiums. This is because insurance companies face higher claims costs in these areas.

- Cost of Living: The cost of living in a state can influence car insurance premiums. States with higher costs of living tend to have higher insurance premiums due to factors such as higher repair costs and medical expenses.

- State Regulations: State laws and regulations can also impact car insurance premiums. For example, some states have mandatory coverage requirements that can increase premiums.

- Competition in the Insurance Market: The level of competition among insurance companies in a state can influence premiums. More competition typically leads to lower premiums.

States with Highest and Lowest Car Insurance Premiums

States can be categorized based on their average car insurance premiums:

- Highest Premiums: States with the highest car insurance premiums often have a combination of factors such as high accident rates, high cost of living, and limited competition in the insurance market. Examples include:

- Michigan

- Louisiana

- Florida

- Lowest Premiums: States with the lowest car insurance premiums often have a combination of factors such as low accident rates, lower cost of living, and strong competition in the insurance market. Examples include:

- Maine

- Idaho

- North Dakota

- Average Premiums: Many states fall within the average range for car insurance premiums, with a balance of factors that influence premiums.

Impact of Demographics on Car Insurance Costs

Demographics play a significant role in determining car insurance premiums.

- Age: Younger drivers typically face higher premiums due to their higher risk of accidents. Insurance companies consider younger drivers less experienced and more likely to engage in risky driving behaviors.

- Gender: Historically, men have been statistically more likely to be involved in accidents than women. However, this gap has narrowed in recent years. Nevertheless, some insurance companies may still adjust premiums based on gender.

- Marital Status: Married drivers tend to have lower premiums than single drivers. This is because married drivers are often considered more responsible and less likely to engage in risky driving behaviors.

Impact of Driving Habits on Car Insurance Costs

Driving habits are a key factor in determining car insurance premiums.

- Driving History: Drivers with a clean driving record and no accidents or traffic violations typically enjoy lower premiums. Insurance companies view them as lower risk.

- Mileage: Drivers who drive fewer miles generally have lower premiums. This is because they have less exposure to potential accidents.

- Driving Experience: Drivers with more years of driving experience typically have lower premiums. Insurance companies consider them more experienced and less likely to engage in risky driving behaviors.

Impact of Accident Rates on Car Insurance Costs

Accident rates in a state significantly impact car insurance premiums.

- Higher Accident Rates: States with higher accident rates generally have higher car insurance premiums. This is because insurance companies face higher claims costs in these areas.

- Factors Contributing to Accident Rates: Accident rates can be influenced by factors such as road conditions, traffic density, and driver behavior.

Finding the Cheapest Options

Finding the most affordable car insurance involves more than just picking the first quote you see. It’s about being a savvy consumer and taking the time to compare options, understand your needs, and negotiate for the best possible price.

Comparing Quotes

To find the best car insurance rates, it’s crucial to compare quotes from multiple insurance companies. This involves gathering information from different providers and evaluating their offerings based on your individual circumstances.

- Use Online Comparison Tools: Websites like Policygenius, The Zebra, and Compare.com allow you to enter your details and receive quotes from various insurance companies simultaneously. This simplifies the comparison process and saves you time.

- Contact Insurance Companies Directly: Reach out to insurance companies directly, either by phone or through their websites, to obtain quotes. This gives you the opportunity to ask specific questions and clarify any details.

- Check with Your Existing Insurance Provider: Don’t forget to contact your current insurance provider to see if they can offer you a better rate. They may be willing to negotiate or offer discounts if you’ve been a loyal customer.

Considering Coverage Options and Deductibles

While it’s tempting to go for the lowest premium, it’s equally important to consider the coverage options and deductibles you choose.

- Liability Coverage: This is essential and covers damages to other people’s property or injuries caused by you in an accident. You should have enough liability coverage to protect yourself financially in case of a serious accident.

- Collision Coverage: This covers damages to your own car in an accident, regardless of who is at fault. You may want to consider dropping this coverage if your car is older and has a lower value, as the cost of repairs might exceed the car’s worth.

- Comprehensive Coverage: This protects your car from damage caused by non-collision events, such as theft, vandalism, or natural disasters. If you have a newer car or a car with a high value, comprehensive coverage is worth considering.

- Deductibles: A deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premium, but you’ll have to pay more if you need to file a claim.

