Car Insurance State Farm is a household name, known for its reliable coverage and dedicated customer service. This comprehensive guide delves into the world of State Farm, exploring its history, insurance offerings, customer experience, pricing structure, and much more. We aim to provide you with a clear understanding of what State Farm has to offer and how it compares to other car insurance providers.

From understanding the various types of car insurance policies to navigating the claims process, we’ll cover all the essential aspects to help you make an informed decision. We’ll also explore State Farm’s commitment to technological innovation and its vision for the future of car insurance in a rapidly changing landscape.

State Farm Overview

State Farm is a leading insurance company in the United States, offering a wide range of insurance products and financial services. It has a rich history and a strong reputation for customer service and financial stability.

History of State Farm

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. Mecherle’s vision was to provide affordable car insurance to farmers and rural residents, who were often underserved by traditional insurance companies. State Farm’s initial focus was on automobile insurance, and it quickly gained popularity for its low premiums and comprehensive coverage. The company expanded its product offerings over the years to include home, life, health, and other insurance products, as well as financial services such as banking and mutual funds.

Core Values and Mission Statement

State Farm’s core values are centered around customer service, integrity, and financial strength. The company’s mission statement is: “To help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” These values and mission statement guide State Farm’s operations and its commitment to providing exceptional customer experiences.

Market Position

State Farm is one of the largest and most respected insurance companies in the United States. It holds a significant market share in the car insurance industry, consistently ranking among the top providers. The company’s strong brand recognition, extensive agent network, and competitive pricing have contributed to its success. State Farm has a loyal customer base and a reputation for providing reliable and affordable insurance products.

Car Insurance Products and Services

State Farm offers a comprehensive suite of car insurance products and services designed to meet the diverse needs of its customers. These products provide financial protection against various risks associated with owning and operating a vehicle, offering peace of mind and financial security in the event of an accident or other unforeseen events.

Types of Car Insurance

State Farm provides a variety of car insurance options to cater to different needs and budgets. Here are some of the most common types of car insurance offered:

- Liability Insurance: This is the most basic type of car insurance, and it is required by law in most states. It covers damages to other people’s property or injuries to others if you are at fault in an accident.

- Collision Insurance: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Insurance: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses, lost wages, and other expenses if you are injured in an accident, regardless of who is at fault.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault, up to a certain limit.

Coverage Options

State Farm offers a range of coverage options within each type of car insurance, allowing you to customize your policy to fit your specific needs and budget. Some common coverage options include:

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means lower premiums, while a lower deductible means higher premiums.

- Limits: This refers to the maximum amount your insurance company will pay for a covered claim. You can choose different limits for different types of coverage, such as liability coverage, collision coverage, and comprehensive coverage.

- Rental Car Coverage: This coverage helps pay for a rental car if your vehicle is damaged in an accident and is being repaired.

- Roadside Assistance: This coverage provides assistance for situations such as flat tires, dead batteries, and lockouts.

Unique Features and Benefits

State Farm offers several unique features and benefits that make its car insurance policies stand out. These include:

- Drive Safe & Save®: This program rewards safe drivers with discounts on their premiums. Drivers who maintain a clean driving record and avoid accidents can earn significant savings.

- State Farm® Drive Safe & Save® Mobile App: This app allows you to track your driving habits and earn discounts based on your safe driving behavior.

- 24/7 Customer Service: State Farm offers 24/7 customer service, ensuring that you can get help whenever you need it.

- Online and Mobile Services: State Farm offers a variety of online and mobile services, making it easy to manage your policy, pay your premiums, and file claims.

- Financial Strength and Stability: State Farm is a financially strong and stable company with a long history of providing reliable insurance coverage.

State Farm’s Customer Experience

State Farm prioritizes a seamless and positive customer experience, offering various resources and channels to cater to diverse needs. This section delves into the process of obtaining a car insurance quote, explores the company’s customer service channels, and highlights the digital tools available to customers.

