All States Insurance car coverage is a popular choice for drivers seeking reliable and comprehensive protection. With a rich history in the insurance market, All States Insurance offers a range of policies designed to meet the diverse needs of individuals and families. This guide delves into the world of All States Insurance, exploring their car insurance products, factors influencing costs, customer experiences, and a comparison with competitors.

Whether you’re a seasoned driver or just starting your journey on the road, understanding the ins and outs of car insurance is crucial. All States Insurance provides a comprehensive suite of policies that can help you navigate the unexpected and protect your financial well-being.

Understanding All States Insurance: All States Insurance Car

All States Insurance is a well-established and reputable insurance provider known for offering a wide range of insurance products to individuals and businesses. It has a strong presence in the insurance market, particularly in the United States.

Company History and Presence in the Insurance Market

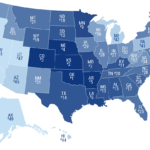

All States Insurance has a rich history, dating back to [Insert year of establishment]. Over the years, the company has grown significantly, expanding its reach and product offerings. It has established a strong reputation for providing reliable and comprehensive insurance solutions. All States Insurance operates in [Number] states across the US, serving a vast customer base.

Mission and Values

All States Insurance is committed to providing its customers with exceptional service and value. The company’s mission is to [Insert mission statement]. Its core values include [List of values, such as customer focus, integrity, innovation, and community involvement]. These values guide the company’s operations and interactions with its customers.

Car Insurance Products Offered by All States Insurance

All States Insurance offers a variety of car insurance products to meet the diverse needs of its customers. These products are designed to provide comprehensive coverage and financial protection in the event of an accident or other unforeseen circumstances.

Liability Coverage

Liability coverage is a crucial component of car insurance. It protects you financially if you are at fault in an accident that causes injury or damage to others. All States Insurance offers different levels of liability coverage, allowing you to choose the amount of protection that best suits your needs.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party if you are at fault in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property if you are at fault in an accident.

Collision Coverage

Collision coverage protects your vehicle from damage caused by a collision with another vehicle or object. It covers repairs or replacement of your car, minus your deductible.

- Deductible: This is the amount you pay out of pocket before your insurance kicks in. You can choose a higher deductible to lower your premium, or a lower deductible for greater coverage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than a collision, such as theft, vandalism, fire, or natural disasters. Like collision coverage, it covers repairs or replacement of your car, minus your deductible.

- Deductible: You can choose a higher deductible to lower your premium, or a lower deductible for greater coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you and your passengers if you are involved in an accident with a driver who has no insurance or insufficient insurance.

- Uninsured Motorist Coverage (UM): This coverage pays for your medical expenses and other damages if you are injured by an uninsured driver.

- Underinsured Motorist Coverage (UIM): This coverage pays the difference between the other driver’s liability coverage and your actual damages if you are injured by an underinsured driver.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident.

- Medical Expenses: PIP covers medical bills, including hospital stays, doctor visits, and rehabilitation.

- Lost Wages: PIP can help replace income you lose due to injuries sustained in an accident.

Other Coverage Options, All states insurance car

All States Insurance offers a range of additional coverage options to customize your policy and enhance your protection.

- Rental Car Coverage: This coverage provides you with a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance in the event of a breakdown, flat tire, or other roadside emergencies.

- Towing and Labor Coverage: This coverage pays for towing and labor costs if your vehicle needs to be towed after an accident or breakdown.

- Gap Insurance: This coverage pays the difference between your car’s actual cash value and the amount you owe on your loan or lease if your vehicle is totaled.

Factors Influencing Car Insurance Costs with All States Insurance

Your car insurance premiums are calculated based on several factors, and All States Insurance considers a range of these factors to determine your individual rate. These factors are designed to assess your risk as a driver and help ensure that your premiums reflect your likelihood of filing a claim.

Factors Determining Car Insurance Premiums

All States Insurance uses a variety of factors to calculate your car insurance premiums. These factors include:

- Driving History: Your driving record is a significant factor in determining your premiums. A clean driving record with no accidents or violations will result in lower premiums. However, accidents, traffic violations, and DUI convictions can significantly increase your premiums. For example, a driver with multiple speeding tickets or an at-fault accident may see a substantial increase in their premiums compared to a driver with a clean record.

- Age: Younger drivers are statistically more likely to be involved in accidents. All States Insurance generally charges higher premiums to younger drivers, as they are considered higher risk. As drivers gain experience and age, their premiums tend to decrease. For example, a 18-year-old driver may pay significantly more than a 40-year-old driver with the same driving record.

