Finding the cheapest auto insurance in Washington state can feel like navigating a maze, but understanding the factors that influence premiums and exploring available discounts can help you secure the best rates. This guide delves into the intricacies of Washington state’s auto insurance market, providing insights on mandatory coverage, cost-determining factors, and strategies for securing affordable coverage.

From understanding minimum liability limits to exploring discount opportunities and comparing insurance providers, this comprehensive guide equips you with the knowledge to make informed decisions and find the most cost-effective auto insurance policy for your needs.

Understanding Washington State Auto Insurance Requirements

Driving in Washington State requires you to have auto insurance, which protects you and others in case of an accident. The state mandates certain coverage types to ensure everyone has the financial resources to cover damages and injuries.

Mandatory Coverage Requirements

Understanding the minimum coverage requirements is crucial to avoid legal repercussions and ensure financial protection.

- Liability Coverage: This covers damages and injuries you cause to others in an accident. Washington State requires a minimum of $25,000 per person, $50,000 per accident for bodily injury, and $10,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are hit by a driver without insurance or with insufficient coverage. The minimum requirement is $25,000 per person, $50,000 per accident for bodily injury, and $10,000 for property damage.

Liability Coverage Breakdown

Liability coverage is essential to protect yourself from significant financial consequences in the event of an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by people injured in an accident caused by you.

- Property Damage Liability: This coverage pays for repairs or replacement of damaged property, including vehicles, buildings, and other structures, if you are at fault in an accident.

Minimum Liability Limits and Their Implications

The minimum liability limits in Washington State are designed to provide a basic level of protection.

If you are involved in an accident where the damages exceed the minimum limits, you may be personally liable for the remaining costs.

For example, if you cause an accident resulting in $30,000 in damages to another vehicle, your $10,000 property damage liability coverage will only cover $10,000 of the cost. You would be personally responsible for the remaining $20,000.

Factors Influencing Auto Insurance Costs

Auto insurance premiums in Washington state are influenced by various factors, each contributing to the final cost you pay. These factors are carefully considered by insurance companies to assess your risk as a driver and determine the appropriate premium for your coverage.

Driving History

Your driving history is a crucial factor in determining your auto insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or even DUI convictions will significantly increase your premiums. Insurance companies view these incidents as indicators of higher risk, leading to higher premiums.

Vehicle Type

The type of vehicle you drive also plays a significant role in your insurance costs. Luxury cars, high-performance vehicles, and newer models are generally more expensive to insure due to their higher repair costs and greater risk of theft. Conversely, older, less expensive vehicles tend to have lower insurance premiums.

Age

Age is another factor that influences auto insurance costs. Younger drivers, particularly those under 25, are often considered higher risk due to their lack of experience and higher likelihood of accidents. As drivers age and gain more experience, their premiums generally decrease. However, senior drivers over 65 may also see their premiums increase due to potential health concerns and reduced reaction times.

Location

Your location, including your city and zip code, can significantly impact your auto insurance premiums. Insurance companies consider the frequency of accidents, theft rates, and the cost of living in a particular area when setting premiums. Areas with higher crime rates or higher traffic density tend to have higher insurance costs.

Credit Score

While it may seem surprising, your credit score can also influence your auto insurance premiums. Insurance companies believe that individuals with poor credit are more likely to make late payments on their insurance premiums. Therefore, they may charge higher premiums to those with lower credit scores.

Driving Habits, Cheapest auto insurance in washington state

Your driving habits, such as your annual mileage and the types of roads you frequently drive on, can also impact your insurance costs. Drivers who commute long distances or drive frequently on highways may have higher premiums than those who drive shorter distances or primarily drive in urban areas.

Exploring Discount Opportunities

Saving money on your car insurance is a top priority for most drivers, and thankfully, many insurance companies in Washington state offer a wide range of discounts. These discounts can significantly reduce your premium, making your coverage more affordable.

Discount Categories

Discounts are typically categorized based on factors related to your driving habits, vehicle, and personal circumstances. Let’s delve into some common discount categories:

- Safe Driving Discounts: These discounts reward drivers with a clean driving record. They may include:

- Accident-Free Discount: This is a common discount for drivers who haven’t been involved in any accidents for a specified period. For example, some insurers might offer a discount after three years of accident-free driving.

- Defensive Driving Course Discount: Completing a defensive driving course demonstrates your commitment to safe driving practices and can often lead to a discount.

- Good Driver Discount: This discount is awarded to drivers with a good driving history, often measured by factors like accident frequency and traffic violations.

