Cotton States Insurance stands as a prominent player in the insurance industry, offering a diverse range of products and services to individuals and businesses across a vast geographic footprint. With a rich history rooted in the Southern United States, Cotton States Insurance has evolved into a trusted provider, catering to the specific needs of its target audience.

The company’s commitment to customer satisfaction is evident in its personalized approach, competitive pricing, and comprehensive coverage options. Cotton States Insurance’s unwavering focus on building strong relationships with its policyholders has solidified its position as a leading name in the insurance landscape.

Cotton States Insurance Overview

Cotton States Insurance is a well-established insurance company offering a range of insurance products and services to individuals and businesses across the southeastern United States.

Cotton States Insurance has a rich history dating back to the early 20th century. It was founded in 1919 as a mutual insurance company, meaning that policyholders owned the company. This principle of mutual ownership has been a cornerstone of Cotton States Insurance throughout its history, fostering a strong sense of community and shared responsibility.

Key Milestones and Significant Events, Cotton states insurance

The history of Cotton States Insurance is marked by significant milestones and events that have shaped its growth and evolution.

- 1919: Cotton States Mutual Insurance Company was founded in Atlanta, Georgia, by a group of farmers seeking to provide affordable insurance options for their crops and livestock. The company’s initial focus was on agricultural insurance, offering coverage for perils like fire, windstorm, and hail.

- 1950s: Cotton States expanded its product offerings to include personal lines of insurance, such as auto and home insurance, to meet the growing needs of its policyholders.

- 1970s: The company began to focus on expanding its reach beyond its core markets in the Southeast, establishing operations in other states. This expansion was driven by the company’s commitment to providing affordable and reliable insurance solutions to a wider customer base.

- 1990s: Cotton States continued to grow and diversify its product offerings, adding commercial insurance products to its portfolio. This expansion allowed the company to serve a broader range of customers, including small businesses and corporations.

- 2000s: The company continued to innovate and adapt to the changing insurance landscape, embracing technology and developing new products and services to meet the evolving needs of its customers.

Services Offered

Cotton States Insurance offers a comprehensive suite of insurance products designed to protect individuals, families, and businesses against a wide range of risks. Their services are categorized into several key areas, each offering tailored solutions to meet diverse needs.

Types of Insurance Products

Cotton States Insurance provides a variety of insurance products to cater to different needs and circumstances. These products can be categorized into several key areas:

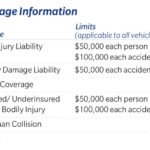

| Product Name | Description | Key Features |

|---|---|---|

| Auto Insurance | Protects against financial losses arising from accidents, theft, or damage to your vehicle. |

|

| Home Insurance | Protects your home and belongings from damage caused by fire, storms, theft, and other perils. |

|

| Life Insurance | Provides financial security to your loved ones in the event of your death. |

|

| Health Insurance | Covers medical expenses, including doctor visits, hospital stays, and prescription drugs. |

|

| Business Insurance | Protects businesses from financial losses due to various risks, such as property damage, liability claims, and employee accidents. |

|

Target Audience

Cotton States Insurance primarily targets individuals and families residing in the Southeastern United States. This region encompasses states like Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, and West Virginia.

The target audience is characterized by its diverse demographics, including working professionals, retirees, small business owners, and families of varying sizes. These individuals and families share common needs and concerns related to their financial well-being and protection against unforeseen circumstances.

Understanding the Needs and Concerns of the Target Audience

The target audience of Cotton States Insurance faces specific needs and concerns that are deeply rooted in the unique characteristics of the Southeastern region.

- Economic Factors: The Southeastern region is known for its diverse economy, with significant contributions from industries like agriculture, tourism, manufacturing, and energy. However, it also experiences economic fluctuations, including periods of unemployment and economic hardship. This necessitates affordable and reliable insurance solutions to safeguard financial stability during challenging times.

- Climate and Natural Disasters: The Southeast is prone to severe weather events like hurricanes, tornadoes, and floods, which pose significant risks to property and personal safety. This necessitates comprehensive insurance coverage that provides adequate protection against natural disasters.

- Healthcare Costs: The rising cost of healthcare is a major concern for individuals and families across the Southeast. This necessitates affordable and accessible health insurance options to manage healthcare expenses and ensure peace of mind.

