Cheap car insurance wa state – Cheap car insurance in Washington State is a hot topic, especially for those looking to save money while maintaining adequate coverage. Navigating the world of car insurance can be daunting, but understanding the key factors that influence your premiums can empower you to find the best deal. From understanding the minimum liability requirements to exploring available discounts, this guide will equip you with the knowledge you need to make informed decisions about your car insurance in Washington.

This guide delves into the intricacies of car insurance in Washington, providing insights into the different types of coverage, the factors affecting your rates, and strategies for finding affordable options. We’ll also explore various discounts and tips for lowering your premiums, helping you secure the best possible coverage at a price that fits your budget.

Understanding Washington State Car Insurance: Cheap Car Insurance Wa State

Driving in Washington state requires you to have car insurance, which protects you and others in case of accidents. This insurance covers various aspects of potential damages and liabilities, ensuring financial protection for everyone involved. Let’s delve deeper into the types of coverage required in Washington and the factors that influence insurance rates.

Required Car Insurance Coverage in Washington

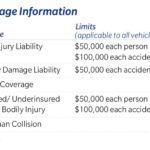

Washington state mandates that all drivers carry specific car insurance coverage. This coverage protects you financially in case of an accident. Here’s a breakdown of the required coverage:

- Liability Coverage: This coverage is essential and protects you from financial responsibility for damages or injuries you cause to others in an accident. Liability coverage is divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other related costs for injuries you cause to others. Washington requires a minimum of $25,000 per person and $50,000 per accident.

- Property Damage Liability: This covers damages to another person’s vehicle or property that you cause in an accident. Washington requires a minimum of $10,000 per accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. Washington requires a minimum of $25,000 per person and $50,000 per accident for this coverage.

Factors Affecting Car Insurance Rates in Washington

Your car insurance premiums in Washington are determined by several factors, including:

- Driving Record: Your driving history plays a significant role in your insurance rates. A clean driving record with no accidents or traffic violations will typically result in lower premiums. On the other hand, a history of accidents, speeding tickets, or DUI convictions will likely increase your rates.

- Vehicle Type: The type of vehicle you drive is another key factor. Sports cars and luxury vehicles are generally more expensive to insure than standard cars, as they are often associated with higher repair costs and potential for higher-risk driving.

- Age and Gender: Your age and gender can also affect your insurance rates. Younger drivers, especially those under 25, are often considered higher risk due to their lack of experience. Similarly, insurance companies may consider certain genders to be more prone to accidents, although this practice is being challenged and is subject to change.

- Location: Where you live in Washington can influence your insurance rates. Areas with higher traffic density and more accidents tend to have higher premiums. This is because insurance companies have to pay out more claims in these areas.

- Credit Score: In some states, including Washington, insurance companies may use your credit score to determine your insurance rates. A good credit score is generally associated with lower premiums, while a poor credit score can lead to higher rates.

Finding Affordable Car Insurance Options

Finding the best car insurance in Washington State can be challenging, especially when you’re looking for affordable options. This section will help you navigate the process by providing insights into crucial factors to consider when comparing quotes and offering valuable tips to lower your premiums.

Key Factors for Comparing Car Insurance Quotes

It’s important to compare quotes from different car insurance providers to ensure you’re getting the best deal. When comparing quotes, consider these factors:

- Coverage Options: Different providers offer various coverage options, such as liability, collision, comprehensive, and uninsured motorist coverage. Ensure you understand the coverage levels provided by each provider and choose the options that best suit your needs and budget.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles typically result in lower premiums. Consider your risk tolerance and financial situation when choosing your deductible.

- Discounts: Many car insurance providers offer discounts for various factors, such as safe driving records, good credit scores, multiple car insurance policies, and safety features in your vehicle. Inquire about available discounts and ensure you’re taking advantage of all applicable ones.

- Customer Service: Consider the reputation of the insurance provider and their customer service record. Read reviews, check online ratings, and contact the provider directly to assess their responsiveness and helpfulness.

Tips for Lowering Car Insurance Premiums

Here are some effective strategies for lowering your car insurance premiums in Washington State:

- Improve Your Driving Record: A clean driving record is crucial for lower premiums. Avoid traffic violations and accidents to maintain a good driving history.

- Increase Your Deductible: As mentioned earlier, a higher deductible can lead to lower premiums. Consider raising your deductible if you’re comfortable with a higher out-of-pocket expense in case of an accident.

- Bundle Your Policies: Many insurance providers offer discounts for bundling multiple policies, such as home, renters, or life insurance, with your car insurance. Consider bundling your policies to save money.

