Sr22 insurance washington state – SR-22 insurance in Washington State is a crucial requirement for drivers who have been convicted of certain traffic violations. This type of insurance acts as a financial guarantee that the driver will be able to cover any damages or injuries caused in an accident. It’s often mandated after serious offenses like driving under the influence (DUI) or driving without insurance. Understanding the intricacies of SR-22 insurance, including its purpose, cost, and maintenance, is essential for drivers facing this requirement.

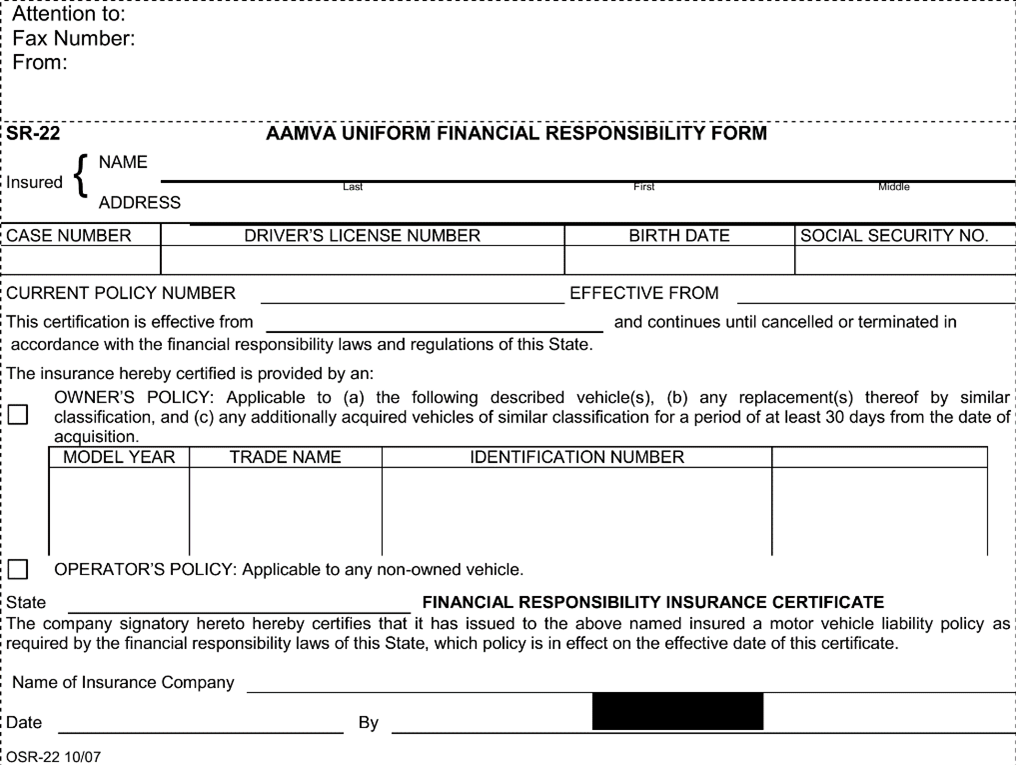

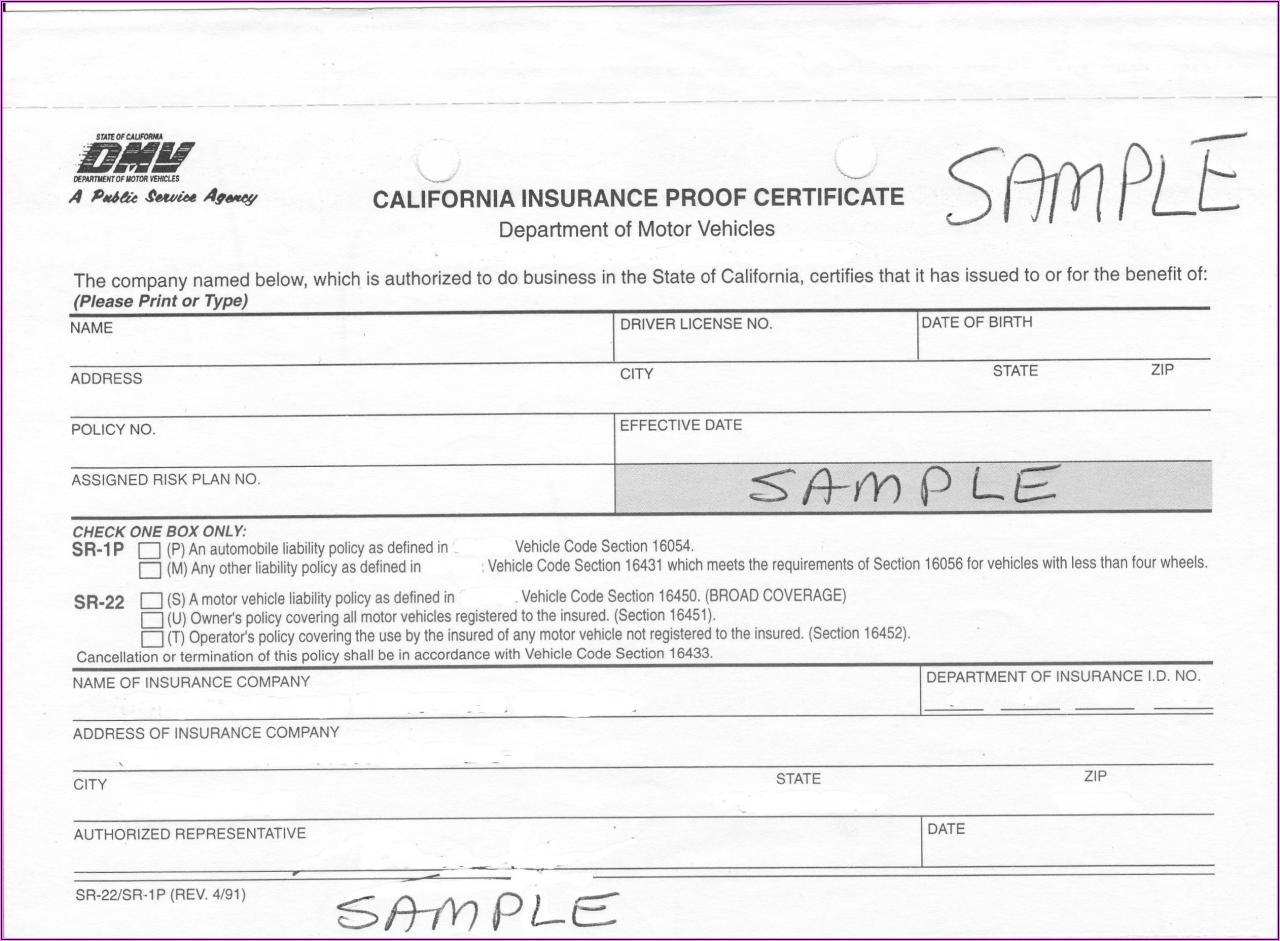

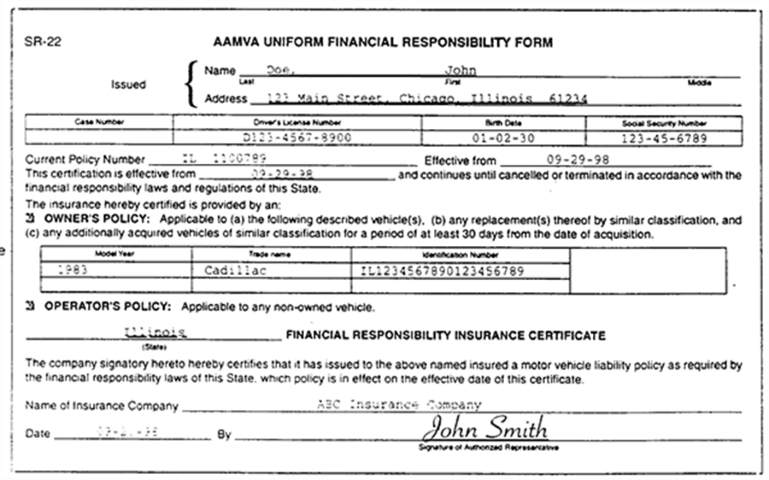

The Washington State Department of Licensing (DOL) plays a key role in overseeing SR-22 insurance. It’s the DOL that issues the SR-22 certificate, which your insurance company files on your behalf. This certificate serves as proof to the state that you have the required financial responsibility. The duration of the SR-22 requirement varies based on the severity of the violation and the driver’s history. While obtaining an SR-22 may seem daunting, it’s crucial for maintaining your driving privileges in Washington.

SR-22 Insurance in Washington State

SR-22 insurance is a financial responsibility form required by the Washington State Department of Licensing (DOL) to prove that you have the minimum liability insurance coverage required by law. It serves as a guarantee that you will be able to pay for any damages or injuries you may cause in an accident.

Purpose of SR-22 Insurance

The primary purpose of SR-22 insurance in Washington is to ensure that drivers who have been convicted of certain traffic offenses or who have had their driving privileges revoked or suspended have the necessary financial protection to cover potential liabilities. It acts as a safeguard for the public, ensuring that individuals with a history of driving infractions maintain adequate insurance coverage.

