State of Florida insurance is a complex and dynamic market, shaped by unique factors like its vast coastline, hurricane vulnerability, and a robust regulatory environment. The Sunshine State’s insurance landscape is a tapestry woven with diverse needs, from homeowners seeking protection against natural disasters to drivers navigating the roads and individuals seeking healthcare coverage.

This comprehensive guide explores the key aspects of Florida’s insurance market, providing insights into its size, growth, regulatory framework, rate trends, and consumer protections. We delve into the challenges and opportunities facing insurers and consumers alike, highlighting the evolving landscape of this vital industry.

Florida Insurance Market Overview: State Of Florida Insurance

The Florida insurance market is one of the largest and most complex in the United States, driven by the state’s unique demographics, climate, and regulatory environment.

Size and Growth of the Florida Insurance Market

The Florida insurance market is characterized by significant growth, driven by factors such as population growth, increasing property values, and the growing vulnerability to natural disasters. The state’s insurance premiums have been steadily increasing, reflecting the rising costs of covering risks associated with hurricanes and other perils.

Key Insurance Segments in Florida, State of florida insurance

- Property Insurance: This segment is the largest and most significant in Florida, accounting for a substantial portion of the state’s insurance market. It covers homeowners, businesses, and other property owners against risks such as hurricanes, windstorms, and other natural disasters.

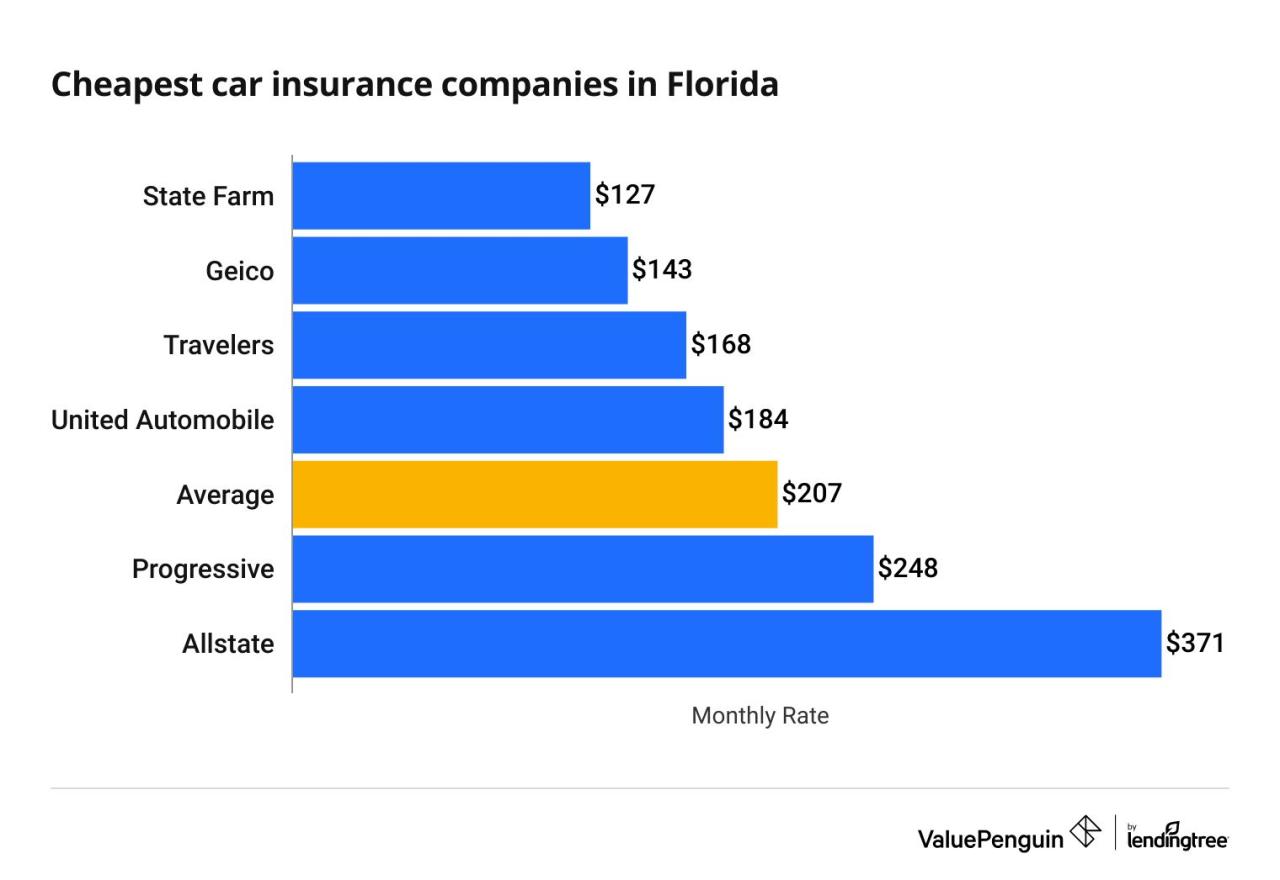

- Auto Insurance: Florida’s auto insurance market is also sizable, with a significant number of vehicles registered in the state. The high volume of traffic and the potential for accidents contribute to the demand for auto insurance.

