Florida State Minimum Car Insurance is a crucial aspect of driving in the Sunshine State. It’s not just about complying with the law; it’s about protecting yourself and others on the road. Understanding the minimum requirements, the no-fault system, and factors influencing insurance rates is essential for every Florida driver.

This guide will break down the intricacies of Florida’s car insurance laws, providing insights into the minimum coverage requirements, the impact of the no-fault system, and strategies for finding affordable insurance options. Whether you’re a new driver or a seasoned veteran, this information will help you navigate the complexities of car insurance in Florida.

Florida’s Minimum Car Insurance Requirements

Driving in Florida requires you to have a minimum amount of car insurance coverage. This ensures that you can cover the costs of any accidents you may cause, protecting yourself and others on the road.

Florida’s Minimum Liability Coverage Requirements

Florida law mandates that all drivers carry a minimum amount of liability insurance. This coverage protects you financially if you cause an accident that results in injury or damage to another person or their property.

Types of Coverage

The minimum liability coverage in Florida includes:

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other damages incurred by someone else if you are at fault in an accident.

- Property Damage Liability (PDL): This coverage pays for repairs or replacement of another person’s property if you are at fault in an accident.

- Personal Injury Protection (PIP): This coverage pays for your own medical expenses, lost wages, and other damages, regardless of who is at fault in an accident.

Minimum Coverage Amounts

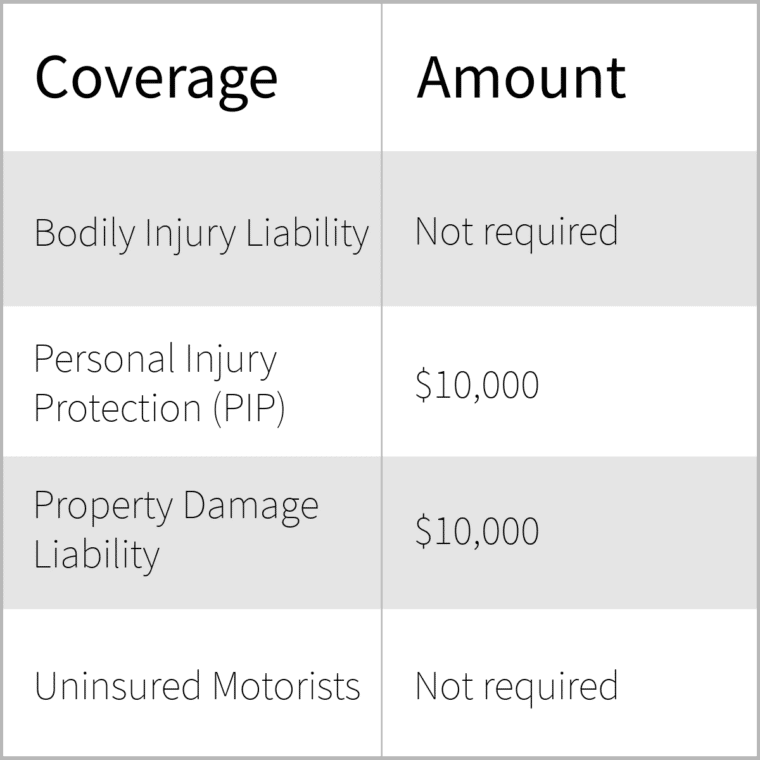

Here is a table summarizing the minimum coverage amounts required by Florida law:

| Coverage Type | Minimum Coverage Amount |

|---|---|

| Bodily Injury Liability (per person) | $10,000 |

| Bodily Injury Liability (per accident) | $20,000 |

| Property Damage Liability | $10,000 |

| Personal Injury Protection (PIP) | $10,000 |

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, which means that after an accident, drivers are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

How Florida’s No-Fault System Works

In Florida, drivers are required to carry Personal Injury Protection (PIP) coverage, which is a type of insurance that covers medical expenses and lost wages for the policyholder and their passengers, regardless of who caused the accident. The PIP coverage pays benefits up to a certain limit, usually $10,000, and the policyholder is responsible for any expenses exceeding that limit.

Personal Injury Protection (PIP) Coverage

PIP coverage plays a crucial role in Florida’s no-fault system. It helps cover medical expenses, such as:

- Hospitalization

- Surgery

- Prescription drugs

- Rehabilitation

- Medical supplies

In addition to medical expenses, PIP coverage also covers lost wages for the policyholder and their passengers. The amount of lost wages covered depends on the policy, but it typically covers a portion of the policyholder’s lost income for a certain period.

Filing a Claim Against Another Driver’s Insurance

While Florida’s no-fault system requires drivers to primarily rely on their own PIP coverage, there are situations where drivers may need to file a claim against another driver’s insurance. These situations typically involve:

- When the other driver is at fault for the accident and the damages exceed the policyholder’s PIP coverage. In such cases, the policyholder can file a claim with the other driver’s insurance company to recover damages beyond their PIP coverage. This can include medical expenses, lost wages, property damage, and pain and suffering.

