State Farm Insurance auto quotes offer a comprehensive way to secure the protection you need for your vehicle. State Farm, known for its commitment to customer satisfaction and financial stability, provides a wide range of auto insurance options tailored to individual needs. Whether you’re a seasoned driver or a new car owner, understanding the factors that influence your auto insurance rates is crucial to making informed decisions.

From driving history and vehicle type to location and coverage options, a myriad of factors contribute to the final quote. State Farm’s online quote system provides a convenient and transparent platform to explore various insurance options and compare rates, empowering you to find the best coverage at a price that fits your budget.

State Farm Insurance Overview

State Farm is a leading provider of insurance and financial services in the United States, known for its strong customer base and commitment to community involvement.

History and Core Values

Founded in 1922 by George J. Mecherle, State Farm started as a small insurance agency in Bloomington, Illinois. Its core values, rooted in honesty, integrity, and a commitment to customer service, have been central to its growth and success. State Farm’s mission is to “help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.”

Primary Insurance Offerings

State Farm offers a wide range of insurance products to meet the diverse needs of its customers. Its primary offerings include:

- Auto Insurance: State Farm is the largest provider of auto insurance in the United States, offering coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection.

- Homeowners Insurance: Provides coverage for damage to the home and its contents, including personal property, liability, and medical payments.

- Life Insurance: Offers various types of life insurance, including term life, whole life, and universal life, to protect families and loved ones financially.

- Renters Insurance: Provides coverage for personal property and liability for renters, protecting them against losses due to theft, fire, or other events.

- Business Insurance: Offers a variety of insurance products for small businesses, including property, liability, workers’ compensation, and business interruption coverage.

Customer Base and Market Presence

State Farm boasts a significant customer base, serving over 83 million policies in the United States and Canada. It is consistently ranked among the top insurance companies in the country, demonstrating its strong market presence and reputation for reliability.

Auto Insurance Quotes

Getting an auto insurance quote from State Farm is a straightforward process designed to provide you with personalized coverage options. You can obtain a quote online, over the phone, or by visiting a local State Farm agent.

Factors Influencing Auto Insurance Rates

State Farm considers various factors when determining your auto insurance rates. These factors help ensure that your premium accurately reflects your individual risk profile.

- Driving History: Your driving record, including accidents, traffic violations, and driving experience, plays a significant role in determining your rates. A clean driving record typically results in lower premiums.

- Vehicle Type: The type of vehicle you drive, including its make, model, year, and safety features, influences your insurance costs. For example, newer vehicles with advanced safety features often have lower premiums than older vehicles with fewer safety features.

- Location: Your location, including the state and zip code, can impact your insurance rates due to factors such as traffic density, crime rates, and the frequency of accidents.

- Coverage Options: The level of coverage you choose, such as liability, collision, and comprehensive, will also affect your premium. Higher coverage levels typically result in higher premiums.

- Other Factors: Other factors, such as your age, credit score, and driving habits, may also be considered when calculating your insurance rates.

State Farm Auto Insurance Features and Benefits, State farm insurance auto quote

State Farm offers a comprehensive range of auto insurance features and benefits designed to provide you with peace of mind and financial protection.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle caused by events other than collisions, such as theft, vandalism, and natural disasters.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes injury or damage to others.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

- Rental Car Coverage: This coverage provides you with a rental car if your vehicle is damaged or stolen and you need transportation while it is being repaired or replaced.

- Roadside Assistance: This coverage provides you with assistance in case of a breakdown, flat tire, or other roadside emergencies.

- Accident Forgiveness: This feature may help you avoid a premium increase after your first at-fault accident, depending on your state and policy.

State Farm’s Online Quote System

State Farm’s online quote system is a user-friendly platform that allows potential customers to get personalized auto insurance quotes quickly and easily. This system simplifies the process of getting an insurance quote, offering a convenient alternative to traditional methods.

Functionality of State Farm’s Online Quote System

The online quote system guides users through a series of steps, asking them to provide essential information about themselves and their vehicle. The system is designed to be intuitive, with clear instructions and easy-to-understand questions. Users can input their information, such as their driving history, vehicle details, and desired coverage, and receive a customized quote in real-time.

Inputting Information and Receiving Personalized Quotes

State Farm’s online quote system requires users to provide specific details about their vehicle, driving history, and desired coverage. Here’s a breakdown of the typical information required:

- Vehicle Information: Year, make, model, and VIN (Vehicle Identification Number) are essential for calculating the quote.

