State Farm homeowners insurance quotes are a crucial starting point for securing the right protection for your home. Understanding the factors that influence these quotes, exploring the coverage options, and navigating the process of obtaining a quote can help you make informed decisions.

This guide delves into the world of State Farm homeowners insurance, covering everything from the core coverage options to the intricacies of obtaining a quote and comparing it with other providers. We’ll explore the key considerations for choosing the right coverage level and deductible, and provide insights into negotiating a favorable rate.

Understanding State Farm Homeowners Insurance: State Farm Homeowners Insurance Quote

State Farm is a leading provider of homeowners insurance in the United States. They offer a wide range of coverage options to protect your home and belongings from various risks. Understanding the different types of coverage and factors that influence your premium is crucial for making an informed decision.

Core Coverage Options

State Farm homeowners insurance policies typically include several core coverage options that protect you against different types of losses. These options are designed to provide comprehensive coverage for your home and belongings.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the walls, roof, foundation, and attached structures like garages and porches. It covers damage caused by perils like fire, windstorms, hail, and vandalism.

- Other Structures Coverage: This coverage extends protection to detached structures on your property, such as sheds, fences, and swimming pools. It covers damage caused by similar perils as dwelling coverage.

- Personal Property Coverage: This coverage protects your personal belongings inside your home, including furniture, electronics, clothing, and jewelry. It covers losses due to covered perils, but it often has limits on certain items like jewelry and artwork.

- Liability Coverage: This coverage protects you from financial losses arising from accidents that occur on your property, resulting in injuries or property damage to others. It provides legal defense and pays for settlements or judgments up to the policy limits.

- Loss of Use Coverage: This coverage helps cover additional living expenses if you’re unable to live in your home due to a covered loss. It can reimburse you for costs like hotel stays, meals, and temporary housing.

Typical Inclusions in a State Farm Homeowners Insurance Policy, State farm homeowners insurance quote

A State Farm homeowners insurance policy typically includes several standard provisions and benefits, providing comprehensive protection for your home and belongings.

- Coverage for Named Perils: Most State Farm policies cover damage caused by specific perils like fire, lightning, windstorms, hail, vandalism, and theft. However, certain perils may require additional coverage or endorsements.

- Replacement Cost Coverage: This coverage option pays for the full cost of replacing damaged property, regardless of depreciation. It helps ensure you can rebuild or replace your home and belongings with similar new items.

- Deductible: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

- Personal Injury Protection: This coverage provides medical payments for injuries sustained on your property, regardless of fault. It covers expenses like medical bills, lost wages, and rehabilitation costs.

- Additional Living Expenses: This coverage helps cover additional living expenses if you’re unable to live in your home due to a covered loss. It can reimburse you for costs like hotel stays, meals, and temporary housing.

Factors Influencing the Cost of a State Farm Homeowners Insurance Quote

The cost of a State Farm homeowners insurance quote is influenced by various factors, including your location, property value, and coverage levels. Understanding these factors can help you make informed decisions about your coverage needs and budget.

- Location: The cost of homeowners insurance varies significantly based on your location. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, typically have higher premiums due to the increased risk of claims. Other factors, such as crime rates and the density of population, also influence premiums.

- Property Value: The value of your home is a primary factor in determining your premium. Higher property values generally result in higher premiums because the potential for a larger claim is greater. State Farm uses various methods to assess the value of your home, including property records, comparable sales data, and professional appraisals.

- Coverage Levels: The amount of coverage you choose for your home and belongings directly impacts your premium. Higher coverage limits, such as those for dwelling coverage, personal property coverage, and liability coverage, typically result in higher premiums. However, adequate coverage is essential to protect yourself from significant financial losses in the event of a covered loss.

- Deductible: The deductible you choose for your policy also influences your premium. A higher deductible means you pay more out-of-pocket in the event of a claim, but it also results in lower premiums. Conversely, a lower deductible means you pay less out-of-pocket but have higher premiums. Choosing a deductible that balances your risk tolerance and budget is essential.

- Homeowner’s Safety Features: Certain safety features in your home, such as smoke detectors, burglar alarms, and fire sprinklers, can lower your premiums. These features reduce the risk of loss and can qualify you for discounts. Installing these features can be a cost-effective way to reduce your insurance premiums.

- Credit Score: In some states, insurers may use your credit score to determine your homeowners insurance premiums. A higher credit score generally indicates a lower risk of claims, leading to lower premiums. It’s essential to maintain a good credit score to potentially benefit from lower insurance rates.

