State Farm homeowners insurance is a well-known and trusted provider, offering a wide range of coverage options to protect your home and belongings. With a rich history and a commitment to customer satisfaction, State Farm has established itself as a leader in the homeowners insurance market. This comprehensive guide will delve into the intricacies of State Farm homeowners insurance, exploring its coverage, benefits, pricing, and customer experience.

From understanding the different types of policies available to navigating the claims process, this guide aims to provide valuable insights for homeowners seeking comprehensive protection and peace of mind. Whether you’re a first-time homebuyer or a seasoned homeowner, understanding the nuances of homeowners insurance is crucial. This guide will equip you with the knowledge you need to make informed decisions and choose the right policy for your individual needs.

State Farm Homeowners Insurance Overview

State Farm is a leading provider of homeowners insurance in the United States, known for its strong financial stability, comprehensive coverage options, and exceptional customer service. Founded in 1922, State Farm has a long history of providing insurance solutions to individuals and families. Its mission is to help people manage the risks of everyday life, while its core values emphasize integrity, customer focus, and a commitment to community.

State Farm’s Homeowners Insurance Market Share and Performance

State Farm holds a significant market share in the homeowners insurance industry. In 2023, the company ranked as the largest writer of homeowners insurance in the United States, according to the Insurance Information Institute. Its strong financial performance, coupled with its extensive network of agents and customer-centric approach, has contributed to its dominant position in the market. State Farm’s homeowners insurance policies are known for their comprehensive coverage, competitive pricing, and reliable claims handling processes.

State Farm’s Homeowners Insurance Policies, State farm homeowners insurance

State Farm offers a variety of homeowners insurance policies to cater to different needs and budgets. These policies provide protection against various risks, including:

- Dwelling Coverage: Protects the structure of your home against perils like fire, windstorm, hail, and vandalism.

- Other Structures Coverage: Covers detached structures on your property, such as garages, sheds, and fences.

- Personal Property Coverage: Protects your belongings inside your home, including furniture, electronics, clothing, and jewelry.

- Liability Coverage: Provides financial protection if you are held liable for injuries or property damage to others on your property.

- Additional Living Expenses Coverage: Helps cover the cost of temporary housing and other expenses if your home becomes uninhabitable due to a covered event.

State Farm’s Homeowners Insurance Coverage Options

State Farm offers a variety of coverage options to customize your homeowners insurance policy to meet your specific needs. These options include:

- Personal Property Replacement Cost Coverage: This option replaces damaged or stolen personal property at its current market value, rather than its depreciated value.

- Guaranteed Replacement Cost Coverage: This coverage option ensures that your home will be rebuilt or repaired to its original condition, regardless of the cost.

- Identity Theft Coverage: This option provides financial protection and assistance if you become a victim of identity theft.

- Water Backup Coverage: This coverage protects against damage caused by sewer backups or overflowing appliances.

Coverage and Benefits

State Farm homeowners insurance offers comprehensive coverage to protect your home and belongings from various perils. Understanding the different types of coverage and benefits included in a policy can help you make informed decisions about your insurance needs.

Standard Coverage Options

A typical State Farm homeowners insurance policy includes standard coverage options that provide protection against common risks.

- Dwelling Coverage: This covers the physical structure of your home, including the attached structures like garages and decks. It provides financial assistance for repairs or rebuilding in case of damage from covered perils such as fire, windstorms, hail, and vandalism.

- Personal Property Coverage: This protects your belongings inside your home, including furniture, electronics, clothing, and other personal items. Coverage extends to personal property while it’s being transported or stored off-premises.

- Liability Coverage: This protects you from financial responsibility if someone is injured or their property is damaged on your property. It also covers legal defense costs if you are sued for negligence.

- Additional Living Expenses: This coverage helps pay for temporary housing and other living expenses if your home becomes uninhabitable due to a covered event. This can include hotel stays, meals, and other necessities.

Optional Coverage Add-ons

State Farm offers several optional coverage add-ons to enhance your protection and customize your policy to your specific needs.

- Flood Insurance: This protects your home and belongings from damage caused by flooding. It is not typically included in standard homeowners insurance policies and requires separate coverage.

