State of Texas car insurance is a crucial aspect of responsible driving in the Lone Star State. Navigating the complexities of Texas car insurance can feel overwhelming, but understanding the key factors, coverage options, and regulations can help you make informed decisions and ensure you have the right protection on the road.

This comprehensive guide will explore the Texas car insurance landscape, covering everything from mandatory coverage requirements and premium influences to choosing the right insurance provider and understanding your policy. We’ll delve into the intricacies of Texas-specific regulations, common claims and disputes, and emerging trends shaping the future of car insurance in the state.

Texas Car Insurance Landscape: State Of Texas Car Insurance

Texas boasts a robust and dynamic car insurance market, playing a crucial role in the state’s economy and protecting its residents against financial risks.

Size and Key Players

The Texas car insurance market is substantial, with a significant number of insurance companies operating within its borders. The state’s large population and extensive vehicle ownership contribute to its size. Notable players in the market include State Farm, Allstate, Geico, and Progressive, which compete fiercely for market share.

Factors Influencing Rates

Car insurance rates in Texas are influenced by several factors, including:

- Demographics: Age, gender, and marital status can impact rates, with younger and unmarried drivers often facing higher premiums.

- Driving Habits: Driving history, including accidents, traffic violations, and driving experience, significantly impacts rates. Drivers with clean records typically enjoy lower premiums.

- Vehicle Type: The make, model, and year of a vehicle influence its insurance cost. High-performance vehicles or luxury cars generally command higher premiums due to their greater repair costs.

- Location: Insurance rates vary based on the location of the insured vehicle. Areas with higher crime rates or traffic congestion tend to have higher premiums.

- Legislative Changes: State laws and regulations regarding car insurance, such as mandatory coverage requirements and minimum limits, influence rates.

Types of Car Insurance Coverage

Texas offers various types of car insurance coverage to meet diverse needs. The most common types include:

- Liability Coverage: This coverage is mandatory in Texas and protects drivers against financial losses if they cause an accident resulting in property damage or injuries to others.

- Collision Coverage: This optional coverage reimburses drivers for damage to their own vehicle in a collision, regardless of fault.

- Comprehensive Coverage: This optional coverage protects against damage to a vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects drivers against financial losses if they are involved in an accident with a driver who is uninsured or underinsured.

- Medical Payments Coverage: This optional coverage pays for medical expenses for the insured driver and passengers, regardless of fault, in the event of an accident.

Mandatory Coverage Requirements

Texas law requires all drivers to carry a minimum amount of car insurance to protect themselves and others in case of an accident. These mandatory coverage requirements are designed to ensure financial responsibility for damages and injuries that may occur on the road.

Liability Coverage

Liability coverage is the most crucial type of car insurance in Texas. It provides financial protection to other drivers and passengers if you are at fault in an accident. Liability coverage comes in two parts:

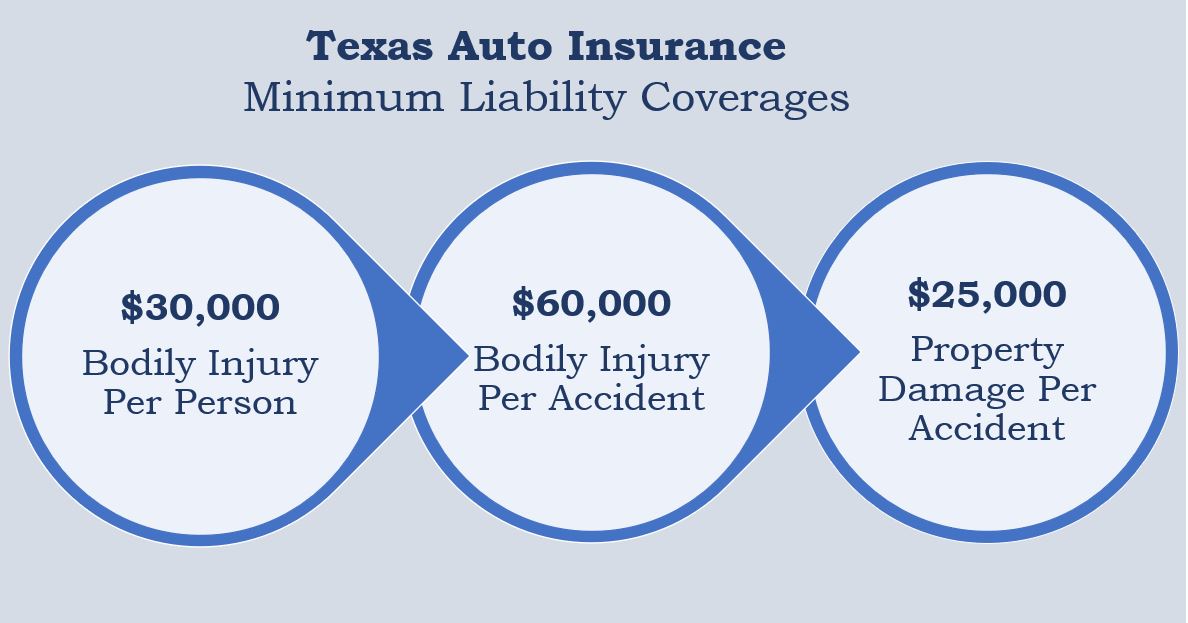

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident. The minimum requirement in Texas is $30,000 per person and $60,000 per accident.

- Property Damage Liability: This covers damages to another person’s vehicle or property caused by your negligence. The minimum requirement in Texas is $25,000 per accident.

Personal Injury Protection (PIP)

While not mandatory in Texas, Personal Injury Protection (PIP) coverage is highly recommended. PIP coverage provides medical benefits to you and your passengers, regardless of who is at fault in an accident. It covers medical expenses, lost wages, and other related expenses. The maximum amount of PIP coverage available in Texas is $2,500.

Uninsured/Underinsured Motorist Coverage

This coverage protects you and your passengers in case you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your losses. Uninsured motorist coverage pays for medical expenses, lost wages, and property damage. Underinsured motorist coverage pays the difference between the other driver’s insurance coverage and your actual losses. The minimum requirement in Texas is $30,000 per person and $60,000 per accident.

Consequences of Driving Without Insurance

Driving without the required car insurance in Texas can have serious consequences. You could face:

- Fines and penalties: Texas law imposes significant fines and penalties for driving without insurance, ranging from hundreds to thousands of dollars.

- License suspension: Your driver’s license can be suspended for a period of time, preventing you from driving legally.

- Vehicle impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Financial responsibility: You are fully responsible for all damages and injuries caused by your negligence in an accident, even if you are not at fault.

Factors Influencing Insurance Premiums

Car insurance premiums in Texas are influenced by a variety of factors, with the goal of reflecting the risk associated with each individual driver and vehicle. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your insurance premium. Higher-performance vehicles, luxury cars, and SUVs generally have higher premiums due to their higher repair costs, potential for higher speeds, and increased risk of theft. Conversely, smaller, less expensive cars tend to have lower premiums.

Driving History

Your driving history is one of the most important factors influencing your car insurance rates. A clean driving record with no accidents or traffic violations will typically result in lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

Age

Age is another important factor, as younger drivers are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for drivers under 25, as they have less experience and are more likely to take risks. However, premiums typically decrease as you age, reaching a lower point in your late 50s and 60s.

Credit Score

While this may seem surprising, your credit score can also influence your car insurance premiums. Insurance companies use credit scores as an indicator of financial responsibility, believing that individuals with good credit are more likely to pay their insurance premiums on time. Drivers with lower credit scores may face higher premiums.

Location

Where you live can also affect your insurance rates. Areas with higher crime rates or more traffic congestion tend to have higher premiums due to the increased risk of accidents and theft.

Other Factors

Other factors can influence your insurance premiums, including:

- Gender: Historically, women have been considered safer drivers than men, but this gap is narrowing. Some insurance companies may offer lower premiums to women, while others may not.

- Marital Status: Married individuals are often considered more responsible and may be eligible for lower premiums in some cases.

- Driving Habits: Your driving habits, such as the number of miles you drive annually and whether you primarily use your vehicle for commuting or pleasure, can influence your premiums.

- Safety Features: Vehicles equipped with safety features such as anti-lock brakes, airbags, and stability control can qualify for lower premiums.

Choosing the Right Insurance Provider

Finding the right car insurance provider in Texas can feel overwhelming with so many options available. You need to consider factors like coverage, price, and customer service to ensure you’re getting the best value for your money.

