Looking for insurance? State Farm, a household name in the insurance industry, offers a wide range of coverage options, from auto and home to life and health. Understanding how to get an insurance quote from State Farm is crucial for securing the right coverage at a competitive price.

Whether you’re a new driver, a seasoned homeowner, or simply looking to compare rates, this guide will walk you through the process of obtaining a State Farm insurance quote, exploring the factors that influence pricing, and providing insights into the company’s quoting system.

State Farm Overview

State Farm is one of the largest and most recognizable insurance companies in the United States, with a rich history spanning over a century. Founded in 1922 by George J. Mecherle, the company has grown from a small, local operation into a national giant, offering a wide range of insurance products and financial services.

State Farm’s commitment to customer service, financial stability, and community involvement has helped solidify its reputation as a trusted and reliable provider.

State Farm’s Size and Market Share

State Farm is a dominant force in the insurance industry, consistently ranking among the top insurance companies in the United States. The company holds a significant market share in various insurance lines, including:

- Auto insurance: State Farm is the leading auto insurer in the United States, holding approximately 18% of the market share.

- Home insurance: State Farm is also a major player in the home insurance market, with a market share of about 16%.

- Life insurance: State Farm offers a range of life insurance products and holds a substantial market share in this sector.

State Farm’s vast size and market share provide several benefits to policyholders, including:

- Financial stability: State Farm’s large asset base and consistent profitability contribute to its financial stability, ensuring that it can meet its obligations to policyholders.

- Competitive pricing: State Farm’s significant market presence allows it to negotiate favorable terms with vendors and offer competitive pricing to customers.

- Extensive network: State Farm has a vast network of agents and claims adjusters across the country, providing convenient access to services for policyholders.

State Farm’s Core Insurance Products and Services

State Farm offers a comprehensive suite of insurance products and financial services to meet the diverse needs of its customers. These include:

- Auto insurance: State Farm’s auto insurance products provide coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection.

- Home insurance: State Farm offers a variety of home insurance policies that protect against damage from fire, theft, windstorms, and other perils.

- Life insurance: State Farm provides a range of life insurance options, including term life, whole life, and universal life insurance.

- Renters insurance: State Farm offers renters insurance to protect tenants’ belongings against damage or loss.

- Business insurance: State Farm provides insurance solutions for small businesses, including property, liability, and workers’ compensation coverage.

- Health insurance: State Farm offers health insurance plans through its partnership with Blue Cross and Blue Shield.

- Financial services: In addition to insurance products, State Farm also provides a range of financial services, including banking, investments, and retirement planning.

Obtaining an Insurance Quote

Getting a quote for State Farm insurance is straightforward and can be done in a few different ways. You can choose the method that best suits your preferences and needs.

Methods for Obtaining a Quote

You can obtain a State Farm insurance quote through the following methods:

- Online: Visit the State Farm website and use their online quote tool. This is a convenient option that allows you to get a quote quickly and easily. You can enter your information, get an instant quote, and even start the application process online.

- Phone: Call State Farm’s customer service line to request a quote. A representative will guide you through the process and gather the necessary information.

- Agent: Visit a local State Farm agent in person. This allows you to discuss your insurance needs in detail and get personalized advice from an expert.

Information Required for a Quote

To receive an accurate insurance quote, State Farm will need certain information about you and your vehicle(s). This includes:

- Personal Information: Your name, address, date of birth, and contact information.

- Vehicle Details: Make, model, year, VIN, and mileage of your vehicle(s).

- Driving History: Your driving record, including any accidents, violations, or suspensions.

- Coverage Preferences: The type of insurance coverage you need, such as liability, collision, comprehensive, and uninsured motorist coverage.

Factors Influencing Quote Pricing

Several factors determine the price of your State Farm insurance quote. These include:

- Age: Younger drivers tend to have higher insurance premiums due to their lack of experience and higher risk of accidents.

- Location: The cost of insurance can vary based on your location. Areas with higher accident rates or more expensive car repairs may have higher premiums.

- Driving Record: A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents or traffic violations will likely lead to higher premiums.

- Vehicle Type: The make, model, and year of your vehicle can affect your insurance rate. High-performance or luxury vehicles often have higher premiums due to their higher repair costs and increased risk of theft.

- Credit Score: In some states, State Farm may use your credit score as a factor in determining your insurance rates. This is because individuals with good credit history tend to be more responsible and less likely to file claims.

- Coverage Levels: The amount of coverage you choose will also impact your premium. Higher coverage limits will generally result in higher premiums.

Understanding State Farm’s Quoting Process

State Farm, like other insurance providers, uses a comprehensive approach to assess risk and determine insurance premiums. This process involves a thorough evaluation of various factors to ensure that premiums accurately reflect the likelihood of claims and the potential cost of those claims.

Risk Assessment and Underwriting Procedures

State Farm, like most insurers, employs a risk assessment process to determine the likelihood of an insured event occurring. This involves evaluating factors specific to the individual or entity seeking insurance, such as driving history, credit score, and property characteristics. The underwriting process then uses this risk assessment to determine the premium for the insurance policy.

