State Farm homeowners insurance coverage provides comprehensive protection for your home and belongings against various risks. It offers a range of coverage options, including dwelling, personal property, and liability, to safeguard your financial well-being in case of unforeseen events. State Farm is a well-established and reputable insurance provider, known for its customer service and commitment to providing peace of mind.

This article will delve into the details of State Farm homeowners insurance coverage, exploring its features, benefits, and costs. We will also discuss the factors that influence premiums, compare State Farm to other providers, and answer common questions about this insurance.

State Farm Homeowners Insurance Overview: State Farm Homeowners Insurance Coverage

State Farm homeowners insurance is a type of insurance policy that protects homeowners from financial losses due to damage or destruction to their property. This insurance is designed to cover a wide range of risks, including fire, theft, vandalism, and natural disasters.

State Farm homeowners insurance offers several key features and benefits to its policyholders. These benefits aim to provide financial protection and peace of mind in the event of unforeseen circumstances.

Types of Coverage

State Farm homeowners insurance policies typically include various types of coverage to address different aspects of a homeowner’s risks. The specific coverage options may vary depending on the policy and the individual’s needs. Here are some common types of coverage:

- Dwelling Coverage: This coverage protects the physical structure of the home, including the foundation, walls, roof, and attached structures. It covers damage caused by perils such as fire, windstorms, hail, and vandalism.

- Other Structures Coverage: This coverage extends protection to detached structures on the property, such as garages, sheds, fences, and swimming pools. It covers damage caused by similar perils as dwelling coverage.

- Personal Property Coverage: This coverage protects the homeowner’s belongings inside the home, including furniture, electronics, clothing, and personal items. It covers losses due to theft, fire, or other covered perils.

- Liability Coverage: This coverage provides financial protection if a homeowner is held liable for injuries or property damage to others. It can cover legal expenses and settlements.

- Additional Living Expenses Coverage: This coverage helps pay for temporary living expenses if the home becomes uninhabitable due to a covered event. It can cover costs such as hotel stays, meals, and other essential living expenses.

Coverage Details and Options

State Farm homeowners insurance offers comprehensive coverage to protect your home and belongings from various perils. It is designed to provide financial support in case of unexpected events that could cause damage or loss. The policy includes different coverage sections, each addressing specific aspects of your property and liability.

Dwelling Coverage

Dwelling coverage protects your home’s structure, including the attached structures like garages and porches. This coverage pays for repairs or replacement costs in case of damage from covered perils like fire, windstorms, hail, and vandalism. The amount of dwelling coverage you need depends on the value of your home.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. This coverage extends to your belongings while they are away from home, like when you are on vacation. The amount of personal property coverage you need depends on the value of your belongings. You may need additional coverage for valuable items like jewelry or art.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. This coverage also covers legal defense costs if you are sued. The amount of liability coverage you need depends on your individual circumstances.

Optional Coverage

State Farm homeowners insurance offers optional coverage to enhance your protection and address specific risks.

Flood Insurance

Flood insurance is a separate policy that covers damage caused by flooding. It is not included in standard homeowners insurance. Flood insurance is essential for homeowners in flood-prone areas.

Earthquake Insurance

Earthquake insurance is another optional coverage that protects your home from damage caused by earthquakes. This coverage is typically required for homeowners in earthquake-prone areas.

Personal Liability Umbrella Coverage

A personal liability umbrella policy provides additional liability coverage beyond the limits of your homeowners insurance. This coverage can be valuable if you face a significant liability claim that exceeds your homeowners insurance policy limits.

Coverage Limits and Deductibles

Coverage limits determine the maximum amount your insurance company will pay for covered losses. Deductibles are the amount you pay out of pocket before your insurance coverage kicks in.

Coverage limits and deductibles are important factors to consider when choosing a homeowners insurance policy.

Policy Features and Services

State Farm homeowners insurance offers a variety of features and services designed to make the policyholder’s experience as smooth and hassle-free as possible. From the claims process to customer support, State Farm prioritizes providing a positive and supportive experience for its policyholders.

The Claims Process

State Farm’s claims process is designed to be straightforward and efficient. The steps involved in filing a claim include:

- Contacting State Farm: You can file a claim by phone, online, or through the State Farm mobile app.

- Providing Claim Information: You’ll need to provide details about the damage, including the date and time of the incident, the cause of the damage, and any relevant documentation.

- Claim Review and Assessment: State Farm will review your claim and assess the damage. This may involve an inspection by a claims adjuster.