- When the other driver is uninsured or underinsured. If the other driver does not have insurance or has insufficient coverage to cover the damages, the policyholder may be able to file a claim with their own uninsured or underinsured motorist (UM/UIM) coverage.

- When the other driver is at fault and the policyholder suffers a serious injury. In cases of serious injuries, such as permanent disability or death, the policyholder may be able to file a claim against the other driver’s insurance company, regardless of whether their own PIP coverage has been exhausted.

Factors Affecting Florida Car Insurance Rates

In Florida, several factors determine the cost of car insurance. These factors are used to assess the risk associated with insuring a particular driver, vehicle, and location. Understanding these factors can help you make informed decisions to potentially lower your insurance premiums.

Driving History

Your driving history is one of the most significant factors influencing your car insurance rates. A clean driving record with no accidents, violations, or claims will result in lower premiums. Conversely, a history of accidents, traffic violations, or insurance claims can significantly increase your rates. Insurance companies consider your driving history to assess your risk of future accidents.

- Accidents: Each accident, regardless of fault, increases your risk profile, leading to higher premiums. The severity of the accident, such as a fender bender or a major collision, also plays a role.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, and DUI convictions, can significantly impact your insurance rates. These violations demonstrate a pattern of risky driving behavior, increasing the likelihood of future accidents.

- Insurance Claims: Filing insurance claims for accidents or damage to your vehicle can also increase your rates. Insurance companies see claims as indicators of potential future claims, raising your risk profile.

Age

Age is another crucial factor in determining car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies reflect this increased risk by charging higher premiums for younger drivers.

- Young Drivers: Due to their lack of experience and higher risk-taking behavior, young drivers often face higher premiums. As drivers gain experience and a clean driving record, their rates tend to decrease.

- Older Drivers: While older drivers generally have lower rates, they may face higher premiums if they have health conditions affecting their driving abilities.

Vehicle Type

The type of vehicle you drive significantly impacts your car insurance rates. Insurance companies consider factors like the vehicle’s value, safety features, and repair costs to determine your premiums.

- Vehicle Value: More expensive vehicles, like luxury cars or sports cars, generally have higher insurance rates due to their higher repair costs and potential for greater losses in case of an accident.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often associated with lower premiums. These features reduce the risk of accidents and injuries, resulting in lower insurance costs.

- Repair Costs: Vehicles with complex designs or rare parts can have higher repair costs, leading to higher insurance premiums.

Location

Your location also plays a role in determining your car insurance rates. Factors like the density of population, traffic volume, crime rates, and weather conditions influence the likelihood of accidents and the severity of damages.

- Urban Areas: Densely populated urban areas with high traffic volume and congestion often have higher insurance rates due to the increased risk of accidents.

- Rural Areas: Rural areas with lower population density and fewer vehicles may have lower insurance rates. However, factors like wildlife encounters and harsh weather conditions can still influence rates.

- Climate: Areas prone to hurricanes, floods, or other natural disasters may have higher insurance rates to cover potential damage to vehicles.

Exploring Additional Car Insurance Coverage Options

While Florida’s minimum car insurance requirements are mandatory, they might not be sufficient to protect you financially in the event of a serious accident. Consider adding optional coverage to ensure you’re adequately protected.

Collision Coverage

Collision coverage protects you against damage to your vehicle caused by an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

For example, if you hit a parked car and damage your vehicle, collision coverage would pay for the repairs or replacement.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle caused by events other than accidents, such as theft, vandalism, natural disasters, and animal collisions. This coverage also pays for repairs or replacement, minus your deductible.

For example, if a tree falls on your car during a storm, comprehensive coverage would pay for the repairs or replacement.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. This coverage pays for your medical expenses, lost wages, and property damage, up to your policy limits.

For example, if you’re hit by a driver who doesn’t have insurance, UM/UIM coverage would pay for your medical bills and other expenses.

Factors Affecting the Cost of Optional Coverage

The cost of optional coverage varies depending on several factors, including:

- Your driving record: A clean driving record will generally result in lower premiums.

- Your vehicle’s make, model, and year: Newer, more expensive vehicles generally have higher premiums.

- Your location: Premiums can vary depending on the area where you live.

- Your coverage limits: Higher coverage limits generally result in higher premiums.

- Your deductible: A higher deductible generally results in lower premiums.

Finding Affordable Car Insurance in Florida

Navigating the world of car insurance in Florida can feel like a maze, especially when you’re looking for the best deal. But don’t worry, with a little effort and smart strategies, you can find affordable car insurance that fits your budget. This section will guide you through the process, providing tips and strategies to help you secure the most cost-effective coverage.