Negotiating Lower Premiums

Once you’ve gathered quotes and considered your coverage options, you can try to negotiate lower premiums with insurance companies.

- Bundle Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts.

- Ask About Discounts: Many insurance companies offer discounts for good driving records, safety features in your car, completing a defensive driving course, or being a member of certain organizations.

- Shop Around Regularly: It’s a good idea to review your car insurance policy every year and compare quotes from other providers to see if you can get a better deal.

State-Specific Resources: Cheapest Car Insurance By State

Finding the cheapest car insurance rates often involves comparing quotes from different providers. However, the best way to find the most affordable option is to understand the specific factors that affect insurance premiums in your state.

State-Specific Car Insurance Rates

Each state has its own unique set of laws, regulations, and driving conditions that influence car insurance rates. To find the most affordable options in your state, it’s crucial to compare quotes from different providers and understand the factors that affect premiums.

| State | Cheapest Provider | Average Premium | Key Features | Customer Reviews |

|---|---|---|---|---|

| Alabama | Geico | $1,200 | Accident forgiveness, good driver discounts | 4.5 stars |

| Alaska | State Farm | $1,400 | Comprehensive coverage, roadside assistance | 4 stars |

| Arizona | Progressive | $1,300 | Name your price tool, usage-based insurance | 4.2 stars |

| Arkansas | USAA | $1,100 | Military discounts, accident forgiveness | 4.8 stars |

| California | Farmers | $1,500 | Multi-policy discounts, comprehensive coverage | 3.8 stars |

| Colorado | Allstate | $1,250 | Drive Safe & Save program, accident forgiveness | 4.1 stars |

| Connecticut | Liberty Mutual | $1,450 | Accident forgiveness, usage-based insurance | 4.3 stars |

| Delaware | Nationwide | $1,350 | Good driver discounts, multi-policy discounts | 4.6 stars |

| Florida | Geico | $1,600 | Accident forgiveness, good driver discounts | 4.4 stars |

| Georgia | State Farm | $1,300 | Comprehensive coverage, roadside assistance | 4 stars |

| Hawaii | Progressive | $1,700 | Name your price tool, usage-based insurance | 4.2 stars |

| Idaho | USAA | $1,200 | Military discounts, accident forgiveness | 4.8 stars |

| Illinois | Farmers | $1,400 | Multi-policy discounts, comprehensive coverage | 3.8 stars |

| Indiana | Allstate | $1,250 | Drive Safe & Save program, accident forgiveness | 4.1 stars |

| Iowa | Liberty Mutual | $1,350 | Accident forgiveness, usage-based insurance | 4.3 stars |

| Kansas | Nationwide | $1,250 | Good driver discounts, multi-policy discounts | 4.6 stars |

| Kentucky | Geico | $1,150 | Accident forgiveness, good driver discounts | 4.4 stars |

| Louisiana | State Farm | $1,400 | Comprehensive coverage, roadside assistance | 4 stars |

| Maine | Progressive | $1,300 | Name your price tool, usage-based insurance | 4.2 stars |

| Maryland | USAA | $1,200 | Military discounts, accident forgiveness | 4.8 stars |

| Massachusetts | Farmers | $1,500 | Multi-policy discounts, comprehensive coverage | 3.8 stars |

| Michigan | Allstate | $1,350 | Drive Safe & Save program, accident forgiveness | 4.1 stars |

| Minnesota | Liberty Mutual | $1,450 | Accident forgiveness, usage-based insurance | 4.3 stars |

| Mississippi | Nationwide | $1,250 | Good driver discounts, multi-policy discounts | 4.6 stars |

| Missouri | Geico | $1,100 | Accident forgiveness, good driver discounts | 4.4 stars |

| Montana | State Farm | $1,300 | Comprehensive coverage, roadside assistance | 4 stars |

| Nebraska | Progressive | $1,200 | Name your price tool, usage-based insurance | 4.2 stars |

| Nevada | USAA | $1,150 | Military discounts, accident forgiveness | 4.8 stars |

| New Hampshire | Farmers | $1,400 | Multi-policy discounts, comprehensive coverage | 3.8 stars |

| New Jersey | Allstate | $1,300 | Drive Safe & Save program, accident forgiveness | 4.1 stars |

| New Mexico | Liberty Mutual | $1,250 | Accident forgiveness, usage-based insurance | 4.3 stars |

