Renters insurance washington state – Renters insurance in Washington State is essential for safeguarding your personal belongings against unexpected events. From fire and theft to natural disasters, this policy provides financial protection, giving you peace of mind knowing you’re covered in case of the unexpected.

This comprehensive guide delves into the nuances of renters insurance in Washington State, exploring different coverage options, factors influencing premiums, and the process of filing a claim. We’ll also address common questions and provide resources to help you find the right policy for your needs.

Renters Insurance Basics in Washington State

Renters insurance in Washington State is a valuable investment that protects your belongings and provides financial security in case of unforeseen events. It acts as a safety net, safeguarding you from potential losses and helping you recover from unexpected situations.

Key Coverages in Renters Insurance Policies

Renters insurance policies typically offer coverage for a range of situations. Understanding these coverages helps you make informed decisions about your policy and ensure you have adequate protection.

- Personal Property Coverage: This coverage protects your belongings, such as furniture, electronics, clothing, and other personal items, against damage or loss due to covered perils. This includes theft, fire, vandalism, and certain natural disasters.

- Liability Coverage: This coverage protects you from financial liability if someone is injured on your property or if you accidentally damage someone else’s property. It covers legal expenses and medical bills associated with such incidents.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary housing, meals, and other necessary expenses while your home is being repaired or rebuilt.

- Medical Payments Coverage: This coverage helps pay for medical expenses for guests who are injured on your property, regardless of fault.

- Personal Property Replacement Cost Coverage: This coverage helps replace your belongings at their current market value, rather than their depreciated value, which is the typical coverage in most standard policies.

Common Exclusions in Renters Insurance Policies

While renters insurance offers extensive protection, there are certain events and situations that are typically excluded from coverage. It’s crucial to be aware of these exclusions to avoid surprises and ensure you have appropriate protection.

- Earthquakes: Most standard renters insurance policies do not cover damage caused by earthquakes. However, you can purchase separate earthquake insurance to address this specific risk.

- Flooding: Similarly, standard policies typically do not cover damage caused by flooding. You can purchase separate flood insurance through the National Flood Insurance Program (NFIP) to protect yourself from this risk.

- Neglect or Intentional Acts: Damage caused by your own negligence or intentional acts is generally not covered. For example, if you leave your door unlocked and your belongings are stolen, your policy may not cover the loss.

- Wear and Tear: Damage caused by normal wear and tear is not covered. For example, if your furniture deteriorates over time, it is not a covered event.

- Certain Types of Valuables: Some high-value items, such as jewelry, art, and collectibles, may require additional coverage or separate insurance policies. It’s important to discuss these items with your insurance agent to ensure they are adequately protected.

Policy Limits and Deductibles

Understanding the policy limits and deductibles associated with your renters insurance is crucial. These factors influence how much you pay for your insurance and how much you receive in coverage.

- Policy Limits: This refers to the maximum amount your insurance company will pay for covered losses. It’s important to choose a policy limit that adequately covers the value of your belongings and potential liability.

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically means lower premiums, but you will pay more in case of a claim. Conversely, a lower deductible means higher premiums, but you will pay less in case of a claim.

Types of Renters Insurance Coverage: Renters Insurance Washington State

Renters insurance in Washington State comes in various forms, each offering different levels of protection for your belongings and liability. Understanding the nuances of these coverage types is crucial for choosing the right policy that aligns with your specific needs and budget.

Personal Property Coverage

This coverage protects your personal belongings against various perils, such as fire, theft, vandalism, and natural disasters. It covers the actual cash value (ACV) or replacement cost value (RCV) of your possessions.

- Actual Cash Value (ACV): This coverage pays the depreciated value of your belongings, meaning the original cost minus depreciation due to age and wear and tear. For example, if your five-year-old laptop was stolen, the ACV coverage would reimburse you for its current market value, which is likely less than its original purchase price.

- Replacement Cost Value (RCV): This coverage reimburses you for the full cost of replacing your damaged or stolen belongings with new, similar items. This option typically costs more than ACV but provides greater financial protection. For instance, if your five-year-old laptop was stolen, the RCV coverage would pay for a new laptop with similar features and specifications, regardless of its age.

It’s essential to carefully consider the value of your belongings and your financial capacity when deciding between ACV and RCV coverage. If you have expensive items, RCV coverage offers greater peace of mind, although it comes at a higher premium.

