Car State Farm Insurance is a household name in the world of auto insurance, known for its extensive coverage options, competitive pricing, and strong reputation. With a long history of providing reliable insurance solutions, State Farm has become a trusted choice for millions of drivers across the country. This comprehensive guide will delve into the various facets of Car State Farm Insurance, exploring its features, benefits, pricing, customer experience, and digital advancements.

State Farm’s commitment to customer satisfaction is evident in its wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. These options cater to diverse needs, allowing drivers to customize their insurance plans to match their specific requirements and risk profiles. Furthermore, State Farm offers a variety of discounts, such as safe driver discounts, good student discounts, and multi-policy discounts, which can help customers save money on their premiums.

State Farm Insurance Overview

State Farm is a leading insurance company in the United States, renowned for its extensive product offerings and exceptional customer service. Founded in 1922, the company has grown to become one of the largest insurers in the country, serving millions of policyholders nationwide. State Farm’s commitment to customer satisfaction and financial stability has earned it a reputation for reliability and trust.

Insurance Products Offered by State Farm

State Farm offers a comprehensive suite of insurance products designed to protect individuals and families against various risks. These products include:

- Auto Insurance: State Farm’s auto insurance provides coverage for liability, collision, comprehensive, and other optional protections. This insurance helps policyholders recover from accidents and injuries, as well as repair or replace damaged vehicles.

- Homeowners Insurance: State Farm’s homeowners insurance safeguards homes and personal belongings against fire, theft, natural disasters, and other perils. It provides financial protection for rebuilding or repairing damaged properties and replacing lost or damaged possessions.

- Life Insurance: State Farm offers various life insurance options, including term life, whole life, and universal life insurance. These policies provide financial security for beneficiaries in the event of the policyholder’s death, ensuring the continuation of financial support for loved ones.

- Renters Insurance: State Farm’s renters insurance protects renters’ personal belongings from damage or loss due to various perils. This insurance provides financial coverage for replacing stolen or damaged items, as well as liability protection for accidents that occur within the rental property.

- Business Insurance: State Farm offers a range of business insurance solutions, including property, liability, workers’ compensation, and commercial auto insurance. These policies help businesses manage risks and protect their assets, ensuring continuity of operations and financial stability.

Key Features and Benefits of State Farm Car Insurance

State Farm’s car insurance offers a comprehensive range of coverage options, discounts, and customer service features designed to provide peace of mind and financial protection.

Coverage Options

State Farm’s car insurance offers a variety of coverage options to meet individual needs, including:

- Liability Coverage: This coverage protects policyholders from financial responsibility for damages caused to others in an accident, including medical expenses, property damage, and lost wages.

- Collision Coverage: This coverage reimburses policyholders for repairs or replacement of their own vehicle in the event of an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects policyholders from damages caused by non-collision events, such as theft, vandalism, natural disasters, and animal collisions.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection for policyholders in accidents involving drivers who are uninsured or underinsured, ensuring that they receive compensation for their injuries and damages.

- Medical Payments Coverage: This coverage helps pay for medical expenses for the policyholder and passengers in their vehicle, regardless of fault.

Discounts

State Farm offers various discounts to help policyholders save on their car insurance premiums, including:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record and no accidents or traffic violations.

- Safe Driver Discount: This discount is offered to drivers who complete defensive driving courses and demonstrate safe driving practices.

- Multi-Policy Discount: This discount is available to policyholders who bundle multiple insurance policies, such as car insurance, homeowners insurance, and life insurance, with State Farm.

- Anti-theft Device Discount: This discount is offered to policyholders who have installed anti-theft devices in their vehicles, reducing the risk of theft.

- Student Discount: This discount is available to students who maintain good grades and are enrolled in college or university.

Customer Service

State Farm is known for its exceptional customer service, providing 24/7 support and assistance to policyholders. The company offers a variety of convenient communication channels, including:

- Online Services: Policyholders can access their account information, manage policies, and file claims online through State Farm’s website.