- Health Insurance: The health insurance market in Florida is complex and diverse, with a mix of private and public insurance plans. The state has a large uninsured population, which presents challenges for healthcare access and affordability.

Major Insurance Companies Operating in Florida

- State Farm: One of the largest and most well-known insurance companies in the United States, State Farm has a significant presence in Florida, offering a wide range of insurance products, including property, auto, and life insurance.

- Allstate: Another major insurance provider in Florida, Allstate offers a comprehensive suite of insurance products, including property, auto, and life insurance.

- Geico: Known for its competitive rates and extensive advertising, Geico is a major player in the Florida auto insurance market.

- Progressive: Progressive is a leading provider of auto insurance in Florida, known for its innovative insurance products and personalized pricing options.

- Florida Peninsula Insurance Company: A Florida-based insurance company specializing in property insurance, Florida Peninsula is known for its focus on providing coverage to homeowners in high-risk areas.

Florida Insurance Regulations and Laws

Florida’s insurance market is heavily regulated, with a complex system of laws and oversight designed to protect consumers and ensure the stability of the insurance industry. The Florida Department of Financial Services (DFS) plays a central role in this regulatory framework.

The Florida Department of Financial Services’ Role in Insurance Regulation

The DFS is responsible for overseeing the insurance industry in Florida, ensuring compliance with state laws and regulations. The DFS’s role encompasses various functions, including:

- Licensing and regulating insurance companies and agents.

- Monitoring the financial solvency of insurance companies.

- Investigating and resolving consumer complaints related to insurance.

- Enforcing insurance laws and regulations.

- Educating consumers about their insurance rights and responsibilities.

Key Insurance Laws in Florida

The Florida Insurance Code is the primary law governing the insurance industry in the state. This comprehensive code establishes rules and regulations for all aspects of insurance, including:

- Insurance company licensing and regulation.

- Insurance policy provisions and requirements.

- Consumer protection provisions.

- Insurance fraud investigation and prosecution.

Other important insurance laws in Florida include:

- The Florida Hurricane Catastrophe Fund: This state-run fund provides reinsurance to insurance companies for hurricane losses, helping to stabilize the market during catastrophic events.

- The Florida Residential Property and Casualty Joint Underwriting Association (JUA): This association provides insurance to property owners who are unable to obtain coverage in the private market, serving as a safety net for consumers.

Impact of Recent Legislation on the Insurance Market

Recent legislative changes in Florida have significantly impacted the insurance market, leading to:

- Increased regulation of insurance rates and claims practices.

- A focus on reducing litigation costs.

- Efforts to improve the solvency of insurance companies.

“The Florida insurance market is dynamic and constantly evolving, influenced by factors such as hurricane activity, legislative changes, and economic conditions.”

These legislative changes have aimed to address concerns about rising insurance premiums and the availability of coverage, particularly in the aftermath of major hurricanes. However, the impact of these changes is still being evaluated, and the long-term effects on the insurance market remain to be seen.

Florida Insurance Rates and Premiums

Florida’s insurance market is unique, characterized by high rates and premiums. This section delves into the factors contributing to these elevated costs and how they compare to national averages.

Comparison to National Averages

Florida’s insurance rates are generally higher than the national average, particularly for homeowners insurance. This disparity stems from several factors, including the state’s vulnerability to hurricanes and other natural disasters, high property values, and legal and regulatory environments that can impact insurance costs.

Factors Influencing Insurance Premiums

Several factors influence insurance premiums in Florida, including:

- Property Location: Coastal properties are subject to higher premiums due to their increased risk of hurricane damage. Properties in areas with a history of frequent hurricanes, floods, or other natural disasters will generally face higher premiums.

- Coverage Types: The type and amount of coverage chosen impact premiums. Comprehensive coverage, including protection against perils like hurricanes, floods, and earthquakes, will be more expensive than basic coverage.

- Property Value: Higher-valued properties generally have higher premiums as the insurer’s potential payout in case of a claim is greater.

- Deductibles: A higher deductible, which is the amount the policyholder pays out-of-pocket before the insurance company covers the remaining costs, can lead to lower premiums.

- Claims History: Individuals with a history of filing claims may face higher premiums as they are considered higher risk.

- Credit Score: In some cases, credit score can be used as a factor in determining insurance premiums. This practice is controversial, as it may disproportionately affect low-income individuals.