- Claim Settlement: Once the claim is approved, State Farm will provide you with a settlement offer. This offer will cover the cost of repairs or replacement, minus any deductible.

The timeline for processing a claim varies depending on the complexity of the claim and the availability of information. In general, State Farm aims to process claims as quickly as possible.

State Farm’s claims process is designed to be straightforward and efficient, with the aim of processing claims as quickly as possible.

Role of Agents and Customer Service

State Farm agents play a vital role in supporting policyholders throughout the claims process. They can provide guidance and assistance with filing claims, understanding coverage, and navigating the claims process. State Farm’s customer service representatives are also available 24/7 to answer questions, provide support, and address any concerns.

State Farm agents and customer service representatives are available to provide guidance and support throughout the claims process.

Unique Features and Services

State Farm offers several unique features and services to enhance the policyholder experience. These include:

- Discounts: State Farm offers a variety of discounts, including those for home security systems, fire alarms, and bundling insurance policies.

- Online Tools: State Farm provides online tools for managing your policy, including online payment options, claims filing, and policy information access.

- Mobile App: The State Farm mobile app allows policyholders to access their policy information, file claims, and contact customer service from their mobile devices.

Cost and Factors Influencing Premiums

Your State Farm homeowners insurance premium is calculated based on various factors, aiming to reflect the potential risk associated with insuring your property. This ensures that you pay a fair price for the coverage you need.

Factors Affecting Premiums

Several factors influence the cost of your State Farm homeowners insurance premium. Understanding these factors can help you make informed decisions that may potentially lower your premium.

- Location: The location of your home significantly impacts your premium. Areas with higher crime rates, natural disaster risks, or a greater frequency of claims generally have higher premiums. For example, homes in coastal areas prone to hurricanes may face higher premiums due to the increased risk of damage.

- Property Value: The value of your home is directly related to the amount of coverage you need and, therefore, your premium. Homes with higher values require more coverage and typically have higher premiums.

- Coverage Levels: The amount of coverage you choose impacts your premium. Higher coverage levels mean higher premiums, as you’re paying for greater protection against losses.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible generally results in a lower premium, as you’re taking on more financial responsibility.

- Home Features: Certain home features can affect your premium. For example, having a security system or fire sprinklers can lower your premium due to the reduced risk of theft or fire damage.

- Claims History: Your past claims history plays a role in determining your premium. Frequent claims may indicate a higher risk and lead to higher premiums.

- Credit Score: In some states, your credit score may be considered when calculating your premium. This is based on the theory that individuals with good credit are more financially responsible and less likely to file claims.

Getting a Quote and Comparing Rates

Getting a quote for State Farm homeowners insurance is a straightforward process. You can request a quote online, over the phone, or through a local State Farm agent. When requesting a quote, you’ll need to provide information about your property, coverage needs, and other relevant details.

You can compare State Farm rates with other insurance companies to ensure you’re getting the best value. Consider factors such as coverage levels, discounts, and customer service when making your decision.

Customer Reviews and Comparisons

State Farm is a well-known and reputable insurance provider, but it’s crucial to consider customer feedback and compare it to other companies before making a decision. This section delves into customer reviews and ratings for State Farm homeowners insurance and compares it to other major providers in the market.

Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into the overall experience with State Farm homeowners insurance. While individual experiences may vary, analyzing aggregated reviews can reveal common themes and trends.

- J.D. Power: State Farm has consistently received above-average ratings for customer satisfaction in J.D. Power’s Home Insurance Study. In the 2023 study, State Farm ranked second among major insurance providers, highlighting its strong performance in areas such as claims satisfaction, policy information, and customer service.

- Consumer Reports: Consumer Reports has also given State Farm high marks for customer satisfaction. Their ratings are based on a combination of factors, including customer surveys, complaint data, and financial stability. In their latest evaluation, State Farm received a score of 82 out of 100, placing it among the top performers in the industry.

- Other Online Platforms: On platforms like Trustpilot and Yelp, State Farm receives mixed reviews. While many customers praise the company for its friendly agents, prompt claims processing, and reasonable rates, others have reported issues with customer service, claims denials, and policy changes.

Comparison with Other Providers, State farm homeowners insurance coverage

Comparing State Farm homeowners insurance to other major providers in the market is essential to determine if it offers the best value and coverage for your needs. Here’s a breakdown of key factors to consider:

- Coverage Options: State Farm offers a comprehensive range of coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. However, other providers, such as Allstate and Liberty Mutual, may offer more specialized coverage options, such as flood insurance or earthquake insurance, depending on your location and specific needs.