Situations Requiring an SR-22 in Washington

The following situations in Washington State typically necessitate an SR-22:

- Driving without insurance

- Driving with a suspended license

- Driving under the influence (DUI) or driving while intoxicated (DWI)

- Hit and run accidents

- Multiple traffic violations within a specific timeframe

- Failure to pay traffic fines or court fees

Duration of SR-22 Insurance Requirements

The duration of an SR-22 requirement in Washington State varies depending on the specific offense or circumstances. It is typically determined by the DOL based on the severity of the offense and the driver’s history. For example, a DUI conviction might require an SR-22 for three years, while a minor traffic violation might only require it for a shorter period.

Obtaining SR-22 Insurance in Washington

Obtaining SR-22 insurance in Washington can be a challenging process, especially if you have a history of driving violations. It’s important to understand the requirements and procedures involved to ensure you meet all the necessary criteria.

The Role of the Washington State Department of Licensing

The Washington State Department of Licensing (DOL) plays a crucial role in the SR-22 insurance process. The DOL is responsible for issuing driver’s licenses and vehicle registrations, and they require proof of financial responsibility, which is where SR-22 insurance comes in. When you receive an SR-22 requirement, the DOL will notify your insurance company. The insurance company will then file an SR-22 form with the DOL, which essentially acts as a guarantee that you have the required minimum liability insurance coverage.

