New York State homeowners insurance is essential for protecting your biggest investment – your home. It safeguards you against financial losses from unforeseen events like fire, theft, or natural disasters. Understanding the intricacies of this insurance can be daunting, but this guide aims to simplify the process, providing you with the knowledge and insights to make informed decisions about your coverage.

This comprehensive guide explores the different types of homeowners insurance policies available in New York, factors influencing premium costs, and essential considerations for securing adequate coverage. We’ll delve into the nuances of policy terms, deductibles, and coverage limits, empowering you to navigate the New York insurance market with confidence.

Understanding New York State Homeowners Insurance

Homeowners insurance in New York State is a crucial financial safety net for property owners, offering protection against various risks that could threaten their homes and belongings. Understanding the purpose, coverage components, and policy types available is essential for making informed decisions and securing adequate coverage.

Purpose of Homeowners Insurance

Homeowners insurance in New York State serves to protect property owners from financial losses arising from covered perils, such as fire, theft, vandalism, and natural disasters. It provides financial compensation to help rebuild or repair damaged property and replace lost or damaged belongings. This insurance also covers liability claims if someone is injured on your property.

Key Coverage Components

Homeowners insurance policies in New York typically include the following key coverage components:

- Dwelling Coverage: This component covers the structure of your home, including the attached garage, decks, and porches, against covered perils. It helps rebuild or repair your home if it’s damaged or destroyed.

- Other Structures Coverage: This coverage extends to detached structures on your property, such as sheds, fences, and detached garages. It provides protection against covered perils similar to dwelling coverage.

- Personal Property Coverage: This component protects your belongings inside your home, such as furniture, appliances, clothing, and electronics. It helps replace or repair these items if they are damaged or stolen.

- Liability Coverage: This coverage protects you from financial losses if someone is injured on your property or you cause damage to someone else’s property. It covers legal expenses and settlements related to such incidents.

- Loss of Use Coverage: This coverage provides temporary living expenses if your home becomes uninhabitable due to a covered peril. It helps cover costs like hotel stays and meals while your home is being repaired or rebuilt.

Types of Homeowners Insurance Policies

New York State offers different types of homeowners insurance policies to cater to various needs and property types. The most common types include:

- HO-3 (Special Form): This is the most comprehensive homeowners insurance policy, offering broad coverage for both named perils and open perils. It provides protection against most risks, except for those specifically excluded in the policy.

- HO-5 (Comprehensive Form): Similar to the HO-3, this policy offers broad coverage for both named perils and open perils, providing comprehensive protection against most risks. It’s often preferred for higher-value homes and properties with unique features.

- HO-8 (Modified Coverage): This policy is designed for older homes that may not meet the requirements for standard coverage. It provides limited coverage for specific perils and may not cover all risks. It’s often used for homes with historical value or unique features.

- HO-4 (Contents Broad Form): This policy is designed for renters and covers their personal belongings against covered perils. It does not cover the structure of the building itself.

- HO-6 (Condominium Unit Owners): This policy is designed for condominium owners and covers their personal belongings and the interior of their unit against covered perils. It does not cover the common areas of the building or the exterior of the unit.

Factors Affecting Homeowners Insurance Premiums

Several factors can influence the cost of homeowners insurance premiums in New York State. These factors include:

- Location: Premiums are higher in areas with a higher risk of natural disasters, crime, and other perils.

- Home Value: The higher the value of your home, the higher your premium will be.

- Coverage Limits: Higher coverage limits for dwelling, personal property, and liability will result in higher premiums.

- Deductible: A higher deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, will result in lower premiums.

- Risk Factors: Factors such as your home’s age, construction materials, safety features, and claims history can affect your premium.

Choosing the Right Homeowners Insurance Policy, New york state homeowners insurance

Selecting the right homeowners insurance policy requires careful consideration of your individual needs and circumstances. It’s important to:

- Assess Your Coverage Needs: Determine the level of coverage you require based on the value of your home, belongings, and potential risks.

- Compare Quotes: Obtain quotes from multiple insurance companies to compare premiums and coverage options.

- Read the Policy Carefully: Review the policy document thoroughly to understand the coverage details, exclusions, and limitations.

