General liability insurance washington state – General liability insurance in Washington State is an essential safety net for businesses and individuals, offering protection against a wide range of potential risks. Whether you operate a bustling retail store, a quiet home office, or offer services to clients, having this insurance can provide peace of mind knowing you’re covered in the event of an unexpected accident or incident.

General liability insurance acts as a shield, safeguarding you from financial ruin due to lawsuits, claims, and legal expenses stemming from property damage, bodily injury, and other unforeseen events. It’s a vital component of risk management, ensuring that your business or personal assets are protected from the potentially devastating consequences of liability.

What is General Liability Insurance?

General liability insurance is a type of coverage that protects businesses and individuals from financial losses resulting from claims of bodily injury, property damage, or personal injury caused by their actions or negligence. It provides a safety net against unexpected legal expenses and financial burdens arising from accidents or incidents that occur during the course of business operations or everyday life.

Common Scenarios Where General Liability Insurance Provides Coverage

General liability insurance offers protection in various scenarios, covering a wide range of situations where businesses or individuals could be held liable for accidents or incidents that result in injury, damage, or other losses.

- Slip and fall accidents: If a customer slips and falls on a wet floor in your store, general liability insurance can cover medical expenses, legal fees, and potential settlements.

- Product liability claims: If a customer is injured by a defective product you sell, general liability insurance can help cover the costs associated with the claim, including legal defense, medical expenses, and product recalls.

- Property damage: If a customer accidentally damages property while visiting your business, general liability insurance can cover the costs of repairs or replacement.

- Advertising injury: If you accidentally use someone’s copyrighted material in your advertising, general liability insurance can help cover legal expenses and potential settlements.

- Personal injury: If you are accused of defamation or slander, general liability insurance can help cover legal expenses and potential settlements.

Potential Risks Covered by General Liability Insurance in Washington State

General liability insurance in Washington State covers a wide range of potential risks, including:

- Bodily injury: This covers injuries to people caused by your actions or negligence, such as a customer tripping on a loose floorboard in your store.

- Property damage: This covers damage to property caused by your actions or negligence, such as a fire caused by faulty wiring in your building.

- Personal injury: This covers claims of defamation, slander, libel, or invasion of privacy, such as a customer alleging that you made false statements about them in your advertising.

- Advertising injury: This covers claims arising from your advertising activities, such as copyright infringement or false advertising.

- Medical payments: This covers medical expenses for injuries sustained by others on your property, even if you are not legally liable.

- Legal defense costs: This covers the cost of legal representation if you are sued for any of the above risks.

Who Needs General Liability Insurance in Washington State?

In Washington State, general liability insurance is essential for many businesses and individuals to protect them from financial losses due to accidents, injuries, or property damage. This type of insurance is particularly crucial for those who interact with the public or operate in environments that pose potential risks.

General liability insurance is a legal requirement for many industries in Washington State, and it is a crucial tool for managing risk and mitigating potential financial losses.

Types of Businesses and Individuals Requiring General Liability Insurance, General liability insurance washington state

General liability insurance is essential for various types of businesses and individuals in Washington State. Here are some key examples:

- Retail Businesses: Businesses that sell products to the public, such as clothing stores, grocery stores, and hardware stores, are susceptible to customer accidents or injuries on their premises. General liability insurance protects them from financial liability arising from such incidents.

- Service Businesses: Service businesses, such as hair salons, restaurants, and cleaning services, are also at risk of customer injuries or property damage. General liability insurance provides coverage for claims arising from negligence or accidents during service delivery.

- Contractors and Construction Businesses: Contractors and construction businesses operate in high-risk environments and are susceptible to accidents involving injuries or property damage. General liability insurance is essential to protect them from financial liability arising from such incidents.

- Non-Profit Organizations: Non-profit organizations that host events or operate facilities are at risk of accidents or injuries to participants or visitors. General liability insurance protects them from financial liability for such incidents.

- Home-Based Businesses: Individuals operating home-based businesses, such as freelance writers or consultants, may also benefit from general liability insurance to protect themselves from liability arising from accidents or injuries related to their business activities.

Specific Regulations and Requirements for Different Industries

Washington State has specific regulations and requirements for general liability insurance in various industries. These regulations are designed to ensure adequate financial protection for the public and businesses.