- Location: Your location plays a role in determining your premiums. Areas with higher crime rates, traffic congestion, and accident rates tend to have higher insurance premiums. For instance, drivers living in urban areas with heavy traffic and high accident rates may pay more than drivers in rural areas with lower traffic volume and fewer accidents.

- Vehicle Type: The type of vehicle you drive influences your premiums. Luxury vehicles, sports cars, and high-performance vehicles are generally more expensive to repair or replace, leading to higher insurance premiums. For example, the premium for a high-end sports car will be significantly higher than for a basic sedan. Safety features and the vehicle’s theft risk are also considered.

- Credit Score: Your credit score can surprisingly impact your car insurance premiums. Insurers may use your credit score as a proxy for risk assessment, as individuals with poor credit history may be more likely to file claims. A higher credit score can lead to lower premiums. It is important to note that this practice is not permitted in all states.

Discounts Offered by All States Insurance

All States Insurance offers various discounts to help policyholders save money on their premiums. These discounts can significantly reduce your overall costs. Some common discounts include:

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, free of accidents or violations for a specified period. The longer you maintain a clean record, the higher the discount may be.

- Good Student Discount: This discount is available to students who maintain a certain GPA. All States Insurance recognizes that good students tend to be responsible and may be less likely to be involved in accidents.

- Multi-Car Discount: If you insure multiple vehicles with All States Insurance, you may be eligible for a multi-car discount. This discount is often offered to encourage customers to insure all their vehicles with the same company.

- Other Discounts: All States Insurance may offer other discounts, such as discounts for anti-theft devices, driver safety courses, and loyalty programs. It is essential to inquire about available discounts when you get a quote.

Reducing Car Insurance Costs

You can take several steps to potentially reduce your car insurance costs:

- Maintain a Clean Driving Record: Avoid traffic violations and accidents. A clean driving record is crucial for lower premiums.

- Shop Around for Quotes: Compare quotes from multiple insurers to find the best rates. All States Insurance encourages you to compare their rates with other insurers.

- Consider a Higher Deductible: A higher deductible means you pay more out of pocket in the event of an accident but will result in lower premiums. This can be a good strategy if you have a good emergency fund and are willing to take on more financial risk.

- Take Advantage of Discounts: Explore all available discounts offered by All States Insurance and other insurers. These discounts can significantly reduce your premiums.

- Improve Your Credit Score: If your credit score is low, consider improving it. A higher credit score can potentially lead to lower car insurance premiums.

Customer Experience with All States Insurance

Customer experience is a crucial factor when choosing an insurance provider. All States Insurance strives to provide a positive and efficient experience for its policyholders. This section explores customer reviews, customer service channels, and the claim handling process to understand the overall customer experience with All States Insurance.

Customer Reviews and Testimonials

Customer reviews and testimonials offer valuable insights into the experiences of individuals who have interacted with All States Insurance. These reviews provide a diverse perspective on the company’s strengths and areas for improvement.

- Many customers praise All States Insurance for its competitive rates and comprehensive coverage options. They appreciate the flexibility in customizing policies to meet their specific needs.

- Positive reviews often highlight the responsiveness and professionalism of customer service representatives. Customers appreciate the ability to reach representatives through various channels, including phone, email, and online chat.

- Some customers have expressed concerns about the claim handling process, citing delays or difficulties in resolving certain claims. However, the company generally receives positive feedback for its efforts to resolve issues promptly and fairly.

Customer Service Channels

All States Insurance offers multiple customer service channels to ensure accessibility and convenience for its policyholders.

- Phone: Customers can reach a customer service representative by calling the company’s toll-free number. This channel provides immediate assistance and allows for personalized interactions.

- Email: For non-urgent inquiries or to provide documentation, customers can send an email to the company’s designated address. This channel allows for detailed communication and provides a written record of interactions.

- Online Chat: For quick and convenient assistance, customers can utilize the company’s online chat feature. This channel is particularly useful for addressing simple questions or obtaining general information.

Claim Handling Process

All States Insurance aims to provide a seamless and efficient claim handling process for its policyholders.

- Customers can file claims online, by phone, or through their mobile app. The company provides clear instructions and guidance throughout the process.

- Once a claim is filed, All States Insurance assigns a dedicated claims adjuster who will investigate the claim and communicate with the policyholder throughout the process.

- The company aims to resolve claims promptly and fairly. However, the time it takes to process a claim can vary depending on the complexity of the situation.

All States Insurance vs. Competitors

Choosing the right car insurance provider can be a daunting task, especially with so many options available. It’s essential to compare different companies to find the best fit for your needs and budget. All States Insurance is one such provider that competes with other major players in the market. Let’s delve into a comparison of All States Insurance with its competitors, analyzing their strengths and weaknesses.