Impact of Natural Disasters

Florida’s susceptibility to natural disasters, particularly hurricanes, has a significant impact on insurance rates. Hurricane damage can be extensive, leading to substantial claims payouts for insurers.

“The cost of reinsurance, which is insurance for insurers, is a major factor in determining homeowners insurance premiums in Florida. Reinsurance premiums rise when there are more hurricanes or other natural disasters, leading to higher homeowner insurance rates.”

As a result, insurance companies factor in the risk of hurricanes and other natural disasters when setting premiums. This can lead to significant fluctuations in rates, particularly in areas with a high risk of hurricane damage.

Florida Insurance Claims and Disputes

Florida experiences a high volume of insurance claims due to its susceptibility to natural disasters, particularly hurricanes. Understanding the process of filing a claim and navigating potential disputes is crucial for policyholders.

Insurance Claims Filing Process in Florida

Filing an insurance claim in Florida involves several steps:

- Report the Claim: Contact your insurance company immediately after an insured event, such as a hurricane, fire, or theft. Provide detailed information about the incident, including the date, time, and location.

- Document the Damage: Take photographs and videos of the damage to your property. Gather receipts for any repairs or temporary housing expenses.

- Submit the Claim: Complete and submit the necessary claim forms to your insurance company. This may involve providing additional documentation, such as proof of ownership or a police report.

- Insurance Company Investigation: The insurance company will investigate your claim, including inspecting the damage and reviewing your policy coverage.

- Claim Adjustment: Based on the investigation, the insurance company will determine the amount of coverage and issue a payment. You may need to negotiate the settlement if you disagree with the amount offered.

Common Insurance Claim Disputes

Disputes often arise during the insurance claim process. Some common areas of contention include:

- Coverage Disputes: Policyholders may disagree with the insurance company’s interpretation of their policy coverage, particularly regarding exclusions or limitations.

- Valuation Disputes: The insurance company may undervalue the damage to your property, leading to disputes about the amount of compensation.

- Delay in Payment: Insurance companies may delay payment of claims, causing financial hardship for policyholders. This can be particularly problematic after a natural disaster when time is of the essence.

- Bad Faith Claims: Policyholders may file bad faith claims against insurance companies if they believe the insurer has acted in bad faith by denying or delaying legitimate claims.

Resolving Insurance Claim Disputes

Several methods can be used to resolve insurance claim disputes:

- Negotiation: You can attempt to negotiate a settlement with the insurance company directly. It is often helpful to have an attorney or insurance advocate represent you during this process.

- Mediation: Mediation involves a neutral third party who helps the parties reach a mutually acceptable agreement. Mediation can be a cost-effective way to resolve disputes without going to court.

- Arbitration: Arbitration involves a neutral third party who hears both sides of the dispute and makes a binding decision. Arbitration can be a faster and less expensive alternative to litigation.

- Litigation: If all other methods fail, you can file a lawsuit against the insurance company. Litigation is the most time-consuming and expensive option but can be necessary to protect your rights.

Florida Insurance Consumer Protection

In Florida, the insurance market is heavily regulated to protect consumers from unfair practices and ensure they have access to necessary coverage. The state government has established a comprehensive framework of consumer rights and protections to address common insurance issues.

Consumer Rights and Protections

Florida law grants consumers several rights and protections when it comes to insurance. These include:

- The right to be treated fairly and honestly by insurance companies.

- The right to receive clear and understandable insurance policies.

- The right to have your claim handled promptly and fairly.

- The right to appeal a denied claim or other insurance company decision.

- The right to file a complaint with the Florida Office of Insurance Regulation (OIR) if you believe your rights have been violated.

Resources for Consumers

Consumers facing insurance issues can access various resources for assistance and information. These include:

- The Florida Office of Insurance Regulation (OIR): The OIR is the primary regulatory body for insurance in Florida. Consumers can file complaints, access educational materials, and find answers to common insurance questions on the OIR website.

- The Florida Department of Financial Services (DFS): The DFS is responsible for investigating consumer complaints and taking enforcement action against insurance companies that violate state law.

- The Florida Insurance Consumer Helpline: The helpline provides consumers with information and guidance on a variety of insurance issues.

Role of the Florida Office of Insurance Regulation

The Florida Office of Insurance Regulation plays a crucial role in protecting consumers by:

- Licensing and regulating insurance companies operating in Florida.

- Enforcing state insurance laws and regulations.

- Investigating consumer complaints and taking appropriate action against insurance companies that violate consumer rights.

- Providing education and outreach to consumers on insurance issues.

- Monitoring insurance rates and ensuring they are fair and reasonable.

Florida Insurance Trends and Challenges

The Florida insurance market is a dynamic and complex landscape, shaped by a confluence of factors including technological advancements, climate change, and regulatory shifts. These forces drive emerging trends and present unique challenges for insurers operating within the state. Understanding these trends and challenges is crucial for navigating the future of Florida’s insurance industry.