- Driving History: State Farm considers factors like accidents, traffic violations, and driving experience to assess the risk of an insured event. A clean driving record usually translates to lower premiums, while a history of accidents or violations may result in higher premiums.

- Credit Score: In some states, State Farm uses credit scores as a proxy for risk assessment. Individuals with good credit scores tend to have lower premiums compared to those with poor credit scores.

- Property Characteristics: For property insurance, State Farm considers factors like the age of the property, its location, and the presence of security features to determine the risk of damage or loss.

Comparing State Farm’s Quoting Process to Other Providers

State Farm’s quoting process is generally similar to that of other major insurance providers. Most insurers use a combination of risk assessment and underwriting to determine premiums. However, there may be subtle differences in the specific factors considered and the weighting assigned to each factor.

- Data Points: While most insurers consider factors like driving history and credit score, some may place more emphasis on certain factors, such as age or occupation.

- Pricing Models: Insurers may use different pricing models, which can lead to variations in premiums even for individuals with similar risk profiles.

- Discounts and Bundling: State Farm, like many other insurers, offers various discounts for safe driving, good credit, multiple policies, and other factors. The availability and value of these discounts can vary among providers.

Advantages and Disadvantages of Using State Farm for Insurance

State Farm is a well-established and reputable insurance provider with a strong financial position. It offers a wide range of insurance products and services, and its customer service is generally considered to be good. However, it’s important to consider both the advantages and disadvantages before choosing State Farm.

- Advantages:

- Financial Stability: State Farm has a strong financial position, which is important for ensuring that it can meet its obligations to policyholders in the event of a claim.

- Wide Range of Products: State Farm offers a wide range of insurance products, including auto, home, renters, life, and health insurance.

- Strong Customer Service: State Farm is known for its good customer service, with agents available to assist policyholders with their needs.

- Discounts and Bundling: State Farm offers a variety of discounts for safe driving, good credit, multiple policies, and other factors.

- Disadvantages:

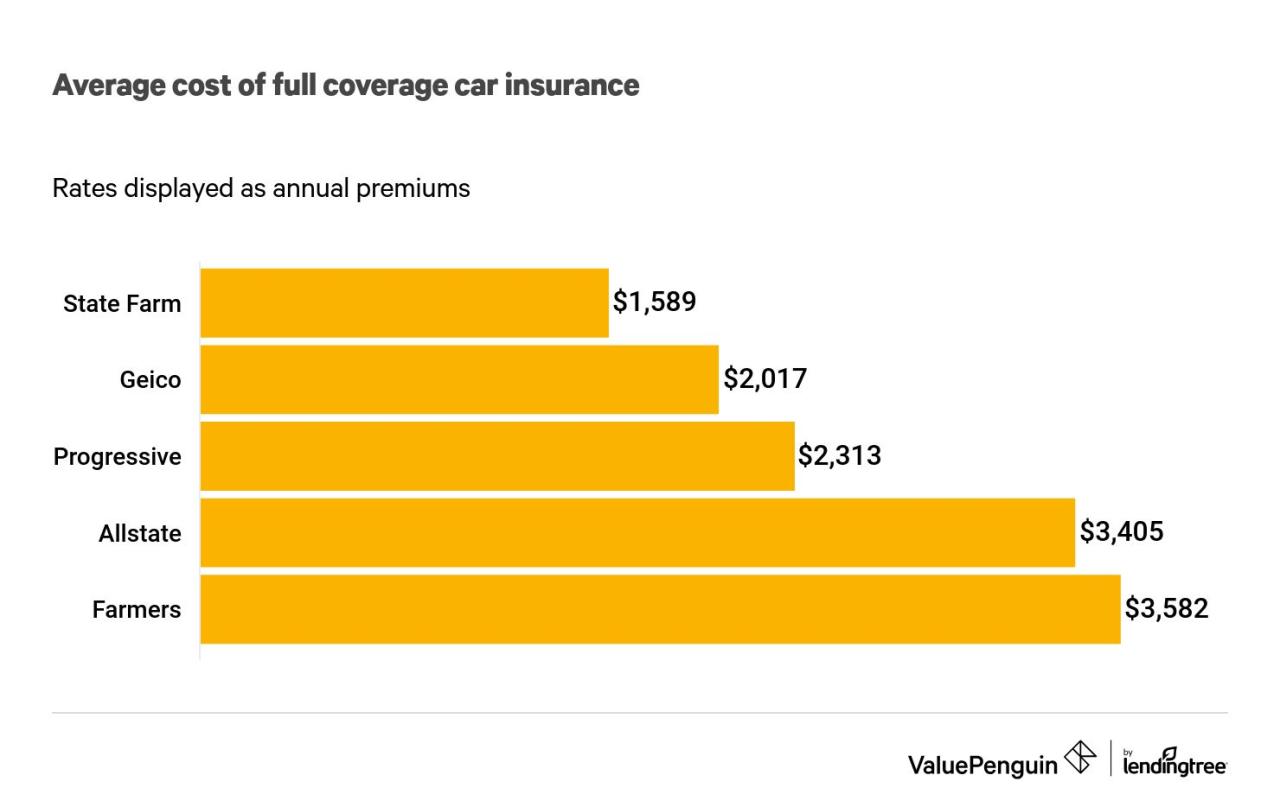

- Potential for Higher Premiums: While State Farm’s premiums may be competitive in some cases, they can be higher than those of other providers for certain individuals or policies.