- Community Values: The Southeast is known for its strong sense of community and family values. This translates into a desire for insurance providers that offer personalized service, local support, and a commitment to supporting the community.

Catering to the Unique Requirements of the Target Audience

Cotton States Insurance understands the unique needs and concerns of its target audience and has tailored its services to address these requirements effectively.

- Affordable and Accessible Insurance Solutions: Cotton States Insurance offers a wide range of insurance products at competitive prices, making them accessible to individuals and families with varying income levels. This ensures that everyone has access to the financial protection they need.

- Comprehensive Coverage for Natural Disasters: Recognizing the region’s susceptibility to natural disasters, Cotton States Insurance provides comprehensive coverage for hurricanes, tornadoes, floods, and other natural perils. This helps customers mitigate financial losses and rebuild their lives after a disaster.

- Focus on Local Support and Community Involvement: Cotton States Insurance emphasizes local support and community involvement by maintaining a network of agents and offices throughout the Southeast. This provides customers with personalized service, quick claims processing, and a sense of connection with their local community.

- Commitment to Customer Service: Cotton States Insurance prioritizes customer service by providing responsive and knowledgeable agents who are available to answer questions, address concerns, and provide personalized guidance. This commitment to customer satisfaction ensures a positive experience for policyholders.

Geographic Coverage

Cotton States Insurance provides coverage across a significant portion of the United States, catering to a diverse range of clients with varying insurance needs. This wide reach ensures that individuals and businesses can access reliable and comprehensive insurance solutions, regardless of their location within the company’s service area.

States Covered

Cotton States Insurance operates in a specific set of states, each with its unique insurance landscape. Understanding the specific coverage areas allows potential clients to determine if Cotton States Insurance is a suitable option for their needs.

- Alabama

- Arkansas

- Florida

- Georgia

- Kentucky

- Mississippi

- Missouri

- North Carolina

- Oklahoma

- South Carolina

- Tennessee

- Texas

- Virginia

Coverage Area Map

A visual representation of Cotton States Insurance’s coverage area is crucial for understanding the geographic scope of their services. This map highlights the states where Cotton States Insurance operates, allowing potential clients to quickly determine if they are within the coverage area.

The map would depict the United States with the states mentioned above shaded or highlighted to indicate the coverage area.

Regional Variations in Insurance Offerings and Policies

Insurance offerings and policies can vary significantly across different regions due to factors such as local regulations, demographics, and risk profiles. Cotton States Insurance adapts its products and services to meet the specific needs of each state it operates in.

- State-Specific Regulations: Each state has its own set of insurance regulations that govern the types of policies offered, coverage limits, and pricing. Cotton States Insurance ensures its offerings comply with all applicable state laws. For example, in Florida, insurers must comply with specific regulations regarding hurricane coverage, which may differ from those in other states.

- Local Risk Profiles: The risk profile of a region can influence insurance offerings and pricing. For instance, areas prone to natural disasters, such as hurricanes or earthquakes, may have higher premiums for property insurance. Cotton States Insurance considers these factors when tailoring its products to different regions.

- Demographics and Market Needs: Demographics and market needs can also shape insurance offerings. For example, in areas with a high concentration of agricultural businesses, Cotton States Insurance may offer specialized farm insurance products. Similarly, in urban areas with a high density of commercial properties, the company may offer tailored commercial insurance solutions.

Customer Experience

Cotton States Insurance prioritizes providing a positive and seamless customer experience. They strive to make insurance accessible and straightforward, offering a range of services and support to meet the needs of their policyholders.

Customer Service Approach

Cotton States Insurance emphasizes personalized service and responsiveness. Their customer service representatives are knowledgeable and readily available to answer questions, address concerns, and assist with policy-related matters. They aim to resolve issues efficiently and ensure customer satisfaction.

Customer Testimonials and Reviews

Cotton States Insurance receives positive feedback from its customers. Many testimonials highlight the company’s promptness, helpfulness, and professionalism. Online reviews often praise their efficient claims processing and personalized attention. For instance, one customer shared, “I was impressed with the speed and ease of filing a claim. The representative was very helpful and kept me informed throughout the process.”

Online Presence and Digital Experience

Cotton States Insurance maintains a user-friendly website that provides easy access to information about their services, policies, and resources. The website features a clear and intuitive navigation structure, allowing customers to quickly find the information they need.

