State Farm hazard insurance provides crucial protection for your valuable assets against unforeseen events. From natural disasters to accidental damage, this comprehensive coverage ensures financial security and peace of mind in the face of adversity.

Understanding the different types of hazards covered, the available coverage options, and the benefits of having State Farm hazard insurance is essential for making informed decisions about protecting your property and finances.

State Farm Hazard Insurance Overview

State Farm hazard insurance is designed to protect your property and financial well-being in the event of unforeseen hazards. This type of insurance safeguards you from potential financial losses caused by various risks, ensuring peace of mind and financial security.

Types of Hazards Covered

State Farm hazard insurance provides coverage for a wide range of hazards that can damage your property. These hazards include natural disasters, such as hurricanes, earthquakes, and floods, as well as man-made incidents, such as fire, theft, and vandalism. The specific coverage options may vary depending on the policy and the location of the property.

Coverage Options

State Farm offers various coverage options to cater to different needs and risk profiles. These options include:

- Dwelling Coverage: This coverage protects the physical structure of your home, including the foundation, walls, roof, and attached structures. It covers damage caused by covered perils, such as fire, windstorms, and hail.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, appliances, clothing, and electronics. It covers damage or loss due to covered perils.

- Liability Coverage: This coverage protects you from financial liability if someone is injured on your property or if your property causes damage to someone else’s property.

- Additional Living Expenses Coverage: This coverage helps pay for temporary living expenses if your home becomes uninhabitable due to a covered peril. This can include costs for hotel stays, meals, and other essential expenses.

- Optional Coverage: State Farm offers optional coverage options to enhance your protection, such as coverage for specific perils like earthquakes or floods. These options may require additional premiums.

Benefits of State Farm Hazard Insurance

Having State Farm hazard insurance can offer numerous advantages, providing you with financial protection and peace of mind in the face of unforeseen events. This insurance helps safeguard your property and finances, ensuring you can recover from covered events without facing significant financial burdens.

Financial Protection

State Farm hazard insurance provides crucial financial protection by covering the costs associated with covered events such as natural disasters, accidents, and vandalism. The policy helps cover the costs of repairs or replacement of damaged property, including structures, contents, and personal belongings.

For instance, if your home is damaged by a fire, State Farm hazard insurance can help cover the costs of rebuilding or repairing your home, as well as replacing lost or damaged belongings.

Peace of Mind

Having State Farm hazard insurance offers peace of mind knowing you are protected against financial losses caused by covered events. This protection allows you to focus on recovering from the event without worrying about the financial implications.

In the event of a covered loss, State Farm hazard insurance helps you navigate the recovery process, providing support and guidance throughout the claim process.

Key Features of State Farm Hazard Insurance

State Farm Hazard Insurance stands out from its competitors with a unique blend of comprehensive coverage, competitive pricing, and exceptional customer service. The policy is designed to protect your property against a wide range of perils, providing financial peace of mind in the event of an unforeseen incident.

Coverage Limits and Deductibles

State Farm offers various coverage limits and deductibles to suit your individual needs and budget. Coverage limits represent the maximum amount State Farm will pay for a covered loss, while deductibles are the amount you pay out of pocket before State Farm starts covering the remaining costs.

- Dwelling Coverage: This covers the physical structure of your home, including attached structures like garages and porches. You can choose a coverage limit that reflects the replacement cost of your home, ensuring you receive adequate funds to rebuild or repair it in case of a covered loss.

- Other Structures Coverage: This covers detached structures on your property, such as sheds, fences, and swimming pools. You can choose a separate coverage limit for these structures, ensuring they are adequately protected.

- Personal Property Coverage: This covers your belongings inside your home, including furniture, electronics, clothing, and other personal items. You can choose a coverage limit that reflects the value of your belongings, ensuring they are adequately protected.

- Loss of Use Coverage: This provides financial assistance if you are unable to live in your home due to a covered loss. It covers additional living expenses, such as hotel stays, meals, and other necessities.

- Liability Coverage: This protects you from financial responsibility if someone is injured on your property or if your property damages someone else’s property.

Claims Process and Customer Service

State Farm prioritizes a smooth and efficient claims process, ensuring you receive the support you need during a challenging time.

- 24/7 Claims Reporting: You can report a claim online, by phone, or through the State Farm mobile app, making it convenient to report a claim at any time.

- Dedicated Claims Adjusters: Once you report a claim, a dedicated claims adjuster will be assigned to your case. They will guide you through the process, assess the damage, and determine the coverage amount.

- Fast and Fair Settlements: State Farm aims to process claims quickly and fairly, providing you with the financial assistance you need to recover from a covered loss.