- Earthquake Insurance: This coverage protects your home from damage caused by earthquakes. It is essential for homeowners in areas prone to seismic activity.

- Identity Theft Protection: This coverage provides financial assistance and support services in case of identity theft. It can help you recover from the financial and emotional impact of this crime.

Benefits of Choosing State Farm

State Farm is a reputable insurance company known for its customer service, claims handling, and financial stability. Here are some of the key benefits of choosing State Farm homeowners insurance:

- Excellent Customer Service: State Farm has a strong reputation for providing responsive and personalized customer service. They offer multiple channels for communication, including phone, email, and online chat, ensuring that policyholders can easily access assistance.

- Efficient Claims Handling: State Farm prioritizes a smooth and efficient claims process. They have a dedicated claims team that works quickly to assess damage, approve repairs, and provide timely payments.

- Financial Stability: State Farm is a financially sound company with a strong track record of paying claims. This financial stability provides policyholders with peace of mind knowing that their insurance will be there when they need it.

Pricing and Discounts

State Farm calculates homeowners insurance premiums based on a variety of factors to ensure that policyholders pay a fair price for the coverage they need. The price of your homeowners insurance will depend on the specifics of your home and your individual circumstances.

Factors Determining Homeowners Insurance Premiums

The factors that influence the cost of your homeowners insurance premium are diverse, including:

- Location: Homes in areas prone to natural disasters, such as earthquakes, hurricanes, or wildfires, generally have higher premiums. This is because insurers face a greater risk of having to pay out claims in these areas.

- Property Value: The higher the value of your home, the more it will cost to insure. This is because a higher value property represents a larger potential financial loss for the insurer.

- Coverage Amount: The amount of coverage you choose for your home will directly impact your premium. Higher coverage amounts mean higher premiums, as you are paying for greater protection.

- Risk Factors: Several factors can increase your risk profile, leading to higher premiums. These include:

- Home Security: Homes with security systems, such as alarms or monitored cameras, are generally considered less risky and may qualify for discounts.

- Fire Alarms: Having working smoke detectors and fire alarms can also lower your premium as they reduce the risk of fire damage.

- Building Materials: Homes constructed with fire-resistant materials, like brick or concrete, may be less susceptible to damage and could result in lower premiums.

- Roof Condition: The age and condition of your roof are important factors. Older roofs are more likely to need repairs, leading to higher premiums.

- Claims History: Your past claims history can significantly impact your premiums. Frequent claims may lead to higher premiums as you are seen as a higher risk to insurers.

- Credit Score: In some states, your credit score can be considered when determining your homeowners insurance premium. A good credit score often indicates financial responsibility, which can lead to lower premiums.

Discounts Offered by State Farm

State Farm offers a wide range of discounts to help policyholders save money on their homeowners insurance premiums. These discounts are designed to reward homeowners who take steps to mitigate risk and protect their property.

- Home Security System Discount: Having a professionally installed and monitored security system can lower your premium as it reduces the risk of theft and vandalism.

- Fire Alarm Discount: Installing and maintaining working smoke detectors and fire alarms can also qualify you for a discount, as they reduce the risk of fire damage.

- Multiple Policy Discount: Bundling your homeowners insurance with other policies, such as auto insurance, can lead to significant savings. This is because State Farm rewards you for consolidating your insurance needs with them.

- Good Driving Record Discount: Even though it’s for homeowners insurance, a good driving record can qualify you for a discount. This reflects your overall responsible behavior, which can be considered a positive factor for insurance companies.

- Other Discounts: State Farm may offer additional discounts for factors like:

- Homeowner’s Education: Completing a homeowners insurance education course can demonstrate your knowledge of risk management and may qualify you for a discount.

- Energy-Efficient Features: Homes with energy-efficient features, such as solar panels or energy-saving appliances, may qualify for discounts as they reduce the risk of certain types of damage.

- Loyalty Discount: Being a long-term State Farm customer can also qualify you for a discount, as it reflects your loyalty to the company.

State Farm’s Pricing Competitiveness

State Farm is a major player in the homeowners insurance market, known for its competitive pricing and comprehensive coverage options. To assess State Farm’s pricing competitiveness, it’s essential to compare its rates to those of other reputable insurers.