The Process of Obtaining SR-22 Insurance

The process of obtaining SR-22 insurance typically involves the following steps:

- Contact an insurance company: Start by contacting multiple insurance companies to compare quotes and find the best rates. Be transparent about your driving history and the reason you need SR-22 insurance.

- Provide necessary documentation: You’ll need to provide your insurance company with your driver’s license information, vehicle registration details, and any relevant court documents related to your driving violation.

- Pay the premium: SR-22 insurance typically comes with a higher premium than standard auto insurance. This is because you are considered a higher risk driver due to your driving violations.

- File the SR-22 form: Once you have purchased SR-22 insurance, your insurance company will file the SR-22 form with the Washington State Department of Licensing.

- Maintain coverage: It’s crucial to maintain continuous SR-22 insurance coverage for the required period, which is typically determined by the court or the DOL.

Typical Costs Associated with SR-22 Insurance

The cost of SR-22 insurance in Washington can vary significantly depending on several factors, including:

- The severity of your driving violation: A more serious violation, such as a DUI, will typically result in a higher premium than a less serious violation, such as a speeding ticket.

- Your driving history: If you have a history of multiple driving violations, you’ll likely face higher premiums.

- Your insurance company: Different insurance companies have different pricing structures, so it’s important to compare quotes from multiple providers.

- Your vehicle: The type and value of your vehicle can also impact the cost of your SR-22 insurance.

