PA State Minimum Auto Insurance is a crucial aspect of driving in Pennsylvania. It Artikels the minimum coverage requirements that every driver must have to be legally allowed on the road. This means understanding the types of coverage, the financial responsibility limits, and the potential consequences of not meeting these requirements.

This article will provide a comprehensive overview of PA’s minimum auto insurance requirements, explaining the different coverage options available, the factors influencing insurance costs, and tips for finding affordable insurance. We will also discuss the process of filing a claim in Pennsylvania and address common questions regarding auto insurance.

Pennsylvania’s Minimum Auto Insurance Requirements

Pennsylvania law requires all drivers to have a minimum amount of auto insurance coverage to protect themselves and others in case of an accident. This ensures financial responsibility and helps cover potential costs associated with injuries, property damage, and other liabilities.

Types of Coverage

Pennsylvania mandates several types of auto insurance coverage to provide financial protection in various scenarios. These coverages include:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injuries or property damage to others. It covers medical expenses, lost wages, and property repair costs for the other party involved.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It helps cover your medical expenses, lost wages, and property damage costs if the other driver is unable to pay for the damages.

- Property Damage Liability Coverage: This coverage pays for damages to another person’s vehicle or property if you are at fault in an accident. It covers repairs or replacement costs for the damaged property.

Minimum Financial Responsibility Limits, Pa state minimum auto insurance

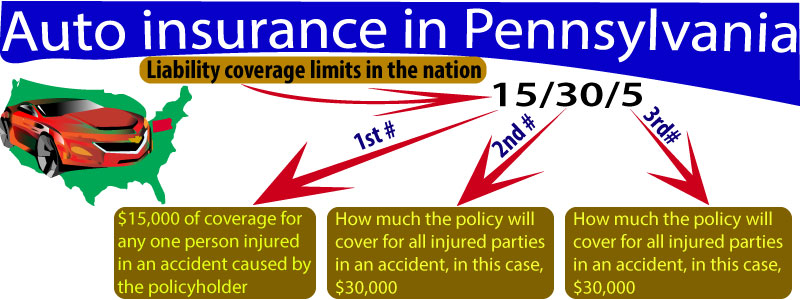

The state of Pennsylvania sets minimum financial responsibility limits for each type of coverage, as Artikeld below:

| Coverage Type | Minimum Limit |

|---|---|

| Liability Coverage (per person) | $15,000 |

| Liability Coverage (per accident) | $30,000 |

| Property Damage Liability Coverage | $5,000 |

| Uninsured/Underinsured Motorist Coverage (per person) | $15,000 |

| Uninsured/Underinsured Motorist Coverage (per accident) | $30,000 |

It’s important to note that these are minimum limits, and you may want to consider purchasing higher coverage limits to better protect yourself financially.

Understanding Pennsylvania’s Coverage Options

While Pennsylvania’s minimum auto insurance requirements are mandatory, you have the option to purchase additional coverage to better protect yourself and your vehicle in the event of an accident. These optional coverages can provide financial security and peace of mind, but they come at an additional cost.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s a valuable coverage option for newer vehicles or those with high market value. However, you’ll need to pay a deductible, which is the amount you pay out of pocket before the insurance company covers the rest.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It’s a good idea to consider this coverage if you have a newer or expensive vehicle. Like collision coverage, you’ll have to pay a deductible.

Medical Payments Coverage

Medical payments coverage (MedPay) pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. It’s a valuable coverage option if you don’t have health insurance or if your health insurance has a high deductible. MedPay coverage has a limit on the amount it will pay out.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage pays for medical expenses, lost wages, and other related expenses for you and your passengers, regardless of who is at fault in an accident. Pennsylvania requires drivers to carry at least $5,000 in PIP coverage, but you can purchase higher limits. PIP coverage is essential for protecting yourself and your passengers from the financial burdens of an accident.

Table Comparing Coverage Options

| Coverage Option | Cost | Benefits |

|---|---|---|

| Collision Coverage | Higher premium | Pays for repairs or replacement of your vehicle in an accident, regardless of fault. |

| Comprehensive Coverage | Higher premium | Pays for damage to your vehicle from events other than collisions, such as theft or hail. |

| Medical Payments Coverage (MedPay) | Lower premium | Pays for medical expenses for you and your passengers, regardless of fault. |

| Personal Injury Protection (PIP) | Higher premium | Pays for medical expenses, lost wages, and other related expenses for you and your passengers, regardless of fault. |

Factors Influencing Auto Insurance Costs in Pennsylvania

Your auto insurance premiums in Pennsylvania are influenced by a variety of factors, and understanding these factors can help you make informed decisions to potentially lower your costs.

Driver’s Age

Your age plays a significant role in determining your auto insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents due to their lack of experience and higher risk-taking behavior. Therefore, insurance companies often charge higher premiums for younger drivers. As drivers gain experience and age, their premiums generally decrease.

Driving History

Your driving history is a critical factor in determining your insurance costs. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, having a history of accidents, speeding tickets, or other violations will increase your premiums. Insurance companies consider this history because it reflects your driving habits and risk profile.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Certain vehicles are considered more expensive to repair or replace, or are statistically more likely to be involved in accidents. For example, sports cars, luxury vehicles, and trucks with high horsepower often have higher insurance premiums due to their higher repair costs and potential for higher speeds.

Location

Your location can significantly impact your auto insurance premiums. Areas with higher crime rates, traffic congestion, or a higher density of vehicles tend to have higher insurance costs. Insurance companies assess the risk of accidents and claims based on the location where you live and drive.

