State of Texas homeowners insurance is a critical aspect of protecting your biggest investment. The Lone Star State faces unique challenges, from volatile weather patterns to a dynamic insurance market. Understanding the intricacies of Texas homeowners insurance is essential for safeguarding your property and financial well-being.

This guide delves into the Texas homeowners insurance landscape, covering everything from basic coverage and cost factors to navigating claims and preparing for natural disasters. We’ll explore the complexities of the market, provide tips for choosing the right insurance provider, and offer insights into future trends shaping the industry.

Texas Homeowners Insurance Market Overview

The Texas homeowners insurance market is one of the largest and most dynamic in the United States. It’s a complex ecosystem influenced by various factors, including weather patterns, property values, and legislative changes. This dynamic market also boasts a competitive landscape of insurance providers, each vying for a share of the market.

Weather Patterns and Natural Disasters, State of texas homeowners insurance

Weather patterns play a significant role in shaping the Texas homeowners insurance market. Texas is prone to severe weather events like hurricanes, tornadoes, hailstorms, and wildfires, leading to significant property damage and insurance claims. The frequency and severity of these events directly impact insurance premiums, as insurers factor in the risk of future claims. For instance, after a particularly destructive hurricane season, insurers might adjust their rates to account for the increased risk.

Property Values and Risk Assessment

Property values are another key factor influencing the Texas homeowners insurance market. As property values rise, so do the potential costs of rebuilding or repairing damaged homes. Insurers consider property values when determining premiums, ensuring adequate coverage for potential losses. For example, a home in a high-value neighborhood will generally have a higher premium than a similar home in a less affluent area.

Legislative Changes and Market Regulation

Legislative changes and market regulation also play a significant role in the Texas homeowners insurance market. The Texas Department of Insurance (TDI) regulates the insurance industry in the state, setting standards for coverage, rates, and consumer protection. Recent legislative changes, such as those impacting coverage for specific perils or the ability of insurers to deny coverage based on prior claims, have had a noticeable impact on the market.

Competitive Landscape of Insurance Providers

The Texas homeowners insurance market is highly competitive, with numerous national and regional insurance providers vying for customers. This competition benefits consumers, leading to a wider range of coverage options and more competitive pricing. Some of the key players in the Texas homeowners insurance market include State Farm, Farmers Insurance, Allstate, and USAA. These providers offer a variety of coverage options and pricing structures, allowing homeowners to choose the policy that best meets their needs.

Understanding Texas Homeowners Insurance Coverage

A standard Texas homeowners insurance policy provides coverage for various perils, but it also has exclusions. Understanding these aspects is crucial for ensuring adequate protection for your property and financial well-being.

Coverage Included in a Standard Texas Homeowners Insurance Policy

A standard Texas homeowners insurance policy typically includes coverage for several perils, protecting your home and belongings against various unforeseen events. These coverages are designed to help you recover from financial losses and rebuild your life after a covered incident.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the attached structures like garages and porches, against covered perils such as fire, lightning, windstorms, hail, and vandalism. The coverage amount is usually based on the cost to rebuild or repair your home to its original condition, taking into account factors like construction costs and the current market value.

- Other Structures Coverage: This coverage extends protection to detached structures on your property, such as sheds, fences, and swimming pools. The coverage amount is typically a percentage of your dwelling coverage, usually 10% or less.

- Personal Property Coverage: This coverage protects your belongings inside your home, including furniture, electronics, clothing, and other personal items. The coverage amount is typically a percentage of your dwelling coverage, usually 50% or less. It’s important to note that personal property coverage may have sublimits for specific items like jewelry, artwork, and valuable collections. It’s advisable to consider additional coverage for high-value items.

- Liability Coverage: This coverage protects you from financial losses if someone is injured or their property is damaged on your property. For example, if a guest slips and falls on your icy driveway, your liability coverage would help cover their medical expenses and any legal costs associated with the incident. The coverage amount typically ranges from $100,000 to $300,000 or more, depending on your policy.

- Additional Living Expenses Coverage: This coverage helps cover your expenses if you are unable to live in your home due to a covered event, such as a fire or a major storm. It can help pay for temporary housing, meals, and other essential expenses until your home is repaired or rebuilt. The coverage amount is typically a percentage of your dwelling coverage, usually 20% or less.

Specific Perils Covered

A standard Texas homeowners insurance policy covers a wide range of perils, providing protection against various risks that can impact your property. Understanding the specific perils covered is crucial for knowing what your policy will protect you from.