Example: A driver in Washington with a DUI conviction might pay an SR-22 insurance premium of $150-$200 per month, while a driver with a speeding ticket might pay a premium of $50-$100 per month.

Factors Affecting SR-22 Insurance Costs in Washington

Several factors influence the cost of SR-22 insurance in Washington. Understanding these factors can help you make informed decisions and potentially lower your premiums.

Factors Affecting SR-22 Insurance Costs

- Driving History: Your driving history plays a significant role in determining your SR-22 insurance cost. A history of traffic violations, accidents, or DUI convictions will generally result in higher premiums.

- Age and Gender: Insurance companies often consider age and gender when calculating premiums. Younger drivers, especially males, are statistically more likely to be involved in accidents, which can lead to higher rates.

- Vehicle Type: The type of vehicle you drive can impact your insurance cost. Sports cars and luxury vehicles are typically more expensive to insure due to their higher repair costs and increased risk of theft.

- Location: Where you live can influence your insurance rates. Areas with higher rates of accidents or crime often have higher insurance premiums.

- Credit Score: In some states, including Washington, insurance companies can use your credit score to assess your risk. A good credit score may lead to lower premiums, while a poor credit score could result in higher rates.

- Coverage Levels: The amount of coverage you choose will impact your premiums. Higher coverage limits, such as liability coverage, will generally lead to higher insurance costs.

- Insurance Company: Different insurance companies have different pricing structures and underwriting practices. Comparing quotes from multiple insurers can help you find the most affordable SR-22 insurance.

SR-22 Insurance vs. Standard Auto Insurance

SR-22 insurance is generally more expensive than standard auto insurance. This is because SR-22 insurance is designed for high-risk drivers who have been convicted of serious traffic violations. SR-22 insurance is typically more expensive due to the increased risk associated with these drivers.

Impact of Driving History and Credit Score on SR-22 Insurance Premiums

- Driving History: Your driving history has a significant impact on SR-22 insurance premiums. A clean driving record can help you qualify for lower rates. However, if you have a history of traffic violations, accidents, or DUI convictions, you can expect to pay higher premiums.

- Credit Score: Your credit score can also affect your SR-22 insurance premiums. Insurance companies may use your credit score to assess your risk. A good credit score may result in lower premiums, while a poor credit score could lead to higher rates.

Maintaining SR-22 Insurance in Washington: Sr22 Insurance Washington State

Maintaining an SR-22 in Washington requires careful adherence to specific rules and regulations. Failure to do so can lead to serious consequences, including the suspension of your driving privileges.

Maintaining SR-22 Insurance

It’s crucial to understand that an SR-22 is not a separate insurance policy; it’s a certificate filed with the Washington State Department of Licensing (DOL) by your insurance company, demonstrating proof of financial responsibility. To maintain your SR-22, you must:

- Keep your insurance policy active: Your SR-22 is directly linked to your insurance policy. If your policy lapses or is canceled, your SR-22 will also be revoked.

- Pay your insurance premiums on time: Failing to make timely premium payments can lead to policy cancellation and the revocation of your SR-22.

- Inform your insurer of any changes: Changes in your address, vehicle ownership, or driving record must be reported to your insurer immediately. Failure to do so can affect your SR-22.

- Renew your SR-22 as required: The duration of your SR-22 depends on the reason it was filed. It could be for a specific period or until the DOL determines it’s no longer necessary. You’ll need to renew your SR-22 when it expires.

Consequences of Failing to Maintain an SR-22

Failing to maintain an SR-22 in Washington can have severe consequences, including:

- Suspension of your driving privileges: The DOL can suspend your driver’s license if your SR-22 is revoked.

- Fines and penalties: You may face fines and penalties for driving without an SR-22.

- Difficulty obtaining future insurance: Failing to maintain an SR-22 can make it difficult to obtain insurance in the future. Insurance companies may consider you a high-risk driver.

- Legal issues: Driving without an SR-22 can lead to legal complications, especially if you’re involved in an accident.