- Construction: The Washington State Department of Labor and Industries (L&I) requires contractors and construction businesses to carry general liability insurance with specific minimum coverage limits, depending on the type of project and the number of employees.

- Health Care: Healthcare providers, including hospitals, clinics, and medical offices, are required to carry general liability insurance to protect themselves from liability arising from medical negligence or accidents. The minimum coverage limits vary depending on the type of healthcare facility and the services provided.

- Child Care: Child care facilities in Washington State are required to carry general liability insurance to protect themselves from liability arising from accidents or injuries to children in their care. The minimum coverage limits are set by the Washington State Department of Early Learning.

Potential Consequences of Not Having General Liability Insurance

Operating a business or undertaking activities that expose you to potential liability without general liability insurance can have significant consequences.

- Financial Ruin: If a customer or visitor is injured on your property or as a result of your services, you could be held liable for their medical expenses, lost wages, and other damages. Without general liability insurance, you could be forced to pay these costs out of your own pocket, potentially leading to financial ruin.

- Legal Fees and Court Costs: Even if you are not ultimately found liable for an accident, you may still have to incur legal fees and court costs to defend yourself against a claim. General liability insurance covers these expenses, saving you from significant financial burdens.

- Damage to Reputation: A lawsuit or a negative public perception of your business due to an accident can significantly damage your reputation, leading to lost customers and revenue. General liability insurance can help mitigate these risks by providing financial protection and legal support.

Key Components of General Liability Insurance in Washington State

General liability insurance is designed to protect businesses and individuals from financial losses arising from various incidents that could occur in the course of their operations or activities. This type of insurance provides coverage for a range of potential liabilities, offering peace of mind and financial security in the event of unforeseen circumstances.