Pricing Comparison

Understanding pricing is crucial when choosing car insurance. All States Insurance typically offers competitive rates, but it’s important to compare its prices with other providers to ensure you’re getting the best deal.

- Factors influencing pricing: Several factors influence car insurance premiums, including your driving history, age, location, vehicle type, and coverage options.

- Comparison tools: Online comparison websites like Bankrate, NerdWallet, and Insurify can help you quickly compare quotes from multiple insurers, including All States Insurance.

- Discounts and promotions: Many insurance companies offer discounts for various factors like good driving records, safety features in your car, and bundling insurance policies.

Coverage Options

The coverage options offered by different insurance companies can vary significantly. All States Insurance provides a comprehensive range of coverage options, but it’s essential to compare them with other providers to ensure you’re getting the coverage you need.

- Liability coverage: This coverage protects you financially if you’re at fault in an accident causing damage to another person’s property or injuries.

- Collision coverage: This coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Customer Service

Customer service is a critical factor when choosing an insurance company. You want to ensure you can easily reach them when you need assistance and receive prompt and helpful support.

- Availability: All States Insurance offers various customer service channels, including phone, email, and online chat.

- Response time: Compare the response times of different insurance companies to see how quickly they address your inquiries.

- Customer satisfaction ratings: You can check customer satisfaction ratings from independent organizations like J.D. Power to get an idea of the customer experience with different insurance providers.

Financial Stability

The financial stability of an insurance company is crucial, as it ensures they can pay claims in the event of a major disaster or significant losses.

- Credit ratings: Check the credit ratings of different insurance companies from agencies like A.M. Best, Standard & Poor’s, and Moody’s. Higher ratings indicate a more financially stable company.

- Claims-paying history: Review the claims-paying history of different insurance companies to see how they handle claims and their financial stability.

- Reserve levels: The amount of money an insurance company holds in reserves is an indicator of its financial strength. Higher reserve levels indicate a more stable company.

Obtaining a Car Insurance Quote from All States Insurance

Getting a car insurance quote from All States Insurance is a straightforward process. You can obtain a quote online or by contacting a representative directly. The process involves providing information about yourself, your vehicle, and your coverage preferences.

Obtaining a Quote Online

To obtain a car insurance quote online, you will need to visit the All States Insurance website and follow these steps:

- Navigate to the “Get a Quote” section of the website.

- Enter your zip code and select your state of residence.

- Provide information about your vehicle, such as the year, make, model, and VIN.

- Enter your driving history, including your age, driving experience, and any accidents or violations.

- Specify your coverage preferences, such as liability limits, collision and comprehensive coverage, and any optional add-ons.

- Review your quote and make any necessary adjustments.

- Submit your information and receive your personalized quote.

Obtaining a Quote Through a Representative

If you prefer to obtain a quote through a representative, you can contact All States Insurance by phone or email. You will need to provide the same information as you would when obtaining a quote online.

Information Required for a Quote

To obtain an accurate car insurance quote, you will need to provide All States Insurance with the following information:

- Driver details: Your name, date of birth, address, driving history, and any other relevant information.

- Vehicle information: The year, make, model, VIN, and any modifications to your vehicle.

- Coverage preferences: The type and amount of coverage you desire, including liability limits, collision and comprehensive coverage, and any optional add-ons.

Conclusive Thoughts

All States Insurance presents a compelling option for car insurance, offering a blend of competitive pricing, comprehensive coverage, and customer-centric service. By understanding the key factors that influence premiums and exploring the various policy options available, individuals can make informed decisions to secure the right level of protection for their driving needs. Whether you’re seeking peace of mind on the road or simply looking for a reliable insurance partner, All States Insurance stands ready to provide the coverage you deserve.

FAQ Corner

How do I get a car insurance quote from All States Insurance?

You can get a quote online, by phone, or by visiting an All States Insurance agent. To get an online quote, you’ll need to provide some basic information about yourself and your vehicle, such as your driving history, age, location, and vehicle type.

What discounts are available from All States Insurance?

All States Insurance offers a variety of discounts, including safe driver, good student, multi-car, and bundling discounts. To see which discounts you qualify for, contact an All States Insurance agent or visit their website.

What is the difference between liability and collision coverage?

Liability coverage protects you from financial responsibility if you cause an accident that injures someone or damages their property. Collision coverage protects you from damage to your own vehicle in an accident, regardless of who is at fault.

How do I file a claim with All States Insurance?

You can file a claim online, by phone, or by visiting an All States Insurance agent. To file a claim online, you’ll need to provide your policy number, the date and time of the accident, and a description of what happened.