Competitive Landscape

Cotton States Insurance operates in a highly competitive insurance market, facing a diverse range of competitors, both regional and national. Understanding the competitive landscape is crucial for Cotton States to effectively position itself and differentiate its offerings.

Key Competitors

Cotton States Insurance competes with a range of insurance companies across various segments, including:

- National Carriers: Companies like State Farm, Allstate, and Nationwide offer a broad range of insurance products with extensive nationwide coverage.

- Regional Insurers: These companies, such as Southern Farm Bureau and Blue Cross Blue Shield, often specialize in specific regions and cater to local market needs.

- Direct-to-Consumer Insurers: Companies like Geico and Progressive operate primarily online, offering competitive pricing and streamlined processes.

- Independent Agents: These agents represent multiple insurance companies, providing clients with a range of options and personalized service.

Comparison with Competitors

Cotton States Insurance differentiates itself through a combination of factors, including:

- Pricing: Cotton States strives to offer competitive pricing, often aligning with or slightly below the industry average. While national carriers may offer lower rates in certain segments, Cotton States focuses on providing value through its services and customer experience.

- Product Offerings: Cotton States offers a comprehensive suite of insurance products, including auto, home, business, and life insurance. While its product portfolio may not be as extensive as some national carriers, it provides a solid selection to meet the needs of its target audience.

- Customer Service: Cotton States emphasizes personalized service and a focus on building long-term relationships with its customers. It often outperforms competitors in customer satisfaction surveys, demonstrating its commitment to providing a positive and responsive experience.

Competitive Advantages and Disadvantages

Cotton States Insurance possesses several key advantages, including:

- Regional Expertise: As a regional insurer, Cotton States has a deep understanding of the specific needs and risks of its target market, enabling it to provide tailored solutions.

- Strong Community Presence: Cotton States is often deeply embedded in the communities it serves, building trust and loyalty among its customers. This local focus can be a significant advantage over national carriers.

- Personalized Service: Cotton States emphasizes personalized service, providing customers with dedicated agents who can offer tailored advice and support.

However, Cotton States also faces some challenges, including:

- Limited Brand Recognition: Compared to national carriers, Cotton States has a smaller brand footprint, which can limit its reach and visibility.

- Resource Constraints: As a regional insurer, Cotton States may have fewer resources available for marketing, product development, and technology compared to its larger competitors.

- Competition from Direct-to-Consumer Insurers: The rise of direct-to-consumer insurers like Geico and Progressive poses a challenge to traditional insurance companies, as these companies often offer lower prices and convenient online platforms.

Financial Performance

Cotton States Insurance’s financial performance is a crucial indicator of its stability, growth potential, and ability to meet its obligations to policyholders. This section delves into the company’s key financial metrics, analyzing their implications and exploring the impact of industry trends and economic factors on its performance.

Key Financial Metrics

The financial performance of Cotton States Insurance is assessed through various key metrics, including:

- Premium Revenue: This metric reflects the total amount of money collected from policyholders for insurance coverage. Growth in premium revenue indicates an expanding customer base and increased market share.

- Loss Ratio: This metric measures the percentage of premium revenue spent on claims and other expenses related to insured events. A lower loss ratio signifies efficient claims management and profitability.

- Combined Ratio: This metric combines the loss ratio with the expense ratio, which represents the percentage of premium revenue spent on administrative and operating expenses. A combined ratio below 100% indicates profitability, while a ratio above 100% suggests losses.

- Underwriting Profitability: This metric assesses the profitability of the insurance business, considering factors such as premium revenue, claims, and operating expenses.

- Return on Equity (ROE): This metric measures the company’s profitability relative to its shareholder equity. A higher ROE indicates efficient use of capital and strong financial performance.

Impact of Industry Trends and Economic Factors

The insurance industry is constantly evolving, influenced by factors such as:

- Technological Advancements: Digitalization and data analytics are transforming insurance operations, impacting customer experience, risk assessment, and claims processing.

- Regulatory Changes: New regulations and compliance requirements can affect insurance pricing, underwriting practices, and overall operating costs.

- Economic Conditions: Economic downturns can lead to increased claims frequency and severity, while economic growth can boost insurance demand.

- Natural Disasters: Catastrophic events, such as hurricanes and earthquakes, can significantly impact insurance companies’ financial performance.