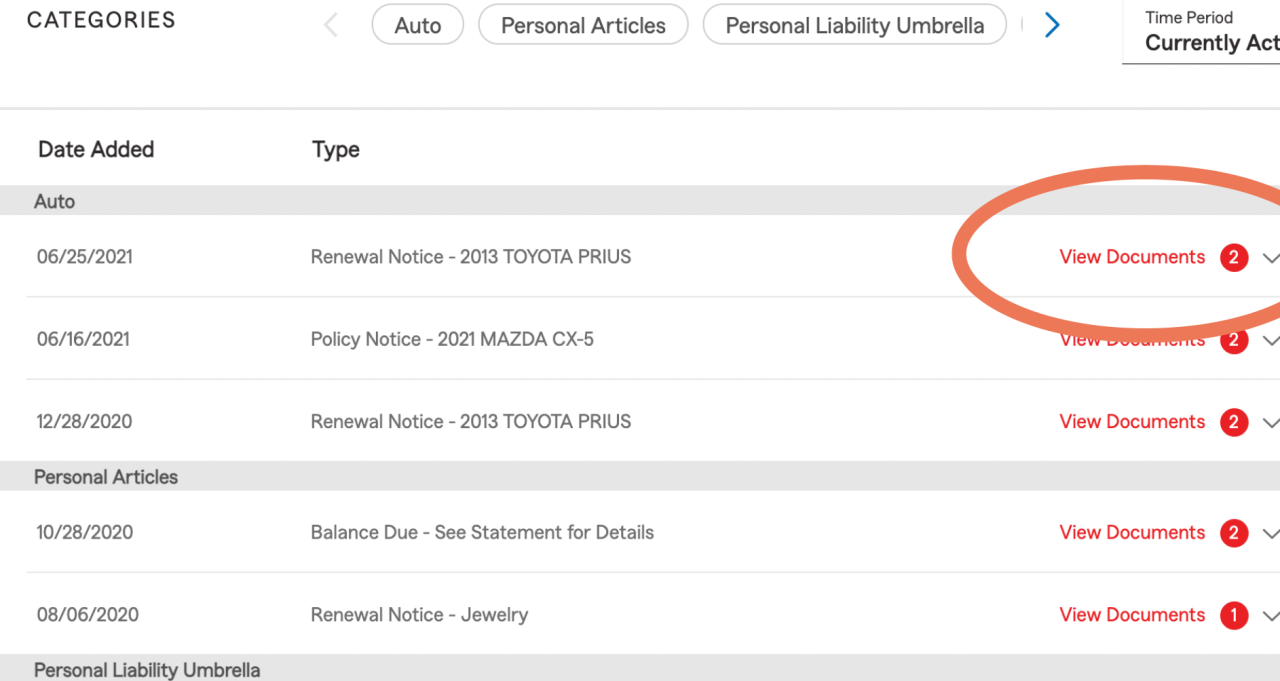

Obtaining a State Farm Homeowners Insurance Quote

Getting a homeowners insurance quote from State Farm is a straightforward process. You can choose from several methods to request a quote, and the information required is typically standard for homeowners insurance.

Methods for Obtaining a Quote

The following methods can be used to obtain a homeowners insurance quote from State Farm:

- Online: State Farm’s website offers a user-friendly online quote tool. You can enter your information, including your address, property details, and coverage preferences, to receive an instant quote.

- Phone: Calling State Farm’s customer service line allows you to speak directly with a representative who can guide you through the quote process and answer any questions you may have.

- Agent: Visiting a local State Farm agent’s office allows you to meet with an insurance professional who can provide personalized advice and help you choose the right coverage for your needs.

Required Information

When requesting a quote, State Farm will typically ask for the following information:

- Personal Information: This includes your name, address, contact details, and date of birth.

- Property Information: This includes the address of your home, the year it was built, the square footage, and any renovations or improvements made.

- Coverage Preferences: This includes the type of coverage you want (e.g., dwelling, personal property, liability), the desired coverage limits, and the deductible amount.

- Claims History: State Farm may ask about your past insurance claims to assess your risk profile.

Choosing the Right Coverage and Deductible

Choosing the right coverage level and deductible is crucial for ensuring adequate protection and affordability. Here are some key considerations:

- Coverage Limits: Consider the replacement cost of your home and belongings to determine the appropriate coverage limits. Underinsured homes can result in significant financial losses in case of a major event.

- Deductible: A higher deductible typically leads to lower premiums. However, you will have to pay a larger amount out of pocket in case of a claim. Carefully assess your risk tolerance and financial capacity to choose a suitable deductible.