Comparing Quotes

Before settling on a provider, it’s crucial to compare quotes from multiple insurers. This allows you to see a range of coverage options and prices, enabling you to make an informed decision. You can use online comparison tools, contact insurers directly, or work with an insurance broker.

- Online comparison tools: These websites allow you to enter your information once and receive quotes from multiple insurers simultaneously, saving you time and effort. Popular options include The Zebra, Insurify, and Policygenius.

- Contacting insurers directly: You can get a quote by calling or visiting the websites of individual insurers. This allows you to ask specific questions and gather more detailed information about their policies.

- Working with an insurance broker: Brokers can represent you and shop for quotes from multiple insurers on your behalf. They can provide expert advice and help you find the best coverage at the most competitive price.

Factors to Consider

When comparing quotes, pay attention to the following factors:

- Coverage options: Different insurers offer varying levels of coverage, so it’s essential to compare what’s included in each policy. Consider factors like liability limits, collision and comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP).

- Pricing: Obviously, price is a major factor in choosing an insurer. Look beyond the initial quote and consider factors like discounts, deductibles, and potential rate increases in the future.

- Customer service: Read reviews and check customer satisfaction ratings to gauge the insurer’s responsiveness and helpfulness. Consider factors like ease of filing claims, claim processing times, and overall customer experience.

- Financial stability: Look for insurers with strong financial ratings, indicating their ability to pay claims in the event of an accident. You can find this information from rating agencies like AM Best and Standard & Poor’s.

Negotiating with Insurance Providers, State of texas car insurance

Once you’ve narrowed down your options, you can negotiate with insurers to get the best possible rates. Here are some tips:

- Ask about discounts: Most insurers offer discounts for various factors, including good driving records, safety features in your car, multiple policies, and affiliations with certain organizations. Be sure to inquire about these discounts and ensure you’re receiving all applicable ones.

- Shop around: Don’t be afraid to tell insurers you’re getting quotes from other providers. This can motivate them to offer you a more competitive price.

- Consider bundling policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings. Inquire about bundling options with your preferred insurers.

- Be prepared to walk away: If you’re not satisfied with the quote or the insurer’s attitude, be prepared to walk away and consider other options. There’s no obligation to accept the first offer you receive.

Understanding Your Policy

It’s crucial to understand the ins and outs of your Texas car insurance policy to ensure you’re adequately protected and can navigate the claims process smoothly. A typical policy is divided into different sections, each outlining specific coverages, exclusions, and limitations.

Policy Sections and Provisions

Your Texas car insurance policy will include several sections, each addressing a specific aspect of coverage. Here’s a breakdown of some key sections:

- Declarations Page: This page summarizes the essential details of your policy, including your name, address, policy number, coverage types, and premium amount.

- Coverages: This section details the types of coverage you’ve purchased, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. It also Artikels the limits and conditions of each coverage.

- Exclusions: This section specifies situations or events not covered by your policy. For example, damage caused by wear and tear, intentional acts, or driving under the influence may be excluded.

- Conditions: This section Artikels the responsibilities of both you and the insurance company, such as your duty to notify the insurer of an accident, cooperate with investigations, and maintain accurate information. It also details the process for making claims and resolving disputes.

Understanding the Claims Process

Filing a claim is a straightforward process, but it’s essential to understand the steps involved and the required documentation.

- Report the Accident: Immediately contact your insurance company to report the accident. Provide details about the incident, including the date, time, location, and parties involved.

- Gather Evidence: Collect as much evidence as possible, including photos of the damage, police reports, witness statements, and medical records.

- Submit a Claim: Your insurance company will provide a claim form. Fill it out accurately and completely, providing all relevant information and supporting documents.

- Review and Adjust: Your insurer will review your claim and assess the damage. They may request additional information or inspections. Once the assessment is complete, they will determine the amount of coverage available.

- Negotiate Settlement: If you’re satisfied with the offered settlement, you can accept it. However, you have the right to negotiate if you believe the amount is insufficient.

Tips for Effective Claim Filing

- Act Promptly: Contact your insurer as soon as possible after an accident. Delays can impact your claim processing.

- Document Everything: Keep a detailed record of the accident, including dates, times, locations, and names of involved parties.

