Tesla Insurance States: Where Can You Get Coverage? As Tesla continues to revolutionize the automotive industry, the company has expanded its reach to offer insurance to its vehicle owners. But not all states have access to Tesla’s insurance program. This exploration delves into the current availability of Tesla Insurance, the factors influencing its expansion, and how to determine eligibility based on your location.

This comprehensive guide will analyze the key aspects of Tesla Insurance, including its coverage options, unique features, pricing structure, and customer experiences. We’ll also explore potential future trends and developments in the Tesla Insurance market, providing insights into the evolving landscape of electric vehicle insurance.

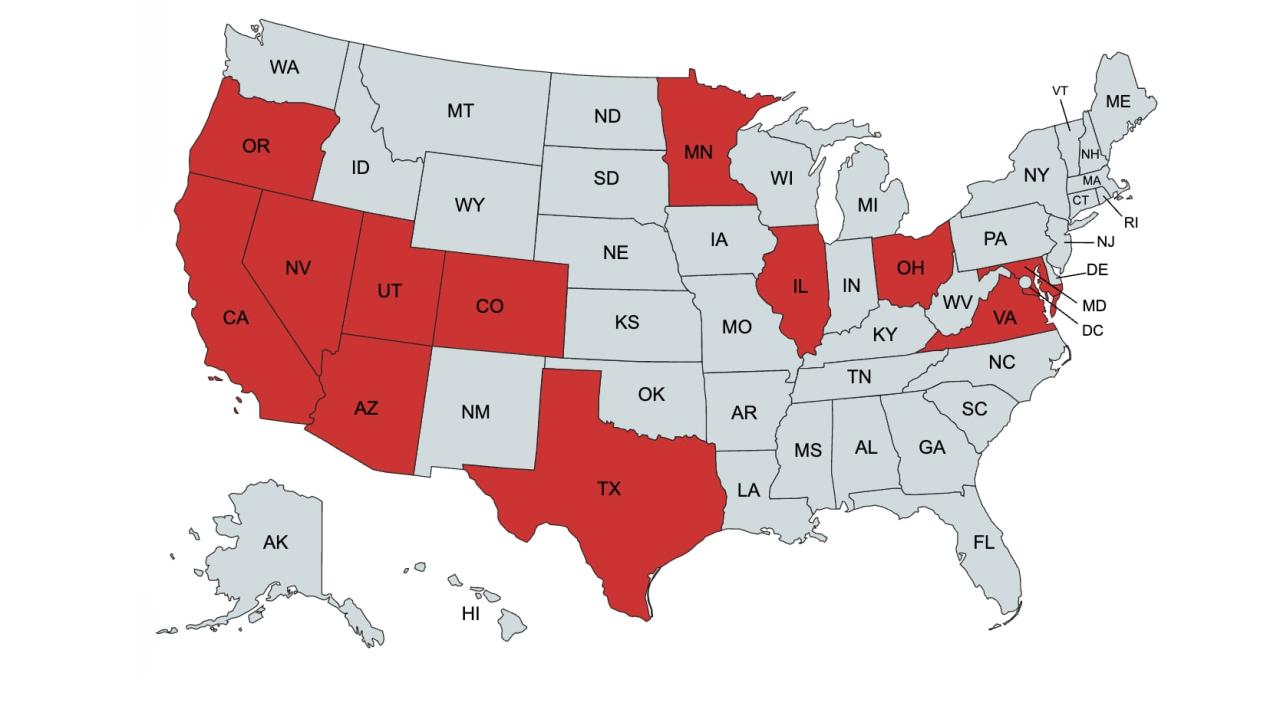

Tesla Insurance Availability

Tesla Insurance, the company’s foray into the auto insurance market, is available in a limited number of states. This strategic approach allows Tesla to fine-tune its insurance model and gain valuable data before expanding to a wider audience.

States Where Tesla Insurance is Available, Tesla insurance states

Tesla Insurance is currently offered in the following states:

- Arizona

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- Wisconsin

Factors Influencing Tesla Insurance Expansion

Tesla’s decision to expand or restrict insurance coverage to specific states is influenced by several factors:

- Regulatory Environment: Tesla needs to ensure its insurance offerings comply with the regulations of each state. States with favorable regulatory frameworks for innovative insurance models are more likely to be targeted for expansion.

- Market Size and Demand: Tesla will likely prioritize states with a significant number of Tesla vehicle owners, creating a larger potential customer base for its insurance products.

- Data Availability: Tesla leverages data from its vehicles to develop its insurance models. States with robust data sharing regulations and access to comprehensive data sets will be more attractive for expansion.

- Competition: Tesla will consider the competitive landscape in each state. States with a more fragmented insurance market or limited presence of other tech-focused insurers may be more appealing for Tesla to enter.

Determining Tesla Insurance Eligibility Based on Location

Tesla Insurance eligibility is primarily determined by the state of residence of the vehicle owner. If the owner resides in a state where Tesla Insurance is available, they are generally eligible to purchase a policy. However, there may be additional requirements or limitations based on the specific vehicle model and other factors. To confirm eligibility, individuals can visit the Tesla Insurance website or contact Tesla directly.