- Mobile App: State Farm’s mobile app allows policyholders to access their insurance information, manage policies, and file claims on the go.

- Phone Support: State Farm offers 24/7 phone support to assist policyholders with any questions or concerns.

- Agent Network: State Farm has a vast network of agents across the country who are available to provide personalized advice and assistance to policyholders.

Car Insurance Features and Benefits

State Farm offers a comprehensive suite of car insurance coverages designed to protect you financially in the event of an accident or other unforeseen circumstances. Understanding the different types of coverage and their benefits is crucial for making informed decisions about your car insurance policy.

Types of Car Insurance Coverage

State Farm provides various types of car insurance coverage, each designed to address specific risks.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. It covers medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage.

Discounts for Car Insurance

State Farm offers a variety of discounts to help you save money on your car insurance premiums.

- Safe Driver Discounts: These discounts reward drivers with a clean driving record, demonstrating their responsible driving habits.

- Good Student Discounts: This discount is available to students who maintain good grades, highlighting their commitment to academic excellence.

- Multi-Policy Discounts: State Farm offers discounts to customers who bundle multiple insurance policies, such as car insurance, homeowners insurance, and life insurance, demonstrating their loyalty to the company.

State Farm Car Insurance Pricing and Factors

Getting the best car insurance rate requires understanding the factors that influence pricing. State Farm, like other insurance providers, considers various aspects to determine your premium. This section delves into the key factors influencing State Farm car insurance rates, providing insights into how you can potentially lower your costs.

Factors Affecting State Farm Car Insurance Premiums

State Farm, like other insurers, uses a complex algorithm to calculate your car insurance premium. Several factors contribute to your final rate, including:

- Driving History: Your driving record plays a crucial role in determining your premium. A clean driving record with no accidents or violations will likely result in a lower rate. However, if you have a history of accidents, speeding tickets, or DUI convictions, your premium will likely be higher.

- Vehicle Type: The make, model, year, and safety features of your vehicle significantly impact your insurance cost. Higher-performance vehicles or those with expensive parts are generally more expensive to insure.

- Location: Where you live influences your car insurance premium. Areas with higher crime rates or traffic congestion tend to have higher insurance costs.

- Coverage Levels: The amount of coverage you choose, such as liability, collision, and comprehensive, affects your premium. Higher coverage levels typically result in higher premiums.

- Age and Gender: Your age and gender can influence your premium. Younger drivers, particularly males, are statistically more likely to be involved in accidents, which can lead to higher premiums.

- Credit Score: Some states allow insurers to consider your credit score when determining your premium. A higher credit score may indicate a lower risk to the insurer and potentially result in a lower rate.

