State Farm insurance quote auto is a crucial step in securing affordable and reliable car insurance. As one of the largest and most trusted insurance providers in the United States, State Farm offers a comprehensive range of coverage options tailored to individual needs. Understanding the intricacies of obtaining a quote, comparing it to competitors, and exploring the various coverage options can be overwhelming. This guide aims to provide you with a clear and concise overview of the State Farm insurance quote process, empowering you to make informed decisions regarding your auto insurance.

State Farm has a long-standing reputation for providing competitive rates and excellent customer service. They offer a variety of discounts and promotions, which can further reduce your premiums. The process of getting a quote is straightforward and can be done online, over the phone, or in person. State Farm’s online tools and resources make it easy to manage your policy and file claims. This guide will delve into the key factors that influence auto insurance premiums, the different coverage options available, and the importance of comparing State Farm’s quotes to competitors. By understanding the ins and outs of State Farm insurance quote auto, you can confidently choose the right coverage for your needs and budget.

Understanding State Farm Insurance: State Farm Insurance Quote Auto

State Farm is a leading provider of insurance products in the United States, known for its reliable service and commitment to customer satisfaction. Founded in 1922, State Farm has grown to become one of the largest and most trusted insurance companies in the country. With a strong reputation for financial stability and a wide range of insurance options, State Farm offers a comprehensive solution for individuals and families seeking peace of mind.

State Farm’s Services and Coverage Options

State Farm provides a wide array of insurance products, including auto, home, life, health, and business insurance. They offer a variety of coverage options to meet individual needs and budgets.

Auto Insurance Coverage

State Farm offers comprehensive auto insurance coverage that includes:

- Liability coverage: This protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries.

- Collision coverage: This covers damage to your vehicle in an accident, regardless of who is at fault.

- Comprehensive coverage: This protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you are involved in an accident with a driver who does not have adequate insurance.

- Personal injury protection (PIP): This covers your medical expenses and lost wages if you are injured in an accident, regardless of fault.

Other Insurance Products

State Farm also offers a range of other insurance products, including:

- Home insurance: This protects your home and belongings from damage caused by fire, theft, natural disasters, and other covered perils.

- Life insurance: This provides financial protection for your loved ones in the event of your death.

- Health insurance: This helps cover the cost of medical care, including doctor visits, hospital stays, and prescription drugs.

- Business insurance: This provides coverage for businesses, including property, liability, and workers’ compensation.

Key Features and Benefits of Choosing State Farm

State Farm is known for its excellent customer service, competitive rates, and innovative features.

Customer Service

State Farm has a strong reputation for providing exceptional customer service. They offer 24/7 support through their website, mobile app, and phone lines. They also have a network of local agents who can provide personalized assistance and advice.

Competitive Rates

State Farm offers competitive rates on its insurance products. They use a variety of factors to determine your rate, including your driving history, age, location, and the type of vehicle you drive. They also offer discounts for safe drivers, good students, and multiple policyholders.

Innovative Features

State Farm offers a variety of innovative features that make it easy to manage your insurance. They have a mobile app that allows you to file claims, pay bills, and access your policy information. They also offer online quote tools that allow you to get a quote in minutes.

Obtaining an Auto Insurance Quote

Getting a quote from State Farm is a straightforward process that can be completed online, over the phone, or in person at a local State Farm agent’s office. Regardless of your preferred method, the process involves providing some essential information to receive an accurate estimate of your insurance premium.

Key Information for an Accurate Quote

The information you provide will be used to assess your individual risk profile, which helps determine your insurance premium. Here are some of the key details you’ll typically need to share:

- Personal Information: This includes your name, address, date of birth, and contact information.

- Vehicle Information: You’ll need to provide details about the vehicle you want to insure, such as the year, make, model, and vehicle identification number (VIN).

- Driving History: Your driving record is crucial. This includes information about your driving experience, any accidents or traffic violations, and your driving history in general.

- Coverage Preferences: You’ll need to indicate the type of coverage you desire, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Other Factors: Depending on the specific circumstances, you may also be asked to provide information about your driving habits, parking location, and the purpose of the vehicle.

Factors Influencing Auto Insurance Premiums

Several factors influence the cost of your auto insurance premium. State Farm, like other insurance companies, uses a complex algorithm to calculate premiums based on these factors:

- Driving History: A clean driving record with no accidents or violations typically leads to lower premiums.

- Age and Experience: Younger drivers with less experience often pay higher premiums due to their higher risk profile.

