Lowest auto insurance rates by state are a hot topic for drivers across the country, as everyone wants to save money on their premiums. The cost of auto insurance can vary greatly depending on where you live, and understanding the factors that influence these rates is essential for finding the best deal.

From state regulations to individual driving habits, a multitude of factors play a role in determining how much you pay for car insurance. This guide explores the key elements that shape auto insurance rates, providing insights into how to compare quotes and secure the most affordable coverage for your needs.

Auto Insurance Rates: Understanding the Basics

Auto insurance is a vital component of responsible car ownership. It provides financial protection against potential losses arising from accidents, theft, or other unforeseen events. Having adequate coverage can safeguard you from significant financial burdens, ensuring peace of mind on the road.

The cost of auto insurance varies significantly based on several factors. These factors can be categorized into individual characteristics, vehicle-related attributes, and location-specific elements.

Factors Influencing Auto Insurance Rates

Understanding the key factors that influence auto insurance rates can help you make informed decisions and potentially lower your premiums. These factors are typically considered by insurance companies when calculating your rates.

- Driving History: Your past driving record, including accidents, traffic violations, and driving experience, plays a crucial role. A clean driving record generally leads to lower premiums.

- Age and Gender: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Similarly, gender can also influence rates, with some insurance companies historically charging higher premiums for young male drivers.

- Credit Score: In some states, insurance companies may use your credit score as a proxy for risk assessment. A higher credit score generally translates to lower premiums, as it indicates financial responsibility.

- Vehicle Type and Value: The type of vehicle you drive, its safety features, and its market value significantly influence your insurance rates. Luxury cars and high-performance vehicles tend to have higher premiums due to their higher repair costs and potential for greater damage.

- Location: Your location, including your state, city, and neighborhood, can impact your insurance rates. Areas with higher crime rates or more traffic congestion tend to have higher premiums due to a greater likelihood of accidents.

- Coverage Levels: The amount of coverage you choose, such as liability limits, comprehensive coverage, and collision coverage, will directly affect your premium. Higher coverage levels generally result in higher premiums.

Lowest Auto Insurance Rates: Significance and Finding the Best Deal

The concept of “lowest auto insurance rates” is highly sought after by car owners. It represents the most affordable option available for the desired level of coverage, offering significant financial savings. However, finding the lowest rates requires a strategic approach, considering various factors and exploring multiple options.

State-Specific Factors Influencing Rates: Lowest Auto Insurance Rates By State

While national trends in auto insurance pricing exist, individual states have unique factors that significantly impact premiums. These factors can be categorized into state regulations, demographics, and local conditions.

State Regulations

State governments play a crucial role in shaping the auto insurance landscape. They establish regulations that dictate minimum coverage requirements, pricing practices, and other aspects of the industry.

- Minimum Coverage Requirements: States have varying mandatory coverage levels for liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. Higher minimum coverage requirements generally lead to higher premiums.

- No-Fault Laws: Some states have no-fault insurance systems, where drivers are primarily compensated by their own insurer, regardless of fault in an accident. These systems can influence premiums as they limit payouts for pain and suffering.

- Rate Regulation: States can regulate how insurers set premiums. Some states allow for more freedom in pricing, while others have stricter controls. Rate regulation can impact competition and ultimately affect premiums.

Demographics

Demographics play a significant role in determining insurance rates. Insurers consider factors such as age, driving history, and credit score to assess risk.

- Age: Younger drivers, particularly teenagers, are statistically more likely to be involved in accidents. As a result, they often face higher premiums. However, premiums typically decrease with age as drivers gain experience and maturity.

- Driving History: Drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and face higher premiums. Maintaining a clean driving record can significantly reduce insurance costs.

- Credit Score: While controversial, some states allow insurers to use credit scores as a factor in determining premiums. The rationale is that individuals with poor credit may be more likely to file claims. However, this practice has been criticized for disproportionately impacting low-income individuals.

Local Conditions

Local conditions, such as traffic density, weather patterns, and crime rates, can also influence auto insurance premiums.

- Traffic Density: Areas with heavy traffic congestion have a higher risk of accidents, leading to higher premiums. Cities and urban areas often have higher insurance rates than rural areas.

- Weather Conditions: States with severe weather events, such as hurricanes, tornadoes, or blizzards, can have higher premiums. Insurers factor in the risk of damage to vehicles and the potential for claims.