Liability Coverage

Liability coverage protects you from financial losses arising from accidents or injuries that occur on your rented property, causing harm to others or their property. For instance, if a guest trips and falls on your stairs, injuring themselves, liability coverage would help cover their medical expenses and legal fees.

- Personal Liability: This coverage protects you from claims of negligence or wrongdoing that result in bodily injury or property damage to others. It typically includes a limit of coverage, such as $100,000, which represents the maximum amount your insurer will pay for a single incident.

- Medical Payments: This coverage helps pay for medical expenses incurred by others, regardless of fault, if they are injured on your property. It typically has a lower limit than personal liability coverage, such as $1,000.

Liability coverage is essential for renters as it protects you from significant financial losses that could arise from unforeseen accidents. It’s crucial to choose a policy with adequate coverage limits based on your individual circumstances and the potential risks associated with your property.

Additional Living Expenses (ALE)

ALE coverage provides financial assistance to cover temporary housing, meals, and other essential living expenses if your rental property becomes uninhabitable due to a covered peril. For example, if a fire forces you to evacuate your apartment, ALE coverage would help cover the cost of staying in a hotel or renting a temporary apartment until your home is repaired.

This coverage is essential for renters as it helps minimize the financial burden and inconvenience associated with displacement due to a covered event. It’s important to note that ALE coverage typically has a limit, such as $1,000 per month, and a maximum duration, such as six months.

Other Coverage Options

Renters insurance policies may also offer additional coverage options, such as:

- Personal Injury Protection: This coverage protects you from claims of slander, libel, or invasion of privacy.

- Water Damage Coverage: This coverage protects your belongings from damage caused by water leaks or floods.

- Identity Theft Coverage: This coverage provides financial assistance and support in the event of identity theft.

- Valuable Items Coverage: This coverage provides additional protection for high-value items, such as jewelry, art, or antiques, that exceed the standard limits of your policy.

These additional coverage options can provide valuable protection, but they typically come at an extra cost. It’s essential to evaluate your individual needs and prioritize coverage based on your specific circumstances.

Coverage Comparison Table

| Coverage Type | Description | Benefits | Limitations |

|---|---|---|---|

| Personal Property Coverage | Protects your belongings against damage or loss due to covered perils. | Provides financial compensation for damaged or stolen belongings. | May have limits on coverage amount and specific items. |

| Liability Coverage | Protects you from financial losses arising from accidents or injuries that occur on your rented property. | Covers legal expenses and damages resulting from negligence or wrongdoing. | Coverage limits may not be sufficient for all incidents. |

| Additional Living Expenses (ALE) | Provides financial assistance to cover temporary housing and living expenses if your rental property becomes uninhabitable. | Helps minimize financial burden and inconvenience during displacement. | Coverage limits and duration may be limited. |

| Other Coverage Options | Offers additional protection for specific risks, such as personal injury, water damage, identity theft, or valuable items. | Provides comprehensive coverage for various potential risks. | May require additional premiums for specific coverage options. |

It’s important to note that the specific coverage options and their limitations may vary depending on the insurance company and the policy you choose.

Examples of Situations Where Specific Coverage Types Would Be Most Beneficial

- Personal Property Coverage: If your apartment is burglarized and your laptop, smartphone, and other electronics are stolen, personal property coverage would reimburse you for the cost of replacing these items.

- Liability Coverage: If a guest slips and falls on your icy sidewalk, injuring themselves, liability coverage would help cover their medical expenses and legal fees.

- Additional Living Expenses (ALE): If a fire forces you to evacuate your apartment and you need to stay in a hotel for several weeks while your apartment is repaired, ALE coverage would help cover the cost of your temporary housing.

- Other Coverage Options: If you have a valuable collection of art or jewelry, you may want to consider purchasing valuable items coverage to ensure adequate protection for these assets.

It’s important to understand the specific coverage options and their limitations before purchasing renters insurance.

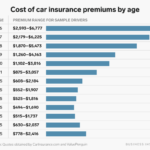

Factors Affecting Renters Insurance Premiums

Your renters insurance premium is determined by various factors that insurers consider to assess your risk. Understanding these factors can help you make informed decisions to potentially lower your premium.

Location

Your location significantly influences your renters insurance premium. Insurance companies assess the risk of theft, vandalism, and natural disasters in your area. Areas with higher crime rates or more frequent natural disasters, such as earthquakes or floods, generally have higher premiums. For instance, living in a coastal area with a history of hurricanes may result in a higher premium than living in an inland area with minimal risk of natural disasters.