- Driving History: This includes details like your driving record, any accidents or violations, and years of driving experience.

- Coverage Preferences: Users can select their preferred coverage levels, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Personal Information: Basic information like your name, address, and contact details is needed to generate a quote.

Once the information is submitted, State Farm’s system analyzes the data and provides a personalized quote based on the user’s specific circumstances.

Advantages of Using the Online Quote System

Using State Farm’s online quote system offers several advantages:

- Convenience: The system is accessible 24/7, allowing users to get quotes at their convenience, without having to call or visit an agent’s office.

- Speed: Quotes are generated in real-time, providing instant feedback and reducing the time needed to get an estimate.

- Transparency: Users can see how their information is used to calculate the quote, fostering transparency in the process.

- Comparison: The system allows users to compare different coverage options and prices, enabling them to choose the best fit for their needs and budget.

Potential Limitations of the Online Quote System

While convenient, the online quote system has some potential limitations:

- Limited Personalization: While the system provides personalized quotes, it may not be able to capture all the nuances of an individual’s situation, which could be addressed during a personal consultation with an agent.

- Technical Issues: Technical glitches or internet connectivity problems can disrupt the process, leading to delays or incomplete quotes.

- Complexity of Coverage: Some users may find the online system challenging to navigate, especially if they are unfamiliar with the different types of auto insurance coverage.

Customer Experience with State Farm Quotes

Getting an auto insurance quote from State Farm is a straightforward process, but the experience can vary depending on your chosen method. Here’s a breakdown of the customer experience with State Farm quotes, including customer feedback and a comparison of online versus agent-assisted quotes.

Customer Testimonials and Reviews

Customer feedback is essential for understanding the overall experience with State Farm quotes. Here are some common themes found in customer reviews:

- Positive Experiences: Many customers praise State Farm for its user-friendly online quote system, quick turnaround times, and helpful customer service. They appreciate the transparency of the quote process and the ability to easily compare different coverage options.

- Negative Experiences: Some customers have reported difficulties with the online quote system, such as technical glitches or confusing navigation. Others have expressed dissatisfaction with the communication from agents, citing issues like lack of responsiveness or unclear explanations of policy details.

Online Versus Agent-Assisted Quotes

The method you choose for obtaining a quote can significantly impact your experience. Here’s a comparison of online and agent-assisted quotes:

- Online Quotes: Online quotes offer convenience and speed. You can get a quote anytime, anywhere, without needing to schedule an appointment. However, online quotes may lack the personalized attention and guidance that an agent can provide.

- Agent-Assisted Quotes: Agent-assisted quotes provide personalized service and expert advice. An agent can help you understand your coverage options, tailor your policy to your specific needs, and answer any questions you may have. However, this method requires more time and effort, as you need to schedule an appointment and potentially visit an agent’s office.

Importance of Clear and Concise Communication

Clear and concise communication is crucial throughout the quote process. This includes:

- Accurate Information: State Farm needs accurate information from you to provide an accurate quote. This includes details about your vehicle, driving history, and desired coverage levels. Ensure you provide accurate information to avoid delays or inaccuracies in your quote.

- Transparent Explanations: State Farm should clearly explain the terms and conditions of your quote, including coverage options, deductibles, and premiums. Ask questions if anything is unclear, and ensure you fully understand the details of your quote before accepting it.

- Prompt Responses: State Farm should respond promptly to your inquiries, whether you’re contacting them online or through an agent. Timely communication builds trust and confidence in the quote process.

Comparing State Farm Auto Quotes to Competitors

It’s crucial to compare quotes from various insurance providers to find the best coverage at the most competitive price. While State Farm is a well-established and reputable company, it’s important to assess how its rates and offerings stack up against other major players in the auto insurance market.

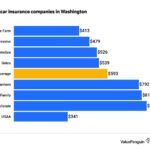

Comparison of Rates

To provide a comprehensive comparison, we’ll analyze State Farm’s rates against those offered by Geico, Progressive, and Allstate. These companies are known for their competitive pricing and broad customer base. We’ll consider factors such as driving history, vehicle type, and coverage levels to ensure a fair comparison.