- Fire and Lightning: These perils are covered by most homeowners insurance policies. They protect your home and belongings from damage caused by fire, lightning strikes, and the subsequent effects, such as smoke damage and water damage from firefighting efforts.

- Windstorm and Hail: These perils are particularly relevant in Texas, known for its frequent windstorms and hailstorms. Coverage for these perils protects your home and belongings from damage caused by strong winds, flying debris, and hail impacts. It’s essential to ensure your policy provides adequate coverage for windstorm and hail, as these events can cause significant damage.

- Vandalism and Malicious Mischief: This coverage protects your home and belongings from damage caused by intentional acts of vandalism or malicious mischief. It can help cover repairs or replacements for damaged property, such as broken windows, graffiti, or stolen items.

- Theft: This coverage protects your home and belongings from loss due to theft or burglary. It can help cover the cost of replacing stolen items, including personal property, jewelry, and electronics. It’s essential to note that some policies may have limitations on the coverage amount for specific items, such as jewelry or artwork.

- Other Perils: Some policies may also cover other perils, such as falling objects, explosions, and damage caused by aircraft or vehicles. It’s crucial to review your policy carefully to understand the specific perils covered and any limitations or exclusions that may apply.

Exclusions in Texas Homeowners Insurance Policies

While Texas homeowners insurance policies offer broad coverage, there are certain perils and events that are typically excluded. Understanding these exclusions is crucial for making informed decisions about your insurance coverage and ensuring you have adequate protection for your property.

- Earthquakes: Earthquakes are not typically covered by standard Texas homeowners insurance policies. If you live in an earthquake-prone area, you may need to purchase separate earthquake insurance to protect your property from seismic events.

- Flooding: Flooding is also typically excluded from standard homeowners insurance policies. You may need to purchase separate flood insurance through the National Flood Insurance Program (NFIP) or a private insurer to protect your property from flood damage.

- Acts of War: Damage caused by acts of war or terrorism is typically excluded from homeowners insurance policies. You may need to explore other insurance options or government programs to protect your property from such events.

- Neglect or Intentional Acts: Damage caused by negligence or intentional acts by the homeowner is typically excluded from homeowners insurance policies. For example, if you fail to maintain your property and it suffers damage due to neglect, your insurance may not cover the repairs.

- Other Exclusions: Other common exclusions may include damage caused by wear and tear, insect infestations, mold, and certain types of construction defects. It’s crucial to review your policy carefully to understand all the exclusions that may apply.

Factors Affecting the Cost of Homeowners Insurance in Texas

Several factors can influence the cost of homeowners insurance in Texas, making it crucial to understand these factors when comparing quotes and selecting a policy.

