State Auto Home Insurance offers a comprehensive approach to safeguarding your home, ensuring peace of mind and financial security. Established with a strong commitment to customer satisfaction, State Auto provides a wide range of coverage options tailored to meet diverse needs. Whether you own a modest starter home or a sprawling estate, State Auto offers customizable policies designed to protect your most valuable asset.

State Auto’s commitment to personalized service shines through its dedication to understanding individual customer requirements. They go beyond simply providing insurance; they strive to build lasting relationships with their policyholders. By combining competitive rates with exceptional customer support, State Auto has become a trusted name in the home insurance industry.

State Auto Insurance Overview

State Auto Insurance is a well-established insurance company with a rich history and a strong commitment to providing reliable and affordable insurance solutions. Founded in 1921, State Auto has grown to become a leading provider of personal and commercial insurance products across the United States.

History

State Auto Insurance was founded in 1921 in Columbus, Ohio, by a group of businessmen who recognized the need for a reliable and affordable insurance option for the growing automobile market. The company began by offering automobile insurance and has since expanded its product offerings to include a wide range of insurance solutions for individuals and businesses.

Mission and Core Values

State Auto Insurance is guided by a mission to provide its customers with exceptional insurance products and services that meet their unique needs. The company is committed to building strong relationships with its customers, employees, and business partners, based on the core values of integrity, customer focus, teamwork, and innovation.

Key Services Offered

State Auto Insurance offers a comprehensive range of insurance products and services to meet the diverse needs of its customers.

Personal Insurance

State Auto offers a wide variety of personal insurance products, including:

- Auto insurance: Provides coverage for damage to your vehicle and liability protection in case of an accident.

- Homeowners insurance: Protects your home and belongings against damage caused by fire, theft, and other covered perils.

- Renters insurance: Provides coverage for your personal belongings and liability protection in case of an accident in your rental property.

- Life insurance: Provides financial protection for your loved ones in the event of your death.

- Health insurance: Offers coverage for medical expenses, including hospital stays, doctor visits, and prescription drugs.

Commercial Insurance

State Auto also provides a comprehensive suite of commercial insurance products to protect businesses of all sizes, including:

- Business property insurance: Protects your business property against damage caused by fire, theft, and other covered perils.

- General liability insurance: Provides protection against lawsuits and claims arising from accidents or injuries that occur on your business premises.

- Workers’ compensation insurance: Provides coverage for medical expenses and lost wages for employees who are injured or become ill on the job.

- Commercial auto insurance: Protects your business vehicles against damage and liability in case of an accident.

- Professional liability insurance: Provides protection for professionals against claims arising from errors or omissions in their work.

Other Services

In addition to its core insurance products, State Auto also offers a range of other services, such as:

- Financial planning: Provides guidance and support to help you achieve your financial goals.

- Claims assistance: Offers 24/7 support to help you file and manage your insurance claims.

- Customer service: Provides personalized support to answer your questions and address your concerns.

Home Insurance Coverage Options

State Auto offers various home insurance coverage options to meet your specific needs and protect your property. These options provide different levels of protection, so it’s important to understand the benefits and limitations of each to choose the right coverage for your situation.

Dwelling Coverage

Dwelling coverage is the most essential part of your home insurance policy, providing financial protection against damage to your home’s structure. This coverage protects your home’s physical structure, including walls, roof, foundation, and attached structures like garages and porches. It covers damages caused by various perils, such as fire, windstorm, hail, vandalism, and theft. However, it’s important to note that dwelling coverage does not cover damage caused by events excluded from your policy, such as earthquakes or floods.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. This coverage reimburses you for the value of your possessions lost or damaged due to covered perils. The amount of personal property coverage you need depends on the value of your belongings.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or you are found liable for damages to another person’s property. This coverage can help pay for medical expenses, legal fees, and settlements. The amount of liability coverage you need depends on your individual circumstances and risk factors.

Other Coverage Options

State Auto offers additional coverage options to enhance your home insurance protection, including:

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages if you or a member of your household is injured in an accident on your property.

- Medical Payments Coverage: This coverage pays for medical expenses for anyone injured on your property, regardless of fault.

- Loss of Use Coverage: This coverage provides financial assistance if you are unable to live in your home due to a covered loss. It helps cover expenses like temporary housing and living costs.

- Additional Living Expenses (ALE): This coverage helps cover additional living expenses, such as hotel bills and meals, while your home is being repaired after a covered loss.

Common Home Insurance Claims

Common home insurance claims include:

- Fire: Fires can cause significant damage to your home and belongings. State Auto will cover the cost of repairs or replacement of your home and personal property.

- Windstorm and Hail: Windstorms and hail can damage your roof, siding, and windows. State Auto will cover the cost of repairs or replacement of damaged components.

- Vandalism and Theft: Vandalism and theft can result in damage to your home and loss of personal property. State Auto will cover the cost of repairs and replacement of stolen or damaged items.

- Water Damage: Water damage can occur due to burst pipes, flooding, or other causes. State Auto will cover the cost of repairs or replacement of damaged areas.