Obtaining a Car Insurance Quote

State Farm provides multiple avenues for obtaining a car insurance quote, offering flexibility and convenience.

- Online Quote: Customers can obtain an instant quote through State Farm’s website, simply by entering their details and vehicle information. This option allows for quick comparison of different coverage options and price estimates.

- Mobile App: The State Farm mobile app facilitates convenient quote requests on the go. Customers can access the app to input their details, compare quotes, and receive personalized recommendations tailored to their needs.

- Phone Call: Customers can contact State Farm’s dedicated customer service line to receive a personalized quote over the phone. This option allows for direct interaction with a representative who can answer specific questions and provide tailored advice.

- Agent Appointment: Customers can schedule an in-person appointment with a local State Farm agent to discuss their insurance needs and obtain a customized quote. This option provides a more personalized approach and allows for detailed discussions regarding specific coverage requirements.

Customer Service Channels

State Farm offers various customer service channels to ensure prompt and efficient assistance.

- Phone Support: State Farm provides 24/7 phone support, allowing customers to reach a representative at any time, day or night. This ensures immediate assistance for urgent inquiries or issues.

- Online Chat: Customers can access online chat support through State Farm’s website, allowing for real-time communication with a representative. This option is particularly convenient for quick questions or inquiries that don’t require an immediate phone call.

- Email Support: State Farm provides email support for inquiries that require detailed information or documentation. Customers can reach out via email, allowing for a more comprehensive exchange of information and a detailed response from a representative.

- Social Media: State Farm actively engages with customers on social media platforms, offering support and information. This channel provides an accessible platform for quick inquiries and general communication.

Digital Tools and Resources

State Farm offers a range of digital tools and resources to enhance customer experience and provide convenient access to information and services.

- Mobile App: The State Farm mobile app allows customers to manage their insurance policies, access digital ID cards, report claims, and receive personalized notifications. The app provides a centralized platform for managing all aspects of their insurance needs.

- Online Account: Customers can access their online account to view policy details, make payments, update contact information, and manage other account-related tasks. This provides a secure and convenient platform for managing their insurance policies online.

- Claim Reporting: State Farm’s online claim reporting system allows customers to file claims quickly and easily, providing a streamlined process for reporting accidents or incidents. The system allows for uploading photos and documentation, further simplifying the process.

- Digital Documents: State Farm provides access to digital copies of important documents, such as insurance cards and policy information, eliminating the need for physical copies. This ensures convenient access to critical documents whenever needed.

Pricing and Discounts

State Farm’s car insurance pricing is determined by a variety of factors, including your driving history, vehicle type, location, and coverage options. The company uses a complex algorithm to calculate your individual premium, aiming to provide a fair price based on your specific risk profile.

Factors Influencing Rates

State Farm’s car insurance rates are influenced by several factors. These factors are used to assess your individual risk and determine the appropriate premium for your coverage.

- Driving History: Your driving record, including accidents, violations, and DUI convictions, significantly impacts your insurance rates. A clean driving history typically leads to lower premiums.

- Vehicle Type: The make, model, year, and safety features of your vehicle play a crucial role in determining your insurance rates. Higher-value vehicles with advanced safety features may have higher premiums.

- Location: Your address and the surrounding area’s crime rate, traffic density, and weather conditions influence your insurance rates. Areas with higher risk factors tend to have higher premiums.

- Coverage Options: The level of coverage you choose, such as liability, collision, and comprehensive, directly affects your premium. Higher coverage limits generally result in higher premiums.

- Age and Gender: Statistically, younger drivers and males tend to have higher insurance rates due to their higher risk profiles.

- Credit Score: In some states, State Farm may consider your credit score when determining your insurance rates. A good credit score may lead to lower premiums.

Discounts Offered

State Farm offers a wide range of discounts to help you save on your car insurance premiums. These discounts are designed to reward safe driving practices, responsible ownership, and loyalty.

- Safe Driver Discount: This discount is available to drivers with a clean driving record, rewarding safe driving practices.

- Good Student Discount: This discount is offered to students who maintain a certain GPA, recognizing their responsible behavior and academic achievements.

