State Farm automobile insurance quotes offer a comprehensive solution for securing reliable and affordable coverage for your vehicle. Whether you’re a seasoned driver or a new car owner, understanding the ins and outs of State Farm’s insurance policies is crucial. From exploring their history and core values to navigating the quote process and comparing coverage options, this guide provides an in-depth overview of everything you need to know about State Farm auto insurance.

State Farm, a leading name in the insurance industry, has a long history of providing reliable and affordable coverage to millions of customers. Their commitment to customer satisfaction and their wide range of coverage options have made them a trusted choice for drivers across the country. Understanding the factors that influence your quote, exploring their various coverage options, and comparing State Farm’s offerings with competitors are essential steps in making an informed decision about your auto insurance needs.

Understanding State Farm Automobile Insurance

State Farm is a leading provider of automobile insurance in the United States. It is known for its comprehensive coverage options, competitive rates, and excellent customer service. Understanding State Farm’s history, values, and key features can help you determine if it’s the right insurance provider for your needs.

History and Background

State Farm was founded in 1922 by George J. Mecherle, a farmer in Bloomington, Illinois. The company began as a small, local insurer focused on providing affordable car insurance to farmers. Over the years, State Farm expanded its operations, offering a wide range of insurance products, including home, life, and health insurance. Today, State Farm is one of the largest insurance companies in the world, with over 80,000 employees and a network of over 18,000 agents.

Core Values and Mission

State Farm’s core values are built on principles of integrity, customer service, and financial strength. The company’s mission is to “help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” State Farm strives to build long-term relationships with its customers by providing them with personalized insurance solutions and exceptional customer support.

Key Features and Benefits of State Farm Automobile Insurance

State Farm offers a comprehensive range of automobile insurance coverage options, including:

- Liability coverage: This protects you financially if you cause an accident that results in injuries or property damage to others.

- Collision coverage: This covers damage to your vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive coverage: This protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

- Medical payments coverage: This covers medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Personal injury protection (PIP): This covers medical expenses, lost wages, and other expenses related to injuries you sustain in an accident, regardless of who is at fault.

- Rental car coverage: This helps cover the cost of renting a car if your vehicle is damaged in an accident or is being repaired.

In addition to these standard coverage options, State Farm also offers a variety of optional features, such as:

- Roadside assistance: This provides help with services such as jump-starting your battery, changing a flat tire, or towing your vehicle if it breaks down.

- Accident forgiveness: This prevents your insurance rates from increasing after your first at-fault accident.

- Discounts: State Farm offers a variety of discounts for good drivers, safe vehicles, and other factors.

“State Farm is committed to providing our customers with the best possible insurance experience. We offer a wide range of coverage options, competitive rates, and excellent customer service. We are here to help you manage the risks of everyday life and protect what matters most to you.” – State Farm Insurance

Obtaining a Quote from State Farm

Getting a quote from State Farm is easy and can be done in a few simple steps. You can choose the method that best suits your preferences and convenience.

Getting a Quote from State Farm

To obtain an auto insurance quote from State Farm, you will need to provide some basic information about yourself, your vehicle, and your driving history. Here’s what you’ll need:

- Your personal information: This includes your name, address, date of birth, and contact information.

- Your vehicle information: You will need to provide the make, model, year, and VIN of your vehicle.

- Your driving history: You will need to provide information about your driving record, including any accidents, tickets, or violations.

- Your coverage preferences: You will need to indicate the type of coverage you are interested in, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Your location: State Farm’s rates can vary depending on your location, so you will need to provide your zip code or address.

Methods of Obtaining a Quote

There are several ways to get an auto insurance quote from State Farm. Each method offers its own advantages and disadvantages.

- Online: Getting a quote online is the fastest and most convenient method. You can visit State Farm’s website and enter your information into their online quote form. This allows you to compare different coverage options and receive a quote instantly.

- Phone: You can also get a quote by calling State Farm’s customer service line. A representative will ask you the necessary questions and provide you with a quote over the phone. This method allows for personalized assistance and clarification of any questions you may have.