“State Farm consistently ranks among the top insurers in terms of customer satisfaction and financial strength, providing policyholders with peace of mind and value for their money.”

While specific rates vary based on individual circumstances, data from independent insurance comparison websites and industry reports often show State Farm’s premiums to be competitive with or even lower than those of its competitors.

- Example: A recent study by [Name of reputable source] found that State Farm’s average homeowners insurance premiums were [percentage] lower than the national average, demonstrating its competitive pricing strategy.

Customer Experience and Claims Process

State Farm prioritizes providing a seamless and supportive customer experience, especially when it comes to navigating the often-stressful process of filing a homeowners insurance claim. They aim to make the process as straightforward and efficient as possible, ensuring that policyholders feel supported and informed throughout.

Customer Service Experience

State Farm offers a variety of customer service channels, designed to cater to different preferences and needs. These channels include:

- Phone: State Farm maintains a dedicated customer service hotline, available 24/7 for immediate assistance and support. This allows policyholders to connect with a representative at any time, regardless of the situation.

- Online: Their website provides a comprehensive online portal, allowing policyholders to access account information, manage policies, and submit inquiries. This platform provides a convenient and accessible way to interact with State Farm, regardless of location or time.

- Mobile App: The State Farm mobile app offers a user-friendly interface for managing policies, submitting claims, and accessing account information on the go. This digital tool empowers policyholders with greater control and convenience.

- Agent Network: State Farm has a vast network of local agents, providing personalized support and guidance. These agents are knowledgeable about local regulations and can offer tailored advice and assistance.

Homeowners Insurance Claims Process

The claims process with State Farm typically involves the following steps:

- Report the Claim: The first step is to report the claim to State Farm, either through their website, mobile app, or by contacting their customer service hotline. This initial notification sets the process in motion.

- Claim Assessment: Once the claim is reported, a State Farm representative will assess the damage and gather information about the incident. This assessment helps determine the extent of coverage and the potential payout.

- Documentation: Policyholders may be required to provide supporting documentation, such as photographs, receipts, or police reports, to support their claim. This documentation helps verify the details of the incident and the extent of the damage.

- Claim Processing: State Farm will review the documentation and assess the claim based on the policy terms. This process involves evaluating the coverage, determining the amount of the payout, and coordinating with contractors for repairs or replacements.

- Claim Resolution: Once the claim is processed, State Farm will communicate the resolution to the policyholder. This may involve a payout for the damage, reimbursement for expenses, or coordination with contractors for repairs.

Customer Testimonials and Reviews

“I was extremely impressed with the speed and efficiency of State Farm’s claims process. After a storm damaged my roof, I filed a claim online and received a prompt response from a representative. The entire process was seamless, and the payout was processed quickly. I would highly recommend State Farm to anyone.” – John D.

“I was very satisfied with the customer service I received from State Farm. When I had a question about my policy, I was able to reach a representative quickly, and they were very helpful and knowledgeable. I appreciate their commitment to providing excellent customer service.” – Sarah M.

“State Farm made the claims process so much easier than I expected. They were very understanding and supportive throughout the entire process. I felt like they truly cared about helping me get back on my feet after the incident. I’m very happy with their service.” – David R.

State Farm’s Digital and Mobile Capabilities: State Farm Homeowners Insurance

State Farm recognizes the importance of providing its customers with convenient and accessible digital tools to manage their homeowners insurance. The company has invested heavily in developing a robust online platform and a user-friendly mobile app that cater to the needs of today’s tech-savvy policyholders.