Strengths and Weaknesses of State Farm’s Offerings

State Farm has a strong reputation for its customer service and extensive network of agents. However, its pricing can sometimes be higher compared to online-only competitors. We’ll delve into the strengths and weaknesses of State Farm’s auto insurance offerings, highlighting key aspects such as coverage options, discounts, and customer service.

Key Features and Benefits Comparison

This table presents a side-by-side comparison of key features and benefits offered by State Farm and its top competitors:

| Feature | State Farm | Geico | Progressive | Allstate |

|---|---|---|---|---|

| Coverage Options | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection |

| Discounts | Safe driver, good student, multi-car, multi-policy | Safe driver, good student, multi-car, multi-policy | Safe driver, good student, multi-car, multi-policy | Safe driver, good student, multi-car, multi-policy |

| Customer Service | Agent network, 24/7 claims service, online account management | Online quote and claims process, 24/7 customer support | Online quote and claims process, 24/7 customer support, mobile app | Agent network, online account management, 24/7 claims service |

| Technology | Mobile app for claims reporting and policy management | Mobile app for claims reporting, policy management, and roadside assistance | Mobile app for claims reporting, policy management, and telematics programs | Mobile app for claims reporting, policy management, and virtual inspections |

This table provides a general overview of key features. It’s important to note that specific coverage options, discounts, and benefits may vary based on individual circumstances and state regulations.

Tips for Getting the Best Auto Insurance Quote

Getting the best auto insurance quote from State Farm involves a combination of smart strategies and proactive steps. By understanding your coverage needs, leveraging available discounts, and comparing quotes from multiple insurers, you can secure a policy that provides adequate protection while fitting your budget.

Leveraging Discounts and Promotions

State Farm offers a wide range of discounts to help policyholders save money on their auto insurance premiums. These discounts can significantly reduce your overall costs.

- Good Driver Discounts: State Farm rewards safe drivers with discounts for maintaining a clean driving record. This typically involves having no accidents or traffic violations for a specified period.

- Safe Vehicle Discounts: Driving a newer, safer vehicle with advanced safety features can qualify you for a discount. State Farm recognizes vehicles with anti-theft devices, airbags, and other safety technologies.

- Multi-Policy Discounts: Bundling your auto insurance with other State Farm policies, such as homeowners or renters insurance, can result in significant savings. The combined coverage often comes with a discount.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices and potentially earn you a discount.

- Student Discounts: State Farm offers discounts to students who maintain good grades or attend college full-time.

- Loyalty Discounts: Staying with State Farm for an extended period can lead to loyalty discounts, rewarding your continued business.

- Payment Discounts: Paying your premiums in full or setting up automatic payments can sometimes result in discounts.

Shopping Around and Comparing Quotes

While State Farm offers competitive rates, it’s crucial to shop around and compare quotes from multiple insurers. This ensures you’re getting the best possible deal for your specific needs.

- Online Quote Tools: Most insurance companies, including State Farm, provide online quote tools that allow you to quickly and easily compare different coverage options and prices.

- Independent Insurance Agents: Working with an independent insurance agent can provide access to quotes from multiple insurers, simplifying the comparison process.

- Comparison Websites: Websites dedicated to comparing insurance quotes, such as Insurance.com or Bankrate, can help you gather quotes from various providers in one place.

Last Point: State Farm Insurance Auto Quote

By carefully considering your needs, comparing quotes from multiple insurers, and taking advantage of available discounts, you can secure a competitive auto insurance policy that safeguards your vehicle and your financial well-being. State Farm’s dedication to customer service and its commitment to providing personalized insurance solutions make it a trusted choice for drivers seeking reliable protection.

Questions and Answers

What are the key factors that influence my State Farm auto insurance quote?

Your driving history, vehicle type, location, coverage options, and credit score can all impact your auto insurance rates.

How can I get the best possible auto insurance quote from State Farm?

Shop around and compare quotes from multiple insurers, consider bundling your insurance policies, maintain a good driving record, and take advantage of available discounts.

What are the advantages of using State Farm’s online quote system?

Convenience, speed, and transparency are key advantages. You can access quotes anytime, compare options side-by-side, and receive personalized results without any pressure.

What are the differences between obtaining a quote online and through a State Farm agent?

Online quotes offer a quick and easy way to get a preliminary estimate. Working with an agent allows for personalized advice and tailored coverage options based on your specific needs.