- Multi-Policy Discount: State Farm provides a discount when you bundle multiple insurance policies, such as car, home, or life insurance, under one account.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can reduce your insurance premiums.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

- Loyalty Discount: Long-term State Farm customers may be eligible for loyalty discounts, rewarding their continued business.

- Paperless Discount: Choosing electronic communication for your policy documents can qualify you for a discount.

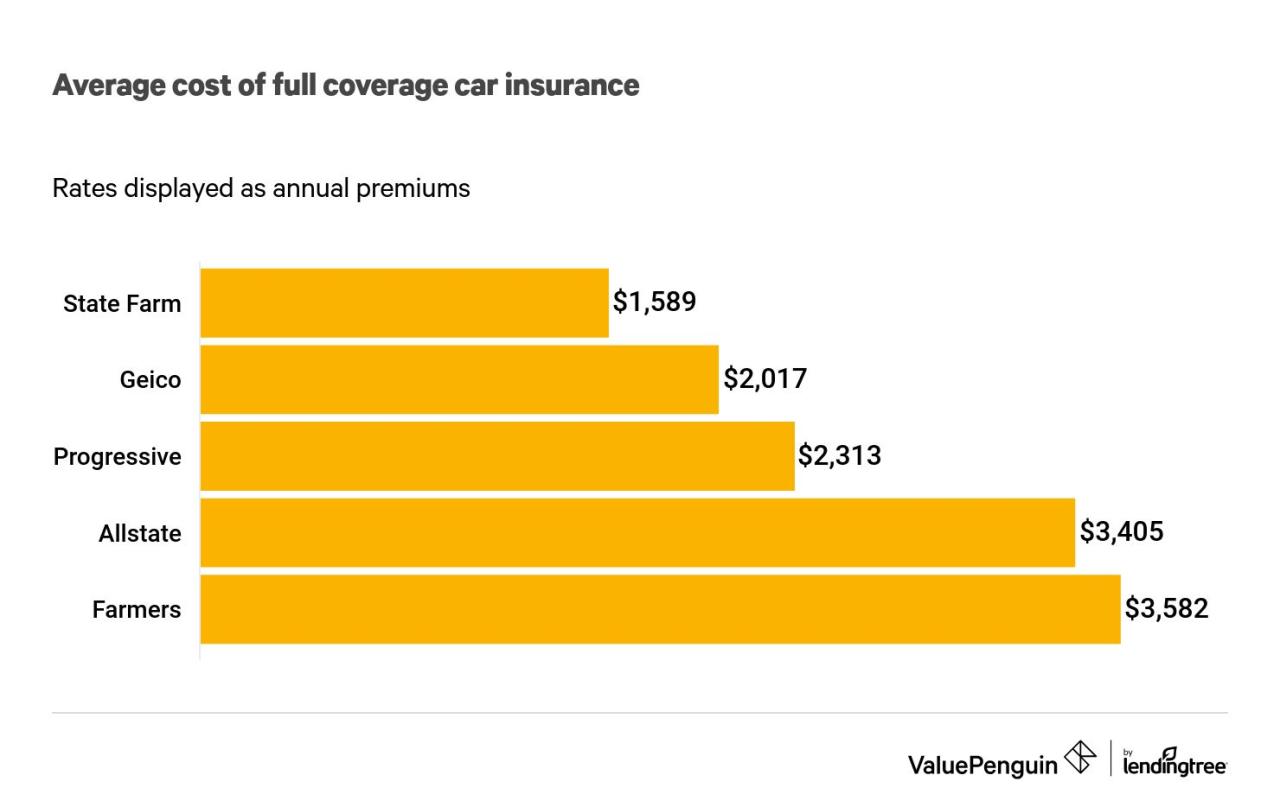

Pricing Comparison with Competitors

State Farm’s car insurance pricing is competitive within the market. However, it’s important to compare quotes from multiple insurers to find the best rate for your specific needs. Factors like your location, driving history, and coverage options can significantly impact pricing.