- Be Honest and Accurate: Provide truthful information to your insurer to avoid delays or claim denials.

- Cooperate with Investigations: Respond to any requests for information or inspections promptly and fully.

- Understand Your Coverage: Familiarize yourself with the limits and conditions of your policy to ensure you understand what’s covered and what’s not.

Texas-Specific Regulations and Laws

Texas boasts a unique set of car insurance laws that are designed to protect drivers and ensure financial responsibility on the road. These regulations are enforced by the Texas Department of Insurance, a key player in the state’s car insurance landscape.

The Texas Auto Insurance Plan (TAIP)

The Texas Auto Insurance Plan, often referred to as the “Texas Assigned Risk Plan,” serves as a safety net for drivers who are unable to obtain insurance through traditional channels. This plan allows drivers with a history of high-risk driving behavior, such as multiple accidents or traffic violations, to secure coverage from participating insurance companies. It operates on a shared risk basis, ensuring that all participating companies contribute to the coverage of these high-risk drivers.

Texas Department of Insurance (TDI)

The Texas Department of Insurance plays a pivotal role in regulating the car insurance industry in Texas. It establishes minimum coverage requirements, monitors insurance companies, and investigates consumer complaints. TDI’s website provides a wealth of information for drivers, including details on insurance requirements, complaint procedures, and tips for finding the right insurance provider.

Recent Changes to Texas Car Insurance Laws

In recent years, Texas has witnessed several changes to its car insurance laws, aimed at improving driver safety and financial protection. For example, the state has introduced new requirements for uninsured motorist coverage, designed to protect drivers in the event of an accident with an uninsured driver. Additionally, there have been updates to the financial responsibility laws, ensuring that drivers have adequate coverage to cover potential damages in case of an accident.

Staying Informed About Your Rights and Responsibilities

To stay informed about your rights and responsibilities as a driver in Texas, it’s essential to consult the Texas Department of Insurance website and familiarize yourself with the state’s car insurance laws. TDI provides a comprehensive range of resources, including publications, FAQs, and consumer guides, to help drivers navigate the complexities of car insurance.

Common Insurance Claims and Disputes

Navigating the process of filing a car insurance claim in Texas can be challenging, especially when unexpected disputes arise. Understanding the common types of claims, potential disputes, and strategies for resolution is crucial for Texas drivers.

Types of Car Insurance Claims

Texas car insurance policies typically cover a range of claims, with the most common being collision, liability, and uninsured/underinsured motorist claims.

- Collision Claims: These claims cover damage to your vehicle resulting from an accident, regardless of fault. For instance, if you hit a tree or another vehicle, collision coverage will help pay for repairs or replacement, minus your deductible.

- Liability Claims: Liability coverage protects you financially if you cause an accident and injure someone or damage their property. This coverage pays for the other party’s medical expenses, lost wages, and property damage up to your policy limits.

- Uninsured/Underinsured Motorist Claims: This coverage is essential if you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It covers your medical expenses, lost wages, and property damage, up to your policy limits.

Disputes During the Claims Process

While the claims process is usually straightforward, disputes can arise, leading to delays and frustration.

- Determining Fault: In Texas, the “fault” in an accident can be a major point of contention. The at-fault driver is usually responsible for the other party’s damages. However, disputes can arise if both parties believe they were not at fault, or if the insurance companies disagree on the allocation of fault.

- Policy Coverage: Disputes can also arise over the extent of coverage provided by your policy. For example, if you are involved in an accident with a hit-and-run driver, your uninsured motorist coverage may apply. However, the insurance company may dispute the claim if they argue that the accident does not meet the policy’s definition of a hit-and-run.

- Amount of Compensation: Disputes can also arise over the amount of compensation offered for damages. The insurance company may offer a settlement amount that you believe is too low. For example, they may undervalue your vehicle’s repairs or deny certain medical expenses.

Resolving Disputes

If you encounter a dispute during the claims process, several strategies can help you resolve it:

- Negotiate with the Insurance Company: First, try to negotiate a fair settlement with the insurance company. You can present supporting documentation, such as medical bills, repair estimates, and witness statements, to support your claim.

- File a Complaint: If negotiation fails, you can file a complaint with the Texas Department of Insurance (TDI). The TDI can investigate your complaint and help resolve the dispute.

