State car insurance plays a crucial role in ensuring safe roads and protecting drivers and their vehicles. Each state has its own set of regulations, influencing coverage requirements, premium costs, and available insurance programs. Understanding these nuances is essential for finding the right insurance policy and navigating the complexities of the state-specific car insurance landscape.

From understanding the fundamental principles of state car insurance regulations to exploring key considerations like cost, coverage options, and state-specific programs, this comprehensive guide provides insights into the world of state car insurance.

Understanding State Car Insurance

Navigating the world of car insurance can feel like driving through a maze. With countless options and varying requirements, it’s essential to understand the role state regulations play in shaping your coverage.

State Car Insurance Regulations

State car insurance regulations establish the minimum coverage requirements for all drivers. These regulations ensure that drivers are financially responsible for damages caused by accidents. They also protect victims by guaranteeing they have access to compensation for their injuries and property damage.

Role of State Government Agencies

State government agencies, typically called Departments of Insurance or similar, oversee the insurance industry within their respective states. These agencies play a crucial role in:

- Licensing and regulating insurance companies

- Monitoring insurance rates and ensuring they are fair and competitive

- Investigating consumer complaints and resolving disputes

- Educating the public about insurance options and consumer rights

Key Differences in Car Insurance Requirements, State car insurance

Each state has unique car insurance requirements based on factors like:

- The state’s population density and traffic volume

- The average cost of living and medical expenses

- The state’s legislative priorities and public safety concerns

These differences manifest in the types of coverage required, minimum liability limits, and other regulations. For instance:

| State | Minimum Liability Coverage |

|---|---|

| California | 15/30/5 |

| Florida | 10/20/10 |

| New York | 25/50/10 |

*Note: This table represents simplified examples and does not reflect all requirements or variations across states. Always refer to your state’s Department of Insurance for the most up-to-date information.*

Key Considerations for State Car Insurance

Choosing the right car insurance policy can be a complex process, and understanding the factors that influence premiums is crucial. State-specific regulations and local market dynamics play a significant role in determining the cost of car insurance. This section explores key considerations for state car insurance, including factors that impact premiums and how state regulations affect policy costs.