It’s crucial to consider the value of the coverage you receive, the quality of customer service, and the discounts offered when comparing insurance quotes.

Claims Process and Customer Satisfaction

State Farm’s claims process is designed to be straightforward and efficient, aiming to provide a smooth experience for policyholders. The company strives to ensure fair and timely compensation for covered losses.

Steps Involved in Filing a Car Insurance Claim

Filing a car insurance claim with State Farm involves a series of steps that help ensure a smooth and efficient process.

- Report the Accident: The first step is to contact State Farm immediately after an accident to report the incident. You can do this by phone, online, or through the State Farm mobile app.

- Provide Information: State Farm will ask for details about the accident, including the date, time, location, and the other parties involved. You will also need to provide information about your vehicle and any injuries sustained.

- File a Claim: Once you have reported the accident, State Farm will guide you through the process of filing a formal claim. This typically involves providing additional documentation, such as a police report or medical records.

- Claim Review and Assessment: State Farm will review your claim and assess the damage to your vehicle or the extent of your injuries. They may send an adjuster to inspect the vehicle or review medical records.

- Claim Settlement: Once the claim is reviewed and assessed, State Farm will determine the amount of compensation you are entitled to. This may involve a payment for repairs, replacement parts, or medical expenses.

Claim Settlement Process

The claim settlement process involves careful consideration of various factors to ensure fair and accurate compensation.

- Policy Coverage: State Farm will review your policy to determine the coverage you have for the specific type of claim. For example, collision coverage would apply to damage caused by an accident, while comprehensive coverage would cover damage from events like theft or vandalism.

- Liability Determination: If the accident involved another party, State Farm will investigate the cause of the accident to determine liability. This will help determine who is responsible for the damages and who will be responsible for paying for them.

- Damage Assessment: State Farm will assess the damage to your vehicle or the extent of your injuries. This may involve obtaining quotes from repair shops or reviewing medical records.

- Negotiation and Settlement: Once the damage has been assessed, State Farm will negotiate a settlement with you. This may involve a payment for repairs, replacement parts, or medical expenses. If you are not satisfied with the initial offer, you can negotiate a higher settlement.

Customer Satisfaction Ratings and Reviews, Car insurance state farm

Customer satisfaction with State Farm’s claims process is generally positive.

- J.D. Power: J.D. Power, a well-respected consumer research firm, consistently ranks State Farm highly for customer satisfaction in its annual auto insurance studies. State Farm has consistently received above-average ratings for its claims process, including factors like ease of filing a claim, communication with adjusters, and overall satisfaction with the settlement.

- Consumer Reports: Consumer Reports, another reputable consumer organization, also gives State Farm high marks for its claims process. In their reviews, customers often praise State Farm for its responsiveness, professionalism, and fair settlements.

- Online Reviews: Online reviews on websites like Trustpilot and Google Reviews provide a mixed picture of customer satisfaction with State Farm’s claims process. While many customers report positive experiences, some have expressed frustration with delays, communication issues, or disagreements over settlements. It’s important to note that these reviews can be subjective and may not reflect the overall experience of all State Farm customers.

Financial Strength and Stability: Car Insurance State Farm

When it comes to car insurance, choosing a financially stable company is crucial. You want to ensure that your insurer will be there to pay your claims when you need them most. State Farm’s strong financial standing is a testament to its long-standing commitment to its customers.

Financial Performance and Stability

State Farm’s financial performance is a key indicator of its stability. The company consistently ranks among the top insurance providers in the United States. In 2022, State Farm reported a net income of $8.6 billion, demonstrating its ability to generate strong profits and manage its financial resources effectively. This consistent profitability allows State Farm to maintain a strong capital base, which acts as a cushion against unexpected events or market fluctuations.