- Crime Rates: Areas with high crime rates, particularly theft and vandalism, can also lead to higher insurance premiums. Insurers consider the risk of damage to vehicles and the potential for claims.

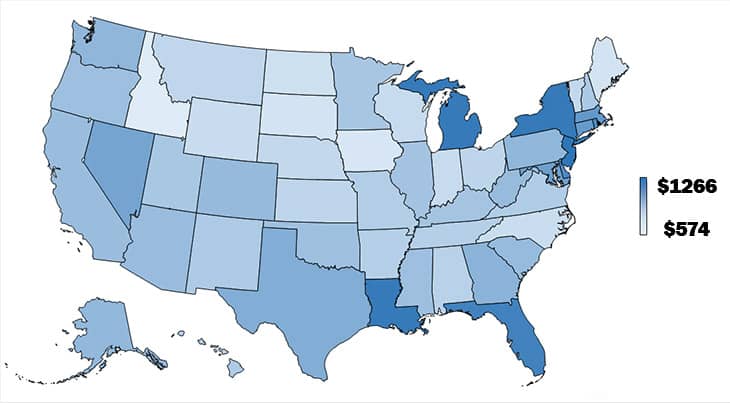

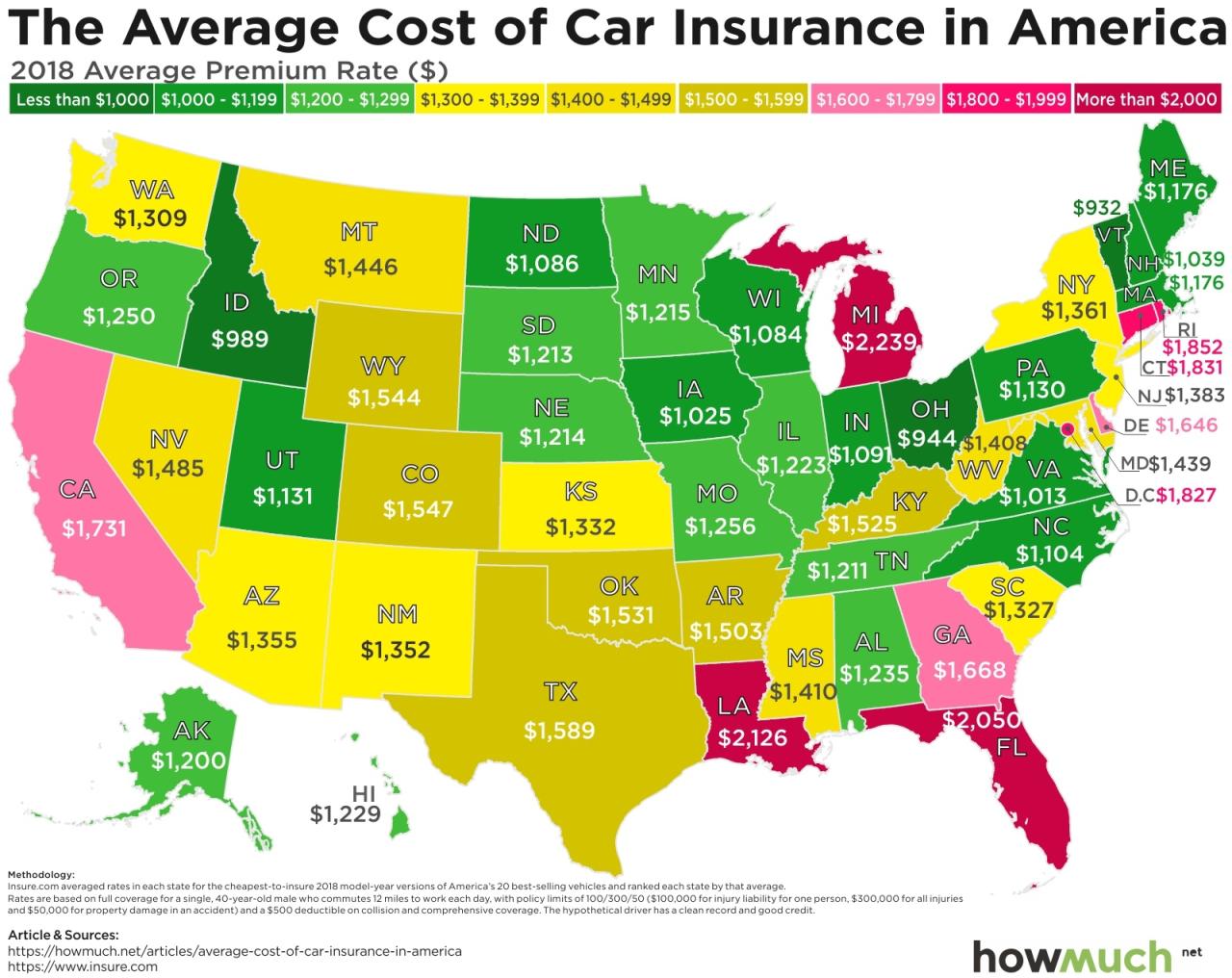

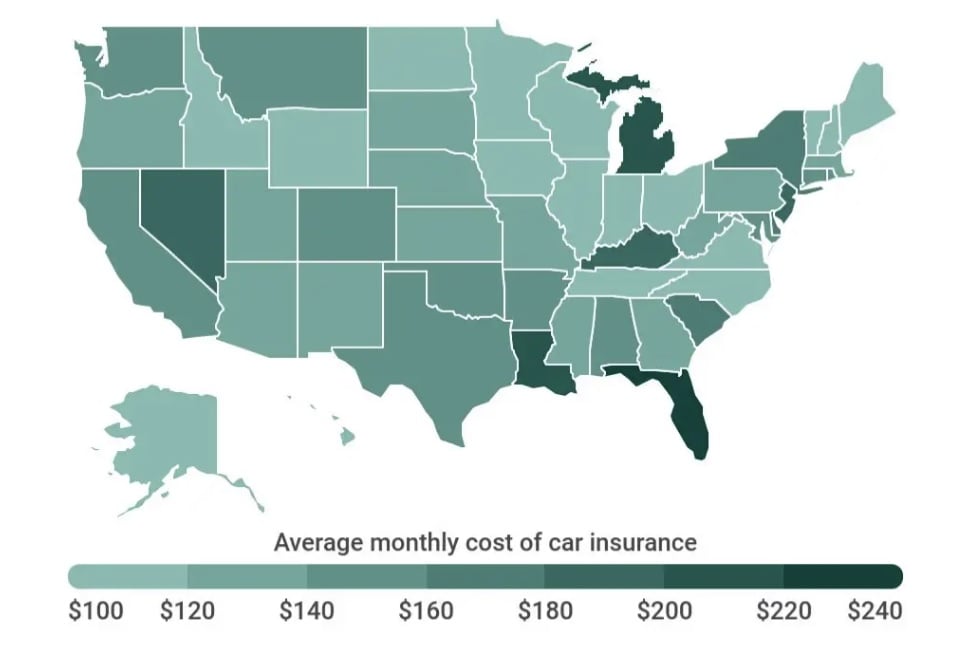

Comparison of Average Rates Across States

Understanding how auto insurance rates vary across states is crucial for consumers seeking the most affordable coverage. This section delves into a comprehensive comparison of average auto insurance premiums across the United States, shedding light on the factors contributing to these differences.

Average Auto Insurance Premiums by State

The following table provides a snapshot of average auto insurance premiums for each state, highlighting notable trends and the underlying factors influencing these variations.

| State | Average Premium | Notable Trends |

|---|---|---|

| Alabama | $1,580 | Higher than average due to high rates of uninsured drivers and accidents. |

| Alaska | $2,120 | Highest in the nation, attributed to harsh driving conditions and higher vehicle theft rates. |

| Arizona | $1,670 | Rates influenced by a high population density and a significant number of uninsured drivers. |

| Arkansas | $1,510 | Lower than average, reflecting lower population density and a relatively lower accident rate. |

| California | $2,040 | High rates due to a large population, traffic congestion, and a high number of uninsured drivers. |

| Colorado | $1,530 | Rates influenced by a growing population and increasing traffic volume. |

| Connecticut | $1,850 | Higher than average, attributed to a high population density and a relatively high number of accidents. |

| Delaware | $1,640 | Rates influenced by a high population density and a significant number of uninsured drivers. |

| Florida | $2,010 | High rates due to a large population, a high number of uninsured drivers, and a high number of accidents. |

| Georgia | $1,570 | Rates influenced by a growing population and increasing traffic volume. |