- Good Student Discounts: These discounts are often offered to students who maintain good academic standing. To qualify, students may need to provide proof of good grades or a certain GPA.

- Multi-Car Policies: Insuring multiple vehicles with the same company can result in a discount on your premiums. This discount recognizes the reduced risk associated with insuring several cars under one policy.

Common Discounts and Eligibility Criteria

Here’s a table showcasing some common discounts and their eligibility criteria:

| Discount Type | Eligibility Criteria |

|---|---|

| Accident-Free Discount | No accidents for a specified period (e.g., 3 years) |

| Defensive Driving Course Discount | Completion of an approved defensive driving course |

| Good Driver Discount | Clean driving record with no accidents or violations |

| Good Student Discount | Maintaining good academic standing (e.g., GPA of 3.0 or higher) |

| Multi-Car Policy Discount | Insuring multiple vehicles with the same company |

| Anti-theft Device Discount | Installation of anti-theft devices (e.g., alarm systems, immobilizers) |

| Vehicle Safety Feature Discount | Having vehicles equipped with safety features (e.g., airbags, anti-lock brakes) |

| Loyalty Discount | Being a long-term customer with the same insurance company |

| Paperless Billing Discount | Opting for electronic communication instead of paper bills |

| Payment in Full Discount | Paying your premium in full upfront instead of installments |

Remember: Discount eligibility and availability may vary depending on the insurance company, specific policy, and state regulations. It’s always best to contact your insurer directly to inquire about available discounts and their requirements.

Choosing the Right Insurance Provider

Finding the cheapest auto insurance in Washington state is only half the battle. It’s crucial to choose a provider that offers the right coverage, excellent customer service, and financial stability.

