Cheapest state for car insurance is a question on the minds of many drivers, as they seek ways to save money on their monthly premiums. While factors like age, driving history, and vehicle type play a role, the state you live in can have a significant impact on your car insurance costs. Understanding how state regulations, accident rates, and the competitive landscape of insurance companies influence premiums can help you find the most affordable options.

This article delves into the factors that affect car insurance costs, exploring how states with lower accident rates, competitive insurance markets, and favorable regulations often result in lower average premiums. We’ll analyze the methodology used to identify the cheapest states, showcasing the top contenders and highlighting their unique characteristics. Additionally, we’ll provide practical tips for reducing your car insurance costs, emphasizing the importance of shopping around for quotes, understanding your coverage needs, and maintaining a good driving record.

Factors Influencing Car Insurance Costs

Car insurance premiums are influenced by a variety of factors, each playing a significant role in determining the final cost. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Demographics

Your demographics, such as age, driving history, and credit score, can significantly impact your car insurance rates.

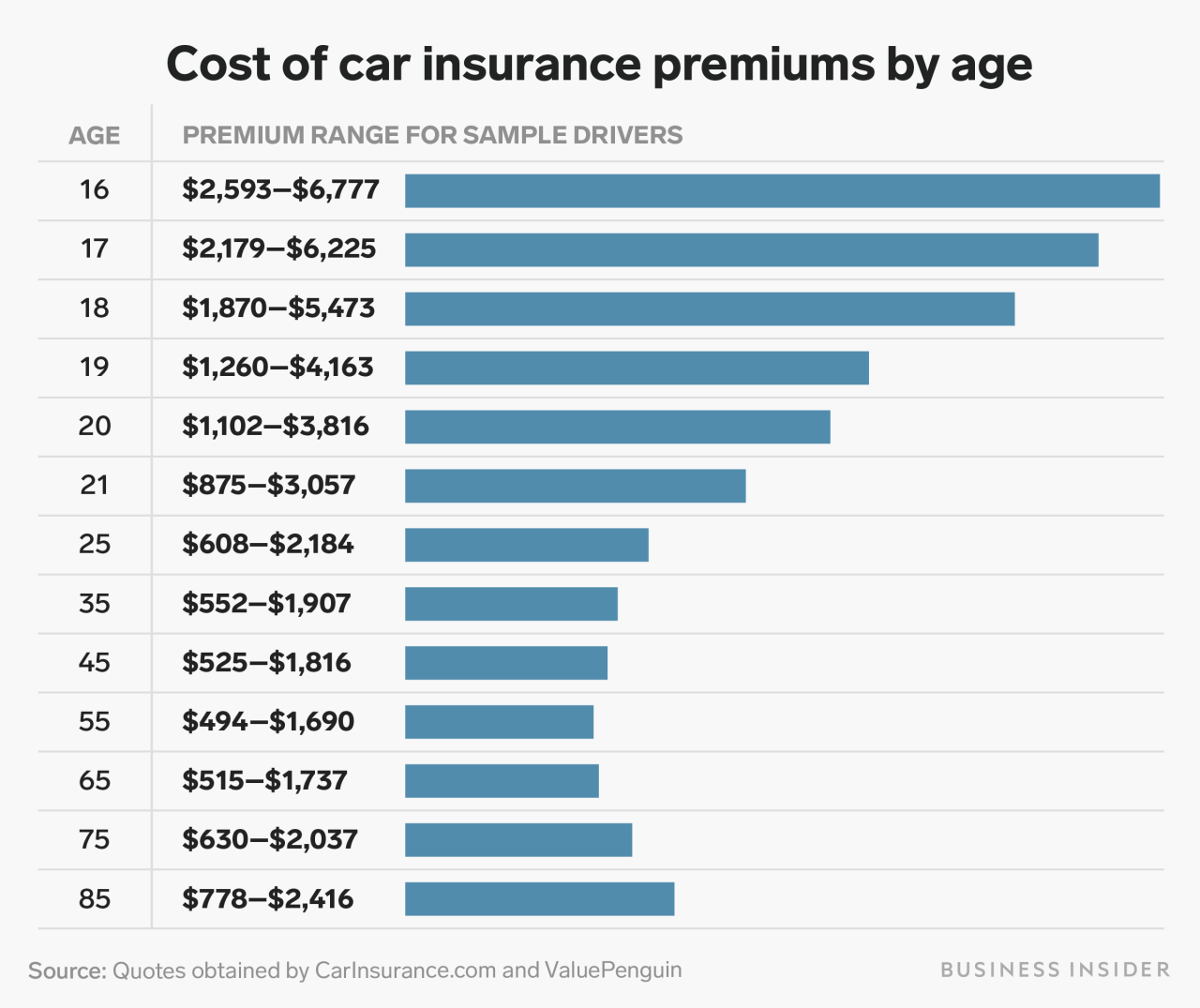

- Age: Younger drivers, especially those under 25, are generally considered higher risk due to their lack of experience. As you gain experience and age, your premiums tend to decrease. Conversely, older drivers, particularly those over 65, may also face higher premiums due to potential health concerns.

- Driving History: A clean driving record with no accidents, tickets, or violations is essential for lower premiums. Insurance companies view drivers with a history of accidents or violations as higher risk, leading to increased rates.

- Credit Score: While controversial, credit scores are increasingly used by insurance companies to assess risk. Individuals with lower credit scores may face higher premiums, as a poor credit history can be associated with riskier behavior, including driving habits.

Vehicle Type, Make, and Model

The type, make, and model of your vehicle play a crucial role in determining your insurance rates.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance models are often considered higher risk due to their potential for higher speeds and greater damage in accidents. Conversely, smaller, less powerful cars are generally associated with lower premiums.

- Make and Model: Specific makes and models are often associated with different repair costs, safety ratings, and theft rates. Vehicles with a history of expensive repairs or higher theft rates may result in higher premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts. These features can reduce the risk of accidents and severity of injuries, leading to lower premiums.

Location

Your location, including state, city, and zip code, significantly influences your car insurance rates.