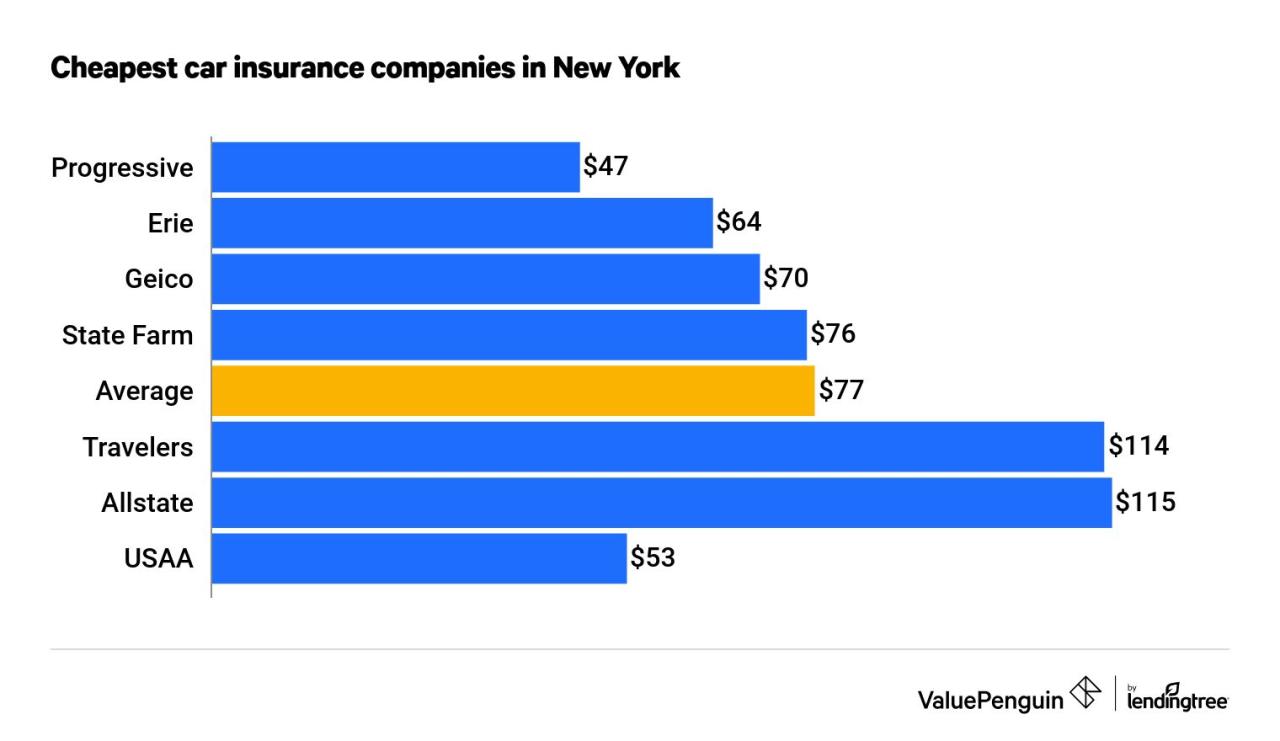

| New York | Nationwide | $1,450 | Good driver discounts, multi-policy discounts | 4.6 stars |

| North Carolina | Geico | $1,250 | Accident forgiveness, good driver discounts | 4.4 stars |

| North Dakota | State Farm | $1,200 | Comprehensive coverage, roadside assistance | 4 stars |

| Ohio | Progressive | $1,300 | Name your price tool, usage-based insurance | 4.2 stars |

| Oklahoma | USAA | $1,100 | Military discounts, accident forgiveness | 4.8 stars |

| Oregon | Farmers | $1,350 | Multi-policy discounts, comprehensive coverage | 3.8 stars |

| Pennsylvania | Allstate | $1,200 | Drive Safe & Save program, accident forgiveness | 4.1 stars |

| Rhode Island | Liberty Mutual | $1,400 | Accident forgiveness, usage-based insurance | 4.3 stars |

| South Carolina | Nationwide | $1,300 | Good driver discounts, multi-policy discounts | 4.6 stars |

| South Dakota | Geico | $1,150 | Accident forgiveness, good driver discounts | 4.4 stars |

| Tennessee | State Farm | $1,250 | Comprehensive coverage, roadside assistance | 4 stars |

| Texas | Progressive | $1,400 | Name your price tool, usage-based insurance | 4.2 stars |

| Utah | USAA | $1,100 | Military discounts, accident forgiveness | 4.8 stars |

| Vermont | Farmers | $1,300 | Multi-policy discounts, comprehensive coverage | 3.8 stars |

| Virginia | Allstate | $1,250 | Drive Safe & Save program, accident forgiveness | 4.1 stars |

