State insurance fund idaho – The Idaho State Insurance Fund stands as a crucial resource for businesses seeking reliable and comprehensive insurance coverage. Established to safeguard businesses from financial hardship in the face of unforeseen events, the fund provides a comprehensive range of insurance solutions tailored to the unique needs of Idaho’s diverse business landscape. From workers’ compensation to liability insurance, the Idaho State Insurance Fund serves as a safety net, ensuring that businesses can navigate challenges with confidence and stability.

The fund’s commitment to serving Idaho businesses extends beyond simply providing insurance. It also actively promotes workplace safety and health initiatives, fostering a culture of prevention and minimizing the likelihood of workplace accidents. This dedication to proactive safety measures has earned the Idaho State Insurance Fund a reputation for excellence and trustworthiness within the state’s business community.

Overview of the Idaho State Insurance Fund

The Idaho State Insurance Fund (ISIF) is a state-operated workers’ compensation insurance provider that has been serving Idaho businesses and their employees since 1917. It is a self-funded, non-profit organization dedicated to providing comprehensive and affordable workers’ compensation insurance solutions.

Purpose and Mission

The ISIF’s primary purpose is to protect Idaho businesses and their employees from the financial burden of work-related injuries and illnesses. Its mission is to:

- Provide safe and healthy workplaces for all Idaho workers.

- Offer fair and equitable workers’ compensation benefits to injured employees.

- Help Idaho businesses manage their workers’ compensation costs.

Types of Insurance Coverage

The ISIF offers a wide range of workers’ compensation insurance coverage options to meet the diverse needs of Idaho businesses, including:

- Standard Workers’ Compensation Coverage: This provides basic coverage for work-related injuries and illnesses, including medical expenses, lost wages, and death benefits.

- Voluntary Coverage: Businesses can choose to purchase additional coverage options, such as coverage for specific types of injuries or illnesses, or coverage for employees working in high-risk industries.

- Employer Liability Coverage: This coverage protects employers from lawsuits arising from work-related injuries or illnesses.

Benefits of Choosing the Idaho State Insurance Fund, State insurance fund idaho

Choosing the ISIF for workers’ compensation insurance offers numerous benefits to Idaho businesses, including:

- Financial Stability: As a self-funded organization, the ISIF has a strong financial foundation, providing stability and security to policyholders.

- Competitive Rates: The ISIF strives to offer competitive rates to help businesses manage their workers’ compensation costs.

- Dedicated Customer Service: The ISIF provides dedicated customer service representatives who are available to assist businesses with their insurance needs.

- Safety and Risk Management Resources: The ISIF offers a variety of safety and risk management resources to help businesses create safer workplaces and reduce the risk of work-related injuries and illnesses.

- Experienced Claims Management: The ISIF has a team of experienced claims professionals who handle claims efficiently and fairly.

Eligibility and Coverage

The Idaho State Insurance Fund (ISIF) provides workers’ compensation insurance to businesses operating in Idaho. To be eligible for coverage, businesses must meet specific criteria. This section Artikels the eligibility requirements, the different types of coverage offered, and the process for obtaining coverage.

Eligibility Criteria

To be eligible for ISIF coverage, businesses must operate in Idaho and meet the following criteria:

- Employ at least one employee.

- Be a for-profit business.

- Not be exempt from workers’ compensation coverage by Idaho law.

Types of Coverage

ISIF offers various types of coverage to meet the specific needs of different businesses. The primary coverage includes:

- Workers’ Compensation: This coverage provides benefits to employees who suffer work-related injuries or illnesses. Benefits include medical expenses, lost wages, and disability payments.

- Employer’s Liability: This coverage protects employers from lawsuits filed by employees or their families for work-related injuries or illnesses.

- Occupational Disease: This coverage provides benefits to employees who develop work-related illnesses, such as lung disease or cancer, due to prolonged exposure to hazardous substances.

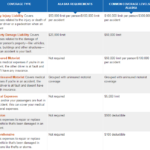

Coverage Limits and Deductibles

Coverage limits and deductibles vary depending on the type of coverage and the specific policy.

