Florida State Insurance sets the stage for this exploration of the Sunshine State’s insurance landscape. From the bustling cities to the tranquil beaches, Florida’s diverse population and unique geographical features present a dynamic and complex insurance market.

This comprehensive guide delves into the intricacies of the Florida insurance market, covering the major players, types of insurance available, regulatory frameworks, consumer considerations, and emerging trends. It provides valuable insights for both residents and businesses seeking to understand and navigate this vital industry.

Florida State Insurance Landscape

Florida’s insurance market is a complex and dynamic environment, influenced by various factors including a high concentration of property, susceptibility to natural disasters, and regulatory frameworks. Understanding the current state of the market, major providers, challenges, and the impact of natural disasters is crucial for stakeholders seeking to navigate this landscape.

Major Insurance Providers in Florida

Florida’s insurance market is characterized by a diverse range of providers, including national, regional, and state-specific companies. These companies compete to offer a variety of insurance products, including property, casualty, and life insurance.

- National Insurance Providers: These companies operate across the United States and have a significant presence in Florida. Examples include State Farm, Allstate, and Geico, which offer a wide range of insurance products and services.

- Regional Insurance Providers: These companies focus on specific regions, including Florida. Examples include Florida Peninsula Insurance Company, United Property & Casualty Insurance Company, and Citizens Property Insurance Corporation. These companies often cater to specific needs of the local market, such as hurricane coverage.

- State-Specific Insurance Providers: These companies are specifically licensed to operate in Florida. Examples include Florida’s Citizens Property Insurance Corporation, a state-run insurer designed to provide coverage when private insurers are unwilling or unable to do so.

Challenges Faced by the Insurance Industry in Florida

The insurance industry in Florida faces numerous challenges, including the high cost of reinsurance, the impact of natural disasters, and regulatory complexities.

- High Cost of Reinsurance: Reinsurance is a crucial component of the insurance industry, as it allows primary insurers to transfer risk to reinsurers. However, the high cost of reinsurance in Florida, driven by the state’s susceptibility to hurricanes, has made it challenging for insurers to offer affordable premiums.

- Impact of Natural Disasters: Florida’s vulnerability to hurricanes and other natural disasters poses significant financial risks to insurers. The high frequency and intensity of hurricanes in recent years have led to substantial claims payouts, increasing insurance premiums and causing some insurers to withdraw from the market.

- Regulatory Complexities: Florida’s insurance regulations are among the most complex in the nation, adding to the cost of doing business for insurers. The state’s regulatory environment can be challenging to navigate, requiring insurers to comply with a multitude of rules and regulations.

Impact of Natural Disasters on the Insurance Market

Natural disasters, particularly hurricanes, have a profound impact on Florida’s insurance market. The frequency and intensity of hurricanes in recent years have led to significant claims payouts, increasing premiums and making it difficult for insurers to remain profitable.

- Increased Premiums: After major hurricanes, insurers often face a surge in claims payouts, leading to increased premiums for policyholders. This is a direct consequence of the increased risk associated with hurricane-prone regions.

- Insurer Withdrawals: The high cost of claims payouts can make it challenging for insurers to remain profitable in Florida. In some cases, insurers may choose to withdraw from the market or limit the number of policies they offer, leaving some policyholders with fewer options.

- Government Intervention: In the wake of major hurricanes, the government may step in to provide financial assistance to insurers and policyholders. This intervention can help to stabilize the market and ensure that policyholders have access to coverage.

Types of Insurance in Florida

Florida is a state with a diverse population and economy, and this diversity is reflected in the types of insurance available. From protecting your home and car to ensuring your business is covered, there are numerous insurance options to suit your specific needs.

Homeowners Insurance

Homeowners insurance provides financial protection against various perils that can damage your home or property. This includes coverage for fire, theft, vandalism, natural disasters, and more. It also covers liability for injuries or property damage caused by you or your family members on your property.

- Coverage: Homeowners insurance typically covers the structure of your home, personal belongings, liability, and additional living expenses if you are displaced due to a covered event.

- Key Differences: The specific coverage and limits vary based on factors like your location, home type, and the insurance company.

- Examples: Major providers like State Farm, Allstate, and Geico offer homeowners insurance in Florida.