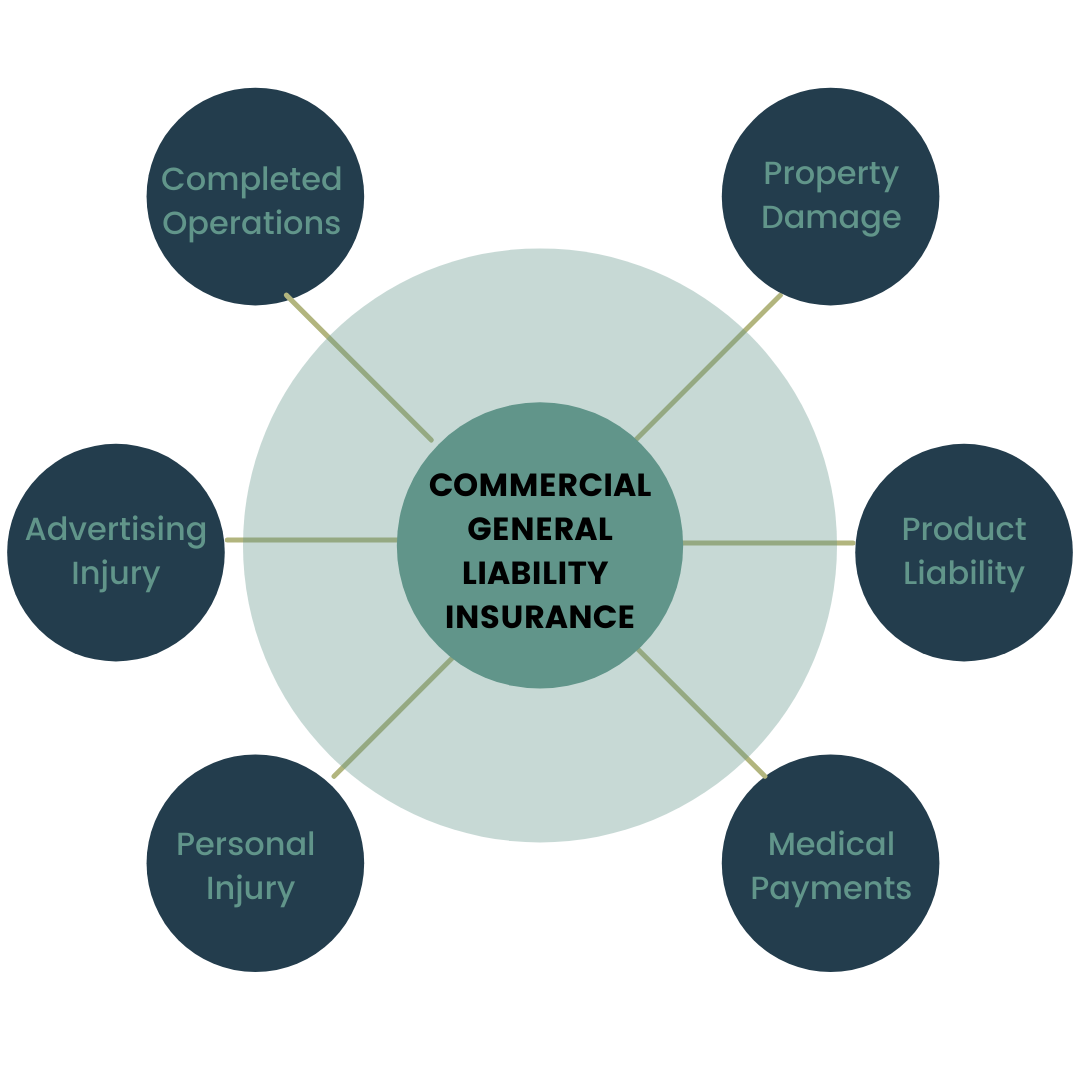

Coverage Components

The coverage components of general liability insurance are crucial to understanding the scope of protection it offers. Each component addresses specific types of liabilities, ensuring comprehensive coverage for a wide range of potential risks.

| Coverage Component | Description | Example |

|---|---|---|

| Bodily Injury and Property Damage Liability | This component covers legal expenses and financial compensation for injuries or damages to third parties resulting from your business operations. This includes medical expenses, lost wages, and property repairs. | A customer slips and falls on a wet floor in your store, injuring their leg. This coverage would help pay for their medical expenses, lost wages, and legal fees. |

| Personal and Advertising Injury Liability | This coverage protects against claims of libel, slander, copyright infringement, and other forms of personal or advertising injury. It helps cover legal expenses and settlements related to these types of claims. | A competitor publishes a false advertisement claiming your product is defective, causing damage to your reputation. This coverage would help defend against the claim and cover any associated legal costs. |

| Medical Payments Coverage | This component provides immediate medical payments to individuals who are injured on your property, regardless of fault. This coverage helps avoid potential lawsuits and fosters goodwill. | A delivery driver trips and falls on your loading dock, sustaining minor injuries. This coverage would cover their medical expenses, regardless of whether you were responsible for the accident. |

| Defense Costs | This component covers legal fees and expenses incurred in defending against lawsuits, even if the claim is ultimately found to be unfounded. It ensures that you have access to legal representation when needed. | You are sued by a customer claiming they were injured by a defective product, but the claim is baseless. This coverage would pay for your legal defense costs to fight the lawsuit. |

Factors Influencing General Liability Insurance Costs

The cost of general liability insurance in Washington State is influenced by several factors, each contributing to the final premium. Understanding these factors can help businesses make informed decisions about their insurance coverage and potentially reduce their costs.

Industry

The industry in which a business operates significantly impacts its general liability insurance cost. Some industries are inherently riskier than others, leading to higher premiums. For example, construction companies face greater risks of accidents and injuries compared to office-based businesses.

- High-risk industries: Construction, manufacturing, healthcare, and transportation typically have higher insurance premiums due to the increased likelihood of accidents and injuries.

- Low-risk industries: Retail, services, and technology businesses often have lower premiums because their risk profiles are generally considered less hazardous.

Business Size

The size of a business is another critical factor influencing insurance costs. Larger businesses generally have higher premiums due to their greater potential for liability claims.

- Larger businesses: Employ more people, have larger operations, and may handle more complex projects, all of which can increase their exposure to risk.

- Smaller businesses: Often have lower premiums because their operations are smaller and their potential for liability claims is typically less significant.

Risk Profile

A business’s risk profile, encompassing factors like its safety practices, claims history, and the nature of its operations, plays a crucial role in determining its insurance costs.

- Strong safety practices: Businesses with robust safety programs and a history of few accidents often receive lower premiums as they demonstrate a commitment to minimizing risks.