Tesla Insurance Coverage and Features

Tesla Insurance, offered by Tesla itself, presents a unique approach to car insurance, leveraging its expertise in electric vehicles and advanced technology. It aims to provide tailored coverage and competitive pricing to Tesla owners.

Coverage Options

Tesla Insurance offers a range of coverage options, comparable to traditional insurance providers, including:

- Liability Coverage: This covers damages to others and their property if you are at fault in an accident. It’s typically required by law.

- Collision Coverage: This covers damage to your Tesla in an accident, regardless of who is at fault. You’ll pay a deductible, which is the amount you pay out-of-pocket before insurance kicks in.

- Comprehensive Coverage: This covers damage to your Tesla from events other than accidents, such as theft, vandalism, or natural disasters. You’ll also pay a deductible for this coverage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): This covers your medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of who is at fault. It’s often required in some states.

Unique Features and Benefits

Tesla Insurance incorporates several features designed to benefit Tesla owners, such as:

- Safety Technology Discounts: Tesla’s advanced safety features, like Autopilot and Full Self-Driving, can potentially reduce your insurance premiums. The insurance algorithm considers the safety features equipped in your Tesla, offering potential discounts based on their impact on accident risk.

- Telematics Data: Tesla Insurance uses data from your car’s sensors and telematics system to assess your driving behavior. This includes factors like speed, acceleration, braking, and time of day, which can influence your premium.

- Direct-to-Consumer Model: Tesla Insurance is offered directly through Tesla, eliminating the need for third-party brokers or agents. This streamlined process can potentially offer faster quotes and policy management.

Comparison with Traditional Insurance Providers

| Feature | Tesla Insurance | Traditional Insurance |

|—|—|—|

| Coverage Options | Comprehensive, comparable to traditional providers | Comprehensive, but may vary by provider |

| Pricing | Can be competitive, particularly for Tesla owners with advanced safety features | Can be competitive, but pricing can vary widely depending on factors like driving history, location, and vehicle type |

| Features | Safety technology discounts, telematics data, direct-to-consumer model | May offer features like accident forgiveness, roadside assistance, and discounts for good driving records |

| Availability | Currently available in select states | Available nationwide, with varying coverage options and pricing |

Tesla Insurance Pricing and Cost Factors

Tesla Insurance, like other insurance providers, considers various factors when determining your premium. These factors aim to assess your risk profile, ensuring a fair and accurate price for your coverage.

Factors Influencing Tesla Insurance Premiums

Several factors contribute to the final cost of your Tesla Insurance policy. These factors are carefully evaluated to provide a personalized premium based on your individual circumstances.

- Vehicle Model: The specific Tesla model you own plays a significant role in determining your premium. Higher-performance models with advanced features tend to be more expensive to insure due to their higher repair costs and potential for greater damage in accidents. For instance, a Model S Plaid, with its exceptional speed and performance, might have a higher premium compared to a Model 3.

- Driving History: Your past driving record, including accidents, traffic violations, and claims history, heavily influences your premium. A clean driving history with no accidents or violations often leads to lower premiums. Conversely, a history of accidents or violations may result in higher premiums due to the increased risk associated with your driving habits.

- Location: The location where you reside also impacts your premium. Areas with higher crime rates, denser traffic, and more frequent accidents typically have higher insurance premiums. This is because insurance companies consider the likelihood of accidents and claims in different regions.

- Age and Gender: Your age and gender can also influence your premium. Younger drivers, especially those with limited driving experience, may face higher premiums due to the statistical correlation between age and accident risk. Gender can also play a role, although this varies depending on the insurance provider and region.

- Coverage Options: The type and amount of coverage you choose will significantly impact your premium. Comprehensive coverage, which protects against theft and damage from non-accidental events, generally costs more than liability coverage, which only covers damage to other vehicles or property. Higher coverage limits, such as increased liability coverage, also contribute to higher premiums.

Typical Cost Structure for Tesla Insurance Policies

The cost structure for Tesla Insurance policies typically includes the following components:

- Base Premium: This is the fundamental cost of insurance based on factors such as your vehicle model, location, and age. It forms the foundation for your premium.

- Driving History Adjustment: This factor reflects your driving record and its impact on your risk profile. A clean driving history may lead to a discount on your base premium, while a history of accidents or violations may result in an increase.

- Coverage Options Adjustment: The type and amount of coverage you choose will further influence your premium. Additional coverage options, such as comprehensive or collision coverage, will increase the overall cost.

- Other Factors Adjustment: Additional factors, such as your credit score or driving habits, may also contribute to adjustments in your premium. Some insurers may consider factors like your credit score to assess your risk profile.

Comparison with Other Insurance Providers

Tesla Insurance pricing can be compared to other insurance providers for similar coverage. While Tesla Insurance offers competitive pricing, it’s crucial to compare quotes from various insurers to find the best deal. Consider factors like coverage options, deductibles, and customer service when making your decision.