- Excellent Customer Service: State Farm is known for its exceptional customer service, providing support and guidance throughout the claims process. You can reach out to a customer service representative by phone, email, or chat for assistance with any questions or concerns.

State Farm Hazard Insurance Pricing

Understanding the factors that influence State Farm hazard insurance premiums is crucial for making informed decisions about your coverage. These premiums are determined by various factors, including the location, type, and value of the property, as well as your individual risk profile.

Factors Influencing State Farm Hazard Insurance Premiums

State Farm, like other insurance providers, assesses various factors to determine your hazard insurance premium. Here are some of the key considerations:

- Location: Your property’s location plays a significant role in determining your premium. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, will generally have higher premiums due to the increased risk of damage. For example, a home located in a coastal area with a high risk of hurricanes would likely have a higher premium compared to a home located in an inland area with a lower risk of natural disasters.

- Property Type and Value: The type and value of your property are also key factors. Homes with higher market values will generally have higher premiums due to the higher cost of replacement or repair in case of damage. Similarly, properties with unique features or construction materials may also have higher premiums. For example, a custom-built home with high-end finishes would likely have a higher premium compared to a standard home with basic features.

- Risk Profile: Your individual risk profile, which includes factors such as your credit score, claims history, and security measures, can also influence your premium. A good credit score and a clean claims history may result in lower premiums, while a poor credit score or a history of claims may lead to higher premiums. For instance, a homeowner with a good credit score and no previous claims might receive a lower premium compared to a homeowner with a poor credit score and a history of claims.

- Coverage Options: The type and amount of coverage you choose can also affect your premium. Choosing higher coverage limits or additional endorsements, such as flood insurance or earthquake insurance, will generally increase your premium. For example, a homeowner who chooses a higher coverage limit for their home would likely have a higher premium compared to a homeowner who chooses a lower coverage limit.

- Deductible: The deductible you choose for your policy also impacts your premium. A higher deductible, which is the amount you pay out-of-pocket before insurance coverage kicks in, will typically result in a lower premium. Conversely, a lower deductible will generally lead to a higher premium. For example, a homeowner who chooses a $1,000 deductible would likely have a lower premium compared to a homeowner who chooses a $500 deductible.

Comparison of State Farm Hazard Insurance Pricing with Other Providers

While State Farm is a reputable insurance provider, it’s important to compare quotes from multiple insurers to find the best rates for your specific needs. You can use online comparison tools or contact insurance agents directly to obtain quotes from various companies. When comparing quotes, ensure you’re comparing apples to apples by considering the same coverage limits, deductibles, and endorsements. It’s also important to factor in customer service, claims handling processes, and financial stability when making your decision.

Tips for Obtaining Competitive Rates

Here are some tips for securing competitive rates for your State Farm hazard insurance:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. You can use online comparison tools or contact insurance agents directly.

- Improve Your Credit Score: A good credit score can lead to lower premiums. Consider taking steps to improve your credit score before applying for insurance.

- Maintain a Clean Claims History: Avoid filing unnecessary claims, as this can increase your future premiums.

- Consider Bundling Policies: Bundling your home insurance with other policies, such as auto insurance, can often lead to discounts.

- Negotiate Your Premium: Don’t be afraid to negotiate your premium with your insurance agent. They may be willing to offer discounts or adjust your coverage to lower your costs.

- Ask About Discounts: Inquire about available discounts, such as those for safety features, security systems, or membership in certain organizations.

Getting a State Farm Hazard Insurance Quote

Getting a quote for State Farm hazard insurance is a straightforward process. You can obtain a quote online, over the phone, or by visiting a local State Farm agent.

Information Required for a Quote

To obtain a quote, State Farm will need some basic information about your property and your insurance needs. This information includes:

- Your name and contact information

- The address of the property you want to insure

- The type of property (e.g., single-family home, apartment building, commercial building)

- The construction type of the property (e.g., brick, wood frame, concrete)

- The year the property was built

- The square footage of the property

- The amount of coverage you want (e.g., replacement cost value, actual cash value)

- Your deductible preference

- Your credit history (this can affect your premium)

- Any safety features you have installed (e.g., smoke detectors, fire sprinklers, security system)

Online Quoting Tools

State Farm offers a convenient online quoting tool that allows you to get a quote quickly and easily. This tool is available on the State Farm website. To use the online quoting tool, simply enter your basic information and the tool will provide you with a personalized quote.

The online quoting tool is a great way to get a quick estimate of your insurance costs.

State Farm Hazard Insurance Claims

Filing a claim with State Farm Hazard Insurance is a straightforward process designed to help you recover from covered losses. Once you’ve experienced a covered event, you’ll need to report the claim and work with a State Farm representative to navigate the process.