- Vehicle Type: The make, model, and year of your vehicle can significantly impact your premium. Some vehicles are more expensive to repair or replace, leading to higher premiums.

- Location: Where you live can affect your premiums. Areas with higher rates of accidents or theft may have higher insurance costs.

- Coverage Level: The type and amount of coverage you choose will directly influence your premium. Higher coverage levels typically mean higher premiums.

- Driving Habits: Factors like your annual mileage, driving frequency, and parking location can also influence your premium.

- Credit Score: In some states, your credit score can be a factor in determining your insurance premium.

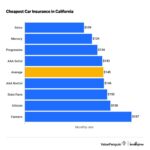

Comparing State Farm Quotes to Competitors

Getting the best auto insurance rate often involves comparing quotes from different providers. While State Farm is a well-known and reputable company, it’s crucial to see how its rates stack up against other major insurance companies. This comparison will help you determine if State Farm offers the best value for your specific needs.

Comparing State Farm Rates, State farm insurance quote auto

It’s essential to understand that auto insurance rates vary based on numerous factors, including your driving history, location, vehicle type, and coverage level. To get a clear picture, you should request quotes from several insurance companies, including State Farm, and compare them side-by-side. You can use online comparison tools or contact insurance companies directly.

Understanding Coverage Options

State Farm offers a comprehensive range of auto insurance coverages designed to protect you financially in case of an accident or other unforeseen events. Understanding the different types of coverage and their benefits is crucial for making informed decisions about your insurance policy.

Liability Coverage

Liability coverage is a fundamental part of any auto insurance policy. It protects you financially if you are at fault in an accident that causes injury or damage to another person or their property.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver and passengers if you are responsible for the accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other damaged property, such as fences or buildings.

For example, if you are driving and accidentally hit another car, causing injury to the other driver, bodily injury liability coverage would help pay for their medical bills and lost wages. If you also damage their vehicle, property damage liability coverage would help pay for repairs or replacement.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

This coverage is typically optional, but it can be very valuable if you have a loan or lease on your vehicle, as lenders often require it. It also helps you recover from an accident without having to pay out of pocket for repairs. For instance, if you hit a tree or a parked car, collision coverage would pay for repairs to your vehicle.

Comprehensive Coverage

Comprehensive coverage pays for damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects.

This coverage is also typically optional, but it can be helpful if you live in an area prone to natural disasters or if you have a new or high-value vehicle. For example, if your car is stolen or damaged by a hailstorm, comprehensive coverage would help pay for repairs or replacement.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage.

This coverage pays for your medical expenses, lost wages, and other damages, even if the other driver is at fault. This coverage is particularly important in states with a high number of uninsured drivers.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as “no-fault” insurance, pays for your medical expenses, lost wages, and other damages, regardless of who is at fault in an accident.

This coverage is mandatory in some states and can be a valuable benefit, especially if you are injured in an accident caused by an uninsured driver or if you are involved in a hit-and-run accident.

Medical Payments Coverage

Medical payments coverage, also known as “med pay,” pays for your medical expenses, regardless of who is at fault in an accident.

This coverage is optional but can be helpful if you have a low deductible or if you want to ensure that your medical expenses are covered, even if you are not at fault in an accident.

Towing and Labor Coverage

Towing and labor coverage pays for the cost of towing your vehicle to a repair shop or to a safe location if it breaks down or is disabled.

This coverage can be helpful in emergencies, especially if you are stranded on the side of the road. You can also add roadside assistance, which can help with things like flat tires, jump starts, and fuel delivery.

Rental Reimbursement Coverage

Rental reimbursement coverage pays for the cost of a rental car while your vehicle is being repaired after an accident.

This coverage can be very helpful if you rely on your vehicle for transportation and need to continue driving while your car is out of commission. It can also be helpful if you need to travel for work or for other reasons.

Gap Insurance

Gap insurance covers the difference between the actual cash value (ACV) of your vehicle and the amount you owe on your loan or lease.

This coverage is helpful if you have a new or high-value vehicle and are financing it. If your vehicle is totaled in an accident, the insurance company will only pay the ACV, which is typically less than the amount you owe on the loan. Gap insurance will cover the difference, so you don’t have to pay out of pocket.

Other Coverage Options

State Farm also offers a variety of other coverage options, such as:

- Custom Equipment Coverage: This coverage protects your custom equipment, such as sound systems, wheels, and tires, if they are damaged or stolen.

