State minimum auto insurance, often referred to as “liability-only” coverage, is the minimum amount of insurance required by law in each state. This coverage protects you financially if you’re at fault in an accident, but it may not cover all your potential losses. Understanding the limitations of state minimum insurance is crucial for ensuring you’re adequately protected on the road.

While state minimum insurance fulfills the legal requirement, it often falls short of providing comprehensive protection. This means that in the event of an accident, you might be personally liable for expenses exceeding your coverage limits, leaving you facing significant financial burdens.

What is State Minimum Auto Insurance?

State minimum auto insurance is a type of insurance that meets the minimum requirements set by your state. It is designed to provide basic financial protection in case you are involved in an accident. This coverage is essential for all drivers, as it can help to cover the costs of damages, injuries, and other expenses related to an accident.

The Purpose of State Minimum Auto Insurance

State minimum auto insurance serves as a safety net for drivers, ensuring that they have a basic level of financial protection in case of an accident. It helps to cover the costs of damages to other vehicles or property, as well as medical expenses for injuries caused by an accident. The purpose is to ensure that all drivers have a minimum level of financial responsibility, protecting both themselves and others on the road.

Defining State Minimum Auto Insurance

State minimum auto insurance is a legal requirement in most states. It refers to the minimum amount of coverage that drivers must have to operate a vehicle legally. This coverage varies by state, with each state having its own specific requirements for liability, medical payments, and other coverage.

Key Components of State Minimum Auto Insurance

State minimum auto insurance typically includes several key components, each providing a specific type of coverage:

- Liability Coverage: This covers damages to other vehicles or property if you are at fault in an accident. It typically includes both bodily injury liability (BI) and property damage liability (PD).

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses.

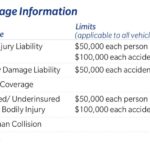

Understanding Coverage Limits

State minimum auto insurance provides the bare minimum coverage required by law. Understanding the coverage limits associated with each type of insurance is crucial for knowing your financial responsibility in case of an accident.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical expenses, lost wages, property damage, and legal fees. State minimum liability coverage typically includes:

- Bodily Injury Liability: This coverage pays for injuries to other people in an accident you cause. It’s usually expressed as a per-person limit and a per-accident limit. For example, 25/50 coverage means up to $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damage to another person’s property, such as their car, in an accident you cause. The coverage limit is usually expressed as a single dollar amount, such as $10,000.

Medical Payments Coverage

Medical payments coverage (Med Pay) covers your medical expenses, regardless of who is at fault in an accident. It’s often called “personal injury protection” (PIP) in some states. The coverage limit is usually expressed as a single dollar amount, such as $1,000. This coverage applies to you and your passengers in your vehicle.

Uninsured Motorist Coverage

Uninsured motorist coverage (UM) protects you if you’re involved in an accident with an uninsured or hit-and-run driver. It covers your medical expenses, lost wages, and property damage. The coverage limit is usually the same as your liability coverage.

Underinsured Motorist Coverage

Underinsured motorist coverage (UIM) protects you if you’re involved in an accident with a driver who has insurance, but their coverage limits are not enough to cover your losses. The coverage limit is usually the same as your liability coverage.

Collision Coverage

Collision coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of who is at fault. It’s usually optional, but it’s often required if you have a loan on your vehicle. Collision coverage has a deductible, which is the amount you pay out of pocket before your insurance kicks in.

Comprehensive Coverage, State minimum auto insurance

Comprehensive coverage pays for repairs to your vehicle if it’s damaged by something other than a collision, such as theft, vandalism, or a natural disaster. It’s usually optional, but it’s often required if you have a loan on your vehicle. Comprehensive coverage also has a deductible.

Impact of Coverage Limits

The coverage limits you choose for your auto insurance policy determine how much your insurance company will pay if you’re involved in an accident. If your coverage limits are too low, you could be responsible for paying out-of-pocket for your own expenses and the expenses of others. For example, if you cause an accident that results in $50,000 in damages, but your liability coverage limit is only $25,000, you’ll be responsible for the remaining $25,000.

Factors Influencing Minimum Requirements

State minimum auto insurance requirements are designed to protect drivers and their victims in the event of an accident. These requirements vary significantly from state to state, reflecting a variety of factors.

Factors Influencing Minimum Requirements

A number of factors influence the minimum auto insurance requirements in each state. These factors include:

- Population Density and Traffic Volume: States with higher population densities and traffic volumes often have stricter minimum insurance requirements. This is because the risk of accidents is higher in these areas. For example, states like California and New York have higher minimum coverage requirements compared to states with lower population densities, such as Wyoming or Montana.

- Cost of Living: The cost of living in a state, including medical expenses and vehicle repair costs, can influence minimum insurance requirements. States with higher costs of living may have higher minimum coverage limits to ensure adequate financial protection for accident victims. For example, states like New York and Massachusetts, which have higher costs of living, have higher minimum coverage requirements compared to states with lower costs of living, such as Arkansas or Mississippi.

- Economic Conditions: States with strong economies may have higher minimum insurance requirements because drivers have more disposable income to afford higher coverage limits. States with weaker economies may have lower minimum requirements to make insurance more affordable for residents. For example, states like California and Texas, which have strong economies, have higher minimum coverage requirements compared to states with weaker economies, such as West Virginia or Mississippi.