Auto Insurance

Auto insurance is mandatory in Florida and protects you against financial losses in the event of an accident. It covers damage to your vehicle, medical expenses for you and your passengers, and liability for injuries or property damage to others.

- Coverage: Auto insurance policies in Florida typically include liability coverage, personal injury protection (PIP), and uninsured motorist coverage (UM).

- Key Differences: The specific coverage and limits vary based on your driving history, vehicle type, and the insurance company.

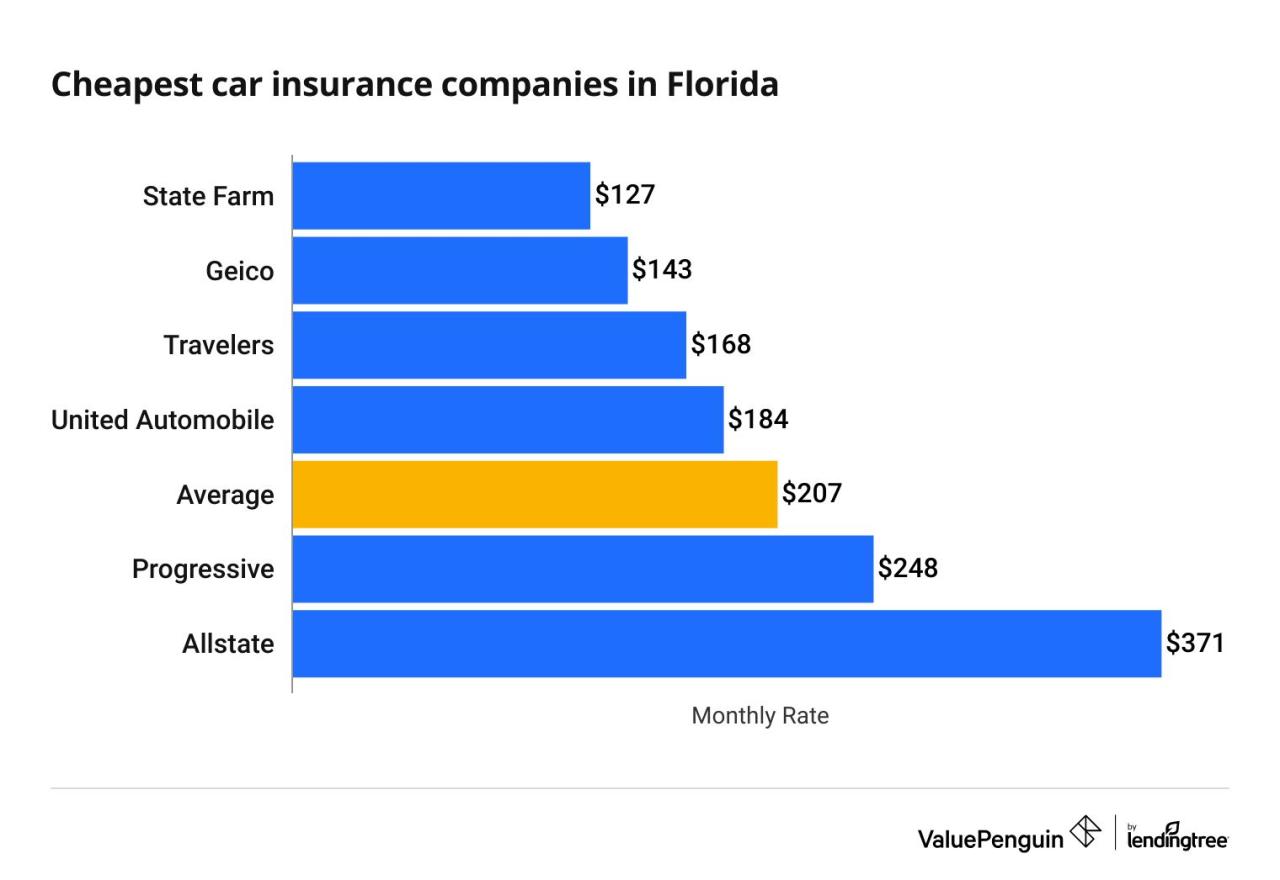

- Examples: Progressive, Liberty Mutual, and USAA are some of the major providers of auto insurance in Florida.