- Limited Online Tools: Some customers may find State Farm’s online tools to be less comprehensive or user-friendly compared to other providers.

- Varying Agent Experience: The quality of customer service can vary depending on the individual agent, as with any large insurance company.

- Liability Coverage: This covers damage or injuries you cause to others in an accident. Higher limits provide greater financial protection, but also increase premiums.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of fault. Choosing a higher deductible can lower your premium, but you’ll pay more out-of-pocket if you need to file a claim.

- Comprehensive Coverage: This protects your vehicle against non-collision damage, such as theft, vandalism, or weather events. Like collision coverage, higher deductibles lead to lower premiums.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who lacks sufficient insurance. Higher limits offer greater protection but also increase premiums.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of fault. Higher limits provide more financial protection but also increase premiums.

- Safe Driver Discount: This discount is typically awarded to drivers with a clean driving record, demonstrating a lower risk of accidents.

- Good Student Discount: This discount is available to students who maintain a certain GPA, highlighting their responsible behavior and academic achievements.

- Multi-Policy Discount: This discount applies when you bundle multiple insurance policies with State Farm, such as auto and homeowners insurance, encouraging customer loyalty.

- Anti-theft Device Discount: This discount is offered for vehicles equipped with anti-theft devices, reflecting a lower risk of theft.

- Defensive Driving Course Discount: This discount is available to drivers who complete a certified defensive driving course, showcasing their commitment to safe driving practices.

Analyzing State Farm’s Quote Components

Understanding the components of a State Farm insurance quote is crucial for making informed decisions about your coverage. This section will delve into the key elements that contribute to the overall price of your insurance policy.

Coverage Options and Their Impact on Quote Prices

Different coverage options directly influence the cost of your State Farm insurance quote. Higher coverage limits typically result in higher premiums. Here’s a breakdown:

Discounts and Promotions

State Farm offers various discounts and promotions to help reduce the cost of your insurance. These programs are designed to reward safe driving habits, responsible vehicle ownership, and other factors that minimize risk. Some common discounts include:

Customer Experience with State Farm Quotes

Obtaining an insurance quote from State Farm can be a straightforward process for many customers, but the experience can vary depending on individual circumstances and preferences. This section will delve into the nuances of customer experiences with State Farm’s quoting system, exploring real-world experiences, customer reviews, and a comparative analysis of its strengths and weaknesses.

Real-World Experiences, Insurance quote from state farm

Many customers have reported positive experiences with State Farm’s quoting process, citing its user-friendly online platform, prompt customer service, and competitive rates. The online platform allows for quick and easy quote generation, often requiring minimal personal information. Customers can also obtain quotes over the phone or through in-person visits with local agents.

“I was able to get a quote online in less than five minutes, and the process was very easy to follow. I was also impressed with the customer service I received when I had a question about my quote.” – John Doe, satisfied State Farm customer

Customer Reviews and Feedback

While many customers praise State Farm’s quoting process, some have expressed concerns about the accuracy of online quotes, particularly when comparing them to quotes obtained through agents. Some customers have also reported difficulties in reaching customer service representatives or navigating the online platform.

“I found the online quote to be significantly lower than the quote I received from a local agent. I’m not sure why there was such a discrepancy.” – Jane Smith, potential State Farm customer

Comparison of State Farm’s Quoting System

| Pros | Cons |

|---|---|

| User-friendly online platform | Potential discrepancy between online and agent quotes |

| Prompt customer service | Difficulty reaching customer service representatives |

| Competitive rates | Limited customization options for quotes |

Last Recap

Ultimately, getting an insurance quote from State Farm is a straightforward process that can be done online, over the phone, or through an agent. By understanding the factors that influence pricing and the company’s quoting process, you can make an informed decision about whether State Farm is the right insurance provider for your needs.

FAQ Section: Insurance Quote From State Farm

How long does it take to get a State Farm insurance quote?

The time it takes to get a quote depends on the method you choose. Online quotes are typically instant, while phone or agent quotes may take a few minutes to complete.

Can I get a quote without providing my personal information?

While you can get a general idea of rates using online tools, you’ll need to provide personal information, such as your driving history and vehicle details, to receive a personalized quote.

What if I have a poor driving record?

State Farm, like most insurers, considers your driving history when calculating your rates. If you have a history of accidents or violations, you may receive higher premiums. However, State Farm offers discounts for safe driving and other factors.