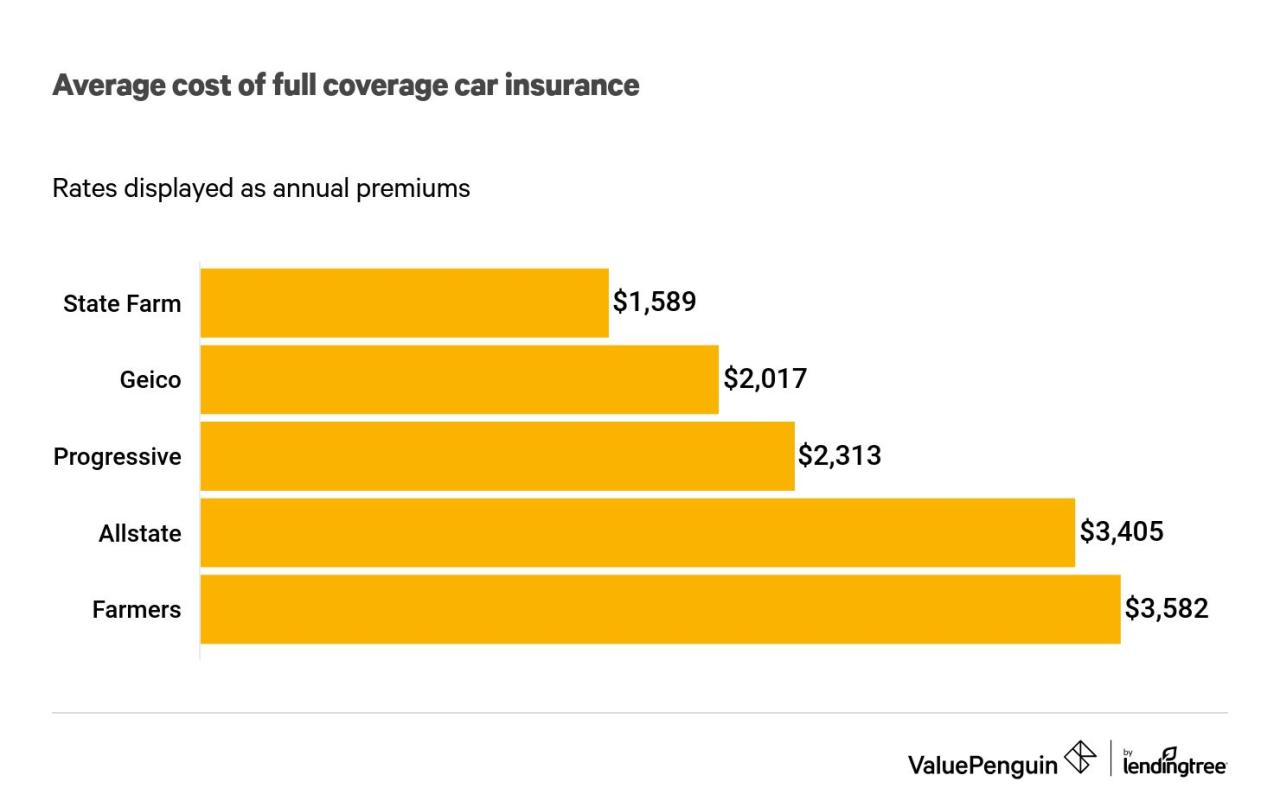

Comparing State Farm Car Insurance Rates with Other Providers

While State Farm is a reputable insurer, it’s essential to compare rates with other major insurance providers to find the best deal. You can use online comparison tools or contact insurance agents directly to obtain quotes from multiple insurers.

Consider factors like:

- Discounts: Many insurers offer discounts for safe driving, good student status, multiple policy bundling, and other factors.

- Customer Service: Evaluate customer service reviews and ratings to assess the insurer’s responsiveness and helpfulness.

- Claims Process: Research the insurer’s claims process and customer satisfaction with their claims handling.

Obtaining a Car Insurance Quote from State Farm

State Farm offers various ways to obtain a car insurance quote:

- Online: State Farm’s website provides an online quote tool that allows you to input your information and receive an instant quote.

- Phone: You can call State Farm’s customer service line to receive a quote from a representative.

- In-Person: You can visit a local State Farm agent to discuss your insurance needs and obtain a quote.

Customer Experience and Reviews

State Farm is one of the largest and most well-known insurance companies in the United States. With a long history and a wide range of products and services, State Farm has built a reputation for customer service and satisfaction. However, like any company, State Farm has its share of positive and negative reviews.

Customer Reviews and Testimonials

Customer reviews provide valuable insights into the overall customer experience with State Farm car insurance. Online platforms like Trustpilot, Consumer Affairs, and Yelp offer a platform for customers to share their experiences, both good and bad.

- Positive Reviews often highlight State Farm’s friendly and helpful customer service representatives, prompt claims processing, and competitive pricing. Customers often praise the company’s strong reputation and financial stability.

- Negative Reviews often center around issues with claims processing, customer support responsiveness, and policy changes. Some customers have reported difficulties in getting claims approved or dealing with delays in receiving payouts.