Flood Insurance

Florida is prone to flooding, and this type of insurance is crucial for protecting your home and belongings from water damage. Flood insurance is separate from homeowners insurance and covers losses due to flooding caused by heavy rainfall, overflowing rivers, or storm surge.

- Coverage: Flood insurance typically covers the structure of your home, personal belongings, and other structures on your property.

- Key Differences: The coverage and limits vary based on the location of your property and the type of flood insurance policy you choose.

- Examples: The National Flood Insurance Program (NFIP) is a government-backed program that provides flood insurance. Private insurance companies also offer flood insurance policies.

Business Insurance

Business insurance is essential for protecting your business from various risks, such as property damage, liability claims, and employee injuries. The specific types of coverage you need will depend on your industry and the size of your business.

- Coverage: Common business insurance policies include general liability insurance, property insurance, workers’ compensation insurance, and professional liability insurance.

- Key Differences: The coverage and limits vary based on your business type, size, and the insurance company.

- Examples: Chubb, Travelers, and The Hartford are some of the major providers of business insurance in Florida.

Health Insurance

Health insurance is essential for covering medical expenses, including doctor visits, hospital stays, and prescription drugs. There are various types of health insurance plans available in Florida, including individual, family, and employer-sponsored plans.

- Coverage: Health insurance plans typically cover preventive care, hospitalization, surgery, and prescription drugs.

- Key Differences: The specific coverage and costs vary based on the type of plan, your age, and your health status.

- Examples: Blue Cross Blue Shield, Humana, and UnitedHealthcare are some of the major providers of health insurance in Florida.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It pays a death benefit to your beneficiaries, which can help them cover expenses like funeral costs, mortgage payments, and other financial obligations.

- Coverage: Life insurance policies typically offer a death benefit, which can be paid as a lump sum or in installments.

- Key Differences: The specific coverage and premiums vary based on your age, health, and the type of policy you choose.

- Examples: MetLife, Prudential, and New York Life are some of the major providers of life insurance in Florida.