| Hawaii | $1,980 | Higher than average, attributed to a high cost of living and a high number of accidents. |

| Idaho | $1,450 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

| Illinois | $1,780 | Rates influenced by a large population, traffic congestion, and a high number of uninsured drivers. |

| Indiana | $1,550 | Rates influenced by a growing population and increasing traffic volume. |

| Iowa | $1,490 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

| Kansas | $1,470 | Rates influenced by a lower population density and a relatively lower accident rate. |

| Kentucky | $1,590 | Higher than average, attributed to a high number of uninsured drivers and accidents. |

| Louisiana | $1,820 | High rates due to a high number of accidents and a high cost of living. |

| Maine | $1,610 | Rates influenced by a lower population density and a relatively lower accident rate. |

| Maryland | $1,750 | Higher than average, attributed to a high population density and a relatively high number of accidents. |

| Massachusetts | $1,920 | High rates due to a high population density and a relatively high number of accidents. |

| Michigan | $1,730 | Rates influenced by a large population, traffic congestion, and a high number of uninsured drivers. |

| Minnesota | $1,520 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

| Mississippi | $1,630 | Higher than average, attributed to a high number of uninsured drivers and accidents. |

| Missouri | $1,540 | Rates influenced by a growing population and increasing traffic volume. |

| Montana | $1,500 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

| Nebraska | $1,480 | Rates influenced by a lower population density and a relatively lower accident rate. |

| Nevada | $1,710 | Rates influenced by a growing population and increasing traffic volume. |

| New Hampshire | $1,560 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

| New Jersey | $1,890 | High rates due to a high population density and a relatively high number of accidents. |

| New Mexico | $1,680 | Rates influenced by a growing population and increasing traffic volume. |

| New York | $1,950 | High rates due to a large population, traffic congestion, and a high number of uninsured drivers. |

| North Carolina | $1,600 | Rates influenced by a growing population and increasing traffic volume. |

| North Dakota | $1,460 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

| Ohio | $1,620 | Rates influenced by a large population, traffic congestion, and a high number of uninsured drivers. |

| Oklahoma | $1,530 | Rates influenced by a growing population and increasing traffic volume. |

| Oregon | $1,690 | Rates influenced by a growing population and increasing traffic volume. |

| Pennsylvania | $1,720 | Rates influenced by a large population, traffic congestion, and a high number of uninsured drivers. |

| Rhode Island | $1,870 | Higher than average, attributed to a high population density and a relatively high number of accidents. |

| South Carolina | $1,650 | Higher than average, attributed to a high number of uninsured drivers and accidents. |

| South Dakota | $1,440 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

| Tennessee | $1,580 | Rates influenced by a growing population and increasing traffic volume. |

| Texas | $1,700 | Rates influenced by a large population, traffic congestion, and a high number of uninsured drivers. |

| Utah | $1,510 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

| Vermont | $1,670 | Rates influenced by a lower population density and a relatively lower accident rate. |

| Virginia | $1,630 | Rates influenced by a growing population and increasing traffic volume. |

| Washington | $1,740 | Rates influenced by a growing population and increasing traffic volume. |

| West Virginia | $1,560 | Rates influenced by a lower population density and a relatively lower accident rate. |

| Wisconsin | $1,590 | Rates influenced by a lower population density and a relatively lower accident rate. |

| Wyoming | $1,490 | Lower than average, reflecting a lower population density and a relatively lower accident rate. |

It’s important to note that these are just average premiums, and individual rates can vary significantly based on factors such as driving history, age, vehicle type, and coverage levels.

Factors Contributing to Rate Variations

Several factors contribute to the significant variations in auto insurance rates across states:

- Population Density and Traffic Congestion: States with higher population densities and heavier traffic tend to have higher accident rates, leading to increased insurance premiums.

- Cost of Living: States with higher costs of living, particularly for medical care, often have higher auto insurance rates.

- Uninsured Motorist Rates: States with a high percentage of uninsured drivers face higher risks for insured drivers, resulting in higher premiums to cover potential losses.

- Severity of Accidents: States with higher rates of severe accidents, such as those involving fatalities or significant injuries, tend to have higher insurance premiums.

- State Laws and Regulations: State laws and regulations, such as those governing minimum coverage requirements and the availability of no-fault insurance, can significantly impact insurance rates.