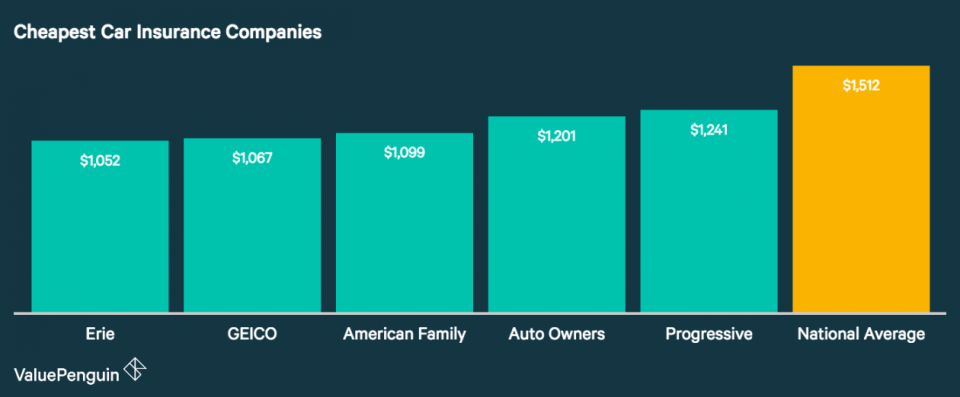

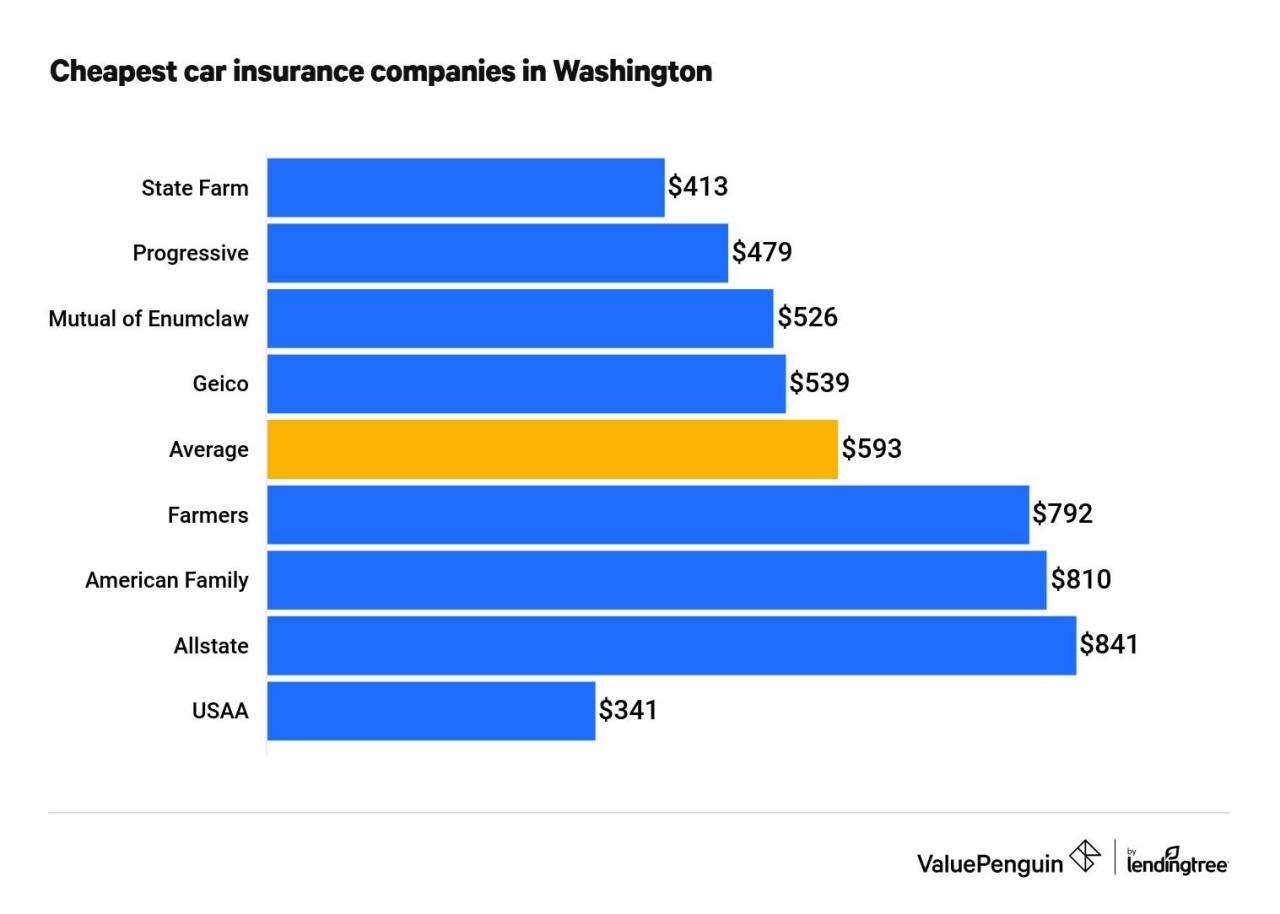

Comparing Top Auto Insurance Providers in Washington State

To make an informed decision, it’s essential to compare several top auto insurance providers in Washington state. Here’s a breakdown of key factors to consider:

Coverage Options

- Liability Coverage: This covers damage to other vehicles or property and injuries to other people in an accident caused by you. It’s mandatory in Washington state and typically includes bodily injury liability and property damage liability.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of who’s at fault. This is optional, but it’s essential if you have a loan or lease on your car.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. This is also optional, but it’s a good idea to have if your car is relatively new or has a high value.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. This is mandatory in Washington state.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages if you’re injured in an accident, regardless of who’s at fault. This is optional, but it’s a good idea to have if you don’t have health insurance.

Customer Service

- Claims Process: Research how easy it is to file a claim and how quickly the insurer processes claims. Look for companies with a good track record of customer satisfaction.

- Availability of Support: Check the insurer’s availability for phone, email, and online support. Consider factors like hours of operation and response times.

- Customer Reviews: Read online reviews and testimonials from other customers to get a sense of the insurer’s customer service reputation.

Financial Stability

- Financial Ratings: Look for insurers with strong financial ratings from agencies like A.M. Best, Standard & Poor’s, and Moody’s. These ratings indicate the insurer’s ability to pay claims in the event of a major catastrophe.

- Claims Payment History: Check the insurer’s claims payment history to see how promptly they pay claims and how often they dispute claims. This information is often available on the insurer’s website or through state insurance regulators.

Obtaining Multiple Quotes

Getting multiple quotes from different insurers is crucial to find the best rate. Here’s why:

- Competitive Pricing: Insurers use different algorithms and factors to calculate premiums. By comparing quotes, you can identify the most competitive rates available.

- Variety of Coverage Options: Different insurers offer different coverage options and discounts. By comparing quotes, you can find the insurer that best meets your needs and budget.

- Negotiation Power: Having multiple quotes gives you leverage to negotiate a lower rate with your preferred insurer.

Checklist for Selecting an Insurance Provider

Here’s a checklist of factors to consider when selecting an insurance provider:

- Coverage Needs: Determine the level of coverage you need based on your vehicle’s value, your driving history, and your financial situation.