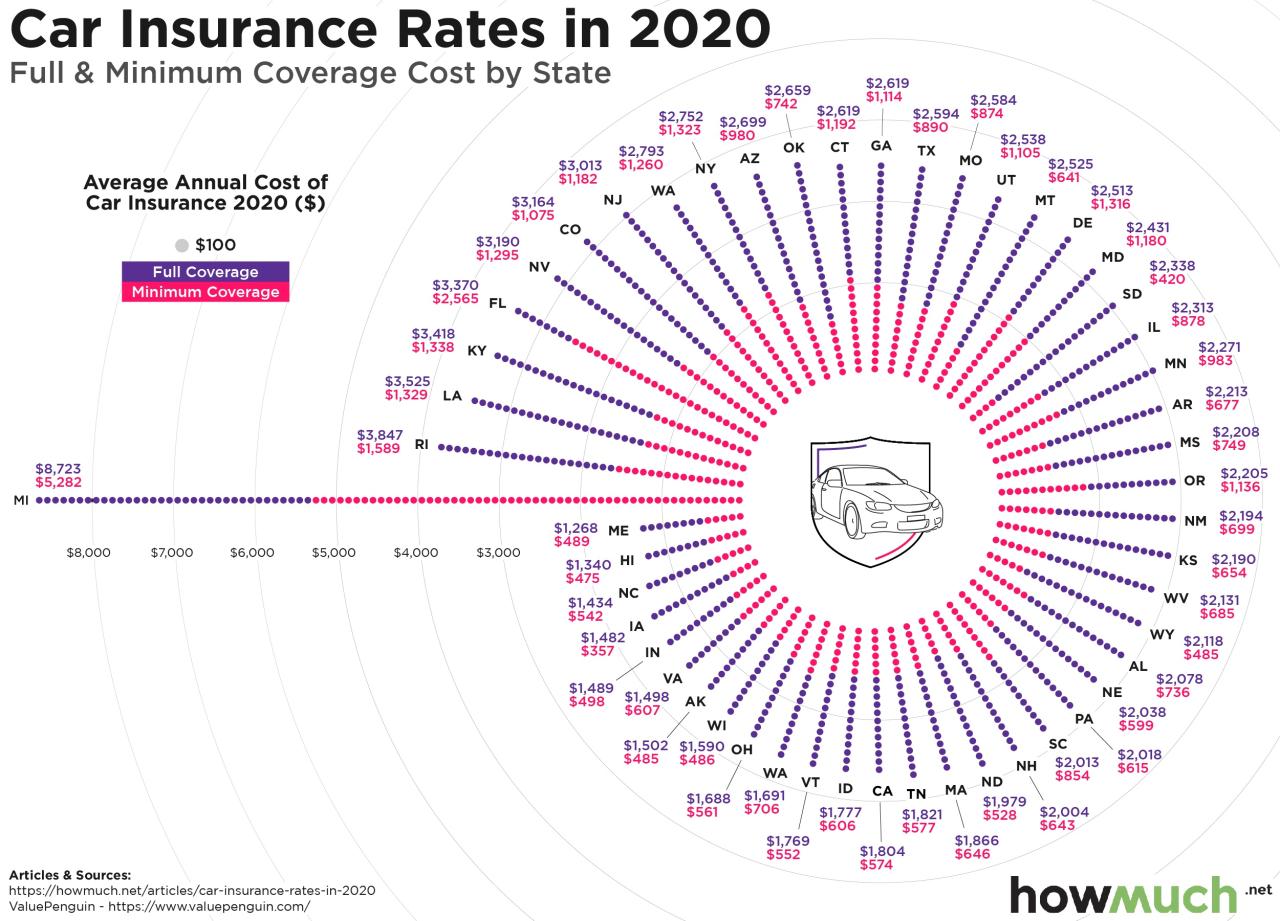

Car Insurance Costs Across States

Car insurance premiums vary significantly across different states. Several factors contribute to these variations, including:

- Traffic Density and Accident Rates: States with higher traffic congestion and accident rates tend to have higher insurance premiums. This is because insurers face a greater risk of paying out claims in these areas.

- Cost of Living and Medical Expenses: States with higher costs of living and medical expenses generally have higher insurance premiums. This is because insurers need to account for the higher costs of repairs and medical treatments.

- State Regulations and Laws: State insurance regulations, such as minimum coverage requirements and mandated benefits, can impact premiums. For example, states with higher minimum coverage requirements may have higher premiums.

- Competition Among Insurers: The level of competition among insurers in a state can also influence premiums. In states with more insurers competing for customers, premiums may be lower due to competitive pricing.

Factors Influencing Car Insurance Premiums

Several factors influence the cost of car insurance premiums, including:

- Demographics: Age, gender, and marital status can influence premiums. Younger drivers, especially males, typically have higher premiums due to higher risk profiles. Married drivers may have lower premiums due to a perceived lower risk of accidents.

- Driving History: A clean driving record with no accidents or violations usually results in lower premiums. Conversely, drivers with a history of accidents or traffic violations may face higher premiums.

- Vehicle Type: The type of vehicle you drive can also affect your insurance premium. High-performance cars, luxury vehicles, and SUVs often have higher premiums due to their higher repair costs and potential for more severe accidents.

- Driving Habits: Your driving habits, such as the number of miles you drive annually and where you drive, can impact your premiums. Drivers who commute long distances or drive in high-risk areas may face higher premiums.

- Credit History: In some states, insurers use credit history as a factor in determining insurance premiums. This is based on the assumption that people with good credit are more likely to be responsible drivers.

Impact of State Insurance Regulations

State-specific insurance regulations can significantly impact car insurance premiums. Some key regulations that affect premiums include:

- Minimum Coverage Requirements: States have minimum coverage requirements that specify the minimum amounts of liability coverage that drivers must carry. States with higher minimum coverage requirements generally have higher premiums.

- Mandated Benefits: Some states require insurers to offer certain benefits, such as personal injury protection (PIP) or uninsured/underinsured motorist coverage. These mandated benefits can increase premiums.

- Rate Regulation: Some states have regulations that control how insurers can set rates. For example, some states may require insurers to file rates with the state insurance department for approval. These regulations can impact premiums by limiting insurers’ ability to adjust rates based on market conditions.

- Tort Laws: State tort laws govern how individuals can sue for damages in accidents. States with “no-fault” systems, where drivers are typically limited to collecting damages from their own insurance, may have lower premiums than states with “fault” systems, where drivers can sue the other party for damages.

Navigating State Car Insurance Options

Choosing the right car insurance policy can be overwhelming, especially when considering the diverse options available across different states. This section delves into the various types of coverage, their benefits, and drawbacks, while highlighting state-specific nuances.

Understanding Coverage Types

Each state mandates a minimum level of car insurance coverage, but additional options provide comprehensive protection. Here’s a breakdown of common coverage types:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for the injured party.

- Property Damage Liability: Covers repairs or replacement costs for damaged property.

- Collision Coverage: Covers repairs or replacement costs for your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: Protects your vehicle against damages from events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Medical Payments Coverage (Med Pay): Covers medical expenses for you and your passengers, regardless of fault, up to a certain limit.

State-Specific Nuances

Each state has unique regulations and requirements regarding car insurance. These differences impact the types of coverage available, the minimum coverage limits, and the overall cost of insurance.

- Minimum Coverage Requirements: States have varying minimum coverage requirements, often expressed as limits for liability, collision, and comprehensive coverage.

- No-Fault Insurance: Some states operate under a no-fault insurance system, where drivers are primarily responsible for their own medical expenses after an accident, regardless of fault.

- Optional Coverage: States may offer additional coverage options, such as roadside assistance, rental car reimbursement, and gap insurance.