Comparing Quotes from Different Insurance Providers

Getting quotes from multiple insurance providers is crucial to finding the best deal. This allows you to compare prices, coverage options, and customer service.

Here’s a step-by-step guide to effectively compare quotes:

- Start with online comparison websites: Sites like Policygenius, The Zebra, and Insurance.com allow you to enter your information once and receive quotes from multiple insurers. This saves you time and effort.

- Contact individual insurance companies directly: While comparison websites are convenient, it’s also a good idea to contact insurance companies directly to discuss your specific needs and get personalized quotes.

- Review the quotes carefully: Pay attention to the coverage details, deductibles, and premiums. Make sure you understand what each quote covers and how it compares to your requirements.

- Consider customer service and reputation: While price is important, don’t overlook customer service and the insurer’s reputation. Look for companies with positive reviews and a history of handling claims efficiently.

Strategies for Lowering Car Insurance Premiums, Florida state minimum car insurance

Once you’ve gathered quotes, you can implement strategies to potentially lower your premiums. These strategies can help you save money on your car insurance:

- Increase your deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums. Consider increasing your deductible if you’re comfortable with the financial risk.

- Improve your credit score: In many states, including Florida, insurance companies use your credit score to assess your risk. Improving your credit score can lead to lower premiums.

- Bundle your insurance policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Maintain a clean driving record: Traffic violations, accidents, and driving under the influence can significantly increase your premiums. Driving safely and avoiding violations can save you money.

- Ask about discounts: Insurance companies offer a variety of discounts, such as good student discounts, safe driver discounts, and discounts for anti-theft devices. Be sure to inquire about all available discounts.

- Shop around regularly: Car insurance rates can change, so it’s a good idea to shop around for quotes at least once a year to ensure you’re getting the best deal.

Importance of Maintaining Adequate Coverage: Florida State Minimum Car Insurance

In Florida, having the minimum required car insurance is not enough to protect yourself financially in the event of an accident. It’s crucial to understand the potential consequences of driving without sufficient coverage and the importance of regularly reviewing your insurance needs.

Driving without adequate car insurance can have serious consequences, including financial ruin, legal troubles, and even license suspension. It’s essential to understand the legal requirements and the potential risks associated with driving without sufficient coverage.

Penalties for Driving Without Minimum Coverage

Driving without the minimum required car insurance in Florida can result in several penalties, including:

- Fines: You could face hefty fines for driving without insurance. The amount of the fine can vary depending on the severity of the offense and the number of previous violations.

- License Suspension: Driving without insurance can lead to the suspension of your driver’s license. This can be a significant inconvenience, preventing you from driving legally.

- Vehicle Impoundment: In some cases, your vehicle may be impounded until you provide proof of insurance.

- Jail Time: In extreme cases, you may even face jail time for driving without insurance, especially if you are involved in an accident that results in injuries or property damage.

Legal Implications of Driving Without Insurance

Driving without insurance can have severe legal consequences, particularly if you are involved in an accident. You could be held personally liable for all damages and injuries, even if the accident was not your fault.

- Financial Responsibility: If you cause an accident without insurance, you could be responsible for covering all medical expenses, property damage, and other related costs. This could lead to significant financial hardship.

- Lawsuits: If you are sued by the other party involved in the accident, you will have to defend yourself in court without the protection of insurance. This can be expensive and time-consuming.

- Criminal Charges: In some cases, driving without insurance can lead to criminal charges, especially if you are involved in a serious accident.

Reviewing Insurance Coverage Regularly

It’s crucial to review your car insurance coverage regularly to ensure it meets your current needs. Your insurance needs can change over time due to factors such as:

- Changes in your driving habits: If you start driving more frequently or in higher-risk areas, you may need to increase your coverage.

- Changes in your financial situation: If your financial situation improves, you may be able to afford higher coverage limits. Conversely, if your financial situation worsens, you may need to consider reducing your coverage.

- Changes in your vehicle’s value: If you purchase a new or more expensive vehicle, you may need to increase your collision and comprehensive coverage limits.

Wrap-Up

Navigating Florida’s car insurance landscape can be challenging, but with the right information and strategies, you can find affordable and adequate coverage. Remember, driving without proper insurance can lead to severe consequences, including hefty fines, license suspension, and even jail time. By understanding your options, comparing quotes, and prioritizing safety, you can ensure you’re protected on the road.

FAQ

What happens if I get into an accident and don’t have the minimum car insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You’ll also be responsible for covering all costs related to the accident, which could be substantial.

Can I get cheaper car insurance if I have a good driving record?

Yes, insurance companies often offer discounts for drivers with clean driving records. Maintaining a good driving history is a great way to save money on your premiums.

What is the difference between liability coverage and collision coverage?

Liability coverage protects you from financial responsibility if you cause an accident, while collision coverage covers damage to your own vehicle in an accident, regardless of fault.