Insurance Regulations and Laws

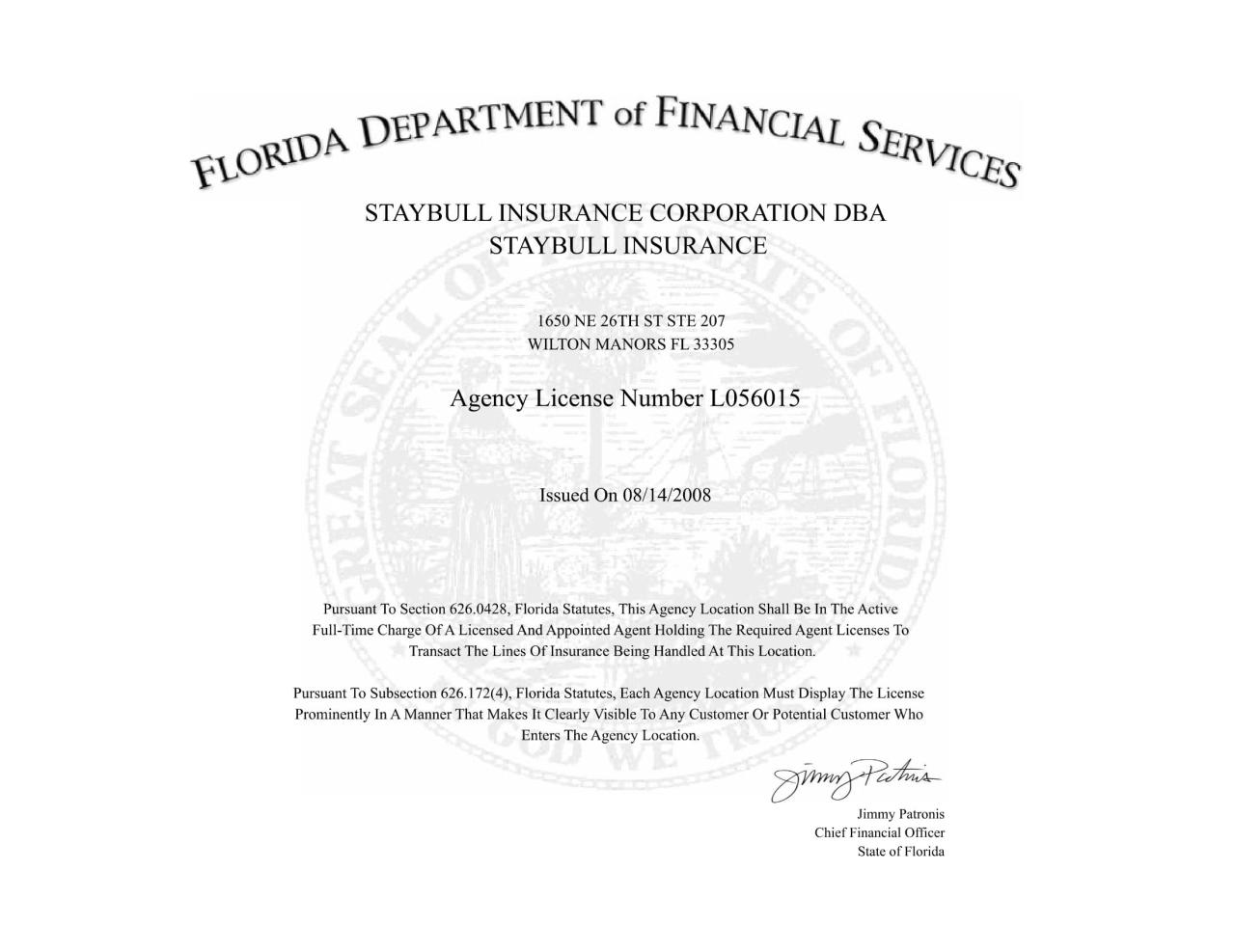

Florida’s insurance industry is subject to a comprehensive regulatory framework designed to ensure the solvency of insurers, protect consumers, and maintain a stable market. The Florida Department of Financial Services (DFS) plays a central role in this framework.

Role of the Florida Department of Financial Services

The DFS is the primary regulatory body for the insurance industry in Florida. It has broad authority to oversee all aspects of the insurance market, including licensing, rate setting, and consumer protection. The DFS’s responsibilities include:

- Licensing and regulating insurance companies, agents, and brokers.

- Supervising the financial condition of insurers and ensuring their solvency.

- Approving insurance rates and forms.

- Investigating consumer complaints and enforcing insurance laws.

- Educating consumers about insurance products and their rights.

The DFS has a dedicated division focused on insurance regulation, which works to ensure that insurers are financially sound and that consumers are protected from unfair or deceptive practices.

Impact of Recent Legislation on the Insurance Market

Recent legislation has significantly impacted the insurance market in Florida, particularly in the areas of property insurance and reinsurance. For example, the passage of Senate Bill 2A in 2022 aimed to address the rising costs of homeowners insurance by:

- Restricting assignment of benefits (AOB) claims.

- Increasing the availability of reinsurance.

- Limiting the frequency of rate increases.

These changes are intended to stabilize the market and reduce the burden on policyholders. However, the long-term impact of these reforms is still being assessed.

Effectiveness of Existing Regulations in Protecting Consumers

Florida’s insurance regulations are generally considered effective in protecting consumers. The DFS actively investigates and resolves consumer complaints, and the state has a robust system for resolving insurance disputes. However, some critics argue that the regulations do not go far enough to address certain issues, such as the rising cost of homeowners insurance and the availability of affordable coverage in high-risk areas.

Consumer Considerations

Navigating the Florida insurance landscape can be complex, but by being an informed consumer, you can make decisions that best protect your assets and financial well-being. Understanding the nuances of insurance policies and the factors that influence pricing is crucial.

Comparing Quotes

It is essential to compare quotes from multiple insurance providers to find the most competitive rates and coverage options. By obtaining quotes from several insurers, you can identify the best value for your specific needs and budget.

Factors to Consider When Choosing an Insurance Policy

Several factors should be considered when choosing an insurance policy, including:

- Coverage: Ensure the policy provides adequate coverage for your specific needs, including property value, liability limits, and any additional endorsements.

- Deductible: A higher deductible generally results in lower premiums, but you will have to pay more out of pocket in the event of a claim.

- Premium: The cost of the insurance policy should be affordable and fit within your budget.

- Claims Process: Understand the insurer’s claims process and their reputation for handling claims fairly and efficiently.

