State Farm Insurance Homeowners, a leading provider of home insurance, offers comprehensive coverage designed to safeguard your most valuable asset – your home. From dwelling coverage to personal property protection and liability insurance, State Farm provides a safety net for unexpected events. This guide explores the ins and outs of State Farm homeowners insurance, covering key features, pricing factors, claims processes, customer service, and valuable tips to ensure you have the right coverage for your needs.

Understanding the nuances of homeowners insurance can be daunting, but State Farm strives to make the process simple and transparent. With a variety of coverage options, discounts, and customer support resources, State Farm empowers homeowners to make informed decisions and protect their investments. Whether you’re a first-time homeowner or a seasoned property owner, this comprehensive guide will equip you with the knowledge to navigate the world of State Farm homeowners insurance with confidence.

State Farm Homeowners Insurance Overview

State Farm is a leading provider of homeowners insurance in the United States, offering comprehensive coverage to protect your home and belongings from a variety of risks. Their policies are designed to provide financial security and peace of mind, helping you rebuild your life in the event of an unexpected event.

Coverage Options

State Farm homeowners insurance policies offer various coverage options to meet your specific needs and budget. These options include:

- Dwelling Coverage: This coverage protects the physical structure of your home, including the foundation, walls, roof, and attached structures like garages and porches. It covers damage caused by perils such as fire, windstorms, hail, and vandalism.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, appliances, electronics, clothing, and jewelry. It covers loss or damage due to covered perils.

- Liability Coverage: This coverage provides financial protection if you are held legally responsible for injuries or property damage to others on your property. For example, if a guest slips and falls on your icy driveway, this coverage would help pay for their medical expenses and legal fees.

- Additional Living Expenses Coverage: This coverage helps pay for temporary living expenses if your home becomes uninhabitable due to a covered peril. This could include hotel costs, meals, and other necessary expenses while your home is being repaired or rebuilt.

Common Situations Where State Farm Homeowners Insurance Provides Protection

State Farm homeowners insurance can provide financial protection in a variety of situations, including:

- Fire Damage: If your home is damaged or destroyed by a fire, State Farm homeowners insurance can help cover the cost of repairs or rebuilding.

- Windstorms and Hail Damage: State Farm homeowners insurance can help cover damage to your home caused by windstorms, hail, or other severe weather events.

- Vandalism and Theft: If your home is vandalized or your belongings are stolen, State Farm homeowners insurance can help cover the cost of repairs or replacement.

- Liability Claims: If someone is injured on your property and you are found legally responsible, State Farm homeowners insurance can help cover your legal defense costs and any damages awarded.

State Farm Homeowners Insurance Pricing and Factors

The cost of homeowners insurance can vary greatly depending on several factors. State Farm, like other insurance providers, considers a range of elements to determine your premiums. Understanding these factors can help you make informed decisions and potentially save on your insurance costs.

Factors Influencing State Farm Homeowners Insurance Premiums

State Farm, like other insurers, assesses several factors to determine your homeowners insurance premiums. These factors include:

- Location: Your home’s location is a key factor influencing premiums. Areas prone to natural disasters, such as earthquakes, hurricanes, or wildfires, tend to have higher premiums. State Farm considers factors like the frequency and severity of claims in your region.

- Property Value: The value of your home is directly related to your insurance premium. Higher-value homes generally require higher coverage amounts, leading to higher premiums. State Farm assesses the property’s replacement cost, which reflects the cost to rebuild your home in case of a total loss.

- Coverage Amount: The amount of coverage you choose for your home and belongings directly affects your premium. Higher coverage limits result in higher premiums. State Farm offers various coverage options, and it’s essential to choose the level that best suits your needs and budget.

- Risk Factors: State Farm considers several risk factors that can influence your premiums, such as:

- Home’s Age and Condition: Older homes with outdated plumbing, electrical systems, or roofing may pose a higher risk of damage, leading to higher premiums.

- Safety Features: Homes equipped with security systems, smoke detectors, and fire sprinklers are generally considered lower risk and may qualify for discounts.

- Claims History: Your past claims history, both with State Farm and other insurers, can influence your premium. A history of frequent claims may lead to higher premiums.

- Credit Score: In some states, State Farm may use your credit score as a factor in determining your premiums. This is because individuals with good credit history are statistically less likely to file claims.

State Farm Homeowners Insurance Pricing Compared to Other Providers, State farm insurance homeowners

It’s challenging to provide a direct comparison of State Farm’s pricing to other major homeowners insurance providers. This is because premiums vary significantly based on individual factors, including location, coverage amounts, and risk profiles.

To get a personalized quote and compare prices, it’s recommended to contact multiple insurers, including State Farm, and provide them with your specific details. You can use online comparison tools or work with an insurance broker to obtain quotes from different companies.

Discounts Offered by State Farm

State Farm offers a variety of discounts to homeowners, which can significantly reduce your premiums. These discounts include:

- Multi-Policy Discounts: State Farm offers discounts for bundling multiple insurance policies, such as homeowners, auto, and life insurance, under one account. This can lead to significant savings by combining your policies.

- Safety Discounts: State Farm provides discounts for homeowners who install safety features, such as smoke detectors, burglar alarms, and fire sprinklers. These features help reduce the risk of accidents and claims, leading to lower premiums.

- Loyalty Discounts: State Farm rewards long-term customers with loyalty discounts. These discounts can vary depending on the length of your policy and your claims history.

- Other Discounts: State Farm may offer additional discounts based on your profession, membership in certain organizations, or participation in home safety programs.

State Farm Homeowners Insurance Claims Process: State Farm Insurance Homeowners

Filing a homeowners insurance claim with State Farm is a straightforward process designed to help you recover from covered losses. Here’s a step-by-step guide to ensure a smooth and efficient claim experience.

Steps for Filing a Claim

The first step in filing a homeowners insurance claim with State Farm is to report the loss to your insurance agent or by calling the State Farm claims hotline. You will need to provide details about the incident, including the date, time, and location of the loss. You will also need to describe the nature of the damage and provide any relevant information, such as police reports or witness statements. State Farm will then assign a claims adjuster to your case.

Documentation and Information Required

To support your homeowners insurance claim, State Farm will require certain documentation. These documents help verify the details of the loss and ensure that your claim is processed efficiently. Here are some of the common documents you may need to provide:

- Proof of Loss: This document Artikels the details of the damage, including a description of the property that was damaged, the cause of the damage, and the estimated cost of repairs or replacement.

- Photographs or Videos: Visual documentation of the damage is essential. Take clear photographs or videos of the damaged property, including the surrounding area, to help the adjuster assess the extent of the loss.

- Receipts and Estimates: If you have any receipts for repairs or replacements, or estimates from contractors, provide these documents to support your claim.

- Police Reports: If the loss was due to a crime, such as theft or vandalism, provide a copy of the police report.

Claim Processing and Payment

Once you have submitted your claim, State Farm’s claims adjuster will review the documentation and conduct an inspection of the damaged property. The adjuster will assess the extent of the damage and determine the amount of coverage available under your policy. If the claim is approved, State Farm will issue a payment for the covered losses.

- Claim Processing Timeframe: The time it takes to process a homeowners insurance claim can vary depending on the complexity of the claim and the availability of documentation. However, State Farm strives to process claims as quickly as possible. In many cases, you can expect to receive a decision on your claim within a few weeks.

- Claim Payment: Once your claim is approved, State Farm will issue a payment for the covered losses. You can choose to receive the payment directly or have it sent to your contractor for repairs or replacement.

State Farm Homeowners Insurance Customer Service and Reviews

State Farm, a well-known name in the insurance industry, prides itself on providing excellent customer service. Their homeowners insurance policyholders have a lot to say about their experiences with State Farm, both positive and negative. This section delves into the customer service aspects of State Farm homeowners insurance, analyzing its strengths and weaknesses, and examining the resources and tools available to policyholders.

Customer Testimonials and Reviews

Customer feedback is crucial in understanding the overall experience with any insurance provider. State Farm homeowners insurance has garnered a mixed bag of reviews, with some customers praising their responsiveness and helpfulness, while others have expressed dissatisfaction with certain aspects of their service.

- Many customers highlight State Farm’s friendly and knowledgeable agents as a major positive. These agents are often praised for their ability to explain complex insurance concepts in a clear and concise manner, making the process of choosing and understanding coverage less daunting.

- State Farm’s online resources and mobile app are also frequently cited as positive aspects. The online portal allows policyholders to manage their accounts, make payments, and access important documents conveniently. The mobile app provides similar functionalities, offering added convenience for on-the-go policyholders.

- However, some customers have voiced concerns about the speed of claim processing and the level of communication during the claims process. Some have reported experiencing delays in receiving claim updates or encountering difficulties getting through to customer service representatives.

State Farm Customer Service Channels

State Farm offers a variety of customer service channels, catering to different preferences and needs. These channels include online portals, phone support, and physical branches.

- The online portal is a convenient option for managing policies, accessing documents, and making payments. It provides a centralized platform for policyholders to access essential information related to their coverage.

- Phone support is available for immediate assistance with inquiries or urgent matters. State Farm aims to provide prompt and helpful phone support to address customer concerns.

- Physical branches offer a more personalized approach, allowing policyholders to interact with agents in person. This option is particularly beneficial for customers who prefer face-to-face interactions or require more complex assistance.

Availability of Resources and Tools

State Farm provides a range of resources and tools to empower policyholders and enhance their experience.

- The online account management system allows policyholders to access their policy details, make payments, update contact information, and view claim history.

- The State Farm mobile app offers similar functionalities as the online portal, providing convenience for policyholders who prefer managing their accounts on the go. The app also features additional features like real-time claim tracking and access to roadside assistance services.

- State Farm also provides educational resources, such as articles, videos, and FAQs, to help policyholders understand their coverage and navigate the insurance process effectively.

State Farm Homeowners Insurance Comparisons

Choosing the right homeowners insurance policy can be a complex decision, and comparing different providers is essential to find the best fit for your needs and budget. This section explores how State Farm homeowners insurance stacks up against other prominent insurance providers, analyzing key aspects like coverage, pricing, and customer service.

Comparison with Other Prominent Providers

- Coverage: State Farm offers a wide range of coverage options, including comprehensive coverage for dwelling, personal property, liability, and additional living expenses. However, other providers like Allstate and Liberty Mutual may offer more specialized coverage options, such as coverage for specific valuables or additional endorsements.

- Pricing: State Farm is generally known for its competitive pricing, but it’s crucial to compare quotes from multiple providers to find the best deal. Factors like location, property value, and coverage level can significantly influence pricing.

- Customer Service: State Farm has a strong reputation for customer service, with numerous positive reviews and a user-friendly online platform. However, other providers like USAA and Nationwide also excel in customer service, offering personalized support and quick claim processing.

Key Features and Benefits of Different Providers

| Provider | Coverage Options | Pricing | Customer Service | Additional Features |

|---|---|---|---|---|

| State Farm | Comprehensive coverage for dwelling, personal property, liability, and additional living expenses | Competitive pricing, but varies based on location, property value, and coverage level | Strong reputation for customer service, user-friendly online platform | Discounts for bundling policies, online claim reporting, mobile app for policy management |

| Allstate | Specialized coverage options, such as coverage for specific valuables or additional endorsements | May offer higher premiums compared to State Farm, but provides extensive coverage | Generally good customer service, but some reviews highlight inconsistent experiences | Claims assistance through a 24/7 call center, online tools for policy management |

| Liberty Mutual | Comprehensive coverage options, including coverage for specific valuables and additional endorsements | Pricing varies based on location, property value, and coverage level | Good customer service, with a focus on personalized support and claim processing | Discounts for bundling policies, online claim reporting, mobile app for policy management |

| USAA | Specialized coverage options for military personnel and their families | Competitive pricing for eligible members, with discounts for active duty and veterans | Excellent customer service, known for its personalized support and quick claim processing | Financial planning tools, insurance education resources, exclusive discounts for members |

| Nationwide | Comprehensive coverage options, including coverage for specific valuables and additional endorsements | Pricing varies based on location, property value, and coverage level | Good customer service, with a focus on personalized support and claim processing | Discounts for bundling policies, online claim reporting, mobile app for policy management |

Pros and Cons of Each Provider

- State Farm:

- Pros: Competitive pricing, wide range of coverage options, strong customer service reputation, user-friendly online platform.