- In-person: You can visit a local State Farm agent to obtain a quote. This allows you to meet with an agent in person and discuss your insurance needs in detail. This method provides a more personalized and interactive experience.

Factors Affecting State Farm Auto Insurance Quotes

State Farm, like other insurance companies, uses a variety of factors to determine your auto insurance premiums. These factors are designed to assess your risk as a driver and help determine how much you’ll pay for coverage. Understanding these factors can help you understand your premium and potentially make changes to lower your costs.

Factors Influencing Premiums

State Farm considers various factors to calculate your auto insurance premium. These factors are categorized into personal, driving, and vehicle-related factors.

- Personal Factors: Your age, driving history, and credit score play a role in determining your premium. Younger drivers with less experience are considered higher risk, while drivers with a clean driving record and good credit scores often get lower rates.

- Driving Factors: Your driving history, including accidents, tickets, and violations, significantly impacts your premium. Drivers with a history of accidents or traffic violations are seen as higher risk and may pay higher premiums.

- Vehicle Factors: The type of vehicle you drive, its safety features, and its value all contribute to your premium. Vehicles with higher safety ratings and anti-theft features may qualify for discounts.

- Location Factors: Your location, including the state and city you live in, also affects your premium. Areas with higher accident rates or theft rates tend to have higher premiums.

How State Farm Uses These Factors to Calculate Premiums

State Farm uses a complex algorithm to assess your risk based on these factors. The algorithm assigns a risk score to each driver, and this score determines the premium you’ll pay. The higher your risk score, the higher your premium will be.

“State Farm’s premium calculation process involves a complex algorithm that considers a wide range of factors to determine your risk as a driver. This algorithm assigns a risk score to each driver, which ultimately determines the premium you’ll pay.”

Strategies for Lowering Insurance Costs

You can take several steps to potentially lower your auto insurance costs:

- Maintain a Clean Driving Record: Avoid accidents and traffic violations. Every incident increases your risk and can lead to higher premiums.

- Improve Your Credit Score: A good credit score can lower your premium in some states. Consider taking steps to improve your credit score, such as paying bills on time and keeping credit utilization low.

- Consider Safety Features: When buying a new car, consider models with advanced safety features like anti-lock brakes, airbags, and stability control. These features can qualify for discounts.

- Explore Discounts: Ask State Farm about available discounts, such as good student discounts, multi-car discounts, and safe driver discounts.

- Increase Your Deductible: Consider raising your deductible if you’re comfortable paying a higher amount out-of-pocket in case of an accident. This can lower your premium.

- Shop Around: Get quotes from multiple insurance companies to compare rates and find the best deal.

State Farm’s Coverage Options

State Farm offers a wide range of coverage options to protect you and your vehicle in case of an accident or other unforeseen events. Understanding the different coverage types and their benefits is crucial for choosing the right policy that meets your specific needs and budget.

Liability Coverage, State farm automobile insurance quote

Liability coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It covers the costs of:

* Bodily injury liability: Pays for medical expenses, lost wages, and pain and suffering of the other driver and passengers if you are at fault in an accident.

* Property damage liability: Pays for repairs or replacement of the other driver’s vehicle and any other property damaged in the accident.

For example, if you are at fault in an accident and cause $10,000 in damages to the other driver’s car and $5,000 in medical expenses for the other driver, your liability coverage would pay up to the policy limits for these costs.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional and not required by law in most states.

For example, if you hit a parked car and damage your own vehicle, collision coverage would pay for the repairs or replacement of your vehicle. However, it would not cover any damage to the parked car.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as:

* Theft

* Vandalism

* Fire

* Hail

* Flood

* Falling objects

For example, if your car is stolen or damaged by a hailstorm, comprehensive coverage would pay for repairs or replacement of your vehicle.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses.

For example, if you are hit by an uninsured driver and suffer injuries, UM/UIM coverage would pay for your medical expenses, lost wages, and other damages.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. This coverage is required in some states.