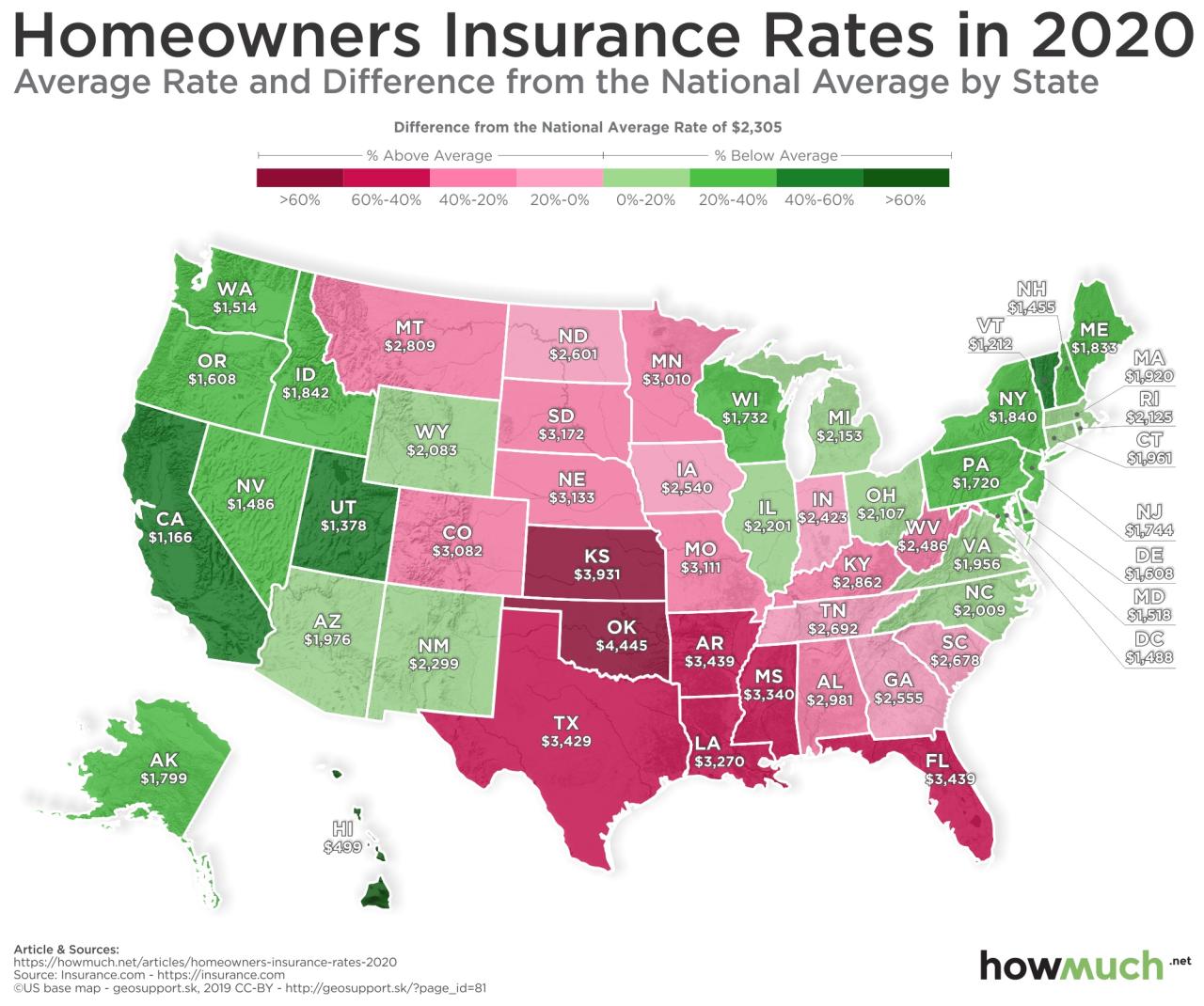

- Location: Your home’s location is a significant factor in determining your insurance premiums. Homes in areas with higher risk of natural disasters, such as hurricanes, tornadoes, and floods, will typically have higher insurance costs. For example, homes in coastal areas of Texas are more likely to be affected by hurricanes, leading to higher insurance premiums.

- Home Value: The value of your home is another key factor influencing your insurance costs. Homes with higher market values typically require higher coverage amounts, leading to higher premiums. It’s important to ensure that your coverage amount is adequate to rebuild or repair your home to its current value.

- Home Features: Certain home features, such as the age of your roof, the type of building materials used, and the presence of security systems, can affect your insurance costs. For example, homes with newer roofs and updated security systems may qualify for discounts, while older homes with outdated features may have higher premiums.

- Claims History: Your claims history can also impact your insurance premiums. If you have filed multiple claims in the past, your insurance company may view you as a higher risk and charge higher premiums. Conversely, if you have a clean claims history, you may be eligible for discounts.

- Credit Score: In some states, including Texas, insurance companies may use your credit score to determine your insurance premiums. Individuals with higher credit scores may be eligible for lower premiums, while those with lower credit scores may face higher premiums.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it also means you will have to pay more out-of-pocket if you file a claim. It’s important to choose a deductible that balances affordability with your risk tolerance.

- Coverage Limits: The coverage limits you choose for your policy can also affect your premiums. Higher coverage limits typically lead to higher premiums. It’s important to choose coverage limits that adequately protect your property and belongings.

Key Considerations for Texas Homeowners

Owning a home in Texas is a significant investment, and safeguarding it with adequate insurance coverage is paramount. This section will explore key considerations for Texas homeowners, including how to choose the right insurance provider, compare quotes, and understand the benefits of bundling policies.

Choosing the Right Insurance Provider

Selecting the right insurance provider can be crucial for ensuring your home is properly protected. Several factors should be considered when making this decision, including financial stability, customer service, and coverage options.

- Financial Stability: Look for insurers with strong financial ratings, such as those assigned by A.M. Best or Standard & Poor’s. This indicates their ability to pay claims in the event of a disaster.

- Customer Service: Research insurers’ reputation for customer service. Consider factors like response times, claim processing efficiency, and overall customer satisfaction.

- Coverage Options: Compare the coverage options offered by different insurers. Ensure the policy meets your specific needs and includes essential features like dwelling coverage, personal property protection, and liability insurance.

Comparing Quotes and Negotiating Rates

Obtaining multiple quotes from different insurers is essential to finding the best rates. There are several ways to compare quotes, including online comparison websites, insurance brokers, and contacting insurers directly.