- Cons: May not offer the most specialized coverage options compared to other providers.

- Allstate:

- Pros: Extensive coverage options, 24/7 claims assistance, online tools for policy management.

- Cons: May have higher premiums compared to State Farm, inconsistent customer service experiences.

- Liberty Mutual:

- Pros: Comprehensive coverage options, personalized customer support, online claim reporting, mobile app for policy management.

- Cons: Pricing can vary widely based on location and coverage level.

- USAA:

- Pros: Competitive pricing for eligible members, excellent customer service, financial planning tools, insurance education resources.

- Cons: Only available to military personnel and their families.

- Nationwide:

- Pros: Comprehensive coverage options, personalized customer support, discounts for bundling policies, online claim reporting, mobile app for policy management.

- Cons: Pricing can vary widely based on location and coverage level.

State Farm Homeowners Insurance Tips and Recommendations

This section provides practical tips for homeowners seeking to obtain the best possible coverage and pricing from State Farm, advice on how to prepare for a potential homeowners insurance claim, and strategies for maximizing discounts and minimizing insurance costs.

Tips for Obtaining Optimal Coverage and Pricing

It is crucial to understand the various aspects of homeowners insurance to ensure you obtain the most suitable coverage at a competitive price.

- Compare Quotes: Obtain quotes from multiple insurance providers, including State Farm, to compare coverage options and pricing. This allows you to identify the best value for your needs.

- Review Your Coverage Needs: Carefully evaluate your home’s value, belongings, and potential risks. This helps you determine the appropriate coverage limits for your specific situation.

- Bundle Policies: Consider bundling your homeowners insurance with other policies, such as auto insurance, to potentially qualify for discounts and save on premiums.

- Negotiate Your Premium: Do not hesitate to negotiate with State Farm to explore potential discounts or adjustments to your premium. This can be particularly helpful if you have a good driving record or have implemented home safety measures.

- Shop Around Periodically: Regularly review your insurance policies to ensure they continue to meet your needs and that you are receiving the best possible rates. Market conditions and your personal circumstances can change over time.

Preparing for a Potential Homeowners Insurance Claim

Being prepared for a potential claim can significantly streamline the process and minimize disruption.

- Maintain Accurate Records: Keep detailed records of your home’s value, belongings, and any renovations or improvements. This documentation can be crucial for supporting your claim.

- Create an Inventory: Develop a comprehensive inventory of your belongings, including descriptions, purchase dates, and estimated values. Consider taking photographs or videos to document your possessions.

- Understand Your Policy: Familiarize yourself with your State Farm homeowners insurance policy, including coverage limits, deductibles, and exclusions. This knowledge can help you understand what is covered and what is not.

- Contact State Farm Promptly: Report any damage or loss to State Farm as soon as possible after it occurs. This ensures a timely and efficient claims process.

- Secure the Property: If possible, take steps to protect your property from further damage after an incident. This may include covering holes, boarding up windows, or securing loose objects.

Strategies for Maximizing Discounts and Minimizing Costs

Several strategies can help you qualify for discounts and minimize your homeowners insurance premiums.

- Home Security Systems: Installing security systems, such as alarms, motion detectors, or video surveillance, can demonstrate a reduced risk and potentially qualify you for discounts.

- Smoke Detectors and Fire Alarms: Maintaining working smoke detectors and fire alarms can significantly reduce the risk of fire damage, leading to potential premium reductions.

- Water Leak Detection: Installing water leak detection systems can help prevent costly water damage, potentially leading to lower premiums.