- Shop Around Regularly: Don’t be afraid to shop around for car insurance quotes periodically, even if you’re satisfied with your current provider. Rates can change, and you may find better deals elsewhere.

- Consider a Usage-Based Insurance Program: Some providers offer usage-based insurance programs that track your driving habits using a device plugged into your car. If you’re a safe driver, you could potentially qualify for lower premiums based on your driving data.

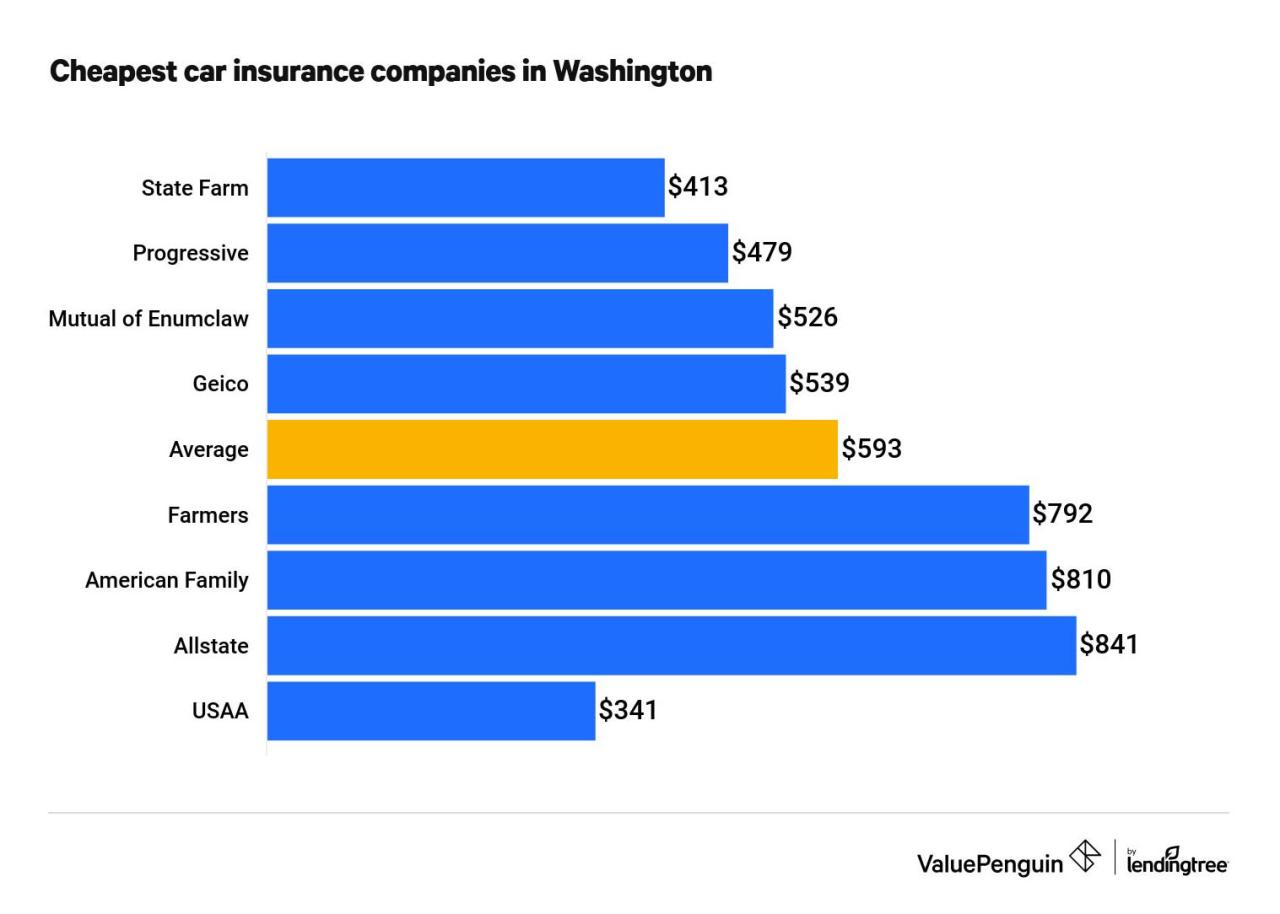

Comparing Car Insurance Providers in Washington State, Cheap car insurance wa state