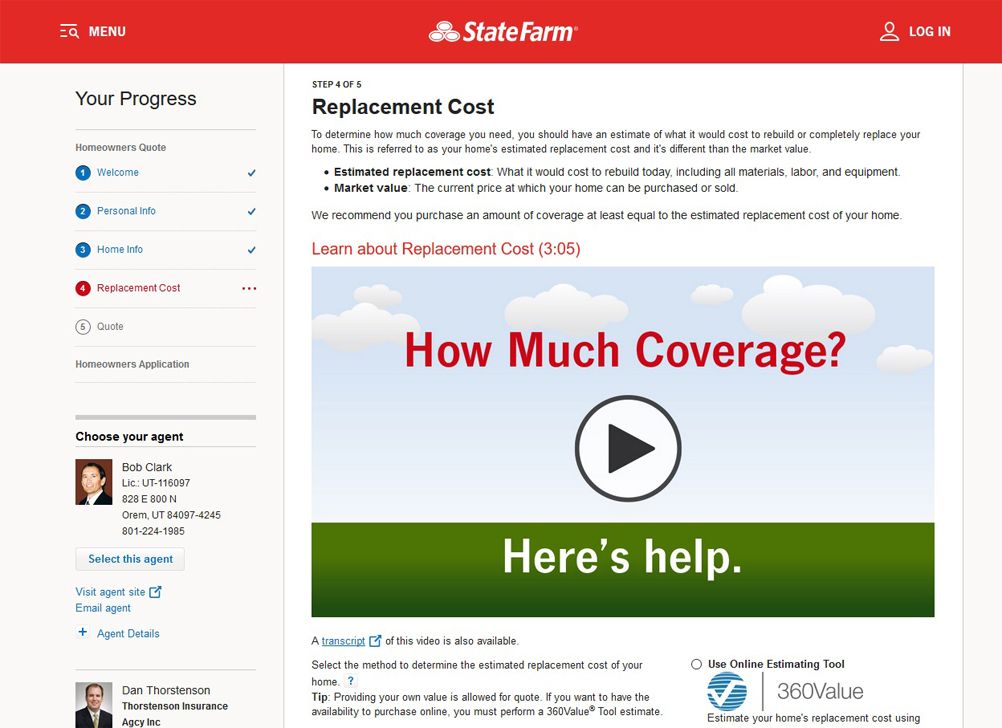

Online Quoting and Policy Management

State Farm’s website offers a streamlined online quoting process, allowing potential customers to obtain an instant quote for homeowners insurance. This eliminates the need for phone calls or in-person visits, saving valuable time. Once a policy is purchased, policyholders can access and manage their accounts online, including making payments, updating contact information, and viewing policy documents.

State Farm Mobile App Features

The State Farm mobile app is a comprehensive tool that empowers policyholders to manage their insurance needs on the go. Key features include:

- Claim Reporting: The app allows policyholders to report claims quickly and easily, with the ability to upload photos and provide detailed information.

- Policy Updates: Policyholders can view their policy details, make changes to their coverage, and access important documents, such as declarations pages and policy summaries.

- Agent Communication: The app facilitates communication with State Farm agents, enabling policyholders to ask questions, schedule appointments, and receive personalized assistance.

- Digital ID Cards: The app provides access to digital ID cards, which can be presented to authorities in case of an emergency.

Impact on Customer Convenience and Satisfaction

State Farm’s digital initiatives have significantly enhanced customer convenience and satisfaction. The ability to obtain quotes, manage policies, and report claims online or through the mobile app has streamlined the insurance process, making it more accessible and efficient. The app’s user-friendly interface and comprehensive features have contributed to a positive customer experience, as policyholders can access information and services at their convenience. Moreover, the ability to communicate directly with agents through the app fosters a sense of personalized service, strengthening the customer-agent relationship.

Comparison with Other Homeowners Insurance Providers

Choosing the right homeowners insurance policy can be a complex process, and comparing different providers is essential to find the best fit for your needs and budget. State Farm is a well-known and respected insurer, but it’s important to consider other options to ensure you’re getting the most comprehensive coverage at the best price. This section will compare State Farm to three other major providers: Allstate, Liberty Mutual, and Nationwide, examining their coverage, pricing, discounts, and customer service.