- Competition in the Insurance Market: States with a more competitive insurance market often have lower premiums as insurers strive to attract customers with more affordable rates.

Understanding these factors can help consumers make informed decisions about their auto insurance needs and potentially find more affordable coverage options.

Finding the Lowest Rates in Your State

Now that you have a better understanding of how auto insurance rates are determined, it’s time to start comparing quotes from different insurance companies. This is the best way to ensure you’re getting the lowest possible rate for the coverage you need.

Comparing Quotes from Different Insurance Companies

It’s important to compare quotes from several insurance companies to ensure you’re getting the best deal. You can do this by contacting companies directly or using an online comparison tool.

- Contact companies directly: You can get a quote by calling or visiting the website of each insurance company. Be sure to have all of your relevant information on hand, such as your driving history, vehicle information, and desired coverage levels.

- Use an online comparison tool: Online comparison tools allow you to enter your information once and receive quotes from multiple insurance companies. This can save you time and effort, and it can help you find the best deal.

Benefits of Using Online Comparison Tools

Online comparison tools can be a valuable resource when shopping for auto insurance. They offer several benefits:

- Convenience: Online comparison tools allow you to compare quotes from multiple companies without having to contact them individually.

- Time-saving: Instead of spending hours calling insurance companies, you can get quotes from several companies in just a few minutes.

- Objectivity: Online comparison tools present quotes from different companies side-by-side, allowing you to easily compare rates and coverage options.

Considering Factors Like Coverage Levels and Deductibles

When comparing quotes, it’s important to consider your coverage levels and deductibles.

- Coverage levels: The amount of coverage you need will depend on your individual circumstances. For example, if you have an older car, you may not need as much collision or comprehensive coverage as someone with a newer car.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible will typically result in a lower premium, but it will also mean you’ll have to pay more if you have an accident.

It’s essential to find a balance between coverage levels, deductibles, and premiums that meets your individual needs and budget.

Factors Affecting Individual Rates

Beyond the average rates that vary by state, numerous factors influence your individual auto insurance premiums. These factors are based on your personal circumstances and driving habits. Understanding how these factors affect your rates can help you make informed decisions and potentially lower your insurance costs.

Driving History

Your driving history plays a significant role in determining your insurance premiums. A clean driving record translates into lower rates, while a history of accidents or violations leads to higher premiums.

- Accidents: Even a single accident can significantly increase your insurance rates. The severity of the accident and the extent of the damage are also considered. For instance, an at-fault accident with significant damage will result in a more substantial rate increase compared to a minor fender bender.

- Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions all negatively impact your insurance premiums. These violations indicate a higher risk of future accidents, leading insurers to charge higher rates. The severity of the violation and the frequency of offenses influence the rate increase.

- Driving Record: Your driving record is a detailed account of your driving history, including accidents, violations, and other incidents. Insurers carefully review this record to assess your risk profile. Maintaining a clean driving record is crucial for securing lower insurance premiums.

Vehicle Type, Usage, and Coverage Options

Your vehicle’s characteristics, how you use it, and the type of coverage you choose also influence your insurance premiums.

- Vehicle Type: The type of vehicle you drive significantly affects your insurance rates. Sports cars, luxury vehicles, and high-performance models are generally considered riskier to insure due to their higher repair costs and potential for accidents. Conversely, smaller, less expensive cars often have lower insurance premiums.

- Vehicle Usage: How often you drive your vehicle and the purpose of your driving also influence your rates. If you primarily use your car for commuting short distances, your rates will likely be lower than someone who frequently drives long distances or for business purposes.

- Coverage Options: The type and amount of coverage you choose directly impact your insurance premiums. Comprehensive and collision coverage, which protect against damage to your vehicle, are generally more expensive than liability coverage, which covers damages to other vehicles or property. You can lower your premiums by choosing higher deductibles, which represent the amount you pay out of pocket before your insurance coverage kicks in.

Discounts and Savings Opportunities

Finding the right auto insurance policy at the best possible price is a priority for most drivers. Luckily, there are various ways to reduce your premiums and save money. Insurance companies offer a range of discounts, and understanding these can significantly impact your overall cost.

Common Discounts

Many insurance companies offer discounts to policyholders who meet specific criteria. These discounts can vary depending on the insurer and the state, but some common ones include:

- Safe Driver Discount: This discount is typically awarded to drivers with a clean driving record, demonstrating responsible driving habits. The discount amount may vary based on the duration of the driver’s safe driving history. For example, a driver with five years of accident-free driving might receive a larger discount than someone with only one year of safe driving.