- Workers’ Compensation: Coverage limits for medical expenses are typically unlimited, while lost wages are subject to a maximum weekly benefit amount. Deductibles for workers’ compensation coverage are typically waived.

- Employer’s Liability: Coverage limits for employer’s liability insurance can vary depending on the policy and the specific risks involved. Deductibles are typically based on a percentage of the policy limit.

- Occupational Disease: Coverage limits for occupational disease insurance are similar to workers’ compensation coverage. Deductibles are typically waived.

Applying for Coverage

To apply for ISIF coverage, businesses must complete an application form and submit it to ISIF. The application process involves:

- Submitting an Application: Businesses can apply for coverage online, by phone, or by mail.

- Providing Information: The application requires information about the business, its employees, and its operations. This includes details about the industry, the number of employees, and the types of work performed.

- Paying Premiums: Once the application is approved, businesses are required to pay premiums to maintain their coverage. Premiums are based on the business’s payroll, industry, and risk factors.

Rates and Premiums

The Idaho State Insurance Fund (ISIF) calculates insurance rates for businesses based on a variety of factors, aiming to ensure a fair and equitable system for all employers. The rates are designed to reflect the risk associated with each industry and the specific characteristics of each business.

Factors Influencing Premium Costs

The premium costs for businesses are determined by a number of factors, including:

- Industry Classification: Each industry is assigned a classification code based on its inherent risk level. Higher-risk industries, such as construction or manufacturing, typically have higher premium rates than lower-risk industries, such as retail or office work.

- Payroll: The amount of payroll a business has directly influences the premium cost. Higher payroll generally equates to higher premiums, as the potential for claims is greater with a larger workforce.

- Loss History: Past claims experience significantly impacts premium rates. Businesses with a history of frequent or costly claims may face higher premiums, while those with a good safety record and low claims experience can often benefit from lower rates.

- Safety Practices: ISIF encourages businesses to implement strong safety programs and invest in workplace safety measures. By demonstrating a commitment to safety, businesses can potentially earn premium discounts or reductions.

- Experience Modification Rate (EMR): The EMR is a numerical value that reflects a business’s past claims experience compared to the industry average. An EMR of 1.0 represents average experience, while an EMR below 1.0 indicates better-than-average experience, potentially leading to lower premiums. Conversely, an EMR above 1.0 suggests a higher-than-average risk and may result in higher premiums.

Typical Premium Rates

ISIF provides a range of premium rates for different industries and business sizes. It’s important to note that these rates can vary based on the specific factors mentioned above. Here are some examples of typical premium rates for various industries:

| Industry | Typical Premium Rate (per $100 of payroll) |

|---|---|

| Construction | $2.00 – $5.00 |

| Manufacturing | $1.50 – $4.00 |

| Retail | $0.50 – $1.50 |

| Office Work | $0.25 – $0.75 |

Premium Reduction Programs

ISIF offers a variety of premium reduction programs to help businesses lower their insurance costs. These programs include:

- Safety Incentive Programs: Businesses can earn discounts on their premiums by implementing and maintaining effective safety programs. These programs often involve employee training, safety audits, and the use of safety equipment.

- Experience Modification Rate (EMR) Reduction Programs: By improving their safety performance and reducing claims, businesses can lower their EMR and potentially qualify for premium reductions.

- Group Rating Programs: Businesses in certain industries can join group rating programs to benefit from the combined safety performance of other businesses in the group. This can lead to lower premiums for individual businesses.

Claims Process and Customer Service

The Idaho State Insurance Fund (ISIF) provides a straightforward claims process to ensure policyholders receive timely and efficient support. This section details the steps involved in filing a claim, the required documentation, the processing timeline, and the available customer service channels.

Filing a Claim

Policyholders can file a claim with ISIF through various methods, including online, by phone, or by mail.

- Online: The ISIF website offers a secure online portal for claim filing, allowing policyholders to submit claims, track their progress, and access relevant information 24/7.