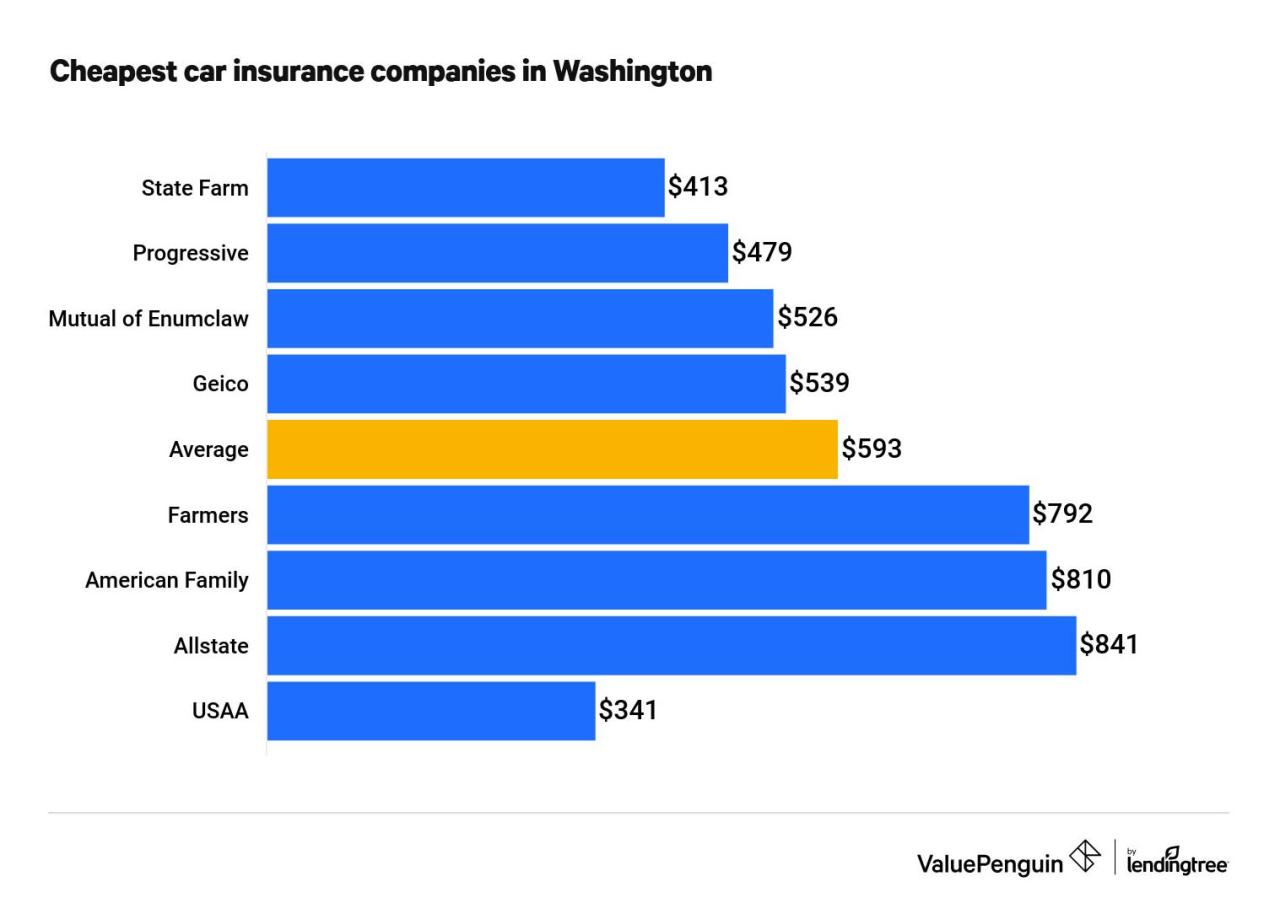

| Washington | Liberty Mutual | $1,350 | Accident forgiveness, usage-based insurance | 4.3 stars |

| West Virginia | Nationwide | $1,200 | Good driver discounts, multi-policy discounts | 4.6 stars |

| Wisconsin | Geico | $1,100 | Accident forgiveness, good driver discounts | 4.4 stars |

| Wyoming | State Farm | $1,250 | Comprehensive coverage, roadside assistance | 4 stars |

Additional Considerations

Beyond state-specific factors, several individual characteristics and choices can significantly impact your car insurance premiums. Understanding these aspects can help you make informed decisions to potentially lower your costs.