It’s essential to note that insurance premiums are dynamic and can vary significantly based on individual circumstances and market conditions.

Tesla Insurance Customer Experience and Reviews: Tesla Insurance States

Tesla Insurance, being a relatively new entrant in the insurance market, has garnered attention for its unique approach to car insurance. While it offers coverage for Tesla vehicles, it also leverages Tesla’s advanced technology and data to potentially provide a more personalized and efficient insurance experience. This section delves into the customer service, claims handling process, and reviews of Tesla Insurance.

Customer Service and Claims Handling Process

Tesla Insurance prides itself on its digital-first approach, offering customers the convenience of managing their policies and filing claims online or through the Tesla app. This streamlines the process and potentially eliminates the need for phone calls or in-person visits.

The claims handling process is designed to be quick and efficient. Customers can typically submit claims through the Tesla app, and Tesla claims adjusters handle the process directly. This potentially eliminates the need for third-party adjusters, which could lead to faster processing times.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the real-world experience of using Tesla Insurance. While reviews are subjective and can vary based on individual experiences, they can offer a glimpse into common themes and areas of satisfaction or dissatisfaction.

Some customers praise Tesla Insurance for its user-friendly app, quick claims processing times, and competitive pricing. Others have reported positive experiences with Tesla’s customer service, finding it responsive and helpful. However, some customers have expressed concerns about limited coverage options, the lack of traditional insurance agents, and the potential for higher premiums compared to traditional insurers.

Comparison with Traditional Insurance Providers

Tesla Insurance differs significantly from traditional insurance providers in several ways:

- Digital-First Approach: Tesla Insurance prioritizes digital interactions, offering online policy management, claims filing, and customer support. This contrasts with traditional insurers, which often rely on phone calls, physical documents, and in-person visits.

- Data-Driven Pricing: Tesla Insurance utilizes data from Tesla vehicles, such as driving habits and safety features, to potentially determine premiums. This data-driven approach can lead to personalized pricing based on individual driving behavior, potentially offering lower premiums for safer drivers.

- Direct Claims Handling: Tesla Insurance handles claims directly through its own adjusters, potentially eliminating the need for third-party adjusters. This can potentially lead to faster processing times and more streamlined communication.

Future Trends and Developments in Tesla Insurance

Tesla Insurance, as a relatively new player in the insurance market, is poised for significant growth and evolution. Its unique approach, leveraging data from Tesla vehicles and its focus on safety, presents opportunities for innovation and expansion.

Impact of Autonomous Driving Technology

The advancement of autonomous driving technology will significantly impact Tesla Insurance. As Tesla vehicles become increasingly autonomous, the traditional risk factors associated with human error, such as distracted driving and speeding, will decrease. This shift will lead to:

- Lower Premiums: With fewer accidents and claims, Tesla Insurance can potentially offer lower premiums to owners of autonomous vehicles, incentivizing adoption.

- Data-Driven Risk Assessment: Tesla Insurance can leverage data from its vehicles’ sensors and AI systems to develop highly accurate risk assessments, allowing for more personalized and dynamic pricing based on individual driving behavior and vehicle performance.

- New Insurance Products: The emergence of autonomous vehicles could lead to new insurance products tailored specifically to their unique features and functionalities, such as coverage for software malfunctions or cyberattacks.

Expansion Beyond Tesla Vehicles

Tesla Insurance’s success and data-driven approach could lead to expansion beyond Tesla vehicles. This could involve:

- Partnerships with Other Automakers: Tesla Insurance could partner with other automakers to offer similar insurance solutions, leveraging its expertise in data analytics and risk assessment. This could potentially lead to a broader market reach and increased competition in the insurance industry.

- Insurance for Connected Vehicles: Tesla Insurance could expand its services to cover other connected vehicles, regardless of brand, offering similar features like usage-based pricing and data-driven risk assessment. This would tap into the growing market of connected vehicles and offer competitive advantages.

Last Point

In conclusion, Tesla Insurance is a compelling option for Tesla vehicle owners seeking comprehensive coverage and tailored benefits. As Tesla expands its insurance footprint and continues to innovate, the future of electric vehicle insurance holds exciting possibilities. By understanding the factors influencing Tesla Insurance availability, coverage, pricing, and customer experiences, Tesla owners can make informed decisions about their insurance needs and explore the benefits of this unique program.

FAQ Corner

Is Tesla Insurance available in all states?

No, Tesla Insurance is not currently available in all states. The company is gradually expanding its coverage area, but it’s essential to check if your state is included.

How does Tesla Insurance pricing compare to traditional insurance providers?

Tesla Insurance premiums can vary depending on factors like vehicle model, driving history, and location. In some cases, Tesla Insurance may offer more competitive pricing, particularly for Tesla owners who have a clean driving record and utilize Tesla’s safety features.

What are the benefits of Tesla Insurance?

Tesla Insurance offers unique benefits, such as discounts for using Tesla’s advanced safety features and access to dedicated customer service channels. It also provides comprehensive coverage tailored to the specific needs of Tesla vehicles.