- Roadside Assistance: This coverage provides assistance with things like flat tires, jump starts, and fuel delivery.

- Accident Forgiveness: This coverage prevents your insurance premiums from increasing after your first at-fault accident.

- Ride Sharing Coverage: This coverage provides additional protection for drivers who use ride-sharing services like Uber or Lyft.

Customer Experience and Reviews

State Farm, being one of the largest insurance providers in the US, naturally attracts a vast number of customers. Their customer experience, therefore, is a critical aspect to consider when evaluating their services. To understand this, we can analyze insights from customer reviews and experiences.

Customer Reviews and Experiences

Customer reviews provide valuable insights into the strengths and weaknesses of State Farm’s customer service. A significant portion of customer reviews highlight positive experiences, praising State Farm’s agents for their professionalism, responsiveness, and helpfulness in addressing their needs. Many customers appreciate the personalized service they receive, with agents taking the time to understand their individual situations and providing tailored solutions.

However, there are also negative reviews that express dissatisfaction with certain aspects of State Farm’s service. Some customers complain about long wait times for claims processing or difficulty reaching customer service representatives. Others express frustration with the company’s handling of claims, particularly in cases where they feel the settlement was inadequate or the process was unnecessarily complex.

State Farm’s Reputation for Handling Claims

State Farm has a generally positive reputation for handling claims, with many customers reporting fair and efficient claim settlements. However, like any large insurance company, State Farm occasionally faces challenges in managing claims, especially in complex or high-value cases.

- Customers have reported varying experiences with claim handling, with some praising the company’s promptness and fairness, while others have encountered delays or perceived unfairness in settlements.

- State Farm has a robust claims process, with dedicated teams of adjusters and investigators to handle claims efficiently. The company also offers a variety of resources and tools to help customers navigate the claims process, including online claim filing and mobile app access.

- Despite its generally positive reputation, State Farm, like any other insurer, faces challenges in handling claims that are complex or involve disputes. In such cases, customers may experience delays or feel that their claims are not being handled fairly.

Digital Tools and Resources

State Farm offers a comprehensive suite of online tools and resources designed to empower customers with greater control and convenience in managing their insurance policies. These digital solutions provide a seamless and efficient way to access policy information, make payments, file claims, and receive personalized support, all from the comfort of their homes.

Online Account Management

State Farm’s online account management platform provides customers with a centralized hub to manage their insurance policies. Here, they can access policy details, view payment history, update personal information, and make payments. This platform offers a user-friendly interface, allowing customers to navigate easily and find the information they need.

Mobile App

State Farm’s mobile app is another valuable tool for managing insurance policies on the go. The app allows customers to:

- View policy details and coverage information

- Make payments and track payment history

- File claims and track claim status

- Access roadside assistance services

- Locate nearby State Farm agents

The app’s intuitive design and comprehensive features make it a convenient and efficient way for customers to manage their insurance needs from their smartphones or tablets.

State Farm Website

The State Farm website provides a wealth of information and resources for customers, including:

- Policy information and FAQs

- Claim filing instructions and forms

- Roadside assistance and other services

- Financial planning tools and calculators

- Customer support resources

The website is well-organized and easy to navigate, allowing customers to quickly find the information they need.

Conclusion

In conclusion, obtaining a State Farm insurance quote for your auto is a critical step in ensuring you have adequate coverage at an affordable price. By understanding the factors that influence premiums, exploring the different coverage options, and comparing quotes to competitors, you can make informed decisions about your car insurance. State Farm’s commitment to customer service, its comprehensive coverage options, and its user-friendly digital platform make it a strong contender in the insurance market. This guide has provided you with the knowledge and resources to navigate the State Farm insurance quote process effectively. Now, you can confidently secure the coverage you need while optimizing your budget.

Questions and Answers

What is the average cost of State Farm auto insurance?

The average cost of State Farm auto insurance varies depending on factors such as your location, driving history, vehicle type, and coverage level. To get an accurate quote, you can contact State Farm directly or use their online quoting tool.

Does State Farm offer discounts on auto insurance?

Yes, State Farm offers a variety of discounts on auto insurance, including good driver discounts, multi-policy discounts, and safe driver discounts. You can find a complete list of available discounts on their website.

What are the different types of coverage available from State Farm?

State Farm offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP). You can choose the coverage that best suits your needs and budget.

How do I file a claim with State Farm?

You can file a claim with State Farm online, over the phone, or by visiting a local agent. They have a dedicated claims team available 24/7 to assist you with the process.