- Premium Costs: Compare quotes from multiple insurers to find the most affordable rates.

- Customer Service: Evaluate the insurer’s customer service reputation, including claims processing, availability of support, and online reviews.

- Financial Stability: Look for insurers with strong financial ratings and a good claims payment history.

- Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, and multi-policy discounts.

- Policy Transparency: Review the policy documents carefully to understand the coverage details, exclusions, and limitations.

Understanding Policy Coverage

Auto insurance policies are complex documents, and understanding the different types of coverage they offer is crucial to ensuring you have adequate protection. This section will break down the essential components of a standard auto insurance policy and explain the benefits and limitations of each coverage option.

Liability Coverage

Liability coverage is the most fundamental type of auto insurance, providing financial protection if you are at fault in an accident that causes injury or damage to others. It covers two primary aspects:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver or passengers in an accident you cause.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or property damaged in an accident you cause.

The amount of liability coverage you need depends on factors such as your driving history, the value of your vehicle, and the state’s minimum requirements. In Washington, the minimum liability coverage requirements are $25,000 per person/$50,000 per accident for bodily injury and $10,000 for property damage.

Collision Coverage

Collision coverage protects you against financial losses if your vehicle is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement, minus your deductible.

Collision coverage is optional, and it is usually recommended if you have a newer or more expensive vehicle. If your vehicle is older or has a lower value, you may choose to forgo collision coverage and rely on liability coverage alone.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It also covers repairs or replacement, minus your deductible.

Like collision coverage, comprehensive coverage is optional. It is usually recommended if you have a newer or more expensive vehicle or if you live in an area prone to natural disasters.

Optional Coverage Options

Beyond the standard coverage options, several additional coverage options can be added to your policy, depending on your individual needs and preferences.

- Rental Reimbursement: This coverage helps cover the cost of renting a car while your vehicle is being repaired after an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses.

- Medical Payments Coverage (MedPay): This coverage pays for your medical expenses, regardless of who is at fault in an accident. It can be particularly beneficial if you have a high deductible on your health insurance plan.

- Gap Insurance: This coverage protects you against the difference between the actual cash value of your vehicle and the amount you owe on your loan if your vehicle is totaled in an accident.

It is important to discuss your specific needs and budget with an insurance agent to determine the best coverage options for your situation.

Managing Your Auto Insurance Policy

You’ve secured your auto insurance policy, but the journey doesn’t end there. Maintaining your policy effectively ensures you have the right coverage at the best price, safeguarding you financially in case of accidents or other unforeseen events.

Regular Policy Review

Periodically reviewing your auto insurance policy is crucial to ensure it aligns with your current needs and circumstances. Changes in your life, such as getting married, buying a new car, or increasing your driving mileage, can impact your insurance requirements and costs.

- Review your policy annually or whenever significant life changes occur. This allows you to identify any areas where your coverage may be insufficient or excessive, potentially saving you money.

- Check for available discounts. Your insurance provider may offer discounts for factors like safe driving records, security features in your car, or bundling your auto insurance with other policies.

- Compare rates from other insurers. It’s always a good idea to compare quotes from multiple insurance companies to ensure you’re getting the best deal.

Filing a Claim

Accidents happen, and when they do, knowing how to file a claim efficiently is essential.

- Contact your insurer immediately after an accident. They will guide you through the claims process and provide necessary instructions.

- Gather all relevant information, including details of the accident, names and contact information of other parties involved, and any witness statements.

- Be truthful and accurate when filing your claim. Providing false information can lead to complications and even denial of your claim.

- Follow the instructions provided by your insurer and respond to their requests promptly. This will help expedite the claims process.

Closing Summary: Cheapest Auto Insurance In Washington State

Navigating the world of auto insurance in Washington state can be overwhelming, but with a clear understanding of your coverage needs, a proactive approach to exploring discounts, and a commitment to safe driving practices, you can find affordable protection that meets your requirements. By utilizing the information and strategies Artikeld in this guide, you can confidently secure the cheapest auto insurance in Washington state, providing peace of mind and financial security on the road.

Essential Questionnaire

What is the minimum liability coverage required in Washington state?

Washington state requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability, and $10,000 for property damage liability.

What are some common discounts offered by insurance companies in Washington state?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and discounts for anti-theft devices.

How often should I review my auto insurance policy?

It’s recommended to review your policy at least annually, or whenever you experience a significant life change, such as a change in driving habits, vehicle ownership, or marital status.