- Online Comparison Websites: Websites like Policygenius and Insurance.com allow you to compare quotes from multiple insurers simultaneously.

- Insurance Brokers: Brokers can help you compare quotes from several insurers and find the best options for your needs.

- Contacting Insurers Directly: You can contact insurers directly to obtain quotes and discuss your specific coverage requirements.

Bundling Homeowners and Other Insurance Policies

Bundling homeowners insurance with other policies, such as auto or renters insurance, can often result in significant discounts. This strategy can save you money on premiums while ensuring all your insurance needs are met under one policy.

- Discounts: Insurers often offer discounts for bundling multiple policies.

- Convenience: Bundling policies can simplify your insurance management, as you only have one insurer to deal with.

- Streamlined Claims Process: In the event of a claim, having all your policies with one insurer can streamline the claims process.

Navigating Claims and Disputes

Navigating the claims process and potential disputes is an essential aspect of Texas homeowners insurance. Understanding the process and your rights can help you effectively resolve any issues that may arise.

Texas Homeowners Insurance Claims Process

The claims process in Texas homeowners insurance typically involves the following steps:

- Report the Claim: Contact your insurance company as soon as possible after the loss occurs. You can usually do this by phone, online, or through their mobile app. Provide detailed information about the event, including the date, time, and nature of the damage.

- Initial Investigation: The insurance company will investigate your claim to verify the details and determine the extent of the damage. This may involve sending an adjuster to inspect your property.

- Claim Adjustment: The insurance company will assess the damage and determine the amount of coverage you are entitled to. This will include any applicable deductibles and policy limits.

- Payment or Denial: If the claim is approved, the insurance company will issue a payment for the covered damages. If the claim is denied, you will receive a letter explaining the reason for the denial.

Tips for Filing a Claim Effectively

Filing a claim effectively can increase your chances of a smooth and timely resolution:

- Document Everything: Keep detailed records of the event, including photos, videos, and receipts for any repairs or expenses incurred. This documentation can be helpful in supporting your claim.

- Be Prompt and Thorough: Contact your insurance company as soon as possible after the loss occurs. Provide accurate and complete information when filing your claim.

- Understand Your Policy: Carefully review your homeowners insurance policy to understand your coverage limits, deductibles, and any exclusions.

- Be Prepared for an Inspection: If an adjuster is scheduled to inspect your property, make sure the area is accessible and safe.

- Keep Communication Open: Maintain open communication with your insurance company throughout the claims process. Ask questions and seek clarification if you are unsure about any aspect of the process.

Common Disputes Between Homeowners and Insurance Companies

Disputes between homeowners and insurance companies can arise due to a variety of factors:

- Coverage Disputes: Disagreements can occur when homeowners believe they are covered for a particular loss, but the insurance company denies coverage.

- Valuation Disputes: Disputes can arise when homeowners disagree with the insurance company’s assessment of the damage or the value of the property.

- Claim Denial: Homeowners may dispute the insurance company’s denial of their claim, arguing that the denial is unjustified.

- Delay in Payment: Homeowners may experience delays in receiving payment for their claims, leading to frustration and disputes.

Resolving Claims Disputes

If you find yourself in a dispute with your insurance company, there are several steps you can take to resolve the issue:

- Review Your Policy: Carefully review your homeowners insurance policy to understand your rights and obligations.

- Negotiate with Your Insurance Company: Attempt to resolve the dispute through negotiation with your insurance company.

- Seek Mediation: Consider seeking mediation, which involves a neutral third party helping both parties reach a resolution.

- File a Complaint: If negotiation and mediation fail, you can file a complaint with the Texas Department of Insurance.

- Consider Legal Action: In some cases, legal action may be necessary to resolve a claims dispute.

Impact of Natural Disasters: State Of Texas Homeowners Insurance

Texas is known for its susceptibility to natural disasters, particularly hurricanes and tornadoes. These events can have a devastating impact on homeowners, causing significant damage to property and leading to financial hardship. This section explores the impact of natural disasters on Texas homeowners insurance, the role of the Texas Windstorm Insurance Association (TWIA), and the importance of flood insurance.

The Role of the Texas Windstorm Insurance Association (TWIA)

The Texas Windstorm Insurance Association (TWIA) is a state-created entity that provides windstorm insurance coverage in coastal areas of Texas where private insurers are unwilling to offer coverage. TWIA is a non-profit organization that operates as a residual market insurer, meaning it provides coverage as a last resort when private insurers decline to offer policies.