- Seek Legal Counsel: In some cases, it may be necessary to seek legal counsel. An attorney can help you understand your rights and options, and they can represent you in negotiations or court proceedings.

Real-Life Examples

- Scenario 1: A driver named Sarah was involved in a rear-end collision. While she was not at fault, the other driver’s insurance company claimed that Sarah was partially responsible. This led to a dispute over the amount of compensation Sarah received for her injuries and vehicle damage.

- Scenario 2: John was involved in an accident with an uninsured driver. He filed a claim with his own insurance company under his uninsured motorist coverage. However, the insurance company disputed the claim, arguing that John had not taken reasonable steps to identify the uninsured driver. This dispute was ultimately resolved through mediation, with John receiving compensation for his damages.

Car Insurance Trends and Future Outlook

The Texas car insurance market is constantly evolving, driven by technological advancements, changing consumer preferences, and evolving regulations. Understanding these trends is crucial for drivers to navigate the complexities of car insurance and make informed decisions about their coverage.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to monitor and analyze driving behavior. Telematics devices, such as smartphone apps or plug-in dongles, collect data on factors like speed, braking, acceleration, and time of day. This information is used to create usage-based insurance (UBI) programs, which offer discounts to drivers with safe driving habits. UBI is becoming increasingly popular in Texas, as it allows insurers to personalize premiums based on actual driving behavior.

- Reduced Premiums for Safe Drivers: UBI programs reward drivers who demonstrate safe driving practices, potentially leading to lower premiums.

- Increased Awareness of Driving Habits: Telematics devices provide drivers with real-time feedback on their driving behavior, encouraging them to adopt safer driving habits.

- Data-Driven Risk Assessment: Insurers can leverage telematics data to assess risk more accurately, potentially leading to more precise and equitable pricing.

Autonomous Vehicles and the Future of Insurance

The emergence of autonomous vehicles (AVs) presents both challenges and opportunities for the car insurance industry. As AVs become more prevalent, traditional insurance models may need to adapt to account for the unique risks and complexities associated with self-driving technology.

- Liability and Responsibility: Determining liability in an accident involving an AV could become complicated, as the responsibility may lie with the manufacturer, the software developer, or the driver (in the case of a partially autonomous vehicle).

- Reduced Accident Rates: AVs have the potential to significantly reduce accident rates due to their ability to react faster and more accurately than human drivers. This could lead to lower insurance premiums in the long run.

- New Coverage Options: New insurance products may emerge to address the specific risks associated with AVs, such as cyber security, data privacy, and liability for autonomous driving systems.

Online Insurance Platforms and Digitalization

The rise of online insurance platforms has transformed the way drivers shop for and purchase car insurance. These platforms offer convenience, transparency, and competitive pricing, empowering consumers to make informed decisions.

- Increased Competition: Online platforms have increased competition in the insurance market, leading to more affordable rates and innovative product offerings.

- Improved Customer Experience: Online platforms offer a seamless and convenient experience, allowing drivers to compare quotes, manage policies, and file claims online.

- Personalized Recommendations: AI-powered algorithms can analyze individual driving profiles and preferences to provide personalized insurance recommendations.

Conclusion

By understanding the intricacies of Texas car insurance, drivers can make informed choices about their coverage, minimize risks, and ensure they are adequately protected on the road. From navigating mandatory requirements to choosing the right provider and understanding policy provisions, this guide empowers you to navigate the Texas car insurance landscape with confidence.

FAQ Compilation

How much does car insurance cost in Texas?

Car insurance costs in Texas vary widely based on factors like age, driving history, vehicle type, and location. It’s best to obtain quotes from multiple insurers to compare prices and find the best value.

What happens if I get into an accident without car insurance in Texas?

Driving without the minimum required car insurance in Texas can result in fines, license suspension, and even jail time. You could also be held financially responsible for any damages or injuries caused in an accident.

What is the Texas Auto Insurance Plan?

The Texas Auto Insurance Plan is a high-risk insurance pool for drivers who have been denied coverage by private insurers due to a poor driving record. It provides basic liability coverage to these drivers.

Can I get a discount on my car insurance in Texas?

Yes, many insurance providers offer discounts for factors like good driving records, safe driving courses, multiple policy bundling, and safety features in your vehicle.