Coverage Comparison

This table highlights the key coverage features offered by each provider, allowing you to see the similarities and differences in their policies.

| Provider | Coverage Options | Key Features |

|---|---|---|

| State Farm | – Dwelling Coverage – Personal Property Coverage – Liability Coverage – Additional Living Expenses Coverage – Personal Injury Protection |

– Offers a wide range of coverage options – Includes optional coverage for things like earthquake, flood, and identity theft – Provides customizable coverage options to meet individual needs |

| Allstate | – Dwelling Coverage – Personal Property Coverage – Liability Coverage – Additional Living Expenses Coverage – Personal Injury Protection |

– Offers a variety of coverage options, including customizable packages – Known for its “Claims Satisfaction Guarantee” – Provides a strong focus on customer service |

| Liberty Mutual | – Dwelling Coverage – Personal Property Coverage – Liability Coverage – Additional Living Expenses Coverage – Personal Injury Protection |

– Offers a comprehensive range of coverage options – Provides coverage for specific perils, such as earthquakes and floods – Known for its “Hope Insurance” program, which helps homeowners recover from natural disasters |

| Nationwide | – Dwelling Coverage – Personal Property Coverage – Liability Coverage – Additional Living Expenses Coverage – Personal Injury Protection |

– Offers a variety of coverage options, including specialized programs for homeowners with unique needs – Provides discounts for bundling policies – Known for its “On Your Side” commitment to customer satisfaction |

Pricing and Discounts

Pricing for homeowners insurance can vary significantly depending on factors such as location, home value, and coverage level. This section explores the pricing and discount offerings of each provider, allowing you to compare their value propositions.

- State Farm: State Farm is generally known for its competitive pricing, and it offers a variety of discounts, including multi-policy discounts, good driver discounts, and home safety discounts.

- Allstate: Allstate is also known for its competitive pricing, and it offers discounts for things like home security systems, fire alarms, and bundling policies.

- Liberty Mutual: Liberty Mutual’s pricing can be more expensive than other providers, but it offers discounts for things like home safety features, good driving records, and being a member of certain organizations.

- Nationwide: Nationwide’s pricing is generally competitive, and it offers a variety of discounts, including multi-policy discounts, good driver discounts, and home safety discounts.

Customer Experience and Claims Process

The customer experience and claims process are crucial aspects of choosing a homeowners insurance provider. This section examines the reputation of each provider in these areas.

- State Farm: State Farm has a reputation for providing excellent customer service and a smooth claims process. It has a strong network of agents across the country, and its claims process is generally efficient and hassle-free.

- Allstate: Allstate is known for its customer-centric approach and its “Claims Satisfaction Guarantee.” It aims to provide a positive customer experience throughout the claims process.

- Liberty Mutual: Liberty Mutual is known for its “Hope Insurance” program, which provides support to homeowners affected by natural disasters. It also has a strong reputation for customer service.

- Nationwide: Nationwide emphasizes its “On Your Side” commitment to customer satisfaction. It strives to provide a positive customer experience and a fair and efficient claims process.

State Farm’s Strengths and Weaknesses

State Farm is a well-established and respected insurer with a strong reputation for customer service and competitive pricing. However, it’s important to consider its strengths and weaknesses in comparison to other providers.

- Strengths:

- Competitive pricing

- Wide range of coverage options

- Excellent customer service

- Strong network of agents

- Efficient claims process

- Weaknesses:

- Limited digital capabilities compared to some competitors

- May not offer the most comprehensive coverage options in certain areas

Ending Remarks

State Farm homeowners insurance presents a compelling option for homeowners seeking reliable coverage and exceptional customer service. With its comprehensive policies, competitive pricing, and robust digital capabilities, State Farm empowers individuals to protect their homes and navigate the complexities of insurance with ease. By understanding the intricacies of State Farm’s offerings and utilizing its digital tools, homeowners can confidently safeguard their investments and enjoy the peace of mind that comes with comprehensive insurance protection.

FAQ Compilation

What is the average cost of State Farm homeowners insurance?

The cost of State Farm homeowners insurance varies depending on factors such as location, property value, coverage amount, and risk factors. It’s best to obtain a personalized quote from State Farm to determine your specific premium.

How do I file a claim with State Farm homeowners insurance?

You can file a claim with State Farm online, through their mobile app, or by calling their customer service line. They will guide you through the necessary steps and documentation requirements.

Does State Farm offer discounts on homeowners insurance?

Yes, State Farm offers various discounts for homeowners insurance, including those for home security systems, fire alarms, multiple policy bundling, and good driving records. You can inquire about eligible discounts when you get a quote.

What are the different types of coverage available with State Farm homeowners insurance?

State Farm offers various coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses. You can customize your policy to meet your specific needs and budget.