- Consult an Insurance Agent: An experienced insurance agent can help you understand your options and choose the policy that best suits your needs.

Factors Influencing Homeowners Insurance Premiums in New York

Your homeowners insurance premium in New York is determined by a number of factors, all designed to assess the risk your home presents to the insurer. These factors are carefully considered to ensure that premiums accurately reflect the likelihood of claims and the potential cost of those claims.

Location

Your home’s location plays a significant role in determining your premium. This is because insurance companies analyze the risk of various areas based on factors like:

- Natural disasters: Areas prone to hurricanes, earthquakes, or floods will have higher premiums. For example, homes on Long Island or near the coast face higher premiums due to hurricane risk.

- Crime rates: Areas with higher crime rates tend to have higher premiums as the risk of theft or vandalism is greater. For example, homes in New York City may have higher premiums compared to those in more rural areas.

- Fire risk: Proximity to fire hazards like forests or industrial areas can influence premiums. For example, homes near a densely wooded area might face higher premiums due to increased fire risk.

Property Value

The value of your home is a key factor in determining your premium. Higher property values generally result in higher premiums because the potential cost of damage or loss is greater.

For example, a home valued at $1 million will likely have a higher premium than a home valued at $500,000, assuming other factors are equal.

Coverage Levels

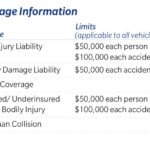

The level of coverage you choose directly impacts your premium. More comprehensive coverage, such as higher limits for dwelling coverage, personal property coverage, or liability coverage, will result in higher premiums.

For example, if you opt for a higher dwelling coverage limit to protect against a greater potential loss, your premium will be higher compared to someone with a lower dwelling coverage limit.

Risk Factors

Your individual risk profile also influences your premium. These factors include:

- Claims history: A history of filing claims can lead to higher premiums. Insurance companies consider past claims as an indicator of potential future claims.

- Safety features: Homes with security systems, fire alarms, and other safety features may qualify for discounts, leading to lower premiums. For example, a home with a burglar alarm system may receive a discount because it reduces the risk of theft.

- Credit score: In some cases, your credit score can impact your premium. A higher credit score may indicate greater financial responsibility and lower risk to the insurer.

Navigating the New York Homeowners Insurance Market: New York State Homeowners Insurance

Choosing the right homeowners insurance policy in New York can feel overwhelming with the many insurers and options available. Understanding the key factors and strategies can make the process smoother and help you find the most suitable coverage for your needs.

Reputable Insurance Companies in New York State

A wide range of reputable insurance companies operate in New York, offering a variety of coverage options and policy features. Some of the most prominent include:

- Allstate

- American Family Insurance

- Chubb

- Farmers Insurance

- Geico

- Liberty Mutual

- Nationwide

- State Farm

- Travelers

- USAA

Comparing Features and Benefits

Once you have identified a few potential insurers, it’s essential to compare their policy features and benefits. Key aspects to consider include:

- Coverage Types: Insurers may offer different levels of coverage, including dwelling, personal property, liability, and additional living expenses.

- Deductibles: A higher deductible generally leads to lower premiums, but you’ll pay more out of pocket in case of a claim.

- Discounts: Many insurers offer discounts for various factors, such as safety features, security systems, and bundling multiple policies.

- Customer Service: Review online reviews and ratings to assess the insurer’s reputation for customer service and claim handling.

Obtaining Quotes and Choosing a Policy

To obtain quotes, you can contact insurers directly, use online comparison tools, or work with an insurance broker. When comparing quotes:

- Ensure the quotes are based on the same coverage levels and deductibles.

- Consider the insurer’s financial stability and claims handling process.

- Read the policy documents carefully to understand the coverage details and exclusions.

“The most suitable policy is one that provides adequate coverage at a reasonable price while meeting your individual needs and risk tolerance.”

Essential Considerations for New York Homeowners

Navigating the complexities of homeowners insurance in New York requires a proactive approach. Understanding your policy’s terms and conditions is crucial to ensure you have the right coverage and protection for your property.