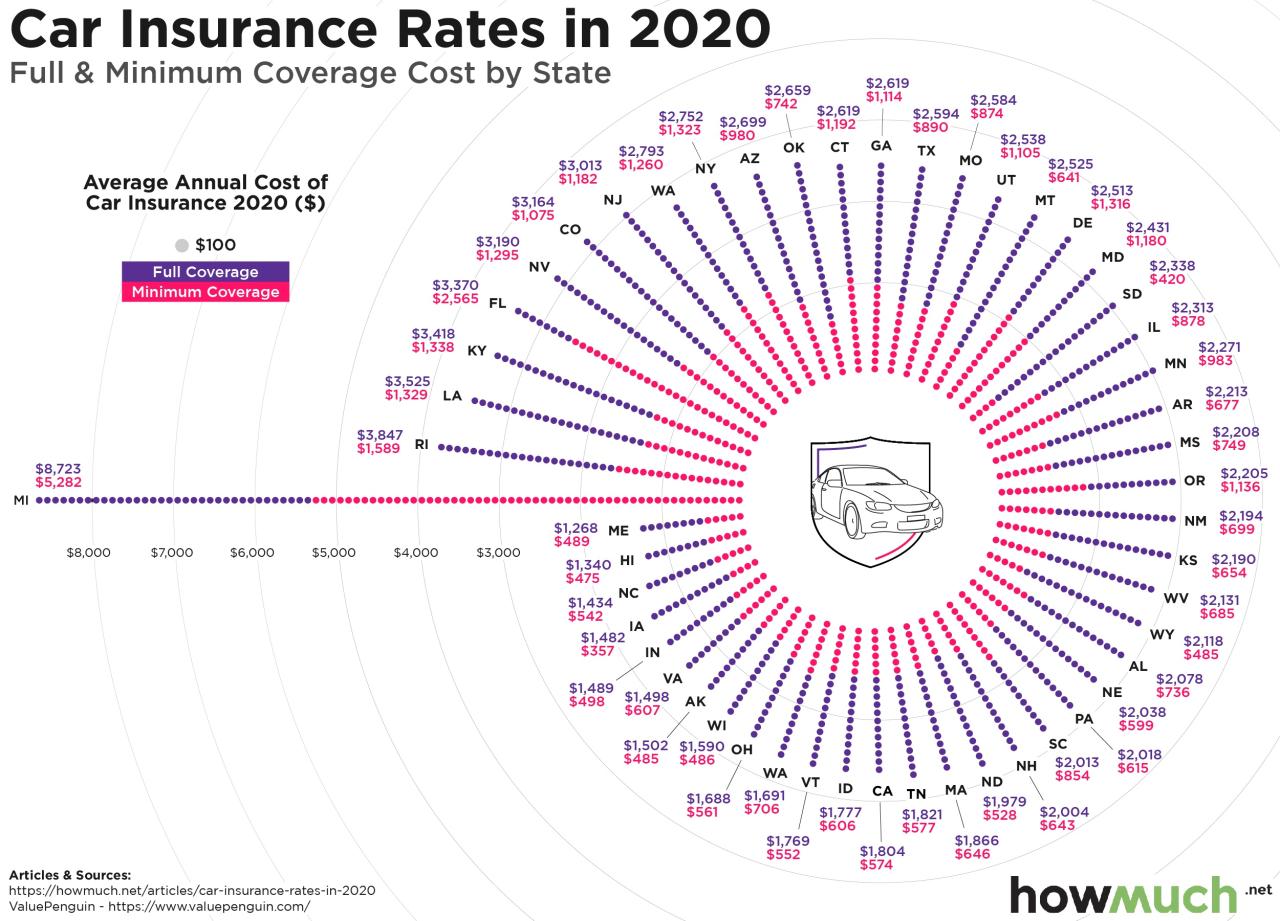

- State: Insurance regulations, traffic density, accident rates, and the cost of repairs vary widely across states. States with higher accident rates or more expensive repairs tend to have higher insurance premiums.

- City: Urban areas often have higher traffic density and accident rates compared to rural areas, leading to higher premiums. Cities with higher crime rates may also experience higher theft rates, resulting in increased insurance costs.

- Zip Code: Even within the same city, specific zip codes can have different accident rates and crime statistics. Insurance companies use this data to adjust premiums accordingly, with higher-risk areas often facing higher rates.

Coverage Options

The type and amount of coverage you choose directly impact your premium.

- Liability Coverage: Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Higher liability limits provide greater protection but come with higher premiums.

- Collision Coverage: Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This coverage is typically optional and may be waived if your vehicle is older or has a low value.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage from non-accident events, such as theft, vandalism, or natural disasters. This coverage is also typically optional and may be waived if your vehicle is older or has a low value.

Methodology for Identifying Cheapest States

Identifying the cheapest states for car insurance requires a comprehensive approach that considers various factors and data points. This involves gathering and analyzing information from reputable sources, such as insurance companies and state regulatory agencies, to understand the nuances of insurance pricing across different regions.

Criteria for Determining Cheapest States

To determine the cheapest states, we analyze several key criteria:

- Average Annual Premiums: This is the most straightforward indicator of affordability. We gather data from reputable sources like the National Association of Insurance Commissioners (NAIC) and insurance companies to calculate average annual premiums for various coverage levels, such as minimum liability and full coverage.

- Minimum Liability Coverage Requirements: Each state mandates minimum liability coverage levels that drivers must maintain. Lower minimum coverage requirements can lead to lower premiums, as drivers need to purchase less insurance. However, it’s crucial to understand that minimum coverage might not be sufficient in case of a serious accident.

- Availability of Discounts: Insurance companies offer various discounts that can significantly impact premiums. These discounts might be based on factors like good driving records, safe driving courses, multiple vehicle insurance, and bundling home and auto insurance. We consider the availability and types of discounts offered in each state to assess their overall affordability.

Top 10 Cheapest States for Car Insurance

The following table displays the top 10 cheapest states for car insurance based on average annual premiums, minimum liability coverage requirements, and availability of discounts:

| Rank | State | Average Annual Premium | Notable Factors |

|---|---|---|---|

| 1 | Idaho | $750 | Low minimum liability requirements, strong competition among insurers, and favorable driving conditions. |

| 2 | Maine | $800 | Limited traffic congestion, low accident rates, and a large number of insurance companies operating in the state. |

| 3 | North Dakota | $825 | Favorable driving conditions, limited urban areas, and a high number of insurance companies offering competitive rates. |

| 4 | Utah | $850 | Low minimum liability requirements, a strong economy, and a large number of insurance companies operating in the state. |

| 5 | Iowa | $875 | Low minimum liability requirements, favorable driving conditions, and a high number of insurance companies offering competitive rates. |