Table Demonstrating Potential Impact of Different Factors on Insurance Premiums

| Factor | Potential Impact on Premium |

|—|—|

| Driver’s Age (Under 25) | Higher |

| Driver’s Age (Over 25) | Lower |

| Clean Driving Record | Lower |

| Accidents or Violations | Higher |

| Expensive Vehicle | Higher |

| Safe Vehicle | Lower |

| High-Risk Location | Higher |

| Low-Risk Location | Lower |

Finding Affordable Auto Insurance in Pennsylvania

Securing affordable auto insurance in Pennsylvania is a crucial step for every driver. With careful planning and smart strategies, you can find a policy that fits your budget without compromising essential coverage.

Comparing Quotes from Multiple Insurers

Obtaining quotes from various insurance companies is the cornerstone of finding affordable auto insurance. By comparing different quotes, you gain a comprehensive understanding of the market and identify the best deals available.

- Use online comparison tools: Many websites specialize in comparing auto insurance quotes from multiple insurers, simplifying the process. These tools allow you to enter your information once and receive quotes from various companies.

- Contact insurers directly: Reach out to insurance companies directly to request quotes. This allows you to ask specific questions and discuss your individual needs with a representative.

Discounts Available to Drivers

Insurance companies offer a variety of discounts to reduce premiums for eligible drivers. These discounts can significantly lower your overall cost, making it even more affordable to maintain your coverage.

- Safe Driving Discounts: Many insurers reward drivers with clean driving records by offering discounts for accident-free driving. The longer your accident-free history, the higher the discount you may qualify for.

- Good Student Discounts: Students with good grades often qualify for discounts on auto insurance. This reflects the assumption that good students are more responsible drivers.

- Multi-Policy Discounts: If you bundle your auto insurance with other policies, such as homeowners or renters insurance, you can often receive a significant discount on your premiums.

Filing a Claim in Pennsylvania: Pa State Minimum Auto Insurance

Navigating the auto insurance claims process in Pennsylvania can be a complex experience, especially if you’ve never filed a claim before. It’s essential to understand the steps involved and your rights as a policyholder to ensure a smooth and successful resolution.

Reporting an Accident

After an accident, it’s crucial to take immediate action to protect yourself and others involved.

- Contact the authorities: If there are injuries or property damage, call 911 immediately. The police will create an accident report, which is a vital document for your insurance claim.

- Exchange information: Gather the following information from all parties involved: names, addresses, phone numbers, insurance company names, and policy numbers.

- Document the scene: Take photos or videos of the accident scene, including any damage to vehicles, injuries, and road conditions.

- Seek medical attention: If you’ve sustained injuries, seek medical attention promptly. Keep a record of all medical expenses.

Contacting Your Insurer

Once you’ve reported the accident to the authorities, the next step is to contact your insurance company.

- Notify your insurer: Contact your insurance company as soon as possible after the accident. Most insurance companies have 24/7 claim reporting lines or online portals for filing a claim.

- Provide necessary details: Be prepared to provide your insurance company with the details of the accident, including the date, time, location, and the names of all parties involved.

- Follow their instructions: Your insurance company will guide you through the claims process and provide you with instructions on what documents you need to submit.

Gathering Necessary Documentation

To support your claim, you’ll need to gather a variety of documents.

- Accident report: Obtain a copy of the police report from the accident scene.

- Photos and videos: Provide your insurance company with any photos or videos you took of the accident scene.

- Medical records: If you sustained injuries, provide your insurance company with copies of your medical records, including bills and treatment plans.

- Vehicle repair estimates: If your vehicle was damaged, obtain estimates from reputable repair shops.

- Other relevant documentation: Any other documents that may be relevant to your claim, such as witness statements or photos of damage to other property.

Understanding the Claims Process

The claims process can be lengthy and complex.

- Initial investigation: Your insurance company will investigate the accident and review your claim documents.

- Negotiation: Once the investigation is complete, your insurance company will assess the damages and make a settlement offer. You have the right to negotiate this offer if you believe it’s too low.

- Payment: If you accept the settlement offer, your insurance company will issue payment for your covered damages.

Rights of Policyholders

As a policyholder, you have certain rights during the claims process.

- Right to a fair and prompt investigation: Your insurance company has a responsibility to conduct a fair and prompt investigation of your claim.

- Right to negotiate: You have the right to negotiate the settlement offer with your insurance company.

- Right to an attorney: You can hire an attorney to represent you during the claims process.

- Right to appeal: If you disagree with your insurance company’s decision, you have the right to appeal their decision.

Conclusion

By understanding the complexities of PA State Minimum Auto Insurance, drivers can make informed decisions about their coverage, ensure they meet legal requirements, and protect themselves financially in the event of an accident. Remember, having adequate auto insurance is not just a legal obligation, it’s a responsible choice that can safeguard your future.

Frequently Asked Questions

How much does PA State Minimum Auto Insurance cost?

The cost of minimum auto insurance in Pennsylvania varies depending on factors like your driving history, age, vehicle type, and location. It’s best to get quotes from multiple insurers to compare prices.

What happens if I get into an accident without enough insurance?

If you are involved in an accident and don’t have the required minimum auto insurance coverage, you could face serious consequences, including fines, license suspension, and even jail time. You may also be held personally liable for any damages or injuries caused.

Can I get a discount on my PA auto insurance?

Yes, many insurers offer discounts for safe driving, good student records, multi-policy bundling, and other factors. Be sure to ask about available discounts when you get quotes.