Policy Terms and Conditions

It’s essential to thoroughly read and understand your homeowners insurance policy. This includes the coverage limits, deductibles, exclusions, and other important provisions.

- Coverage limits specify the maximum amount your insurer will pay for specific types of losses, such as damage to your home or personal belongings.

- Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums.

- Exclusions are situations or events that are not covered by your policy. For example, most homeowners policies exclude coverage for floods or earthquakes.

Deductibles and Coverage Limits

Deductibles and coverage limits play a significant role in managing your insurance costs.

- A higher deductible usually leads to lower premiums. This is because you’re taking on more financial risk, and the insurer is assuming less risk. However, it’s important to choose a deductible you can comfortably afford in case of a claim.

- Coverage limits determine the maximum amount your insurer will pay for a covered loss. It’s crucial to ensure your coverage limits are sufficient to rebuild or repair your home and replace your belongings.

Minimizing Premiums and Maximizing Coverage

You can take several steps to minimize your homeowners insurance premiums and maximize your coverage benefits.

- Improve Home Security: Installing security systems, such as alarms and motion detectors, can lower your premiums as it reduces the risk of theft or vandalism.

- Maintain Your Property: Regularly inspecting and maintaining your home, including roofs, plumbing, and electrical systems, can help prevent costly repairs and reduce your premiums.

- Shop Around for Quotes: Compare quotes from multiple insurers to find the best rates and coverage for your needs.

- Bundle Policies: Bundling your homeowners insurance with other policies, such as auto or renters insurance, can often lead to discounts.

- Consider Discounts: Many insurers offer discounts for things like having a good credit score, being a senior citizen, or being a member of certain organizations.

Understanding New York State Insurance Regulations

New York State has a comprehensive set of regulations governing homeowners insurance, designed to protect consumers and ensure fair practices within the insurance industry. These regulations cover various aspects, from policy requirements and pricing to consumer rights and dispute resolution. Understanding these regulations is crucial for homeowners in New York, as they provide valuable insights into their rights and obligations.

The Role of the New York State Department of Financial Services (DFS)

The New York State Department of Financial Services (DFS) plays a vital role in overseeing the insurance industry and protecting consumers. The DFS is responsible for enforcing insurance laws and regulations, ensuring that insurance companies operate fairly and responsibly. It also provides consumer education and resources to help homeowners understand their insurance rights and responsibilities.

Filing Complaints and Seeking Assistance with Insurance Issues

Homeowners in New York can file complaints with the DFS if they have issues with their insurance company. The DFS has a dedicated consumer complaint process, which can be accessed through its website or by phone. The DFS investigates consumer complaints and takes appropriate action to resolve them. The DFS also offers various resources and assistance to homeowners facing insurance issues, including:

- Information about insurance policies and consumer rights

- Guidance on filing complaints and appealing insurance decisions

- Mediation services to help resolve disputes between homeowners and insurance companies

Homeowners can also seek assistance from other organizations, such as the New York State Insurance Department and the National Association of Insurance Commissioners (NAIC). These organizations provide information and resources to help homeowners navigate the insurance landscape and protect their interests.

Final Review

In conclusion, navigating the world of New York State homeowners insurance can be a complex journey, but with the right knowledge and resources, you can make informed decisions that protect your home and financial well-being. By understanding the key coverage components, factors influencing premiums, and essential considerations, you can secure the most suitable policy to meet your specific needs and budget. Remember to shop around, compare quotes, and seek professional advice to ensure you have the right level of protection for your valuable asset.

Questions and Answers

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage reimburses you for the depreciated value of your damaged property, while replacement cost coverage covers the full cost of replacing it with a new, similar item.

How can I lower my homeowners insurance premiums?

You can potentially reduce your premiums by increasing your deductible, installing safety features like smoke detectors and burglar alarms, and maintaining good credit.

What are some common exclusions in homeowners insurance policies?

Common exclusions include damage caused by floods, earthquakes, and acts of war. It’s crucial to review your policy carefully to understand what’s covered and what’s not.

How can I file a claim with my homeowners insurance company?

Most insurers have a dedicated claims process. You can typically file a claim online, over the phone, or in person. Be sure to document the damage with photos and videos.