TWIA plays a crucial role in providing windstorm insurance coverage to homeowners in high-risk areas, ensuring that they have access to protection against catastrophic events. TWIA’s coverage is typically more expensive than private insurance due to the high risk associated with windstorms in coastal regions. However, it offers a vital safety net for homeowners who may not be able to secure coverage from private insurers.

The Importance of Flood Insurance

Flooding is another significant natural disaster risk in Texas, particularly in areas near rivers, lakes, and coastal regions. Flood insurance is essential for homeowners in flood-prone areas, as standard homeowners insurance policies typically do not cover flood damage.

Flood insurance is available through the National Flood Insurance Program (NFIP), a federal program administered by the Federal Emergency Management Agency (FEMA). NFIP offers flood insurance policies to homeowners in participating communities across the country, including Texas.

Flood insurance policies provide coverage for damage to the structure of a home and its contents caused by flooding. It is crucial for homeowners in flood-prone areas to obtain flood insurance to protect their financial well-being in the event of a flood.

Future Trends in Texas Homeowners Insurance

The Texas homeowners insurance market is constantly evolving, driven by a combination of factors such as climate change, technological advancements, and shifting demographics. Understanding these trends is crucial for homeowners to make informed decisions about their insurance needs and protect their investments.

Factors Influencing Future Rates and Coverage

Several factors will likely shape the future of homeowners insurance in Texas. These include:

- Climate Change and Extreme Weather: The increasing frequency and severity of natural disasters, particularly hurricanes, floods, and wildfires, will continue to drive up insurance premiums. The Texas Department of Insurance has reported a significant increase in hurricane-related claims in recent years, putting pressure on insurers to raise rates to cover potential losses. For example, Hurricane Harvey in 2017 caused billions of dollars in damage across Texas, leading to significant rate increases for homeowners in affected areas.

- Inflation and Construction Costs: Rising inflation and construction costs will also contribute to higher insurance premiums. As the cost of materials and labor increases, insurers will need to adjust their rates to reflect the higher cost of rebuilding damaged homes. For instance, the cost of lumber has risen significantly in recent years, impacting the overall cost of rebuilding homes.

- Demographic Shifts: The growing population and urbanization in Texas are putting a strain on existing infrastructure and increasing the risk of property damage. As more people move to urban areas, the concentration of homes and businesses in these areas increases the potential for cascading damage from natural disasters or other events.

- Regulatory Changes: State and federal regulations can also impact the insurance market. Changes to building codes, insurance regulations, and disaster relief programs can affect insurance premiums and coverage options.

Emerging Technologies and their Impact

Emerging technologies are transforming the homeowners insurance industry, offering opportunities for increased efficiency, personalized coverage, and better risk management.

- Artificial Intelligence (AI): AI-powered systems are being used to assess risks, detect fraud, and automate claims processing. This can help insurers to better understand their policyholders and provide more personalized coverage options. For instance, AI algorithms can analyze satellite imagery and weather data to assess the risk of flooding in specific areas, allowing insurers to offer more accurate and competitive premiums.

- Internet of Things (IoT): Connected devices like smart home sensors and wearable technology can provide valuable data about a homeowner’s property and lifestyle. This data can be used to assess risks, offer discounts for safety measures, and even detect potential problems before they occur. For example, a smart smoke detector can notify an insurer if a fire is detected, allowing for faster response and potentially preventing significant damage.

- Blockchain Technology: Blockchain can be used to streamline insurance claims processing and reduce fraud. It can also provide a secure and transparent platform for managing insurance policies and payments. For example, blockchain can be used to track the provenance of building materials, ensuring their authenticity and quality, which can reduce the risk of fraudulent claims.

Outcome Summary

As you navigate the Texas homeowners insurance market, remember that knowledge is power. By understanding your coverage options, comparing quotes, and staying informed about industry trends, you can make informed decisions that protect your property and peace of mind. Remember to review your policy regularly, update coverage as needed, and seek professional advice when necessary.

Helpful Answers

What are the most common perils covered by Texas homeowners insurance?

Standard Texas homeowners insurance policies typically cover perils like fire, windstorm, hail, theft, and vandalism. However, coverage can vary depending on the specific policy and insurer.

How can I find the best homeowners insurance rates in Texas?

To find the best rates, shop around and compare quotes from multiple insurance providers. Consider factors like coverage options, deductibles, and discounts. It’s also helpful to check your credit score, as it can impact your insurance rates.

What is the Texas Windstorm Insurance Association (TWIA)?

TWIA is a state-created insurance association that provides windstorm coverage to coastal areas of Texas where private insurers may not offer coverage. It’s important to understand TWIA’s role and coverage limits if you live in a high-risk area.