Several reputable car insurance providers operate in Washington State. Here’s a comparison of some popular options:

| Provider | Strengths | Weaknesses |

|---|---|---|

| Geico | Known for competitive rates, strong customer service, and convenient online tools. | May not offer as many discounts as other providers. |

| State Farm | Offers a wide range of coverage options, strong customer service, and a large network of agents. | Rates can be higher than some competitors. |

| Progressive | Known for its personalized coverage options, usage-based insurance program, and online quote comparison tool. | May have a higher deductible than other providers. |

| Farmers | Offers a variety of discounts, strong customer service, and a focus on rural areas. | May not be as widely available in urban areas. |

Exploring Discount Opportunities

In Washington state, car insurance companies offer a variety of discounts to help policyholders save money. These discounts can be substantial, so it’s important to understand what’s available and how to qualify.

Common Car Insurance Discounts in Washington

Discounts can help lower your premiums significantly. Knowing the available options and how to qualify can save you money. Here are some common car insurance discounts offered in Washington:

- Good Driver Discount: This is one of the most common discounts, and it’s awarded to drivers with a clean driving record. To qualify, you typically need to have no accidents or traffic violations for a certain period, usually three to five years.

- Safe Driver Discount: This discount is similar to the good driver discount, but it may be based on specific driving habits, such as avoiding speeding or using a telematics device that tracks your driving behavior.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you can often get a discount on your premiums. This discount is typically a percentage off your overall premium, and the amount can vary depending on the insurer.

- Multi-Policy Discount: If you bundle your car insurance with other types of insurance, such as home or renters insurance, you can often get a discount on your premiums. This discount is usually a percentage off your overall premium, and the amount can vary depending on the insurer.

- Good Student Discount: This discount is available to students who maintain a certain grade point average (GPA). The GPA requirement varies by insurer, but it’s typically around 3.0 or higher.

- Defensive Driving Course Discount: Taking a defensive driving course can help you learn safe driving practices and may qualify you for a discount on your car insurance. The amount of the discount can vary depending on the insurer.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as an alarm system or GPS tracker, can make your vehicle less attractive to thieves and may qualify you for a discount.

- Loyalty Discount: Some insurance companies offer discounts to customers who have been with them for a certain period. The amount of the discount can vary depending on the insurer and the length of your policy.

- Payment Plan Discount: Some insurers offer discounts to customers who pay their premiums in full upfront or who choose to pay their premiums on a monthly basis.

Table of Common Car Insurance Discounts

Here’s a table summarizing common car insurance discounts and their eligibility criteria:

| Discount | Eligibility Criteria |

|---|---|

| Good Driver Discount | Clean driving record with no accidents or traffic violations for a certain period (usually 3-5 years) |

| Safe Driver Discount | Safe driving habits, such as avoiding speeding or using a telematics device that tracks your driving behavior |

| Multi-Car Discount | Insuring multiple vehicles with the same company |

| Multi-Policy Discount | Bundling car insurance with other types of insurance, such as home or renters insurance |

| Good Student Discount | Maintaining a certain GPA (typically 3.0 or higher) |

| Defensive Driving Course Discount | Completing a defensive driving course |

| Anti-theft Device Discount | Installing anti-theft devices in your car, such as an alarm system or GPS tracker |

| Loyalty Discount | Being a customer with the same insurance company for a certain period |

| Payment Plan Discount | Paying premiums in full upfront or choosing a monthly payment plan |

Evaluating Insurance Coverage

Choosing the right car insurance coverage is crucial in Washington state, as it safeguards you financially in case of accidents or other unforeseen events. Understanding the different coverage options and their benefits will help you make an informed decision that aligns with your needs and budget.

Understanding Different Coverage Options

Here’s a table comparing various car insurance coverage options and their benefits:

| Coverage Type | Description | Benefits |

|---|---|---|

| Liability Coverage | Covers damages to other people’s property and injuries caused by you in an accident. | Protects you from financial ruin if you are at fault in an accident. |

| Collision Coverage | Covers damages to your own vehicle in an accident, regardless of fault. | Repairs or replaces your vehicle if it’s damaged in an accident, even if you are at fault. |

| Comprehensive Coverage | Covers damages to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters. | Protects your vehicle from a wide range of risks beyond accidents. |

| Uninsured/Underinsured Motorist Coverage | Covers your damages if you are hit by an uninsured or underinsured driver. | Provides financial protection in cases where the other driver lacks sufficient insurance to cover your losses. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. | Offers financial assistance for medical bills and lost income following an accident, even if you are at fault. |

Evaluating the Advantages and Disadvantages of Each Coverage

Each coverage type offers specific advantages and disadvantages. Consider these factors when deciding which coverage options are best for you:

- Liability Coverage: This coverage is mandatory in Washington state and provides essential protection for others involved in an accident. It’s generally recommended to have high limits to ensure adequate coverage. However, it does not cover damages to your own vehicle.