- Phone: ISIF maintains a dedicated customer service line where policyholders can speak with a claims representative to initiate a claim or receive assistance with the process.

- Mail: Policyholders can also file a claim by mail using the claim forms available on the ISIF website or by contacting customer service to request a form.

Required Documentation

To ensure a smooth and efficient claims process, ISIF requires policyholders to provide specific documentation when filing a claim. This documentation may vary depending on the type of claim but typically includes:

- Claim Form: The completed claim form, which Artikels the details of the incident or injury.

- Proof of Insurance: Evidence of active insurance coverage at the time of the incident, such as a policy copy or declaration page.

- Medical Records: For workers’ compensation claims, medical records from treating physicians, including diagnoses, treatment plans, and bills.

- Police Report: If the incident involved a third party or a vehicle accident, a copy of the police report.

- Photographs: Images of the accident scene or injury, if applicable.

Claim Processing and Payment

ISIF strives to process claims promptly and efficiently. Once a claim is filed, ISIF reviews the documentation and begins the investigation process. The investigation may involve contacting witnesses, reviewing medical records, and conducting site inspections.

- Timeframe: ISIF aims to process claims within a reasonable timeframe, which can vary depending on the complexity of the claim and the availability of required information.

- Payment: Upon approval, ISIF will issue payment for approved claims directly to the policyholder or their designated healthcare provider.

Customer Service Channels

ISIF prioritizes customer satisfaction and offers various channels for policyholders to access support and information:

- Website: The ISIF website provides comprehensive information on claims, coverage, rates, and other relevant topics.

- Phone: ISIF maintains a dedicated customer service line for policyholders to reach claims representatives or receive assistance with any inquiries.

- Email: Policyholders can also contact ISIF through email for general inquiries or claim-related assistance.

- Social Media: ISIF is active on social media platforms, providing updates and engaging with policyholders.

Resources and Information

The Idaho State Insurance Fund (ISIF) offers a wealth of resources to help you navigate the workers’ compensation system. These resources include comprehensive information on the ISIF website, contact information for customer service, and a variety of helpful documents and publications.

Website Resources

The ISIF website is a valuable resource for employers, employees, and healthcare providers. It provides information on a wide range of topics, including:

- Eligibility and coverage

- Rates and premiums

- Claims process

- Safety and prevention

- Forms and publications

The website also features a secure online portal where employers can manage their accounts, file claims, and access other important information.

Contact Information

If you have any questions or need assistance, you can contact the ISIF by phone, email, or mail. The ISIF offers a dedicated customer service team to help you with any inquiries.

Key Information

Here is a table outlining key information about the Idaho State Insurance Fund:

| Information | Details |

|---|---|

| Address | Idaho State Insurance Fund P.O. Box 83720 Boise, ID 83720-0072 |

| Phone Number | (208) 334-2800 |

| Email Address | info@isif.idaho.gov |

| Website URL | https://www.isif.idaho.gov |

Comparisons with Private Insurers

Choosing the right workers’ compensation insurance for your Idaho business can be a significant decision. You have the option of going with a private insurance company or the Idaho State Insurance Fund (ISIF). Both options offer coverage, but they differ in key aspects. Understanding these differences can help you make an informed choice for your business.

Advantages and Disadvantages

Both the ISIF and private insurers offer advantages and disadvantages. It’s crucial to weigh these factors carefully to determine the best fit for your specific needs.

- Idaho State Insurance Fund (ISIF)

- Advantages:

- Stability and Security: As a state-run entity, the ISIF enjoys financial stability and security, ensuring it can meet its obligations even during challenging economic times.

- Lower Premiums: The ISIF often offers competitive premiums, especially for businesses in high-risk industries or those with a history of claims.

- Focus on Idaho Businesses: The ISIF prioritizes the needs of Idaho businesses, offering tailored programs and resources to support local companies.

- Strong Customer Service: The ISIF has a reputation for providing excellent customer service, with dedicated staff available to answer questions and address concerns.