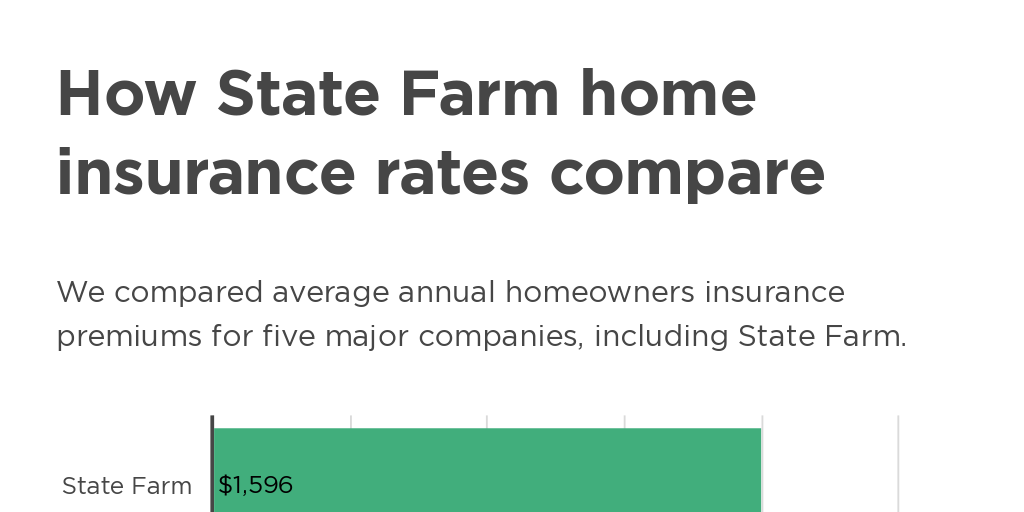

- Rates and Premiums: State Farm is generally known for its competitive rates, but the actual cost of insurance will vary depending on several factors, including your location, home value, coverage level, and personal risk profile. It’s crucial to compare quotes from multiple providers to find the most affordable option.

- Customer Service: State Farm has a reputation for providing excellent customer service, but this can vary depending on the agent and the specific situation. Other providers, such as USAA and Erie Insurance, are also known for their high levels of customer service, so it’s essential to research and compare.

- Claims Process: State Farm is generally considered to have a smooth and efficient claims process. However, some customers have reported challenges with claims denials or delays. Other providers, such as Nationwide and Farmers Insurance, may have faster claim processing times, so it’s worth considering your individual needs and priorities.

Strengths and Weaknesses

State Farm homeowners insurance has several strengths and weaknesses compared to its competitors.

- Strengths:

- Strong Reputation: State Farm is a well-established and trusted brand with a long history of providing reliable insurance services.

- Wide Coverage Options: State Farm offers a comprehensive range of coverage options to meet various homeowner needs.

- Competitive Rates: State Farm generally offers competitive rates, making it a cost-effective option for many homeowners.

- Strong Financial Stability: State Farm is financially sound and has a strong track record of paying claims.

- Weaknesses:

- Limited Customization: State Farm’s coverage options may not be as customizable as some competitors, potentially limiting your ability to tailor the policy to your specific needs.

- Mixed Customer Service Experiences: While State Farm is known for its customer service, some customers have reported negative experiences, highlighting the potential for inconsistencies.

- Limited Availability of Specialized Coverage: State Farm may not offer specialized coverage options, such as flood insurance or earthquake insurance, in all locations.

Closing Notes

By understanding the ins and outs of State Farm homeowners insurance coverage, you can make informed decisions about your home insurance needs. Whether you’re a homeowner seeking comprehensive protection or a renter looking for peace of mind, State Farm offers a variety of options to meet your specific requirements. Remember to carefully review the policy details, compare quotes, and consider the factors that influence premiums to ensure you choose the right coverage for your needs.

Essential Questionnaire

What are the typical deductibles for State Farm homeowners insurance?

Deductibles for State Farm homeowners insurance can vary depending on factors like your coverage level and location. However, common deductibles range from $500 to $2,500.

Does State Farm offer discounts on homeowners insurance?

Yes, State Farm offers a variety of discounts on homeowners insurance, such as those for safety features, bundling policies, and being a loyal customer.

What are the common exclusions in State Farm homeowners insurance policies?

Common exclusions in State Farm homeowners insurance policies include coverage for earthquakes, floods, and acts of war.

How do I file a claim with State Farm homeowners insurance?

You can file a claim with State Farm homeowners insurance by contacting your agent or calling their customer service line. They will guide you through the process and provide support throughout the claim.