- Collision Coverage: This coverage is optional but highly recommended for newer or financed vehicles. It provides financial protection for your own vehicle, regardless of fault. However, it comes with a deductible, which is the amount you pay out-of-pocket before the insurance kicks in.

- Comprehensive Coverage: This coverage is also optional and offers protection against various risks beyond accidents. It’s beneficial for newer vehicles or those with high value. However, it may be less necessary for older vehicles with lower market value.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial in Washington state, as it protects you from financial losses caused by drivers without sufficient insurance. It’s essential for peace of mind, as it covers your damages and medical expenses if you are hit by an uninsured or underinsured driver.

- Personal Injury Protection (PIP): This coverage is also mandatory in Washington state and offers financial assistance for medical expenses and lost wages. It provides valuable protection for you and your passengers, regardless of fault. However, it has limits on the amount of coverage provided.

Determining Essential Coverage Types

The essential coverage types for you depend on your individual circumstances. Here are some examples of situations where specific coverage types might be essential:

- If you have a newer or financed vehicle: Collision and comprehensive coverage are highly recommended to protect your investment.

- If you drive an older vehicle with low market value: Collision and comprehensive coverage may not be necessary, as the cost of repairs may exceed the value of the vehicle.

- If you drive in a high-traffic area or have a long commute: Liability coverage with high limits is crucial to protect yourself from potential financial liabilities.

- If you have a family or passengers: PIP coverage is essential to ensure financial protection for medical expenses and lost wages.

- If you are concerned about uninsured or underinsured drivers: Uninsured/Underinsured Motorist coverage provides valuable protection against financial losses caused by these drivers.

Navigating the Insurance Process

Once you’ve chosen an insurance company and a policy that meets your needs, you’ll need to navigate the insurance process. This involves obtaining a quote, understanding the policy terms, and filing a claim if needed.

Obtaining a Car Insurance Quote

Getting a car insurance quote in Washington is a straightforward process. You can obtain quotes online, over the phone, or in person. To get an accurate quote, you’ll need to provide the following information:

- Your personal information (name, address, date of birth, etc.)

- Your driving history (including any accidents or violations)

- Your vehicle information (make, model, year, VIN)

- Your desired coverage levels

Once you provide this information, the insurance company will generate a quote based on their risk assessment.

Filing a Car Insurance Claim

If you’re involved in an accident, you’ll need to file a claim with your insurance company. The process for filing a claim varies by company, but generally involves the following steps:

- Contact your insurance company as soon as possible after the accident.

- Provide them with the details of the accident, including the date, time, location, and any injuries or damages.

- File a police report if necessary.

- Gather evidence to support your claim, such as photos of the damage, witness statements, and medical records.

Your insurance company will investigate the claim and determine if you’re eligible for coverage. If your claim is approved, they will pay for the damages or injuries according to the terms of your policy.

Understanding Policy Terms and Conditions

It’s crucial to understand the terms and conditions of your car insurance policy. This will help you know what coverage you have, what your responsibilities are, and how to file a claim.

Some key terms to understand include:

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in.

- Premium: The amount you pay for your insurance coverage.

- Coverage limits: The maximum amount your insurance company will pay for covered losses.

- Exclusions: Specific events or circumstances that are not covered by your insurance policy.

If you have any questions about your policy, don’t hesitate to contact your insurance company for clarification.

Closing Notes

Finding cheap car insurance in Washington State requires a strategic approach. By understanding the nuances of car insurance in the state, exploring available discounts, and comparing quotes from different providers, you can secure the best possible coverage at a price that aligns with your needs. Remember, your car insurance is a vital safety net, and finding the right balance between affordability and protection is crucial.

FAQ Explained

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or even more frequently if you experience significant life changes, such as a change in driving habits, a new car purchase, or a move to a different location.

What happens if I get into an accident without enough car insurance?

If you’re involved in an accident and don’t have enough car insurance coverage, you could face serious financial consequences, including hefty legal fees, medical expenses, and property damage costs. You might also lose your driving privileges.

What is SR-22 insurance?

SR-22 insurance is a certificate of financial responsibility required by the state of Washington for drivers who have had their licenses suspended due to certain violations, such as driving without insurance or a DUI.