State Auto’s Claims Process

State Auto has a straightforward claims process to ensure a smooth and efficient experience. Here are the general steps:

- Report the Claim: Contact State Auto immediately after a covered loss to report the claim. You can do this by phone, online, or through your agent.

- Investigation: State Auto will investigate the claim to determine the extent of the damage and the cause of the loss.

- Assessment: Once the investigation is complete, State Auto will assess the damage and determine the amount of coverage.

- Payment: State Auto will issue payment for the covered losses, either directly to you or to your repair contractor.

State Auto’s Home Insurance Features: State Auto Home Insurance

State Auto offers a variety of features and benefits with their home insurance policies, designed to provide comprehensive coverage and peace of mind. These features are tailored to meet the diverse needs of homeowners, encompassing protection against various perils, discounts, and customer service options.

Discounts Available

State Auto offers a wide range of discounts to help homeowners save on their premiums. These discounts can be categorized as follows:

- Safety Discounts: State Auto rewards homeowners who take steps to make their homes safer. For example, installing smoke detectors, burglar alarms, and fire sprinklers can qualify for discounts.

- Loyalty Discounts: State Auto values long-term customers and often provides discounts for those who have been insured with them for a certain period.

- Bundling Discounts: Homeowners who bundle their home and auto insurance with State Auto can often qualify for significant discounts.

- Other Discounts: State Auto may offer discounts based on factors such as homeowner’s age, occupation, and credit score.

Coverage Limits

State Auto provides flexible coverage limits to suit the specific needs of homeowners. The coverage limits typically include:

- Dwelling Coverage: This covers the structure of your home, including the attached garage and any permanent fixtures.

- Personal Property Coverage: This covers your belongings inside your home, such as furniture, electronics, and clothing.

- Liability Coverage: This protects you if someone is injured on your property or if you are held liable for property damage caused by you or a member of your household.

- Additional Living Expenses: This covers your expenses if you are unable to live in your home due to a covered loss, such as a fire or a natural disaster.

Customer Service Options

State Auto provides a variety of customer service options to ensure a seamless and positive experience for policyholders.

- 24/7 Customer Service: State Auto offers 24/7 customer service via phone, email, and online chat.

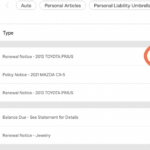

- Online Account Management: Policyholders can manage their policies online, including making payments, updating contact information, and filing claims.

- Mobile App: State Auto provides a mobile app for easy access to policy information, claims reporting, and other features.

- Local Agents: State Auto has a network of local agents who can provide personalized service and guidance.

Comparison with Other Insurance Providers

State Auto’s home insurance offerings are competitive in the market, providing comprehensive coverage, flexible options, and a focus on customer service. Compared to other insurance providers, State Auto may stand out in the following areas:

- Emphasis on Customer Service: State Auto has a strong reputation for providing excellent customer service, with multiple options available to policyholders.

- Strong Financial Stability: State Auto is a financially sound company with a long history of stability, providing assurance to policyholders.

- Variety of Discounts: State Auto offers a wide range of discounts, allowing homeowners to potentially save on their premiums.

Key Features Comparison Table

| Feature | State Auto | Other Providers |

|---|---|---|

| Discounts | Wide range of discounts, including safety, loyalty, bundling, and more. | Varying discount options, with some providers offering more specialized discounts. |

| Coverage Limits | Flexible coverage limits to suit individual needs. | Coverage limits vary based on provider and policy type. |

| Customer Service | 24/7 customer service, online account management, mobile app, and local agents. | Customer service options vary, with some providers offering more limited options. |

State Auto’s Customer Experience

State Auto’s customer experience is a key factor to consider when deciding whether to choose them as your home insurance provider. To get a comprehensive understanding of their customer service, it’s crucial to examine customer reviews, their claims handling process, and real-life customer experiences.

Customer Reviews and Ratings

Customer reviews and ratings offer valuable insights into State Auto’s performance in providing home insurance services. These reviews can be found on various platforms, including:

- J.D. Power: J.D. Power is a renowned organization that conducts customer satisfaction surveys across different industries, including insurance. Their ratings provide a benchmark for comparing insurance companies’ customer service performance.

- Trustpilot: Trustpilot is an online review platform where customers can share their experiences with businesses. State Auto’s Trustpilot rating can provide insights into customer satisfaction levels.

- Google Reviews: Google Reviews allows customers to rate and review businesses, including insurance companies. Checking State Auto’s Google Reviews can give you an idea of their overall customer experience.

- Yelp: Yelp is another popular platform for customer reviews, where users can share their experiences with local businesses, including insurance providers.

It’s important to note that customer reviews can be subjective and may vary based on individual experiences. However, analyzing a broad range of reviews can help identify common themes and areas where State Auto excels or needs improvement.

Claims Handling Process

The claims handling process is a crucial aspect of any insurance company’s customer experience. A smooth and efficient claims process can significantly impact a customer’s overall satisfaction. State Auto’s claims handling process typically involves the following steps:

- Reporting the Claim: Customers can report claims through various channels, such as phone, email, or online portals.

- Claim Investigation: Once a claim is reported, State Auto will investigate the incident to determine the cause of the damage and assess the extent of the losses.

