All states insurance quote is the process of comparing insurance quotes from multiple companies across different states. This is crucial because insurance rates vary significantly based on location, driving history, and other factors. By comparing quotes, you can find the most affordable and suitable insurance plan that meets your specific needs.

This process allows you to identify the best deals available in your area, ensuring you’re not overpaying for coverage. It also helps you understand the different types of coverage offered by various insurance providers and their associated costs. With a comprehensive understanding of your options, you can make an informed decision that best suits your financial situation and risk tolerance.

Understanding “All States Insurance Quote”

An “All States Insurance Quote” refers to obtaining insurance quotes from multiple insurance providers across different states. This approach allows individuals to compare various insurance options and potentially secure the most favorable coverage at the best price.

Purpose of Obtaining Multiple Quotes, All states insurance quote

Obtaining insurance quotes from multiple providers is crucial for making informed decisions about insurance coverage. By comparing quotes, individuals can identify:

- The most competitive rates: Different insurers offer varying rates based on their risk assessment models and pricing strategies. Comparing quotes can help you find the most affordable option that meets your needs.

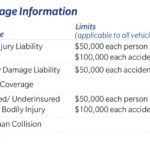

- Coverage options and limits: Insurance providers offer diverse coverage options and limits. Comparing quotes allows you to understand the different levels of protection available and select the most suitable coverage for your specific circumstances.

- Discounts and benefits: Many insurers offer discounts for factors like safe driving records, bundling multiple policies, or being a member of certain organizations. Comparing quotes can help you uncover these potential savings and maximize your benefits.

Factors Influencing Insurance Quotes

Several factors influence insurance quotes, including:

- Coverage options: The type and amount of coverage you choose, such as liability, collision, comprehensive, and uninsured motorist coverage, directly impact your premium.

- Vehicle details: The make, model, year, and value of your vehicle influence your insurance costs. Higher-value vehicles generally have higher premiums due to their repair and replacement costs.

- Driving history: Your driving record, including accidents, violations, and driving experience, plays a significant role in determining your premium. A clean driving record usually translates to lower rates.

- Location: Your geographic location, including the state, city, and neighborhood, influences insurance rates. Areas with higher crime rates or more frequent accidents typically have higher premiums.

- Age and gender: Age and gender are factors considered by some insurers, as they are statistically correlated with driving risks. Younger drivers and males often face higher premiums.

Conclusive Thoughts

In conclusion, obtaining insurance quotes from multiple providers across all states is a smart approach to finding the best coverage at the most competitive price. By understanding the key factors that influence quotes, utilizing various methods to obtain them, and considering the importance of coverage and deductibles, you can secure the most comprehensive and cost-effective insurance plan. Remember, comparing quotes is not just about saving money; it’s about ensuring you have the right level of protection for your needs.

FAQs: All States Insurance Quote

How often should I compare insurance quotes?

It’s generally recommended to compare quotes at least once a year, especially when your driving record changes or you make significant changes to your vehicle or home.

What are the benefits of using an online platform to compare quotes?

Online platforms offer convenience, speed, and the ability to compare quotes from multiple companies simultaneously. They often provide personalized recommendations based on your specific needs.

What if I have a poor driving record?

If you have a poor driving record, you may face higher premiums. However, some companies specialize in insuring drivers with less-than-perfect records. It’s essential to compare quotes from multiple companies to find the best options.

Can I get a discount on my insurance if I have multiple policies with the same company?

Yes, many insurance companies offer discounts for bundling multiple policies, such as car insurance, home insurance, and renters insurance.