- Previous claims: Businesses with a history of significant liability claims may face higher premiums as insurers perceive them as higher risk.

- Nature of operations: Businesses involved in high-risk activities, such as handling hazardous materials or operating heavy machinery, typically have higher premiums due to the inherent dangers associated with their operations.

Location

The location of a business can also impact its insurance costs. Businesses in urban areas with higher population densities may face higher premiums due to the increased likelihood of accidents and injuries. Additionally, areas prone to natural disasters, such as earthquakes or floods, may also have higher premiums.

- Urban areas: Typically have higher premiums due to the higher concentration of people and vehicles, increasing the risk of accidents.

- Rural areas: Often have lower premiums as the risk of accidents and injuries is generally lower in less populated areas.

Financial Stability

A business’s financial stability can influence its insurance costs. Businesses with a strong financial history and good credit ratings may receive lower premiums as insurers perceive them as less risky.

Tips for Reducing Insurance Costs

- Implement robust safety programs: This can demonstrate a commitment to risk mitigation and potentially lower premiums.

- Maintain a good claims history: Minimizing claims can positively impact your risk profile and lead to lower premiums.

- Consider bundling insurance policies: Bundling general liability insurance with other policies, such as workers’ compensation, can sometimes lead to discounts.

- Shop around for quotes: Compare quotes from multiple insurance providers to find the best rates and coverage options.

Finding the Right General Liability Insurance in Washington State

Navigating the world of general liability insurance can be overwhelming, especially when you’re trying to find the best coverage for your specific needs. Fortunately, with a little research and planning, you can find the right policy to protect your business or personal activities in Washington State.

Steps to Finding the Right General Liability Insurance

- Assess your risk: Before you start shopping around, it’s crucial to understand your potential liabilities. What are the risks associated with your business or activities? Consider the nature of your work, the potential for accidents or injuries, and any potential legal claims.

- Determine your coverage needs: Once you’ve assessed your risks, you can determine the specific coverage you need. General liability insurance typically covers bodily injury, property damage, and personal injury, but it’s essential to review the policy details to ensure it meets your requirements.

- Get quotes from multiple insurers: Compare quotes from at least three different insurers to ensure you’re getting the best possible price and coverage. You can use online comparison tools or contact insurance brokers directly.

- Review policy details carefully: Don’t just focus on the price; read the policy carefully to understand the coverage, exclusions, and limitations. Pay attention to the policy’s limits, deductibles, and any specific endorsements or riders.

- Ask questions: Don’t hesitate to ask questions about the policy, the insurer’s reputation, and any claims processes. You want to choose an insurer you feel comfortable working with.

Resources for Finding General Liability Insurance

- Independent Insurance Brokers: Brokers can provide you with quotes from multiple insurers, making the comparison process easier. They can also offer expert advice and help you choose the right policy.

- Online Insurance Comparison Websites: Websites like Insure.com and Policygenius allow you to compare quotes from different insurers in one place. However, it’s important to note that these websites may not always show all available options.

- Professional Organizations: Some professional organizations offer group insurance plans to their members. This can be a good option if you’re a member of a trade association or other professional group.

Key Considerations When Comparing Quotes

- Premium: The premium is the amount you pay for your insurance policy. Consider the premium in relation to the coverage offered. A lower premium may not always be the best option if it means less coverage.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means a lower premium, but you’ll need to be prepared to pay more in the event of a claim.

- Limits: The limits on your policy determine the maximum amount your insurer will pay for a claim. Choose limits that are sufficient to cover your potential liabilities.

- Exclusions: Carefully review the policy’s exclusions, which are specific situations or events that are not covered by the policy.

- Insurer’s Reputation: Research the insurer’s financial stability and customer satisfaction ratings. You want to choose an insurer with a good track record of paying claims fairly and promptly.

Common Exclusions and Limitations

General liability insurance policies in Washington State, like most policies, have certain exclusions and limitations that define what is and isn’t covered. It’s crucial to carefully review the policy language and understand these potential gaps in coverage to ensure you’re adequately protected.

Exclusions

Exclusions are specific events, circumstances, or types of claims that are explicitly not covered by the policy. Here are some common exclusions found in general liability insurance policies in Washington State:

- Intentional acts: General liability insurance typically doesn’t cover injuries or damages caused by intentional acts. For example, if you intentionally assault someone, the policy won’t cover the resulting legal costs or damages.