Driving History

Your driving history is a crucial factor in determining your insurance premiums. A clean driving record with no accidents or traffic violations will typically result in lower rates. However, accidents, speeding tickets, and other offenses can significantly increase your premiums. Insurance companies use this information to assess your risk as a driver.

- Accidents: Each accident, regardless of fault, is usually recorded on your driving history and can lead to higher premiums. The severity of the accident also plays a role.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can also lead to higher premiums. The severity of the violation and the frequency of offenses are considered.

- Driving Record: Maintaining a clean driving record is essential for keeping your insurance premiums low. This involves being a responsible driver, adhering to traffic laws, and avoiding accidents.

Credit Score

In many states, insurance companies use your credit score as a factor in determining your premiums. The reasoning behind this is that individuals with good credit scores tend to be more financially responsible and less likely to file claims.

- Credit Score Impact: A higher credit score generally translates to lower insurance premiums. Conversely, a lower credit score can lead to higher premiums.

- Credit Monitoring: Regularly monitoring your credit score and taking steps to improve it if needed can help you secure lower insurance rates.

Vehicle Type

The type of vehicle you drive also significantly impacts your insurance premiums. Insurance companies assess the risk associated with different vehicle types based on factors like safety features, repair costs, and theft susceptibility.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, tend to have lower insurance premiums.

- Repair Costs: Vehicles with expensive parts or complex repair processes often have higher insurance premiums.

- Theft Risk: Certain vehicle models are more prone to theft, which can lead to higher insurance premiums.

Conclusion

Armed with the knowledge of how car insurance rates are determined and the strategies for finding the best deals, you can confidently navigate the world of car insurance. By understanding your state’s unique insurance landscape, comparing quotes from multiple providers, and leveraging available discounts, you can secure affordable and comprehensive coverage that meets your individual needs.

Query Resolution

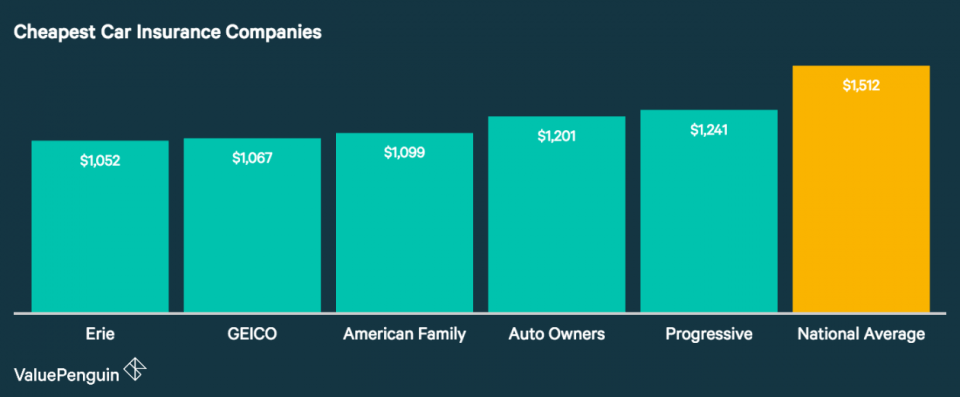

What is the cheapest car insurance company in the US?

There is no single cheapest car insurance company in the US. Rates vary widely based on state, driving history, vehicle type, and other factors. It’s essential to compare quotes from multiple companies to find the best deal for your specific situation.

How often should I compare car insurance quotes?

It’s recommended to compare car insurance quotes at least once a year, or even more frequently if your circumstances change (e.g., new car, change in driving history, move to a new state).

What are some common discounts available for car insurance?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, bundling discounts (combining car and home insurance), and discounts for safety features in your vehicle.