- Financial Stability: Research the financial stability of the insurer to ensure they can pay claims in the event of a major catastrophe.

Understanding Insurance Terms and Conditions

Insurance policies often contain complex terminology and conditions that can be challenging to understand. Take the time to read the policy carefully and seek clarification from the insurer if needed.

Key Terms to Understand:

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in.

- Premium: The amount you pay for your insurance policy.

- Coverage: The types of risks and losses your insurance policy covers.

- Exclusions: Specific events or situations that are not covered by your insurance policy.

- Endorsements: Additional coverage options that can be added to your policy.

Future Trends in Florida Insurance: Florida State Insurance

The Florida insurance market is constantly evolving, driven by factors like climate change, technological advancements, and changing consumer preferences. Understanding these trends is crucial for insurers, policyholders, and stakeholders alike. This section will explore emerging trends in the Florida insurance market, the impact of technology, the potential for new insurance products and services, and the future outlook for the industry.

Impact of Technology on the Insurance Industry, Florida state insurance

Technological advancements are transforming the insurance industry in Florida, impacting every aspect from underwriting and claims processing to customer service and product development.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used to automate tasks, improve risk assessment, and personalize customer experiences. For example, AI-powered chatbots can provide instant customer support, while ML algorithms can analyze vast amounts of data to identify patterns and predict future risks. This allows insurers to offer more accurate pricing and personalized insurance products.

- Blockchain Technology: Blockchain can enhance transparency and security in insurance transactions. It can streamline claims processing, reduce fraud, and improve data management. Blockchain-based platforms can also facilitate peer-to-peer insurance models, where individuals pool their risks and share premiums directly, potentially reducing costs.

- Internet of Things (IoT): Connected devices and sensors can provide real-time data on risks, enabling insurers to offer dynamic pricing and personalized risk management solutions. For example, smart home devices can monitor for potential hazards, leading to proactive risk mitigation and potentially lower premiums.

Potential for New Insurance Products and Services

Technological advancements are paving the way for innovative insurance products and services that cater to evolving needs and risks.

- Cybersecurity Insurance: As cyber threats become more sophisticated, the demand for cybersecurity insurance is increasing. This type of insurance covers losses resulting from data breaches, cyberattacks, and other digital risks.

- Climate Change-Related Insurance: Florida’s vulnerability to hurricanes and rising sea levels necessitates insurance products tailored to climate change risks. This includes insurance for flood damage, storm surge, and other climate-related events.

- Micro-Insurance: Micro-insurance products offer affordable coverage for specific risks, such as mobile phone damage or accidental death. These products can be particularly beneficial for underserved populations and individuals with limited financial resources.

Future Outlook for the Florida Insurance Industry

The future of the Florida insurance industry is expected to be shaped by several key factors.

- Increased Competition: The entry of new players, including InsurTech startups, will increase competition in the market. This will drive innovation and push insurers to adapt to changing consumer preferences and technological advancements.

- Focus on Customer Experience: Consumers are increasingly demanding personalized and digital-first insurance experiences. Insurers will need to invest in technology and data analytics to deliver seamless and convenient services.

- Climate Change Adaptation: The increasing frequency and severity of climate-related events will necessitate greater focus on risk mitigation and adaptation. Insurers will need to develop innovative products and services to address these risks and support the resilience of Florida’s communities.

Last Point

Navigating the Florida insurance market requires careful planning and informed decision-making. By understanding the nuances of the industry, consumers can make choices that best suit their needs and ensure adequate protection. As the state continues to evolve, the insurance market will undoubtedly adapt and innovate, presenting new opportunities and challenges for both providers and policyholders.

Detailed FAQs

What are the most common types of insurance in Florida?

Florida residents typically require a combination of insurance policies, including homeowners insurance, auto insurance, health insurance, and flood insurance.

How do I find the best insurance rates in Florida?

It’s crucial to compare quotes from multiple insurance providers to secure the most competitive rates. Utilize online comparison tools or contact insurance agents directly.

What are the key factors to consider when choosing an insurance policy in Florida?

Consider factors such as coverage limits, deductibles, premiums, policy terms, and the reputation and financial stability of the insurer.

How can I understand insurance terms and conditions?

Don’t hesitate to ask questions to clarify any unclear terms. Insurance agents or brokers can help explain the intricacies of policy language.