Emerging Trends in the Florida Insurance Market

The Florida insurance market is witnessing a rapid evolution driven by technological advancements and the increasing impact of climate change.

- Technological Advancements: Insurers are leveraging technology to enhance efficiency, improve customer service, and manage risk more effectively. Examples include:

- Artificial intelligence (AI) and machine learning (ML): These technologies are being used for tasks such as fraud detection, risk assessment, and personalized pricing.

- Internet of Things (IoT): Connected devices are providing real-time data on property conditions, allowing for proactive risk management and faster claims processing.

- Blockchain technology: Blockchain is being explored for its potential to streamline claims processing and improve transparency in the insurance ecosystem.

- Climate Change: The increasing frequency and severity of natural disasters, particularly hurricanes, are significantly impacting the Florida insurance market.

- Rising insurance premiums: Insurers are adjusting premiums to reflect the increased risk associated with climate change.

- Increased reinsurance costs: Reinsurers are charging higher premiums due to the growing risk of catastrophic events, which in turn increases the cost of insurance for primary insurers.

- Limited availability of insurance: Some insurers are reducing their exposure in Florida due to the escalating risk, leading to limited availability of insurance in certain areas.

Challenges Faced by Insurers in Florida

Florida insurers face a multitude of challenges, including affordability, natural disasters, and regulatory complexities.

- Affordability: Rising insurance premiums due to factors like climate change and litigation costs are making insurance increasingly unaffordable for many Floridians.

- Increased litigation: Florida has a high rate of insurance litigation, which drives up costs and premiums.

- Limited competition: The Florida insurance market is relatively concentrated, with a few large insurers dominating the market. This can limit competition and drive up prices.

- Natural Disasters: Florida is highly vulnerable to natural disasters, particularly hurricanes, which pose significant financial risks for insurers.

- Hurricane frequency and intensity: The frequency and intensity of hurricanes have been increasing in recent years, resulting in significant insurance payouts.

- Catastrophic risk: The potential for catastrophic events in Florida creates a high level of risk for insurers, leading to higher premiums and reinsurance costs.

- Regulatory Complexities: Florida has a complex regulatory environment for insurance, which can create challenges for insurers.

- Rate regulation: The Florida Office of Insurance Regulation (OIR) has strict regulations on insurance rates, which can limit insurers’ ability to adjust premiums to reflect risk.

- Litigation: Florida’s legal environment is considered to be favorable to plaintiffs in insurance lawsuits, which can lead to increased litigation costs for insurers.

Insights on the Future of the Florida Insurance Market

The future of the Florida insurance market is uncertain, but several trends and challenges suggest potential outcomes:

- Continued focus on technology: Insurers will continue to invest in technology to enhance efficiency, improve customer service, and manage risk.

- AI and ML: These technologies will play an increasingly important role in areas such as fraud detection, risk assessment, and claims processing.

- Data analytics: Insurers will leverage data analytics to gain insights into risk patterns and develop more accurate pricing models.

- Increased emphasis on risk management: Insurers will need to adopt more sophisticated risk management strategies to mitigate the impact of climate change and natural disasters.

- Climate change adaptation: Insurers will need to develop strategies to adapt to the changing climate, such as offering discounts for homeowners who take steps to mitigate risk.

- Reinsurance: Insurers will continue to rely heavily on reinsurance to transfer risk and protect their balance sheets.

- Potential for market consolidation: The Florida insurance market may see further consolidation as insurers seek to reduce their exposure to risk.

- Mergers and acquisitions: Insurers may merge or be acquired by larger companies with greater financial resources.

- Withdrawal from the market: Some insurers may choose to withdraw from the Florida market altogether due to the high risk and challenging regulatory environment.

Outcome Summary

Navigating the intricacies of Florida insurance requires a nuanced understanding of the market’s dynamics, regulatory landscape, and consumer rights. By equipping ourselves with knowledge, we can make informed decisions about our insurance needs, ensuring adequate protection and peace of mind in the face of life’s uncertainties. As the Florida insurance market continues to evolve, staying informed about the latest trends and challenges is crucial for navigating this complex and vital industry.

Question Bank

What are the most common types of insurance in Florida?

The most common types of insurance in Florida include property insurance (covering homes and businesses), auto insurance, health insurance, and flood insurance.

How do I find an insurance agent in Florida?

You can find an insurance agent in Florida by searching online directories, contacting your local Chamber of Commerce, or asking for referrals from friends and family.

What are some tips for saving money on Florida insurance?

Some tips for saving money on Florida insurance include shopping around for quotes, bundling policies, improving your home’s security, and maintaining a good driving record.

What are the consequences of not having insurance in Florida?

The consequences of not having insurance in Florida can be severe, including fines, license suspension, and difficulty obtaining a loan or mortgage.