| 6 | Vermont | $900 | Limited traffic congestion, low accident rates, and a large number of insurance companies operating in the state. |

| 7 | Wyoming | $925 | Favorable driving conditions, low population density, and a high number of insurance companies offering competitive rates. |

| 8 | Oklahoma | $950 | Low minimum liability requirements, favorable driving conditions, and a high number of insurance companies operating in the state. |

| 9 | New Hampshire | $975 | Limited traffic congestion, low accident rates, and a large number of insurance companies operating in the state. |

| 10 | South Dakota | $1,000 | Favorable driving conditions, low population density, and a high number of insurance companies offering competitive rates. |

Top Cheapest States for Car Insurance

Now that we’ve explored the factors that influence car insurance costs and how we determine the cheapest states, let’s delve into the specific states that offer the most affordable car insurance premiums.

Top 5 Cheapest States

Based on average annual premiums, here are the top 5 cheapest states for car insurance:

- Idaho: Idaho boasts low accident rates and a competitive insurance market, leading to lower premiums. Additionally, the state’s rural landscape and lower population density contribute to reduced risk factors for insurers.

- Maine: Maine’s relatively low population density, coupled with a strong emphasis on driver safety and education, contributes to its low accident rates. These factors, combined with a competitive insurance market, result in affordable car insurance premiums.

- North Dakota: North Dakota enjoys a relatively low cost of living and a strong emphasis on driver safety. The state’s rural nature and low population density also contribute to lower accident rates, resulting in more affordable insurance premiums.

- Vermont: Vermont’s commitment to driver safety and education, combined with a competitive insurance market, contributes to its affordable car insurance premiums. The state’s rural landscape and low population density also play a role in reducing accident rates.

- Iowa: Iowa’s low accident rates, coupled with a competitive insurance market, contribute to its affordable car insurance premiums. The state’s strong emphasis on driver safety and education further reduces the risk factors for insurers.

Comparison of Insurance Landscapes

While these states share the commonality of affordable premiums, their insurance landscapes exhibit key differences in coverage options, regulations, and driving environments.

- Coverage Options: Some states, like Idaho, may have more limited coverage options compared to others, such as Maine, which might offer a wider range of choices. It’s crucial to research and compare specific coverage options available in each state to ensure you’re getting the protection you need.

- Regulations: States like Vermont have stricter regulations regarding insurance requirements, potentially leading to higher minimum coverage limits. On the other hand, states like North Dakota might have more relaxed regulations, resulting in lower minimum coverage requirements. Understanding these regulatory differences is essential for making informed decisions about your insurance coverage.

- Driving Environments: The driving environments in these states vary significantly. Maine, with its coastal roads and rural landscapes, presents different challenges compared to the flat and often snowy roads of North Dakota. These differences can influence insurance rates as insurers consider the specific risks associated with each driving environment.

Top 10 Cheapest States, Cheapest state for car insurance

Expanding our focus beyond the top 5, here are the top 10 cheapest states for car insurance, along with their key affordability factors:

- Idaho: Low accident rates, competitive insurance market, rural landscape, low population density.

- Maine: Low population density, strong emphasis on driver safety, competitive insurance market.

- North Dakota: Low cost of living, strong emphasis on driver safety, rural nature, low population density.

- Vermont: Commitment to driver safety, competitive insurance market, rural landscape, low population density.

- Iowa: Low accident rates, competitive insurance market, strong emphasis on driver safety.

- Wyoming: Low population density, rural landscape, competitive insurance market.

- South Dakota: Low accident rates, competitive insurance market, rural nature, low population density.

- Oklahoma: Competitive insurance market, relatively low accident rates, strong emphasis on driver safety.

- Mississippi: Competitive insurance market, relatively low accident rates, strong emphasis on driver safety.

- Arkansas: Competitive insurance market, relatively low accident rates, strong emphasis on driver safety.

Tips for Finding Affordable Car Insurance

Finding the cheapest car insurance rates can be a daunting task, but it’s not impossible. With a little research and effort, you can significantly reduce your insurance premiums. Here are some practical tips that can help you save money on your car insurance.