Coverage Limits

The amount of coverage you choose for your renters insurance policy directly affects your premium. Higher coverage limits, which protect you for more losses, typically result in higher premiums. You can choose coverage limits that best suit your needs and budget. For example, if you have expensive electronics or jewelry, you might opt for higher coverage limits to ensure adequate protection.

Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually translates to a lower premium, while a lower deductible means a higher premium. You should carefully consider your financial situation and risk tolerance when choosing your deductible. If you can afford a higher deductible, you can potentially save on your premium.

Personal Risk Factors

Your personal risk factors, such as your credit score, claims history, and the age of your building, can also influence your premium. A good credit score often indicates responsible financial behavior and can lead to lower premiums. A history of filing claims may result in higher premiums, as it suggests a higher risk for the insurer. Similarly, buildings that are older or have a history of maintenance issues may carry higher premiums due to potential risks.

Tips to Lower Renters Insurance Premiums

- Shop around: Compare quotes from multiple insurance companies to find the best rates.

- Increase your deductible: A higher deductible typically results in a lower premium. Make sure you can afford to pay the deductible if you need to file a claim.

- Bundle your insurance: Many insurance companies offer discounts if you bundle your renters insurance with other policies, such as car insurance.

- Improve your home security: Installing security systems, such as alarms or motion detectors, can reduce your risk of theft and may lead to lower premiums.

- Ask about discounts: Insurance companies often offer discounts for various factors, such as being a good student, having a good driving record, or being a member of certain organizations.

Common Discounts Offered in Washington State

Insurance providers in Washington State often offer a range of discounts to lower premiums. Some common discounts include:

- Multi-policy discount: Bundling your renters insurance with other policies, such as auto or home insurance, can save you money.

- Safety and security discounts: Installing smoke detectors, burglar alarms, or security systems can qualify you for discounts.

- Loyalty discount: Staying with the same insurance company for an extended period can earn you a discount.

- Good student discount: Students with good grades may qualify for a discount.

- Pay-in-full discount: Paying your premium in full upfront may result in a discount.

Filing a Renters Insurance Claim in Washington State

When you need to file a claim, it’s crucial to understand the process and know how to navigate it effectively. Filing a claim with your renters insurance provider involves several steps, and the information you provide plays a significant role in the outcome.

Steps Involved in Filing a Renters Insurance Claim, Renters insurance washington state

The process of filing a renters insurance claim typically involves these steps:

- Report the Incident: Contact your insurance provider as soon as possible after the incident occurs. This could be a theft, fire, or any other covered event.

- Provide Details: Be prepared to provide your insurance company with detailed information about the incident. This includes the date, time, location, and a description of what happened.

- Document the Damage: Take photos or videos of the damaged property. This documentation will be crucial for supporting your claim.

- File a Claim: Follow your insurance company’s instructions for filing a claim. This may involve completing a form online or by mail.

- Provide Proof of Loss: You will likely need to provide documentation, such as receipts, estimates, or invoices, to support your claim.

- Claim Processing: Your insurance company will review your claim and determine if it is covered under your policy.

- Payment: If your claim is approved, your insurance company will issue payment for the covered losses.

Importance of Documentation and Communication

Documentation is vital in the claims process. It helps your insurance company assess the extent of the damage and determine the appropriate compensation. Maintaining clear communication with your insurance provider throughout the process is essential. This includes:

- Promptly Responding to Requests: Respond to your insurance company’s inquiries in a timely manner.

- Providing Accurate Information: Ensure the information you provide is accurate and complete.

- Following Up: If you haven’t heard back from your insurance company within a reasonable timeframe, follow up to check on the status of your claim.

Common Claim Scenarios and Handling

Here are some common claim scenarios and how they are typically handled:

- Theft: If your belongings are stolen, you will need to provide a list of the stolen items, including their value. Your insurance company will then assess the claim and determine the amount of coverage.

- Fire: In case of a fire, you will need to document the damage to your belongings and provide estimates for repairs or replacements. Your insurance company will cover the cost of repairs or replacements up to your policy limits.

- Water Damage: If your apartment experiences water damage, you will need to document the damage and provide estimates for repairs. Your insurance company will cover the cost of repairs up to your policy limits.