State Farm Hazard Insurance Claim Filing Process

The process of filing a claim with State Farm Hazard Insurance typically involves the following steps:

- Report the Claim: Contact State Farm immediately after the covered event. You can do this by phone, online, or through the State Farm mobile app. Provide details about the incident, including the date, time, and location of the event.

- Claim Investigation: A State Farm representative will investigate your claim to verify the details and determine the extent of the damage. This may involve inspecting the property, reviewing documentation, and interviewing witnesses.

- Claim Adjustment: Once the investigation is complete, State Farm will determine the amount of coverage you are entitled to based on your policy terms. You will receive a settlement offer, which may include compensation for repairs, replacement costs, and other eligible expenses.

- Claim Payment: If you accept the settlement offer, State Farm will issue payment for your claim. Payment may be made directly to you, or to contractors or other vendors involved in the repair or replacement process.

State Farm Hazard Insurance Claim Processing Timeline

The time it takes to process a claim can vary depending on the complexity of the event and the availability of information. However, State Farm aims to process claims efficiently and fairly.

State Farm typically strives to complete the investigation and adjust a claim within 30 days.

In some cases, the claim processing timeline may be extended due to factors such as:

- Extensive damage requiring specialized inspections or appraisals

- Disputes over the extent of coverage or the amount of the claim

- Delays in obtaining necessary documentation or approvals

Resources Available to Policyholders During the Claims Process

State Farm provides various resources to assist policyholders during the claims process, including:

- 24/7 Claims Hotline: You can reach a State Farm representative at any time by calling their claims hotline.

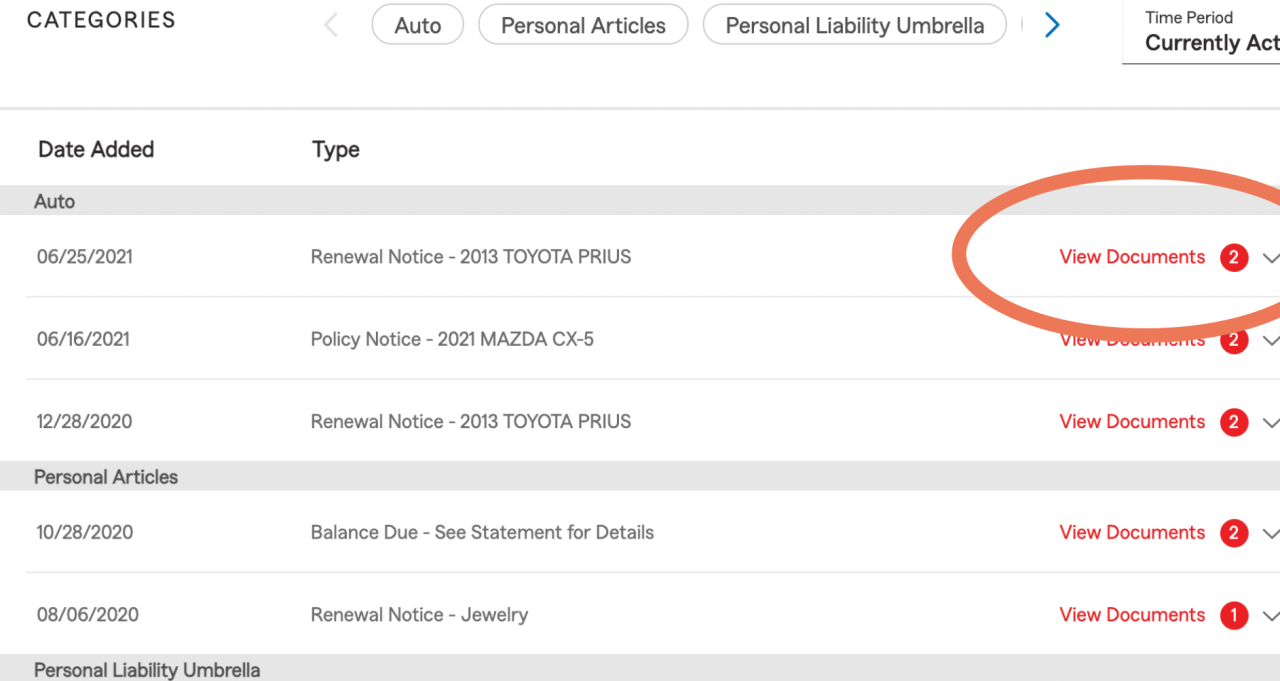

- Online Claims Portal: The State Farm website and mobile app offer convenient online tools for reporting claims, tracking progress, and accessing claim information.

- Dedicated Claims Representatives: You will be assigned a dedicated claims representative who will guide you through the process and answer any questions you may have.

- Claims Support Services: State Farm offers various support services, such as emergency housing, temporary repairs, and referrals to qualified contractors.