- Good Student Discount: This discount is often offered to students who maintain a certain grade point average (GPA). This discount is meant to incentivize good academic performance and recognize the responsible nature of high-achieving students. The specific GPA requirements for eligibility can vary between insurance companies.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount. This discount recognizes the increased business volume generated by insuring multiple vehicles within a single policy.

- Multi-Policy Discount: Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can lead to significant savings. This discount reflects the insurer’s ability to manage multiple policies for a single customer more efficiently.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or GPS tracking systems, can reduce your insurance premiums. These devices deter theft and minimize the risk of loss for the insurance company.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Insurance companies often reward this commitment with a discount.

- Loyalty Discount: Long-term customers who have consistently maintained their insurance policies with the same company may be eligible for a loyalty discount. This discount is a way for insurers to reward customer retention and loyalty.

Bundling Insurance Policies, Lowest auto insurance rates by state

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant cost savings. This is because insurance companies often offer discounts for bundling multiple policies together. The rationale behind this is that managing multiple policies for a single customer is more efficient for the insurer, allowing them to offer a lower combined premium.

Driving Safety Courses and Telematics Programs

Participating in defensive driving courses can not only improve your driving skills but also potentially lower your insurance premiums. These courses teach drivers defensive driving techniques and strategies to avoid accidents, which in turn reduces the risk for the insurance company.

Telematics programs, which utilize devices or apps that track your driving habits, can also lead to savings. These programs monitor factors such as speed, braking, and mileage, providing valuable data about your driving behavior. Insurance companies use this data to assess your risk and offer discounts to safe drivers.

Choosing the Right Insurance Provider

Finding the lowest auto insurance rates is only one part of the equation. Choosing the right insurance provider is equally important to ensure you have reliable coverage and a positive experience when you need to file a claim.

Factors to Consider When Choosing an Insurance Provider

Choosing an insurance provider involves evaluating various factors to ensure you select a company that aligns with your needs and preferences.

- Financial Stability: A financially stable insurance company is crucial because it ensures they can fulfill their obligations to pay claims even in challenging economic times. You can assess a company’s financial strength by checking their ratings from independent agencies like AM Best, Standard & Poor’s, and Moody’s. These agencies evaluate insurers’ financial health based on factors such as their reserves, investment performance, and claims-paying ability. Look for companies with high ratings, indicating a strong financial position.

- Customer Satisfaction: A company’s customer satisfaction reflects its commitment to providing excellent service. You can gather insights into customer satisfaction by reading reviews on websites like J.D. Power, Consumer Reports, and the Better Business Bureau. These platforms allow you to compare customer experiences with different insurers and identify companies known for their responsiveness, fairness, and overall customer support.

- Claims Handling Practices: A company’s claims handling process is a crucial aspect of their service. You can investigate a company’s claims handling practices by checking their reviews and researching their average claim settlement time. Look for companies that are known for their transparency, promptness, and fairness in handling claims.

- Coverage Options and Customization: Different insurance providers offer varying coverage options and customization features. Compare the types of coverage offered, such as liability, collision, comprehensive, and uninsured motorist coverage, to ensure the policy aligns with your specific needs.

- Pricing and Discounts: While finding the lowest rate is important, remember that price shouldn’t be the sole factor in your decision. Compare quotes from multiple companies to understand their pricing structure and the discounts they offer. Consider discounts for safe driving, good student status, multi-car policies, and other factors.

Ending Remarks

By understanding the factors that influence auto insurance rates and utilizing available resources, drivers can effectively navigate the insurance market and find the most competitive prices. Whether you’re a new driver, a seasoned veteran, or simply looking for ways to save money, this guide provides a comprehensive overview of the key considerations for securing affordable and reliable auto insurance.

Commonly Asked Questions

How can I compare auto insurance quotes online?

Many websites allow you to enter your information and compare quotes from multiple insurance companies simultaneously. This can save you time and effort in finding the best deals.

What are some common auto insurance discounts?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for combining multiple insurance policies with the same company.

What is a telematics program?

Telematics programs use devices that track your driving habits, such as speed and braking patterns. If you demonstrate safe driving practices, you may qualify for discounts.