Typical Timeframe for Claim Processing and Payment

The timeframe for claim processing and payment can vary depending on the complexity of the claim and the insurance company’s procedures. However, here’s a general overview:

| Claim Stage | Typical Timeframe |

|---|---|

| Initial Claim Filing | 1-2 Business Days |

| Claim Investigation | 1-2 Weeks |

| Claim Approval | 1-2 Weeks |

| Payment | 1-2 Weeks |

Resources for Renters in Washington State

Navigating the world of renters insurance can feel overwhelming, but you’re not alone. There are many resources available to help you find the right coverage and understand your options. This section will highlight some reputable resources and organizations that can provide guidance and support.

Reputable Resources for Renters Insurance Information

Finding reliable information is crucial when making decisions about your renters insurance. Here are some trustworthy sources:

- Washington State Insurance Commissioner: The Washington State Insurance Commissioner’s website offers valuable information on renters insurance, including consumer guides, FAQs, and complaint filing procedures. You can access this resource at [website address].

- Insurance Information Institute (III): The III is a non-profit organization dedicated to providing information about insurance. Their website features a wealth of resources, including articles, infographics, and tools to help you understand renters insurance. Visit [website address] for more information.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents state insurance regulators. Their website offers information on various insurance topics, including renters insurance, and provides links to state insurance departments. You can find their website at [website address].

Organizations Offering Assistance to Renters in Washington State

If you’re facing challenges as a renter, there are organizations in Washington State that can provide support and resources. Here are a few examples:

- Washington State Housing Finance Commission: This agency provides financial assistance and resources to low- and moderate-income renters, including rental assistance programs and eviction prevention services. Visit their website at [website address] to learn more.

- Washington Low Income Housing Alliance: This organization advocates for affordable housing and provides resources to renters in Washington State. You can find information about their services and programs at [website address].

- Tenant Union of Washington: This non-profit organization provides legal assistance and advocacy for tenants in Washington State. They offer resources on renters’ rights, landlord-tenant disputes, and eviction prevention. You can reach them at [website address].

Trusted Insurance Providers in Washington State

Choosing the right insurance provider is essential. Here are some reputable insurance companies that operate in Washington State:

- State Farm: Known for its comprehensive coverage and strong customer service, State Farm is a leading insurance provider in Washington State. Visit their website at [website address] to get a quote.

- Farmers Insurance: Farmers offers a wide range of insurance products, including renters insurance, and has a strong presence in Washington State. Explore their coverage options at [website address].

- Allstate: Allstate is another well-known insurance provider offering various insurance products, including renters insurance, in Washington State. You can get a quote and learn more about their coverage at [website address].

Comparing Quotes and Finding the Best Policy

Once you’ve identified potential insurance providers, it’s crucial to compare quotes and find the best policy for your needs. Here’s how you can approach this process:

- Gather Information: Before contacting insurance companies, gather essential information about your rental property, such as the address, square footage, and the value of your belongings. This will help you get accurate quotes.

- Use Online Comparison Tools: Several websites and apps allow you to compare quotes from multiple insurance providers simultaneously. These tools can save you time and effort. Consider using reputable websites like [website address] or [website address].

- Review Coverage Options: Pay close attention to the coverage options offered by different providers. Ensure the policy covers your specific needs, such as personal property, liability, and additional living expenses.

- Consider Discounts: Inquire about available discounts, such as multi-policy discounts or safety features installed in your rental property. These discounts can help reduce your premium.

- Read the Policy Carefully: Before committing to a policy, carefully read the policy documents to understand the coverage details, exclusions, and any limitations.

Closing Summary

Understanding renters insurance in Washington State empowers you to make informed decisions about protecting your belongings and financial well-being. By carefully considering your coverage options, factors influencing premiums, and the claims process, you can ensure that you have the right protection in place.

Popular Questions

How much renters insurance do I need?

The amount of coverage you need depends on the value of your belongings. It’s recommended to create an inventory of your possessions and their estimated replacement cost to determine the appropriate coverage amount.

What are some common exclusions in renters insurance policies?

Common exclusions include damage caused by earthquakes, floods, and acts of war. It’s important to review your policy carefully to understand what’s covered and what’s not.

Can I get renters insurance if I have a roommate?

Yes, you can get renters insurance even if you have a roommate. Each roommate should have their own separate policy to cover their personal belongings.

What happens if my landlord has insurance?

Your landlord’s insurance covers the building itself, but not your personal belongings. You still need your own renters insurance to protect your possessions.