Increasing Deductibles

Raising your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lead to lower premiums. A higher deductible signifies a greater willingness to absorb initial costs, which insurers reward with lower premiums. For example, increasing your collision deductible from $500 to $1,000 could result in a 10-15% reduction in your premium. However, make sure you can afford the higher deductible if you need to file a claim.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can offer significant savings. Insurers often offer discounts to policyholders who bundle multiple policies, as it reduces their administrative costs and increases customer loyalty. For example, bundling your car insurance with homeowners insurance could save you 10-20% on your overall premiums.

Maintaining a Good Driving Record

Maintaining a clean driving record is crucial for obtaining affordable car insurance. A history of traffic violations, accidents, or DUI convictions can significantly increase your premiums. Safe driving habits, such as obeying traffic laws, avoiding distractions, and driving defensively, can help you maintain a good driving record and lower your insurance costs.

Shopping Around for Car Insurance Quotes

Getting quotes from multiple insurance providers is essential for finding the best rates. Different insurers use different factors to calculate premiums, so comparing quotes can reveal significant price differences. Online comparison websites and insurance brokers can simplify the process of obtaining quotes from various insurers.

Understanding Your Insurance Needs

Understanding your individual insurance needs and selecting the right coverage levels is crucial for minimizing costs. Consider factors such as your car’s value, your driving habits, and your financial situation. For example, if you have an older car with a lower value, you might consider dropping collision and comprehensive coverage, which can significantly reduce your premiums. However, make sure you have adequate liability coverage to protect yourself financially in case of an accident.

Impact of State Regulations on Car Insurance Costs

State regulations play a crucial role in shaping the car insurance market and ultimately influencing the premiums consumers pay. These regulations dictate various aspects of the insurance landscape, from minimum coverage requirements to pricing practices.

Minimum Liability Coverage Requirements

The minimum liability coverage requirements mandated by each state directly impact insurance costs. States with higher minimum coverage requirements generally have higher average insurance premiums. This is because drivers are required to carry more insurance, which translates to higher costs for insurance companies. For instance, states with higher minimum liability limits for bodily injury and property damage may result in higher premiums for drivers.

No-Fault Insurance Laws

No-fault insurance laws determine how insurance claims are handled after an accident. In no-fault states, drivers are primarily responsible for covering their own losses, regardless of who caused the accident. This system aims to reduce litigation and speed up claim processing. However, no-fault laws can also lead to higher premiums, as drivers are required to carry personal injury protection (PIP) coverage.

Regulations on Insurance Company Pricing Practices

States also regulate how insurance companies can set prices for car insurance. These regulations aim to ensure fair and competitive pricing practices. Some states have strict regulations that limit the factors insurance companies can use to determine premiums, such as credit scores or driving history. Other states have more lenient regulations, allowing insurance companies more flexibility in setting prices.

Comparison of Regulatory Environments

States with lower average insurance premiums tend to have more lenient regulations on insurance company pricing practices. They may also have lower minimum liability coverage requirements and less stringent no-fault insurance laws. For example, states like Texas and Florida have more relaxed regulations compared to states like New York and Pennsylvania. This can lead to lower average premiums in states with less stringent regulations.

Consequences of Deregulation or Changes in Regulations

Deregulation or changes in state regulations can have a significant impact on car insurance costs. For example, if a state were to relax its regulations on insurance company pricing practices, insurance companies could potentially increase premiums. Conversely, if a state were to increase its minimum liability coverage requirements, premiums could also increase.

Concluding Remarks

By understanding the factors that influence car insurance costs and exploring the strategies for finding affordable coverage, you can navigate the insurance landscape effectively and secure the best possible rates. Remember, researching different providers, comparing quotes, and understanding your coverage needs are essential steps towards securing affordable car insurance. Whether you’re a new driver, a seasoned veteran, or simply looking for ways to save money, this guide provides valuable insights and practical tips to help you make informed decisions about your car insurance.

FAQ Guide: Cheapest State For Car Insurance

What are some common factors that affect car insurance rates?

Factors like your age, driving history, credit score, vehicle type, and location can all influence your car insurance rates.

How often should I shop around for car insurance quotes?

It’s recommended to shop around for car insurance quotes at least every 1-2 years to ensure you’re getting the best rates.

What are some ways to lower my car insurance premiums?

You can lower your premiums by increasing your deductible, bundling insurance policies, maintaining a good driving record, and taking advantage of discounts offered by your insurer.