Financial Stability and Growth

Cotton States Insurance’s financial performance is a reflection of its commitment to providing reliable insurance coverage and managing its operations effectively. The company’s focus on financial stability and growth is evident in its:

- Strong Capitalization: Maintaining adequate capital reserves allows the company to absorb unexpected losses and continue operating smoothly.

- Effective Risk Management: Implementing robust risk management practices helps mitigate potential losses and ensure the company’s financial stability.

- Strategic Investments: Investing in technology and innovation helps improve operational efficiency, enhance customer experience, and drive long-term growth.

Industry Trends and Future Outlook: Cotton States Insurance

The insurance industry is constantly evolving, driven by technological advancements, changing customer expectations, and evolving risk profiles. Understanding these trends is crucial for Cotton States Insurance to adapt and thrive in the future.

Emerging Trends in the Insurance Industry

The insurance industry is experiencing a wave of innovation, fueled by technological advancements and changing consumer preferences. Here are some key emerging trends:

- Digital Transformation: The rise of digital technologies, such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT), is transforming the insurance industry. AI-powered chatbots and virtual assistants are enhancing customer service, while blockchain is being used to streamline claims processing and improve data security. IoT devices are enabling insurers to collect real-time data on risk factors, leading to more personalized pricing and risk management strategies.

- Personalized Insurance: Customers are increasingly demanding personalized insurance solutions tailored to their specific needs and risk profiles. Insurers are responding by leveraging data analytics and AI to offer customized policies, pricing, and services.

- Insurtech: The emergence of insurtech startups is disrupting the traditional insurance model. These companies are using technology to offer innovative insurance products, services, and distribution channels, challenging established players in the market.

- Focus on Customer Experience: Customers expect seamless and convenient insurance experiences. Insurers are investing in digital platforms, mobile apps, and personalized communication to enhance customer engagement and satisfaction.

Impact of Emerging Trends on Cotton States Insurance

These emerging trends present both opportunities and challenges for Cotton States Insurance. The company can leverage these trends to enhance its competitiveness and customer value proposition:

- Embrace Digital Technologies: Cotton States Insurance should invest in AI, blockchain, and IoT technologies to streamline operations, improve customer service, and develop innovative products and services. For example, AI-powered chatbots can handle routine customer inquiries, freeing up agents to focus on complex issues.

- Personalize Insurance Offerings: By leveraging data analytics and AI, Cotton States Insurance can create personalized insurance packages that cater to the specific needs of its customers. This can involve offering discounts based on individual risk profiles or developing tailored coverage options.

- Partner with Insurtech Companies: Collaborating with insurtech startups can provide Cotton States Insurance with access to innovative technologies, distribution channels, and customer insights. This can help the company stay ahead of the curve and meet evolving customer demands.

- Enhance Customer Experience: Cotton States Insurance should prioritize customer experience by investing in user-friendly digital platforms, mobile apps, and personalized communication channels. This will enhance customer satisfaction and loyalty.

Future Outlook for Cotton States Insurance

Given the dynamic nature of the insurance industry, Cotton States Insurance’s future outlook is positive, but it requires a proactive approach to capitalize on emerging trends. The company’s focus on customer experience, combined with its commitment to innovation and technology adoption, positions it well for success in the years to come.

“Cotton States Insurance is well-positioned to thrive in the evolving insurance landscape. By embracing emerging trends and focusing on customer-centricity, the company can continue to deliver exceptional value to its customers and achieve sustainable growth.”

Closing Summary

As Cotton States Insurance navigates the ever-changing insurance landscape, its dedication to innovation and customer-centricity remains paramount. The company continues to expand its reach, introduce new products, and enhance its digital offerings, ensuring that it remains a reliable and responsive partner for its customers in the years to come. The company’s commitment to providing exceptional customer service, coupled with its financial stability and robust product portfolio, positions Cotton States Insurance for continued success in the insurance market.

Common Queries

What types of insurance does Cotton States offer?

Cotton States Insurance offers a variety of insurance products, including auto, home, health, life, and business insurance.

Where is Cotton States Insurance headquartered?

Cotton States Insurance is headquartered in Atlanta, Georgia.

Does Cotton States Insurance offer online quotes?

Yes, Cotton States Insurance provides online quotes for various insurance products on their website.

How can I contact Cotton States Insurance customer service?

You can contact Cotton States Insurance customer service through their website, phone number, or email address.