- Credit Score Improvement: Your credit score can influence your insurance premiums. Maintaining a good credit score can potentially lead to lower rates.

- Claim-Free Record: Avoiding claims for a prolonged period can demonstrate responsible behavior and potentially qualify you for discounts.

Closure

Navigating the complexities of homeowners insurance can feel overwhelming, but State Farm simplifies the process with its comprehensive coverage, competitive pricing, and dedicated customer support. By understanding the various aspects of State Farm homeowners insurance, including coverage options, pricing factors, claims processes, and customer reviews, you can make informed decisions to protect your home and your peace of mind. With State Farm as your partner, you can rest assured knowing your most valuable asset is secure.

FAQ Explained

What types of coverage are included in State Farm homeowners insurance?

State Farm homeowners insurance typically includes dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. The specific coverage options may vary depending on your policy and location.

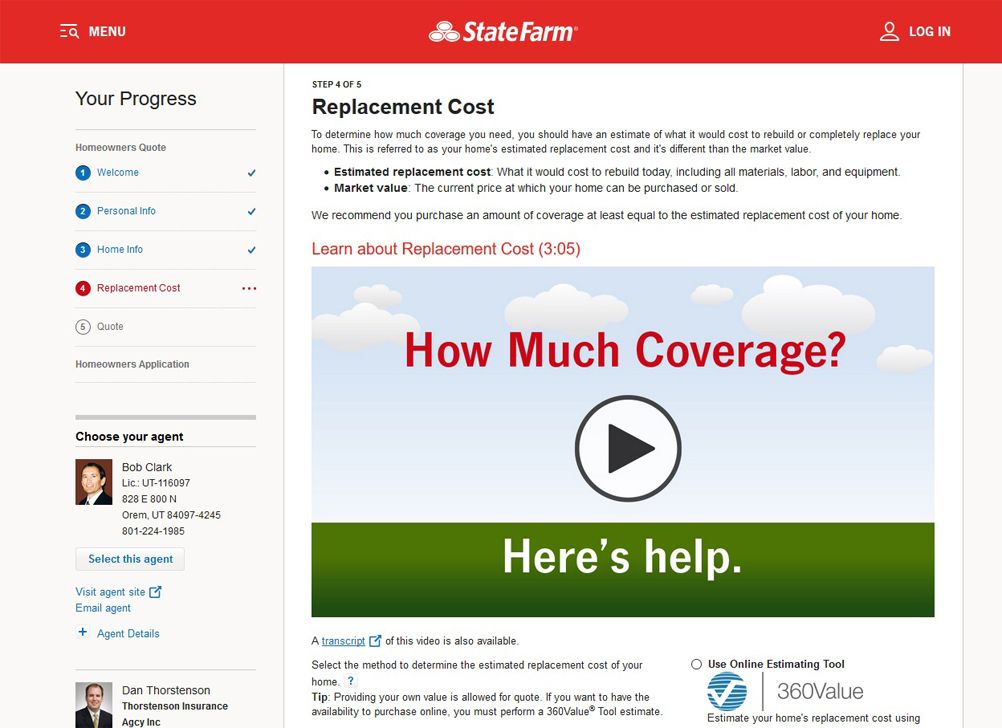

How can I get a quote for State Farm homeowners insurance?

You can get a quote for State Farm homeowners insurance online, over the phone, or by visiting a local State Farm agent. To get a quote, you’ll need to provide information about your home, including its location, size, and value.

What factors influence the cost of State Farm homeowners insurance?

The cost of State Farm homeowners insurance is influenced by several factors, including your home’s location, value, coverage amount, and risk factors such as the presence of a pool or a dog. State Farm also offers discounts for various factors like multi-policy discounts, safety discounts, and loyalty discounts.

How do I file a claim with State Farm homeowners insurance?

You can file a claim with State Farm homeowners insurance online, over the phone, or by visiting a local State Farm agent. You’ll need to provide information about the claim, including the date, time, and location of the incident, as well as any relevant documentation.