Independent Financial Ratings

Independent financial institutions play a vital role in assessing the financial health of insurance companies. These institutions, such as A.M. Best and Standard & Poor’s, use rigorous criteria to evaluate factors like financial performance, capital adequacy, and management practices. State Farm consistently receives top ratings from these institutions, reflecting its strong financial position and its commitment to responsible financial management. For instance, A.M. Best has assigned State Farm an A+ (Superior) rating, indicating a very strong capacity to meet its financial obligations.

Significance of Financial Stability

Financial stability is crucial for car insurance companies for several reasons:

- Claim Payments: A financially sound insurer can confidently pay claims promptly and efficiently, ensuring that policyholders receive the coverage they need in the event of an accident.

- Long-Term Stability: A strong financial position allows an insurer to weather economic downturns and market fluctuations, providing confidence that the company will be around to fulfill its obligations to policyholders in the long run.

- Investment Opportunities: A stable financial base enables insurers to invest in new technologies, products, and services, ultimately benefiting their customers with improved coverage options and customer service.

Technological Innovations

State Farm has embraced technology to enhance its operations and customer interactions, leading to improved efficiency, convenience, and customer satisfaction. This approach reflects the company’s commitment to adapting to the evolving needs of the modern insurance landscape.

State Farm’s Technological Advancements

State Farm has invested heavily in technology to streamline its processes and provide a more personalized and convenient experience for its customers. Here are some of the key technological innovations implemented by State Farm:

- State Farm Mobile App: The State Farm mobile app offers a wide range of features, including policy management, claims reporting, roadside assistance requests, and payment options. This app allows customers to access their insurance information and services anytime, anywhere.

- Digital Customer Service: State Farm has expanded its online and mobile customer service channels, providing customers with multiple ways to contact them, including live chat, email, and online forms. This approach makes it easier for customers to get the information and support they need, without the need for phone calls.

- Telematics Programs: State Farm offers telematics programs, such as Drive Safe & Save, that use technology to track driving habits and reward safe drivers with discounts. These programs utilize smartphone apps or devices installed in vehicles to collect data on driving behavior, such as speed, braking, and acceleration.

- Artificial Intelligence (AI): State Farm is using AI to automate tasks, improve efficiency, and personalize customer interactions. For example, AI-powered chatbots can answer basic customer inquiries and provide quick resolutions.

Impact of Technology on the Car Insurance Industry

Technology has revolutionized the car insurance industry, transforming how companies operate and interact with customers. Here’s how:

- Increased Efficiency and Automation: Technology has enabled insurance companies to automate many tasks, such as policy processing, claims handling, and customer service, leading to faster turnaround times and reduced costs.

- Personalized Customer Experiences: Technology allows insurance companies to collect and analyze customer data, providing them with insights to offer personalized quotes, discounts, and services.

- Enhanced Claims Handling: Technology has improved the claims handling process, with features like mobile claims reporting, real-time updates, and faster processing times.

- Emergence of New Products and Services: Technology has enabled the development of innovative insurance products and services, such as usage-based insurance, telematics programs, and AI-powered risk assessment tools.

State Farm’s Commitment to Technological Advancement

State Farm’s commitment to technological innovation is evident in its continuous investment in research and development. The company actively seeks out new technologies and partnerships to enhance its offerings and stay ahead of the curve in the evolving insurance landscape.

Future Trends and Challenges

The car insurance industry is undergoing a period of rapid transformation, driven by technological advancements, evolving customer expectations, and shifting societal trends. State Farm, like its competitors, faces both exciting opportunities and significant challenges in navigating this dynamic landscape.

Impact of Autonomous Vehicles

The rise of autonomous vehicles (AVs) presents a significant challenge and opportunity for State Farm. AVs are expected to dramatically reduce accidents, leading to a decrease in claims and potentially impacting the traditional car insurance model.

- New insurance products and services: State Farm is developing new insurance products and services specifically tailored to AVs, considering factors like liability, data usage, and vehicle performance. These products might include usage-based insurance programs that monitor driving behavior and adjust premiums accordingly.

- Data-driven risk assessment: AVs generate vast amounts of data, which can be used to assess risk more accurately. State Farm can leverage this data to create more personalized and dynamic insurance pricing models.