Negotiating a Favorable Rate

While State Farm offers competitive rates, there are ways to potentially negotiate a more favorable price:

- Bundle Policies: Combining your homeowners insurance with other policies, such as auto insurance, can often result in discounts.

- Safety Features: Installing safety features like smoke detectors, burglar alarms, and security systems can qualify you for discounts.

- Loyalty: If you have been a State Farm customer for a significant period, you may be eligible for loyalty discounts.

- Shop Around: It’s always a good idea to compare quotes from multiple insurers to ensure you’re getting the best value.

Analyzing State Farm Homeowners Insurance Quotes

Once you’ve obtained a State Farm homeowners insurance quote, it’s essential to analyze it thoroughly and compare it to quotes from other major insurance providers. This will help you determine if State Farm offers the best value for your specific needs and circumstances.

Comparing State Farm Homeowners Insurance with Other Providers

When comparing State Farm homeowners insurance with other providers, consider the following factors:

- Coverage options: State Farm offers a wide range of coverage options, including standard coverage for dwelling, personal property, liability, and additional living expenses. However, it’s important to compare the specific coverage limits and deductibles offered by State Farm with other providers to ensure you’re getting the best value for your money.

- Pricing: State Farm’s pricing can vary depending on factors such as your location, home value, coverage options, and risk factors. It’s essential to obtain quotes from multiple providers to compare pricing and find the most affordable option.

- Discounts: State Farm offers various discounts for homeowners, such as multi-policy discounts, safety discounts, and loyalty discounts. It’s crucial to inquire about these discounts and compare them with those offered by other providers.

- Customer service: State Farm has a reputation for providing excellent customer service. However, it’s essential to research and compare customer reviews and ratings of State Farm with other providers to gauge their overall customer satisfaction levels.

- Financial stability: State Farm is a financially stable company with a strong track record. It’s essential to consider the financial stability of all insurance providers you’re considering to ensure they can fulfill their obligations in the event of a claim.

Key Features and Benefits of State Farm Homeowners Insurance Plans

State Farm offers various homeowners insurance plans, each with unique features and benefits. Here’s a table comparing the key features and benefits of different State Farm homeowners insurance plans:

| Plan | Key Features | Benefits |

|---|---|---|

| State Farm Homeowners Insurance | Standard coverage for dwelling, personal property, liability, and additional living expenses | Comprehensive protection for your home and belongings, financial security in the event of a covered loss |

| State Farm Preferred Homeowners Insurance | Enhanced coverage options, higher coverage limits, and additional benefits | Increased protection for your home and belongings, peace of mind knowing you have comprehensive coverage |

| State Farm Renters Insurance | Coverage for personal property, liability, and additional living expenses | Protection for your belongings and financial security in the event of a covered loss while renting |

Advantages and Disadvantages of Choosing State Farm Homeowners Insurance

Choosing State Farm homeowners insurance can offer several advantages, but it’s important to consider potential disadvantages as well.

- Advantages:

- Strong financial stability and reputation

- Wide range of coverage options

- Competitive pricing and discounts

- Excellent customer service

- Disadvantages:

- Pricing can vary depending on location and risk factors

- Some coverage options may not be available in all areas

- Customer service experiences can vary

- Acts of War: Coverage for damage caused by war, including military action, is typically excluded.

- Earthquakes: Earthquake coverage is often optional and may require a separate policy.

- Flooding: Flood damage is typically not covered by standard homeowners insurance. You’ll need to purchase separate flood insurance.

- Neglect: If damage occurs due to your negligence, such as failing to maintain your property, coverage may be denied.

- Intentional Acts: Coverage is typically excluded for damage caused by intentional acts, such as arson.

Understanding the Fine Print

Before you sign on the dotted line, it’s crucial to thoroughly review your State Farm homeowners insurance policy. Understanding the terms and conditions will ensure you have the coverage you need and are aware of any limitations or exclusions.

Policy Exclusions and Limitations

While State Farm homeowners insurance provides comprehensive coverage, there are specific situations or events that may not be covered. It’s essential to be aware of these exclusions and limitations to avoid any surprises during a claim.

Filing a Claim and Handling Disputes

Knowing the process for filing a claim and resolving disputes with State Farm is vital. Here’s what you need to know:

- Report the Claim Promptly: Contact State Farm as soon as possible after an incident to report the claim. Provide them with all the necessary details, including the date, time, and nature of the event.

- Document the Damage: Take photos or videos of the damage and gather any relevant documentation, such as repair estimates or witness statements.