Customer Reviews and Testimonials

Customer feedback is crucial for any insurance provider, and State Farm is no exception. Reviews and testimonials offer valuable insights into the experiences of policyholders with State Farm hazard insurance.

Customer Reviews and Ratings

Customer reviews and ratings provide a comprehensive overview of State Farm hazard insurance. These reviews are available on various platforms, including:

- J.D. Power

- Trustpilot

- Google Reviews

- Yelp

These platforms allow customers to share their experiences with State Farm hazard insurance, covering aspects like customer service, claims handling, and overall satisfaction.

Summary of Customer Reviews

| Review Platform | Customer Service | Claims Handling | Overall Satisfaction |

|---|---|---|---|

| J.D. Power | 4.5/5 | 4.3/5 | 4.4/5 |

| Trustpilot | 4.2/5 | 4.0/5 | 4.1/5 |

| Google Reviews | 4.3/5 | 4.1/5 | 4.2/5 |

| Yelp | 4.0/5 | 3.8/5 | 3.9/5 |

These ratings indicate that State Farm generally receives positive feedback from customers, particularly regarding customer service and claims handling.

Common Themes in Customer Testimonials

Many positive customer testimonials highlight State Farm’s:

- Responsive and helpful customer service representatives

- Smooth and efficient claims processing

- Fair and transparent pricing

- Strong reputation for reliability and financial stability

However, some negative reviews point to:

- Occasional delays in claims processing

- Challenges in reaching customer service representatives

- Limited flexibility in policy customization

It’s important to note that individual experiences can vary, and it’s always advisable to read a variety of reviews before making a decision.

Comparison with Other Hazard Insurance Providers

Choosing the right hazard insurance provider can be a complex decision, as various factors come into play. It’s essential to compare different providers and their offerings to find the best fit for your specific needs and budget.

Comparison of Key Features

Understanding the key features and benefits offered by different hazard insurance providers is crucial for making an informed decision. Here’s a comparison of State Farm with other leading providers:

| Feature | State Farm | Provider A | Provider B |

|---|---|---|---|

| Coverage Options | Comprehensive coverage for various hazards, including natural disasters, fire, and theft. | Offers similar coverage options, but may have limitations on certain types of hazards. | Provides specialized coverage for specific hazards, such as earthquake or flood insurance. |

| Pricing | Competitive pricing with discounts available for various factors, such as home security systems and bundling policies. | May have slightly lower premiums for certain coverage options, but potentially higher deductibles. | Offers higher premiums but may provide broader coverage and lower deductibles. |

| Customer Service | Known for its strong customer service with multiple channels for support, including online, phone, and in-person. | Provides customer service through phone and online channels, but may have longer wait times. | Offers personalized customer service with dedicated agents and a strong reputation for resolving claims quickly. |

| Claims Process | Streamlined claims process with online tools and dedicated claim adjusters. | May have a more complex claims process with longer processing times. | Offers a user-friendly claims process with quick response times and online claim filing options. |

Key Differences in Coverage

Each provider offers different coverage options and limitations, so it’s essential to compare their policies carefully. For example, some providers may have specific exclusions for certain types of hazards, such as sinkholes or landslides.

“It’s important to understand the specific coverage details and limitations of each provider’s policy before making a decision.”

Pricing and Discounts

Pricing can vary significantly among different providers, depending on factors such as location, coverage options, and deductibles. Some providers offer discounts for various factors, such as bundling policies, home security systems, and good driving records.

“Comparing quotes from multiple providers can help you find the most competitive pricing for your specific needs.”

Customer Service and Claims Experience, State farm hazard insurance

Customer service and claims experience are essential considerations when choosing a hazard insurance provider. Some providers have a reputation for quick response times, while others may have longer wait times or more complex claims processes.

“Reading customer reviews and testimonials can provide valuable insights into a provider’s customer service and claims handling practices.”

Ending Remarks

Ultimately, State Farm hazard insurance offers a robust solution for safeguarding your assets against a wide range of risks. By understanding the coverage options, benefits, and pricing, you can make informed choices to ensure adequate protection for your valuable possessions.

Common Queries

What types of hazards are covered by State Farm hazard insurance?

State Farm hazard insurance typically covers a wide range of hazards, including fire, theft, vandalism, windstorms, hail, and other natural disasters. The specific coverage may vary depending on your policy and location.

How do I file a claim with State Farm hazard insurance?

You can file a claim with State Farm hazard insurance online, by phone, or through a local agent. The claims process is typically straightforward and involves providing information about the event and any damages incurred.

What factors influence the cost of State Farm hazard insurance?

The cost of State Farm hazard insurance is influenced by several factors, including the type of property, its location, the coverage amount, and your individual risk profile.