- Partnership with AV manufacturers: State Farm can collaborate with AV manufacturers to develop integrated insurance solutions, potentially including coverage for vehicle malfunctions and cyberattacks.

Evolving Customer Expectations

Car insurance customers are increasingly demanding personalized, digital-first experiences. They expect seamless online interactions, transparent pricing, and personalized recommendations.

- Digitalization of services: State Farm needs to continue investing in digital platforms and mobile applications to meet customers’ expectations for convenience and self-service. This includes online quoting, policy management, and claims filing.

- Data-driven personalization: State Farm can leverage customer data to personalize insurance offers, provide tailored recommendations, and deliver more relevant communications. This can enhance customer satisfaction and loyalty.

- Transparency and communication: State Farm needs to prioritize clear and transparent communication with customers, explaining pricing factors, coverage options, and claims processes. This builds trust and fosters positive customer relationships.

Cybersecurity Threats

The increasing reliance on technology in the insurance industry creates new vulnerabilities to cyberattacks. State Farm must invest in robust cybersecurity measures to protect customer data and ensure business continuity.

- Data protection and privacy: State Farm needs to implement strong data encryption, access controls, and security monitoring to safeguard customer information from cyber threats.

- Business continuity planning: State Farm should have comprehensive plans in place to mitigate the impact of cyberattacks, including data recovery procedures and business continuity strategies.

- Cybersecurity awareness training: State Farm should provide cybersecurity awareness training to employees to educate them about best practices for preventing and responding to cyber threats.

Climate Change and Extreme Weather

Climate change is leading to more frequent and severe weather events, increasing the risk of car accidents and insurance claims. State Farm needs to adapt its risk assessment and pricing models to account for these changes.

- Risk assessment and pricing: State Farm needs to refine its risk assessment models to incorporate climate change factors, such as increased flood risk and hurricane frequency. This may lead to adjustments in premiums for areas prone to extreme weather.

- Disaster preparedness: State Farm can play a proactive role in disaster preparedness by providing resources and information to customers, helping them mitigate risks and recover from weather-related events.

- Sustainable practices: State Farm can promote sustainable practices in its operations and encourage customers to adopt eco-friendly driving habits, such as reducing emissions and conserving fuel.

Regulatory Landscape

The regulatory environment for car insurance is constantly evolving, with new laws and regulations impacting pricing, coverage, and customer protection. State Farm needs to stay informed about these changes and adapt its operations accordingly.

- Compliance with regulations: State Farm needs to ensure compliance with all applicable state and federal regulations, including those related to data privacy, insurance pricing, and customer protection.

- Advocacy and lobbying: State Farm can actively participate in policy discussions and advocate for regulations that promote a fair and competitive insurance market.

- Innovation and technology: State Farm can leverage technology to streamline regulatory compliance processes and ensure efficient reporting and data management.

Summary

In conclusion, State Farm emerges as a leading car insurance provider, offering a wide range of coverage options, a strong commitment to customer satisfaction, and a focus on financial stability. By understanding State Farm’s offerings, you can determine if it aligns with your specific needs and preferences. With its dedication to technological advancements and customer-centric approach, State Farm is well-positioned to continue serving its policyholders effectively in the years to come.

FAQ Overview

What types of car insurance does State Farm offer?

State Farm offers various car insurance policies, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). The specific coverage options available may vary by state.

How can I get a car insurance quote from State Farm?

You can obtain a car insurance quote from State Farm online, over the phone, or by visiting a local agent. State Farm’s website provides a convenient online quote tool.

What discounts are available for State Farm car insurance?

State Farm offers various discounts, including safe driving, good student, multi-policy, and vehicle safety discounts. You can find more details about available discounts on State Farm’s website or by contacting an agent.

How does State Farm’s claims process work?

State Farm’s claims process involves reporting the accident, providing necessary documentation, and working with a claims adjuster. You can file a claim online, over the phone, or through a local agent. State Farm aims to provide prompt and efficient claim handling.