- Professional services: If your business provides professional services, such as legal or medical advice, general liability insurance usually excludes claims arising from errors or omissions in those services. You’ll need separate professional liability insurance for such claims.

- Environmental damage: Policies often exclude coverage for environmental damage, such as pollution or contamination, unless it’s caused by a sudden and accidental event.

- Employee-related claims: Workers’ compensation insurance typically covers injuries sustained by employees on the job. General liability insurance generally excludes claims made by employees against their employer for workplace injuries.

- Contractual liability: General liability insurance may exclude claims arising from contractual obligations. For instance, if you have a contract with a client and fail to fulfill your obligations, resulting in damages, the policy may not cover those claims.

Limitations

Limitations in general liability insurance policies refer to specific restrictions on the coverage provided. Here are some common limitations:

- Policy limits: Each general liability policy has a limit on the maximum amount of coverage it provides for a single incident or during a policy period. This limit may be per occurrence or per policy period, depending on the policy.

- Deductibles: A deductible is the amount you’re responsible for paying before the insurance company starts covering claims. It’s a way to reduce premiums, but you’ll have to pay the deductible out of pocket before the insurance kicks in.

- Coverage periods: General liability insurance typically covers claims that occur during the policy period. Claims arising outside the policy period are generally not covered.

Claims Process and Procedures: General Liability Insurance Washington State

Filing a claim under your general liability insurance policy in Washington State is a straightforward process, but it’s essential to understand the steps involved to ensure a smooth and timely resolution.

Filing a Claim

The first step in the claims process is to report the incident to your insurance company as soon as possible. This can be done by phone, email, or online through your insurance provider’s website. It’s important to provide as much detail as possible about the incident, including:

- Date, time, and location of the incident

- Nature of the incident and any injuries or damages

- Names and contact information of any parties involved

- Any witnesses to the incident

- Any relevant documentation, such as police reports or medical records

Claim Investigation

Once you have filed your claim, the insurance company will begin an investigation to determine the validity of your claim and the extent of the damages. This investigation may involve:

- Reviewing the policy and any relevant documentation

- Contacting the other parties involved in the incident

- Conducting site inspections or reviewing photographs

- Obtaining expert opinions or assessments

Claim Settlement

Based on the results of the investigation, the insurance company will make a decision on whether to settle your claim. If your claim is approved, the insurance company will pay for the covered damages, up to the policy limits.

Documentation and Information

To ensure a smooth claims process, it’s crucial to provide the insurance company with all necessary documentation and information. This typically includes:

- A copy of your insurance policy

- A detailed written account of the incident

- Any relevant photographs or videos

- Police reports, if applicable

- Medical bills or repair estimates

- Contact information for any witnesses

Role of the Insurance Company

The insurance company plays a vital role in handling and resolving claims. They are responsible for:

- Investigating the claim and determining its validity

- Negotiating with the other parties involved

- Making a decision on whether to settle the claim

- Paying for covered damages, up to the policy limits

- Providing legal representation, if necessary

Ultimate Conclusion

Navigating the complexities of general liability insurance can feel daunting, but understanding its importance and exploring your options is crucial. By carefully evaluating your needs, seeking guidance from experienced insurance professionals, and securing the right coverage, you can build a solid foundation for protecting your business and personal interests in Washington State.

Top FAQs

What is the difference between general liability insurance and workers’ compensation insurance?

General liability insurance protects you from claims made by third parties (not employees) for bodily injury or property damage. Workers’ compensation insurance covers your employees in the event of work-related injuries or illnesses.

How much does general liability insurance cost in Washington State?

The cost of general liability insurance varies based on factors such as industry, business size, risk profile, and coverage limits. It’s best to obtain quotes from multiple insurance providers to compare prices and find the best value.

Can I get general liability insurance online?

Yes, many insurance companies offer online quotes and policy applications for general liability insurance. However, it’s recommended to speak with an insurance agent to ensure you understand the coverage and limitations of the policy.

What happens if I don’t have general liability insurance?

Without general liability insurance, you could be personally liable for any damages or injuries caused by your business or activities. This could result in significant financial losses and potentially even bankruptcy.