State Farm’s Digital and Technological Advancements: Car State Farm Insurance

State Farm, recognizing the evolving needs of its customers in a digital age, has made significant strides in integrating technology into its operations and insurance offerings. The company has embraced a digital-first approach, focusing on creating user-friendly online platforms, mobile apps, and digital tools that streamline policy management, claims reporting, and overall customer interaction.

Online Platforms and Mobile Apps, Car state farm insurance

State Farm’s digital transformation is evident in its robust online platforms and mobile apps. These platforms serve as central hubs for customers to manage their insurance policies, access account information, make payments, and file claims. The State Farm website provides a comprehensive online portal for policyholders, allowing them to:

- Get quotes and purchase insurance

- View and manage policy details

- Make payments and track payment history

- File claims and track claim status

- Access and manage account information

- Contact customer service

State Farm’s mobile app complements its online platform, offering a convenient and accessible way for customers to interact with their insurance policies on the go. Key features of the app include:

- Policy management and access to account information

- Digital ID cards for quick access to policy details

- Real-time claim reporting and tracking

- Roadside assistance request

- Personalized communication and notifications

The user-friendly interface and comprehensive features of both the website and mobile app have significantly enhanced customer convenience and accessibility, allowing policyholders to manage their insurance needs with ease.

State Farm’s Role in the Insurance Industry

State Farm, a household name in the insurance industry, holds a significant position as one of the largest and most influential providers of car insurance in the United States. This prominence is a testament to the company’s long history, commitment to customer service, and adaptability to changing market dynamics.

State Farm’s Contributions to Innovation and Technological Advancements

State Farm has consistently been at the forefront of innovation within the car insurance sector. The company has actively embraced technology to streamline its operations, enhance customer experience, and introduce new products and services. This commitment to innovation has been evident in various areas, including:

- Digital Platforms: State Farm has developed user-friendly mobile apps and online platforms that allow customers to manage their policies, file claims, and access various insurance-related services at their convenience. This has led to increased efficiency and customer satisfaction.

- Telematics: State Farm has integrated telematics technology into its offerings, using devices that track driving behavior and provide insights into risk assessment. This data allows the company to offer personalized insurance rates based on individual driving habits, fostering a more equitable and rewarding system for safe drivers.

- Artificial Intelligence (AI): State Farm leverages AI in various aspects of its operations, from automating claims processing to improving fraud detection. AI-powered chatbots provide 24/7 customer support, while advanced algorithms analyze vast amounts of data to personalize insurance offerings and improve risk assessment.

Conclusion

State Farm car insurance has emerged as a prominent player in the insurance industry, offering a comprehensive suite of coverage options and a strong commitment to customer satisfaction.

The company’s robust financial stability, wide range of coverage choices, competitive pricing, and innovative digital tools have made it a compelling choice for many car owners.

State Farm’s Overall Value Proposition

State Farm’s value proposition is built on its commitment to providing affordable, comprehensive car insurance coverage, combined with exceptional customer service and a focus on technological advancements.

The company’s dedication to meeting the evolving needs of its customers, along with its reputation for financial strength and stability, makes it a reliable and trustworthy insurance provider.

Conclusion

State Farm car insurance stands out as a strong contender in the insurance market, offering a compelling blend of comprehensive coverage, competitive pricing, and a focus on customer satisfaction. By leveraging technology and digital initiatives, State Farm continues to innovate and enhance the insurance experience for its customers. Whether you’re a seasoned driver or a new car owner, exploring the options offered by State Farm car insurance is a worthwhile endeavor.

Top FAQs

What types of car insurance does State Farm offer?

State Farm offers a variety of car insurance coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer additional coverage options such as rental reimbursement and roadside assistance.

How do I get a car insurance quote from State Farm?

You can obtain a car insurance quote from State Farm through their website, mobile app, or by contacting a local agent. The process typically involves providing information about your vehicle, driving history, and desired coverage levels.

What factors affect my State Farm car insurance premium?

Factors that influence your State Farm car insurance premium include your driving history, vehicle type, location, coverage levels, and credit score.