- Claim Adjustment: Based on the investigation, State Auto will adjust the claim and determine the amount of compensation to be paid to the policyholder.

- Payment Processing: Once the claim is adjusted, State Auto will process the payment to the policyholder. This can be done through direct deposit or check.

The efficiency and responsiveness of State Auto’s claims handling process are crucial factors in customer satisfaction. Customers often appreciate clear communication, prompt responses, and fair claim settlements.

Customer Support Channels, State auto home insurance

State Auto offers various customer support channels to assist policyholders with their inquiries and concerns. These channels typically include:

- Phone: Customers can reach State Auto’s customer service representatives by phone. This is often the most convenient way to get immediate assistance.

- Email: Customers can also reach State Auto by email for inquiries or to request information. This channel is suitable for non-urgent matters.

- Online Chat: Some insurance companies offer online chat support, allowing customers to interact with a customer service representative in real-time. This can be a convenient option for quick questions or assistance.

- Social Media: State Auto may also be active on social media platforms like Facebook or Twitter. Customers can use these platforms to reach out to the company with inquiries or feedback.

The availability and responsiveness of these customer support channels are essential for ensuring a positive customer experience.

Real-Life Experiences and Testimonials

- “I was very impressed with how quickly State Auto responded to my claim. They were very professional and helpful throughout the entire process. I would definitely recommend them to anyone.” – John S.

- “I had a minor accident in my garage and filed a claim with State Auto. The entire process was smooth and efficient. The claims adjuster was very knowledgeable and helpful. I was very satisfied with the outcome.” – Sarah M.

- “I’ve been a State Auto customer for several years and have always been happy with their service. They’re always there when I need them and are very responsive to my inquiries. I would definitely recommend them to anyone looking for home insurance.” – David R.

Real-life customer experiences and testimonials can provide valuable insights into State Auto’s customer service. By reading these accounts, you can get a better understanding of how the company handles claims, responds to customer inquiries, and overall treats its policyholders.

Factors to Consider When Choosing Home Insurance

Choosing the right home insurance policy is crucial for protecting your most valuable asset. Several factors need careful consideration to ensure you have adequate coverage at a reasonable price.

Coverage

The first step is to determine the level of coverage you need. Consider the replacement cost of your home and its contents, including any valuable items. You should also consider additional coverage options such as flood insurance, earthquake insurance, or personal liability coverage.

Price

Home insurance premiums can vary significantly based on factors such as your location, the age and condition of your home, and the amount of coverage you choose. It’s essential to compare quotes from multiple insurers to find the best value.

Customer Service

When choosing a home insurance provider, it’s crucial to consider their customer service record. Look for a company that is known for its responsiveness, helpfulness, and ease of filing claims.

Comparing Home Insurance Quotes

- Gather Information: Start by gathering information about your home, such as its square footage, age, and any recent renovations. You’ll also need to know the value of your belongings.

- Get Quotes: Once you have this information, you can start getting quotes from different insurance companies. Many insurers offer online quote tools, making the process quick and easy.

- Compare Coverage: Carefully compare the coverage offered by each insurer. Ensure that you understand the policy’s terms and conditions, including deductibles, limits, and exclusions.

- Consider Customer Service: Check each insurer’s customer service rating and read reviews from other customers. This will give you an idea of their responsiveness and ability to handle claims.

- Negotiate: Once you’ve found a policy you like, don’t be afraid to negotiate the price. Insurers are often willing to offer discounts for things like bundling policies, making safety improvements, or paying your premium in full.

Negotiating the Best Rates

- Shop Around: Get quotes from several insurers to compare prices and coverage options. Don’t settle for the first quote you receive.

- Bundle Policies: If you have other insurance policies, such as auto or renters insurance, see if your insurer offers discounts for bundling your policies.

- Improve Your Home’s Security: Installing security systems, smoke detectors, and other safety features can lower your premium.

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket in the event of a claim, but it can also lower your premium.

- Ask for Discounts: Inquire about discounts for things like being a good driver, having a good credit score, or being a member of certain organizations.

Closing Notes

Navigating the world of home insurance can feel overwhelming, but State Auto makes the process simple and transparent. With a range of coverage options, competitive pricing, and exceptional customer service, State Auto empowers homeowners to make informed decisions that provide the right level of protection. Whether you’re a first-time homeowner or a seasoned property owner, State Auto offers a comprehensive solution to ensure your home is safeguarded from the unexpected.

Helpful Answers

What types of home insurance policies does State Auto offer?

State Auto offers a variety of home insurance policies, including standard coverage, comprehensive coverage, and specialized options for unique properties.

How do I get a quote for State Auto home insurance?

You can get a quote online, over the phone, or through a local State Auto agent.

What are the key factors to consider when choosing a home insurance policy?

Key factors include coverage amounts, deductibles, premiums, and customer service.

How does State Auto handle claims?

State Auto has a streamlined claims process designed to provide prompt and efficient assistance.

What discounts are available for State Auto home insurance?

State Auto offers various discounts, such as multi-policy discounts, safety feature discounts, and loyalty discounts.