- Cooperate with State Farm: Respond to all requests for information from State Farm and provide any required documentation. Be truthful and accurate in your communication.

- Review the Claim Settlement: Once State Farm has assessed the damage and determined the coverage, they will provide you with a settlement offer. Carefully review the offer and ensure it reflects the full extent of the damage.

- Disputes: If you disagree with State Farm’s decision, you have the right to appeal the claim. You can submit a formal appeal letter outlining your reasons for disagreeing with the settlement. If the appeal is denied, you may have the option to pursue further action through mediation or arbitration.

State Farm Homeowners Insurance and Your Needs

Every homeowner has unique needs and priorities when it comes to insurance. State Farm, with its wide range of coverage options and customizable policies, aims to cater to these diverse requirements. Understanding your specific needs is crucial in determining whether State Farm homeowners insurance is the right fit for you.

Factors Influencing Homeowners Insurance Needs

Homeowners’ insurance needs vary significantly depending on several factors. These include the value of your home, the location, your personal belongings, and your risk tolerance.

- Value of your home: The higher the value of your home, the more coverage you’ll need to rebuild or repair it in case of damage. State Farm offers various coverage options, including dwelling coverage, which covers the structure of your home, and personal property coverage, which protects your belongings inside.

- Location: Your location plays a crucial role in determining your insurance needs. Areas prone to natural disasters like hurricanes, earthquakes, or floods may require specific coverage options and higher premiums. State Farm offers coverage for various perils, including windstorms, hail, and earthquakes, depending on your location.

- Personal belongings: The value of your personal belongings, such as jewelry, electronics, and artwork, also influences your insurance needs. State Farm offers personal property coverage, which can be adjusted to include specific items of high value.

- Risk tolerance: Your risk tolerance determines how much coverage you’re comfortable with. If you’re comfortable with a higher deductible, you might opt for a lower premium. Conversely, if you prefer greater peace of mind, you might choose a higher premium with a lower deductible.

Situations Where State Farm Homeowners Insurance Might Be a Good Fit

State Farm homeowners insurance can be a good fit for various situations, such as:

- Homeowners seeking comprehensive coverage: State Farm offers a wide range of coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. This comprehensive coverage can provide peace of mind knowing you’re protected against various risks.

- Homeowners with specific needs: State Farm allows you to customize your policy to meet your unique needs. You can add endorsements for specific perils, such as earthquake or flood coverage, or increase your coverage for high-value items.

- Homeowners looking for competitive pricing: State Farm offers competitive rates and discounts for various factors, such as bundling multiple policies, having a good credit score, and having safety features in your home.

Situations Where State Farm Homeowners Insurance Might Not Be the Best Choice

While State Farm offers a comprehensive range of coverage options, it might not be the best choice for everyone. Some situations where other insurers might be more suitable include:

- Homeowners in high-risk areas: If you live in an area prone to frequent natural disasters, other insurers specializing in high-risk coverage might offer better rates and coverage options.

- Homeowners with unique insurance needs: If you have specific insurance needs not covered by State Farm, other insurers might offer more tailored policies.

- Homeowners seeking lower premiums: While State Farm offers competitive rates, other insurers might offer lower premiums, especially for homeowners with a low risk profile.

Determining if State Farm Homeowners Insurance is Right for You

To determine if State Farm homeowners insurance is the right choice for you, consider the following:

- Compare quotes: Get quotes from multiple insurers, including State Farm, to compare coverage options and pricing.

- Review policy details: Carefully review the policy details, including coverage limits, deductibles, and exclusions.

- Consider your individual needs: Assess your specific needs, such as the value of your home, the location, your personal belongings, and your risk tolerance.

- Seek professional advice: Consult with an insurance agent or broker to discuss your needs and get personalized recommendations.

Final Thoughts

By understanding the nuances of State Farm homeowners insurance quotes, you can confidently navigate the process of securing the right coverage for your home. Remember to carefully review the policy documents, consider your individual needs, and compare options from various providers to ensure you’re making the most informed decision.

Top FAQs

How do I get a State Farm homeowners insurance quote?

You can obtain a quote online, over the phone, or by visiting a local State Farm agent. You’ll need to provide basic information about your home, such as its address, square footage, and construction type.

What factors influence the cost of a State Farm homeowners insurance quote?

Factors such as your location, the value of your home, the age of your home, your credit score, and the coverage levels you choose can all affect the cost of your quote.

What are some common exclusions in State Farm homeowners insurance?

Common exclusions include damage caused by earthquakes, floods, and acts of war. It’s important to review the policy documents carefully to understand any exclusions that apply to your situation.