- Disadvantages:

- Limited Flexibility: Compared to private insurers, the ISIF may offer less flexibility in customizing coverage options to meet specific business needs.

- Potential for Longer Processing Times: The ISIF’s centralized system can sometimes lead to longer processing times for claims compared to private insurers with more localized operations.

- Private Insurers

- Advantages:

- Customization: Private insurers offer greater flexibility in tailoring coverage options to meet the specific needs of different businesses.

- Faster Claim Processing: Private insurers often have more localized operations, potentially leading to faster claim processing times.

- Innovative Solutions: Private insurers may offer innovative risk management programs and safety services to help businesses prevent accidents and reduce costs.

- Disadvantages:

- Higher Premiums: Private insurers may charge higher premiums, particularly for businesses in high-risk industries or with a history of claims.

- Potential for Financial Instability: Private insurers are subject to market fluctuations and financial risks, which could impact their ability to meet their obligations.

- Less Focus on Idaho Businesses: Private insurers may have a broader focus, potentially leading to less tailored services for Idaho businesses.

Factors Favoring the Idaho State Insurance Fund

The ISIF can be a better choice for some businesses, particularly those:

- Operating in High-Risk Industries: The ISIF’s competitive premiums can be especially attractive for businesses in industries with a higher risk of workplace accidents.

- Seeking Stability and Security: The ISIF’s state-backed financial strength provides a sense of security for businesses seeking a reliable and stable insurer.

- Prioritizing Customer Service: The ISIF’s reputation for excellent customer service can be crucial for businesses that value responsiveness and support.

- Valuing Local Focus: Businesses that prefer to work with an insurer that prioritizes Idaho businesses and their unique needs may find the ISIF a better fit.

Future Trends and Developments: State Insurance Fund Idaho

The Idaho insurance market, like other industries, is dynamic and constantly evolving. Several factors are shaping the future of insurance in Idaho, presenting both opportunities and challenges for the Idaho State Insurance Fund (ISIF) and other players in the market.

Impact of Technology and Innovation

The insurance industry is experiencing a technological revolution, with digital advancements impacting every aspect of the business. This includes the way policies are sold, claims are processed, and customer service is delivered.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used to automate tasks, improve risk assessment, and personalize customer experiences. ISIF can leverage these technologies to streamline operations, detect fraud, and offer more tailored insurance solutions.

- Internet of Things (IoT): Connected devices are generating vast amounts of data, providing valuable insights into risk factors. This data can be used to develop more accurate pricing models and offer personalized insurance products based on individual usage patterns. For example, telematics devices in vehicles can track driving behavior, allowing insurers to offer discounts to safe drivers.

- Blockchain Technology: Blockchain can enhance transparency and security in insurance transactions. This can be particularly beneficial for managing claims and ensuring the integrity of data.

Ultimate Conclusion

The Idaho State Insurance Fund is a vital component of Idaho’s economic ecosystem, providing businesses with a reliable and affordable insurance solution. Whether a small startup or a large corporation, the fund offers comprehensive coverage, competitive rates, and exceptional customer service. With a focus on promoting workplace safety and financial security, the Idaho State Insurance Fund empowers businesses to thrive, contributing to the overall prosperity of the state.

Essential Questionnaire

What types of businesses are eligible for coverage through the Idaho State Insurance Fund?

The Idaho State Insurance Fund provides coverage to a wide range of businesses, including but not limited to construction, manufacturing, retail, healthcare, and hospitality. However, specific eligibility criteria may apply depending on the industry and nature of the business.

How can I contact the Idaho State Insurance Fund for more information?

You can reach the Idaho State Insurance Fund through their website, phone number, or email address. Contact information is readily available on their website.

Does the Idaho State Insurance Fund offer any discounts or premium reduction programs?

Yes, the Idaho State Insurance Fund offers various discounts and premium reduction programs based on factors such as safety performance, industry type, and business size. Contact them directly for details on available programs.