For example, if you are injured in an accident, even if you are at fault, PIP coverage would pay for your medical bills and lost wages up to the policy limits.

Rental Reimbursement Coverage

Rental reimbursement coverage pays for a rental car if your vehicle is damaged in an accident and is being repaired.

For example, if your car is damaged in an accident and is being repaired for a week, rental reimbursement coverage would pay for a rental car for that week.

Towing and Labor Coverage

Towing and labor coverage pays for the cost of towing your vehicle to a repair shop if it breaks down or is involved in an accident.

For example, if your car breaks down on the side of the road, towing and labor coverage would pay for the cost of towing it to a repair shop.

Roadside Assistance Coverage

Roadside assistance coverage provides help with services such as:

* Flat tire changes

* Jump starts

* Lockout services

* Fuel delivery

For example, if you run out of gas, roadside assistance coverage would pay for the cost of having fuel delivered to you.

Customer Experience with State Farm

State Farm, a leading insurance provider in the United States, prides itself on its customer-centric approach. To understand the effectiveness of this approach, it’s crucial to delve into the customer experience with State Farm, examining reviews, satisfaction ratings, and the advantages and disadvantages of choosing them as an insurance provider.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the real-world experience with State Farm. These accounts offer a diverse perspective on various aspects of the company, including service quality, claims handling, and overall customer satisfaction.

- Positive reviews often highlight State Farm’s friendly and responsive customer service representatives, efficient claims processing, and fair settlements. Many customers appreciate the personalized attention they receive and the company’s commitment to resolving issues quickly and effectively.

- However, some negative reviews express dissatisfaction with lengthy wait times for claims processing, difficulties in reaching customer service representatives, and perceived unfair settlements. These experiences highlight the importance of considering individual experiences and researching potential issues before choosing State Farm.

Customer Satisfaction Ratings and Industry Rankings

Customer satisfaction ratings and industry rankings provide a broader picture of State Farm’s performance compared to its competitors. These metrics offer valuable insights into the overall customer experience and can help potential customers make informed decisions.

- State Farm consistently ranks high in customer satisfaction surveys conducted by organizations like J.D. Power and the American Customer Satisfaction Index (ACSI). For example, in the J.D. Power 2023 U.S. Auto Insurance Satisfaction Study, State Farm ranked among the top performers, demonstrating its commitment to customer satisfaction.

- However, it’s essential to note that these rankings are based on surveys and may not fully capture the diverse experiences of all customers. Factors like individual experiences, specific claims, and local service variations can influence individual perceptions of State Farm.

Advantages and Disadvantages of Choosing State Farm

Weighing the advantages and disadvantages of choosing State Farm as an insurance provider is crucial for making an informed decision. This analysis helps potential customers understand the benefits and potential drawbacks associated with State Farm.

- Advantages of choosing State Farm include its strong financial stability, extensive network of agents, comprehensive coverage options, and competitive pricing. State Farm’s long-standing reputation and commitment to customer service make it a reliable choice for many individuals.

- However, potential disadvantages include the possibility of longer wait times for claims processing, variations in service quality across different agents and locations, and occasional difficulties in reaching customer service representatives. These factors highlight the importance of thorough research and careful consideration before making a decision.

Comparing State Farm with Other Insurers

Choosing the right auto insurance provider can be a daunting task, as numerous options exist with varying coverage, pricing, and customer service. To make an informed decision, comparing State Farm with its major competitors is crucial. This comparison will analyze key differences in coverage, pricing, and customer service, highlighting the strengths and weaknesses of each insurer.

Coverage Options

State Farm offers a comprehensive range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. However, comparing coverage options with other insurers requires a detailed examination of specific features and limits. For instance, State Farm’s accident forgiveness program may be a significant advantage for drivers with clean driving records, while other insurers may offer more comprehensive roadside assistance or rental car coverage.

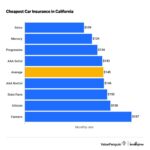

Pricing Comparison

Pricing is a major factor in choosing an insurer, and State Farm’s rates are generally competitive but can vary significantly depending on individual factors such as driving history, location, and vehicle type. Other insurers, like Geico and Progressive, are known for their aggressive pricing strategies, often offering lower premiums for specific customer segments. However, it’s essential to consider the value proposition beyond just the price, as cheaper premiums might come with limited coverage or less favorable customer service.

Customer Service

Customer service is a critical aspect of the insurance experience, and State Farm has a reputation for its extensive agent network and responsive claims handling. However, other insurers, such as USAA, are known for their exceptional customer service, particularly for military personnel and their families. Ultimately, the best customer service experience depends on individual needs and preferences.

Key Differences in Coverage

While State Farm offers a wide range of coverage options, certain insurers excel in specific areas. For example, USAA provides specialized coverage for military members, including deployment coverage and financial assistance for military families. Geico offers unique features like accident forgiveness and ride-sharing coverage, while Progressive stands out with its customizable coverage options and personalized discounts.

Pricing and Discounts

Pricing and discounts vary significantly among insurers. Geico and Progressive often offer lower premiums for specific customer segments, while State Farm may provide more competitive rates for certain demographics. It’s crucial to compare quotes from multiple insurers to find the best value proposition. Some insurers offer discounts for good driving records, safety features, and bundling policies.

Customer Service and Claims Handling

Customer service and claims handling are essential considerations. State Farm is known for its extensive agent network and responsive claims handling. However, USAA is renowned for its exceptional customer service, particularly for military personnel and their families. Other insurers, like Liberty Mutual, offer 24/7 claims assistance and online tools for managing policies.

State Farm’s Digital and Technological Features

State Farm recognizes the importance of providing its customers with convenient and efficient digital tools for managing their insurance policies. The insurer offers a comprehensive mobile app and online portal that allows policyholders to access their insurance information, make payments, file claims, and more, all from the comfort of their homes or on the go.

Benefits of Using Digital Tools for Policy Management and Claims Filing

Using State Farm’s digital tools offers several advantages for policyholders.

- 24/7 Accessibility: Policyholders can access their insurance information and manage their policies anytime, anywhere, regardless of business hours. This accessibility is especially helpful for individuals with busy schedules or those who prefer to manage their affairs online.

- Faster Claim Processing: Filing a claim through the State Farm app or online portal can significantly speed up the process. Policyholders can submit photos and documents electronically, reducing the need for physical paperwork and phone calls. This streamlined process often leads to faster claim approval and payment.

- Improved Communication: The digital tools provide a platform for seamless communication between policyholders and State Farm. Policyholders can easily access their policy documents, view claim status updates, and communicate with customer service representatives through the app or portal. This transparent communication fosters trust and keeps policyholders informed throughout the entire process.

- Personalized Experience: State Farm’s digital tools are designed to provide a personalized experience. Policyholders can customize their account settings, set up notifications for important events, and access relevant information tailored to their specific needs. This personalized approach enhances the overall customer experience and makes managing insurance policies more convenient.

Role of Technology in Enhancing Customer Experience with State Farm

Technology plays a crucial role in enhancing the customer experience with State Farm.

- Simplified Processes: Digital tools streamline various processes, such as policy management, claim filing, and communication, making them more efficient and convenient for policyholders. This simplification reduces frustration and improves customer satisfaction.

- Improved Communication and Transparency: State Farm’s digital platforms provide a channel for transparent communication with policyholders. They can access their policy documents, track claim status updates, and communicate with customer service representatives through the app or portal. This enhanced communication fosters trust and builds a positive relationship with the insurer.

- Personalized Services: State Farm leverages technology to provide personalized services. Policyholders can customize their account settings, receive tailored notifications, and access relevant information based on their individual needs. This personalized approach enhances the overall customer experience and makes managing insurance policies more efficient and user-friendly.