Canceling an SR-22

You can cancel your SR-22 once the required period has elapsed and you meet the conditions set by the DOL. To cancel your SR-22, you’ll need to:

- Contact your insurance company: Inform your insurance company that you want to cancel your SR-22. They will file the necessary paperwork with the DOL.

- Provide proof of clean driving record: The DOL may require you to provide evidence of a clean driving record for a specified period to confirm your eligibility for SR-22 cancellation.

Resources for SR-22 Insurance in Washington

Finding the right SR-22 insurance provider in Washington can be a daunting task. You need to ensure the provider is reliable, offers competitive rates, and understands your specific needs. Here are some resources to help you navigate this process.

Reputable Insurance Providers

Finding the right SR-22 insurance provider in Washington is crucial. You need to ensure the provider is reliable, offers competitive rates, and understands your specific needs. Here are some reputable insurance providers in Washington that offer SR-22 insurance:

- State Farm: Known for its wide range of insurance products and customer service, State Farm is a good option for SR-22 insurance in Washington. They offer competitive rates and a user-friendly online platform.

- Geico: Another popular choice, Geico is known for its competitive pricing and straightforward insurance policies. They also offer convenient online and mobile app access for managing your policy.

- Progressive: Progressive is known for its innovative insurance offerings and its focus on personalized customer service. They provide various discounts and options to help you find the right coverage for your needs.

- Farmers Insurance: Farmers Insurance is a well-established insurance provider with a strong presence in Washington. They offer comprehensive insurance coverage and a network of local agents for personalized assistance.

- Liberty Mutual: Liberty Mutual is a large insurance company known for its strong financial stability and customer-centric approach. They offer various insurance products, including SR-22 insurance, and provide personalized support.

Government Websites

The Washington State Department of Licensing (DOL) is the primary source for information related to SR-22 insurance. Here are some key resources on their website:

- SR-22 Insurance Requirements: This page provides detailed information about SR-22 insurance in Washington, including the types of offenses that require it and the filing process.

- SR-22 Filing Instructions: This section provides step-by-step instructions on how to file an SR-22 with the DOL, including the required forms and documents.

- Insurance Provider Directory: The DOL website offers a directory of licensed insurance providers in Washington. This directory can help you find providers in your area that offer SR-22 insurance.

Key Features of SR-22 Insurance Providers, Sr22 insurance washington state

To make an informed decision, consider comparing the key features of different SR-22 insurance providers in Washington. Here’s a table highlighting some important factors:

| Provider | Average Rates | Discounts | Customer Service | Online Platform |

|---|---|---|---|---|

| State Farm | Competitive | Safe driver, good student, multi-policy | Excellent | User-friendly |

| Geico | Competitive | Safe driver, good student, multi-policy | Good | User-friendly |

| Progressive | Competitive | Safe driver, good student, multi-policy | Excellent | User-friendly |

| Farmers Insurance | Competitive | Safe driver, good student, multi-policy | Good | User-friendly |

| Liberty Mutual | Competitive | Safe driver, good student, multi-policy | Good | User-friendly |

Final Review

Navigating the world of SR-22 insurance in Washington State can be challenging, but it’s important to remember that it’s a temporary requirement designed to ensure you’re financially responsible on the road. By understanding the factors that influence costs, maintaining your SR-22 diligently, and exploring the available resources, you can successfully meet this requirement and get back on the road with peace of mind. Remember, if you have any questions or concerns, reaching out to your insurance provider or the Washington State Department of Licensing can provide valuable guidance and clarity.

Helpful Answers

What happens if I don’t get SR-22 insurance?

You’ll likely face serious consequences, including the suspension of your driver’s license.

How long do I need to have SR-22 insurance?

The duration varies depending on the nature of the violation and your driving history. The Washington State Department of Licensing will inform you of the required timeframe.

Can I choose any insurance provider for my SR-22?

Not all insurance companies offer SR-22 insurance. You’ll need to find a provider that offers this specific type of coverage.

How much does SR-22 insurance typically cost?

The cost varies greatly based on several factors, including your driving history, credit score, and the type of vehicle you drive. SR-22 insurance is usually more expensive than standard auto insurance.