Minimum Coverage Requirements by State

The table below Artikels the minimum coverage requirements for each state:

| State | Bodily Injury Liability | Property Damage Liability | Uninsured Motorist Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|---|---|

| Alabama | 25/50/25 | 25,000 | 25/50/25 | Optional | Optional |

| Alaska | 25/50/15 | 15,000 | 25/50/15 | Optional | Optional |

| Arizona | 15/30/10 | 10,000 | 15/30/10 | Optional | Optional |

| Arkansas | 25/50/25 | 25,000 | 25/50/25 | Optional | Optional |

| California | 15/30/5 | 5,000 | 15/30/5 | Optional | Optional |

State-Specific Insurance Programs and Initiatives

States across the U.S. implement various programs and initiatives to address specific insurance needs and promote road safety. These efforts often target high-risk drivers, low-income individuals, and those seeking affordable coverage.

State-Run Insurance Programs

States may offer specialized insurance programs to address unique needs within their jurisdictions.

- High-Risk Driver Programs: Some states operate programs that provide insurance for drivers with poor driving records, such as multiple accidents or traffic violations. These programs may have higher premiums but offer coverage when traditional insurers decline to provide it.

- Low-Income Insurance Programs: Certain states offer programs that provide affordable auto insurance to low-income individuals. These programs may offer discounts or subsidized premiums to make coverage more accessible.

State-Sponsored Road Safety Initiatives

States often implement initiatives to improve road safety and reduce insurance costs. These initiatives can include:

- Driver Education Programs: Many states require young drivers to complete driver education courses before obtaining a license. These courses aim to enhance driving skills and promote safe driving habits.

- Traffic Enforcement Programs: States may implement programs to enforce traffic laws and deter dangerous driving behaviors. This can include increased patrols, stricter penalties for violations, and campaigns to raise awareness about road safety.

- Public Awareness Campaigns: States often conduct campaigns to educate the public about road safety issues and encourage responsible driving. These campaigns may focus on topics like distracted driving, drunk driving, and the importance of seat belts.

Finding the Right Car Insurance in Your State: State Car Insurance

Finding the right car insurance in your state can be a complex process, but with a strategic approach, you can secure the best coverage at a competitive price. This section will guide you through a step-by-step process to find the perfect car insurance policy for your needs.

Step-by-Step Guide for Finding Car Insurance

This guide Artikels the essential steps to help you find the best car insurance policy in your state.

- Assess Your Needs: Start by evaluating your specific requirements. Consider factors like your driving history, vehicle type, coverage preferences, and budget.

- Gather Quotes: Contact multiple insurance providers to obtain quotes. This will allow you to compare different coverage options and prices.

- Compare Quotes: Carefully analyze the quotes you receive, paying attention to coverage details, deductibles, and premiums.

- Review Policy Details: Before making a decision, thoroughly read the policy documents to understand the terms and conditions.

- Choose the Best Option: Select the policy that best aligns with your needs, budget, and risk tolerance.

- Finalize and Secure Coverage: Once you’ve chosen a policy, complete the necessary paperwork and secure your coverage.

Comparing Major Insurance Providers

Here’s a table comparing some of the major insurance providers in the United States, highlighting key features and pricing. This information is intended to be illustrative and may vary depending on your specific location and needs.

| Provider | Key Features | Pricing |

|---|---|---|

| State Farm | Wide range of coverage options, strong customer service, competitive pricing | $1,200 – $1,800 per year (estimated) |

| Geico | Known for affordable rates, online convenience, and discounts | $1,100 – $1,700 per year (estimated) |

| Progressive | Offers customizable coverage, innovative features, and personalized discounts | $1,000 – $1,600 per year (estimated) |

| Allstate | Strong reputation for claims handling, diverse coverage options, and customer support | $1,300 – $1,900 per year (estimated) |

Tips for Shopping for Car Insurance

Here are some practical tips to effectively shop for car insurance and negotiate rates:

- Compare quotes from multiple providers: Don’t settle for the first quote you receive. Shop around and compare offers from different insurers.

- Consider discounts: Many insurers offer discounts for safe driving, good credit, bundling policies, and other factors.

- Negotiate: Don’t be afraid to negotiate with insurers to try to get a lower rate.

- Review your policy regularly: Your needs and circumstances may change over time, so it’s important to review your policy periodically to ensure it still meets your requirements.

Closing Summary

Navigating the intricacies of state car insurance can be daunting, but by understanding the regulations, exploring available options, and comparing providers, individuals can find the right insurance policy to suit their needs and budget. With careful planning and research, drivers can ensure they are adequately protected on the road while meeting the specific requirements of their state.

FAQ Guide

What are the minimum car insurance requirements in my state?

Each state has its own minimum coverage requirements. It’s essential to check your state’s regulations to ensure you meet the legal requirements for driving.

How can I get a discount on my car insurance?

Many factors can affect your car insurance premiums, including your driving history, credit score, vehicle type, and safety features. Contact your insurance provider to inquire about available discounts.

What happens if I get into an accident in another state?

Most car insurance policies provide coverage in other states, but it’s essential to understand the specifics of your policy and any limitations that may apply.