State Farm’s Community Involvement: State Farm Automobile Insurance Quote

State Farm is renowned not only for its insurance services but also for its strong commitment to community engagement and philanthropic initiatives. The company believes in fostering a positive impact on the communities it serves, demonstrating a deep sense of social responsibility. This commitment extends beyond financial contributions, encompassing a wide range of programs and partnerships designed to address local needs and empower individuals.

State Farm’s Philanthropic Initiatives

State Farm’s philanthropic endeavors are diverse, covering a spectrum of causes and communities. The company supports various non-profit organizations through grants and sponsorships, focusing on areas such as education, disaster relief, and community development.

- State Farm Neighborhood Assist Program: This program empowers communities by providing grants to non-profit organizations working on projects that address critical local issues. Through online voting, individuals can select the projects they believe are most deserving, showcasing State Farm’s belief in community participation and empowerment.

- State Farm Youth Advisory Councils: These councils bring together young people from various communities to discuss issues that affect their lives and collaborate on solutions. This initiative provides a platform for youth voices to be heard and empowers them to become active members of their communities.

- State Farm’s Support for Disaster Relief: State Farm plays a vital role in providing assistance during natural disasters. The company mobilizes resources and personnel to help affected communities recover and rebuild, demonstrating its commitment to supporting those in need.

Impact of State Farm’s Social Responsibility Efforts

State Farm’s dedication to social responsibility has a positive impact on its brand image and customer perception. Customers are increasingly drawn to companies that align with their values and demonstrate a commitment to making a difference.

- Enhanced Brand Image: State Farm’s philanthropic initiatives contribute to a positive and trustworthy brand image, fostering a sense of connection with customers who appreciate the company’s social responsibility.

- Increased Customer Loyalty: Customers who witness State Farm’s commitment to community engagement are more likely to develop a sense of loyalty to the brand. This loyalty translates into repeat business and positive word-of-mouth referrals.

- Attracting and Retaining Employees: State Farm’s commitment to social responsibility also appeals to potential employees who seek to work for organizations that share their values. This can contribute to attracting and retaining top talent.

Examples of State Farm’s Community Engagement Activities

State Farm’s community engagement extends beyond financial contributions. The company actively participates in various events and programs that benefit local communities.

- State Farm Agent Involvement: State Farm agents are encouraged to actively participate in their local communities, supporting local events, sponsoring youth sports teams, and volunteering their time and resources.

- Community Partnerships: State Farm partners with local organizations to address specific community needs. For example, the company has partnered with organizations like the Boys & Girls Clubs of America and the American Red Cross to provide resources and support to underserved communities.

- Employee Volunteerism: State Farm encourages its employees to volunteer their time and skills to various causes. The company provides opportunities for employees to participate in volunteer projects and supports their efforts through paid volunteer time off.

Final Thoughts

Navigating the world of auto insurance can be overwhelming, but with a clear understanding of State Farm’s offerings, you can make informed decisions about your coverage. By exploring their history, understanding the factors that influence your quote, and comparing their coverage options with competitors, you can secure the best possible protection for your vehicle and your peace of mind. Remember, taking the time to research and compare options is essential to finding the most suitable and affordable auto insurance policy for your individual needs.

Popular Questions

How can I get a quote from State Farm?

You can get a quote online, over the phone, or in person at a State Farm agent’s office. Each method requires providing information about your vehicle, driving history, and location.

What factors influence my auto insurance premium?

Factors such as your age, driving record, vehicle type, location, and coverage options can impact your premium. State Farm uses a complex algorithm to calculate your individual rate.

What are some tips for lowering my insurance costs?

Consider increasing your deductible, maintaining a good driving record, bundling your insurance policies, and exploring discounts offered by State Farm.

What is the difference between liability and collision coverage?

Liability coverage protects you from financial responsibility if you cause an accident, while collision coverage covers damage to your vehicle in an accident, regardless of fault.

How does State Farm’s customer service compare to other insurers?

State Farm consistently receives high customer satisfaction ratings and is known for its reliable claims handling process. However, it’s always a good idea to compare customer reviews and ratings from multiple sources.