- Legislative Priorities: State legislatures set minimum auto insurance requirements based on their priorities. Some states prioritize protecting accident victims, while others prioritize affordability for drivers. This can lead to significant variations in minimum coverage requirements across states. For example, states like New York and Massachusetts, which prioritize protecting accident victims, have higher minimum coverage requirements compared to states like Arkansas or Mississippi, which prioritize affordability for drivers.

- Political Climate: The political climate in a state can also influence minimum auto insurance requirements. States with more liberal political climates may have stricter minimum requirements, while states with more conservative political climates may have lower minimum requirements. For example, states like California and New York, which have more liberal political climates, have higher minimum coverage requirements compared to states like Texas or Florida, which have more conservative political climates.

State-by-State Variations

The factors mentioned above result in significant variations in minimum auto insurance requirements across states.

| State | Bodily Injury Liability per Person | Bodily Injury Liability per Accident | Property Damage Liability | Uninsured Motorist Coverage |

|---|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 | $15,000/$30,000 |

| Texas | $30,000 | $60,000 | $25,000 | $25,000/$50,000 |

| New York | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Florida | $10,000 | $20,000 | $10,000 | $10,000/$20,000 |

| Wyoming | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

The Role of Financial Responsibility Laws

Financial responsibility laws are designed to protect the public from drivers who may cause accidents and are unable to cover the resulting damages. These laws ensure that drivers have the financial means to compensate victims for injuries, property damage, and other losses arising from accidents.

State Minimum Auto Insurance Requirements

State minimum auto insurance requirements are a key component of financial responsibility laws. These requirements establish the minimum coverage levels that drivers must carry to meet the financial responsibility obligations. The minimum coverage levels vary by state and typically include:

* Bodily Injury Liability: This coverage protects you if you injure someone in an accident.

* Property Damage Liability: This coverage protects you if you damage someone else’s property in an accident.

* Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

By mandating minimum coverage levels, states aim to ensure that drivers have adequate financial resources to cover potential accident-related costs. This helps protect victims and prevent them from having to bear the financial burden of another driver’s negligence.

Consequences for Failing to Comply with Financial Responsibility Laws

Drivers who fail to comply with financial responsibility laws face serious consequences, including:

* Fines and Penalties: Failure to maintain the required minimum insurance coverage can result in fines and penalties.

* License Suspension: In many states, drivers who fail to maintain insurance can have their licenses suspended until they comply with the law.

* Vehicle Impoundment: In some cases, vehicles may be impounded until the driver provides proof of insurance.

* Jail Time: In extreme cases, failure to comply with financial responsibility laws can result in jail time.

These consequences serve as a deterrent to drivers who may be tempted to forgo insurance and emphasize the importance of complying with state regulations.

Additional Considerations

While state minimum auto insurance fulfills the legal requirements, it might not offer adequate protection for you and your assets in the event of an accident. Consider the potential consequences of a serious accident, including medical bills, property damage, and lost wages.

Purchasing additional coverage beyond the minimum can provide peace of mind and financial security.

Impact of Personal Circumstances

Personal circumstances can significantly impact your insurance needs. Factors such as your age, driving history, vehicle type, and location can influence your risk profile.

- Young drivers are statistically more likely to be involved in accidents, so they might need higher coverage limits.

- Drivers with a history of accidents or violations may face higher premiums and may need more coverage to offset their increased risk.

- Drivers of luxury or high-performance vehicles often require more coverage to reflect the higher cost of repairs or replacement.

- Drivers living in urban areas with higher traffic density and accident rates may need more comprehensive coverage.

Key Considerations for Choosing Coverage

Choosing the right auto insurance coverage involves a careful assessment of your individual needs and financial situation. Here’s a guide to help you make informed decisions:

- Liability Coverage: This is essential to protect you financially if you are found liable for an accident. Consider increasing your liability limits to ensure you have sufficient coverage in case of a serious accident.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of fault. If you have a newer car or a car with a high loan balance, consider purchasing collision coverage.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. If you have a newer car or a car with a high loan balance, consider purchasing comprehensive coverage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It is highly recommended to purchase this coverage, as it can provide crucial financial protection in the event of an accident with an uninsured driver.

- Medical Payments Coverage: This covers your medical expenses, regardless of fault, if you are injured in an accident. It is a valuable addition to your coverage, as it can help offset medical costs that may not be covered by your health insurance.

- Rental Car Coverage: This covers the cost of a rental car if your vehicle is damaged in an accident and is being repaired. This coverage can be helpful if you rely on your vehicle for transportation and cannot afford to be without it while it is being repaired.

Final Summary

In conclusion, while state minimum auto insurance fulfills legal requirements, it’s essential to assess your individual needs and consider additional coverage options. By understanding the limitations of state minimum insurance and taking proactive steps to secure adequate protection, you can drive with greater peace of mind and safeguard your financial well-being in the face of unforeseen circumstances.

FAQ Summary: State Minimum Auto Insurance

What happens if I’m in an accident and only have state minimum insurance?

If you’re at fault in an accident and only have state minimum insurance, your coverage may not be sufficient to cover the other driver’s injuries and property damage. You could be personally liable for the remaining costs.

Can I get lower car insurance rates if I only have state minimum insurance?

Yes, state minimum insurance usually has the lowest premiums. However, it’s important to remember that lower premiums come with lower coverage, which could leave you financially vulnerable in an accident.

What are some examples of additional coverage beyond state minimum?

Common additional coverages include collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP).